Kumusta, Entrepreneurs! Did you know that the Bank of the Philippine Islands‘s projected EBIT for fiscal year 2024 is 683,406 million Philippine pesos, a 20.51% increase from the previous year?

EBIT reflects a company’s profit from its operations, excluding any interest or tax costs. In simple terms, EBIT measures a company’s performance and profitability. However, many people may still be unfamiliar with its meaning and calculation.

Related to that condition, this article will explore what EBIT is, its benefits, and how it’s calculated in financial statements. Stay until the end to know how to count EBIT most simply. Bukod pa rito, ipapakita namin ang mga hakbang para mas madaling maintindihan ang pagkalkula ng EBIT.

Key Takeaways

|

Table of Contents

What is EBIT?

EBIT (Earnings Before Interest and Taxes) is a key profitability indicator for companies. Businesses commonly use this calculation to assess their income from interest and tax expenses. EBIT is often referred to as operating profit because it reflects a company’s earnings.

EBIT allows investors and creditors to evaluate a company’s performance without the impact of interest payments and taxes, offering a clearer view of its operational efficiency and profitability potential. Moreover, it serves as a valuable metric for comparing companies within the same industry.

The Advantages of Calculating EBIT

Advantages for investors

- Understand the overall financial health of the company.

- By using an accounting system that manages EBIT, you could get insights into the company’s operations and strategies.

- The profit before tax formula compares the company’s debt with its competitors.

- Assess the company’s ability to meet its financial obligations.

Advantages for the company

- EBIT inside accounting platforms for Philippine businesses could evaluate the company’s capacity to cover its liabilities and fund operations.

- Provide insights into potential growth areas and profit opportunities.

- Assess the efficiency of company operations, helping to guide improvements or changes in strategy.

How to Calculate EBIT with its Formula and Example

EBIT is calculated by subtracting the cost of goods sold (COGS) and operating expenses from total revenue. Typically, there are two methods: the direct method subtracts operating costs from revenue, while the indirect method starts with net income, adding back interest and tax expenses.

In the end, both how to get EBIT approaches help evaluate profitability before non-operational factors, providing clearer insights into a company’s performance. Sa ganitong paraan, madali mong makikita kung gaano kahusay ang operasyon ng kompanya.

Direct method

EBIT (Earnings Before Interest and Taxes)= Net Sales – COGS – Operating Expenses

Indirect method

EBIT (Earnings Before Interest and Taxes)= Net Income + Interest + Taxes

Example of EBIT Calculation

Here’s an example of income before tax formula calculation for a manufacturing company:

- Sales revenue: PHP 5,000,000

- COGS: PHP 2,200,000

- Operating expenses: PHP 200,000

- Income tax: PHP 40,000

- Interest expense: PHP 150,000

- Net income: PHP 200,000

Using the EBIT formula: EBIT = PHP 200,000 + PHP 150,000 + PHP 40,000 = PHP 390,000

