Struggling to keep track of your business’s financial goals and resources, and need help with organizing your business resources? Financial budgeting can seem overwhelming, but having the right structure in place can make all the difference.

A solid financial budget serves as a roadmap, helping you allocate resources, track progress, and achieve your goals. Financial budgeting templates are perfect for this task, as they offer clear, easy-to-follow frameworks that help you stay on track and avoid costly mistakes.

In this article, we’ll extensively discuss financial budgeting, its many types, examples of budgeting templates, and how to make them. Ready? Tara na, read further to know more!

Key Takeaways

|

Table of Contents

What is Financial Budgeting?

Financial budgeting is the process that helps organizations plan their growth and evolution. It quantifies a business’s projected finances during a specific period, which gives the company a clear financial direction and expectations for income and revenue.

Budgeting serves as a baseline for comparison and allows management to assess how actual performance aligns with expectations. Meanwhile, financial forecasting analyzes historical trends and company data to help management allocate the budget more effectively.

Financial budgeting is one of the most essential parts of an accounting system, along with cash flow management, financial reporting, and cost control, as it helps organizations allocate resources efficiently, track performance, and ensure alignment with strategic goals.

Why is Financial Budgeting Important?

There are several reasons why financial management is crucial:

- Ensuring Resource Availability: Financial budgeting gives you the resources to bring your plans to life and hit your business targets. Leaders can quickly determine which projects or teams need more or fewer resources by planning finances.

- Guiding Financial Goals: Budgeting helps set and track progress toward financial goals. It involves allocating funds and determining the revenue needed to reach company-wide and team objectives. Financial goals should be realistic and backed by data to guide further budget decisions.

- Prioritizing projects and initiatives: A key benefit of financial budgeting is its role in prioritizing projects. When evaluating initiatives, consider how they align with company values, potential ROI, and their impact on broader financial goals. Each project’s value to the organization should be assessed and compared.

- Optimizing financing opportunities: A well-documented budget is essential for securing funding from investors or lenders. Investors highly value detailed financial information, as it demonstrates a company’s ability to manage finances and allocate resources effectively.

- Achieving flexibility: While plans may go as expected, unforeseen events, like the COVID-19 pandemic, often require quick adjustments. A budget is a starting point, and having an agile approach allows leadership to adapt and adjust as needed in response to challenges.

To maximize the benefits of financial budgeting, it’s best to use digital solutions to automate the processes of making financial budgets. One of the ways to do that is to use financial reporting software, which helps with making law-abiding reports and tracks budgeting easily.

Types of Financial Budgets

There are different types of financial budgets, each focusing on different aspects of financial planning. Here are some common ones:

- Zero-based budgeting: This approach starts each period with a zero balance, and all expenses must be justified from scratch. It’s handy for organizations in financial distress, allowing them to reassess and reallocate resources based on current priorities.

- Activity-based budgeting: This method works backwards from a company’s goals to determine the costs needed to achieve them. It’s particularly effective for large businesses aiming to identify inefficiencies, allocate resources more effectively, and cut unnecessary costs.

- Static or Incremental budgeting: This approach adjusts the previous period’s budget by a fixed percentage based on historical financial data. It’s most useful for businesses with stable revenue and predictable expenses, where minor adjustments can help maintain financial consistency.

- Performance-based budgeting: This method aligns budget allocations with measurable outcomes, ensuring funds are spent where they have the greatest impact. Governments and nonprofits often use it to ensure their spending effectively supports long-term goals and missions.

- Value proposition budgeting: This approach focuses on allocating resources only to budget items directly contributing to the organization’s value. It’s commonly used in government budgeting or by businesses that want to control costs rigorously and