Calculate Your EBIT with HashMicro’s Accounting Software

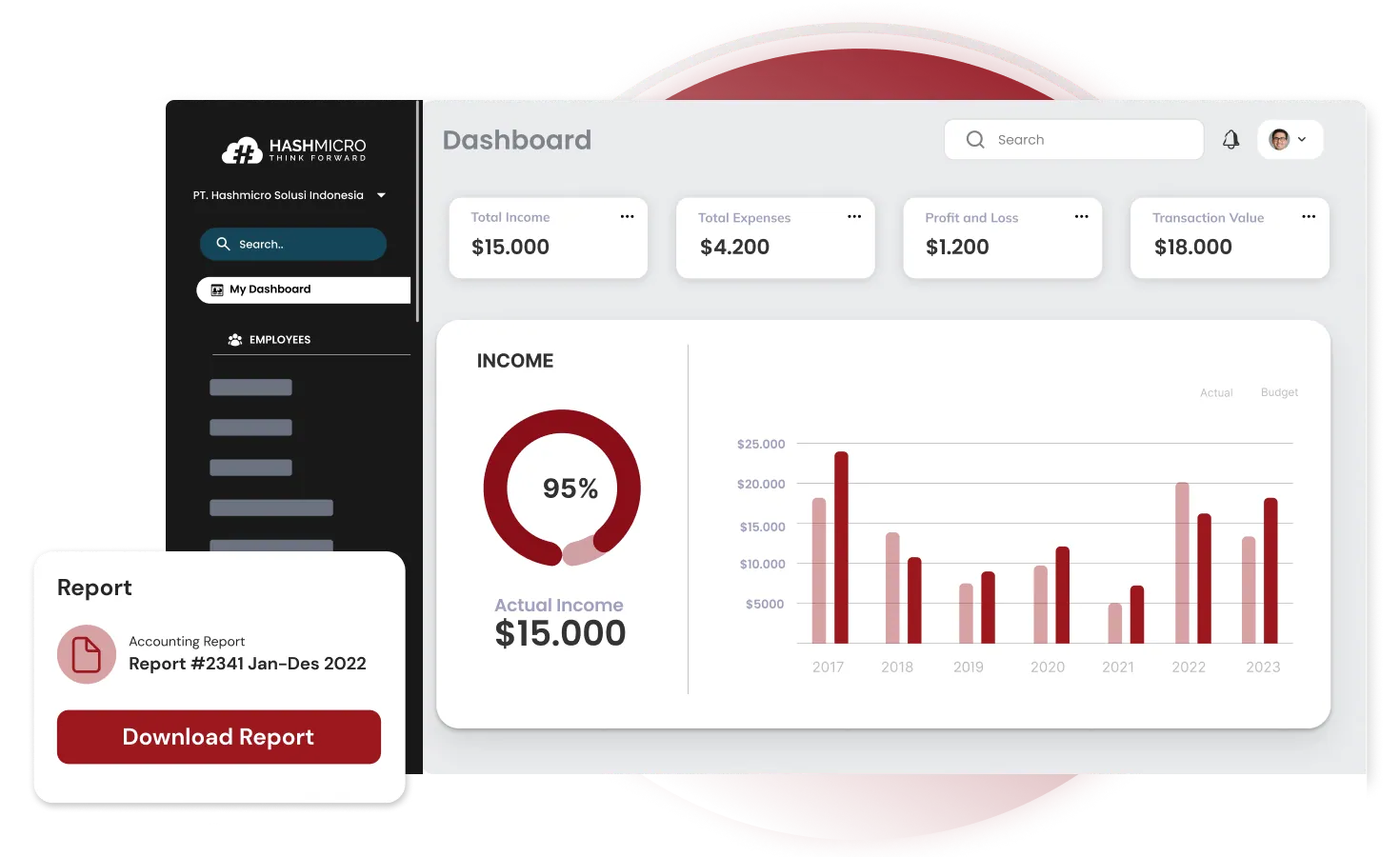

Hashmicro’s accounting software is a smart solution that is now favored by many Filipino entrepreneurs. Its powerful system performance with an easy UI/UX interface makes EBIT in accounting from HashMicro a favorite choice of business people at the mid-to-high level.

With over 1750 customers in Southeast Asia, HashMicro offers many benefits to Filipino businesses. Some of these include free demos, no cost to add users, extensive customization, and earnings before interest and taxes system flexibility that can scale with the company over time.

Here are HashMicro’s top features that can improve the efficiency of your business productivity:

- Financial ratio: This feature automatically calculates various important financial ratios, such as liquidity ratios, profitability ratios, debt ratios, etc.

- Multi-level analytical: Know the trend or insight of all financial transactions in real-time and can be filtered based on various categories (project, branch, etc.)

- Profit & loss: Provide a report that can provide information regarding the deviation between the estimated profit and loss based on the predetermined budget value and the actual profit and loss value.

- Cash flow reports: Track the company’s cash inflows and outflows to maintain liquidity, plan finances, and address potential issues early.

- Forecast budget: Predict future budgets based on historical data to help plan finances, allocate resources efficiently, and make better strategic decisions.

Conclusion

While EBIT, which could referred to as net profit before tax formula, is a valuable metric, a comprehensive financial analysis is still essential to fully understand a company’s financial position, including its interest and debt obligations.

To simplify this process, you can use HashMicro accounting software, which helps generate financial reports such as cash flow statements and income statements, while also streamlining business activities like inventory and taxation. Get a free demo starting now and discover the simplest way to get financial stability.

FAQ About EBIT

-

Which is better, EBIT or EBITDA?

EBITDA is often more valuable for evaluating companies that are capital-intensive or have significant intangible assets (and related amortization costs). Using EBIT might lead to the mistaken belief that the company is facing heavy losses when in reality, these are non-cash expenses.

-

Why is EBIT so important?

Understanding EBIT is valuable as it allows you to compare the profitability and value of various companies, even those with different tax structures, and enables the creation of more comprehensive financial reports.

-

What is another name for EBIT?

EBIT is also known as operating income, operating profit, or earnings before interest and taxes.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “Which is better, EBIT or EBITDA?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “EBITDA is often more valuable for evaluating companies that are capital-intensive or have significant intangible assets (and related amortization costs). Using EBIT might lead to the mistaken belief that the company is facing heavy losses when in reality, these are non-cash expenses.”

}

},{

“@type”: “Question”,

“name”: “Why is EBIT so important?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Understanding EBIT is valuable as it allows you to compare the profitability and value of various companies, even those with different tax structures, and enables the creation of more comprehensive financial reports.”

}

},{

“@type”: “Question”,

“name”: “What is another name for EBIT?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “EBIT is also known as operating income, operating profit, or earnings before interest and taxes.”

}

}]

}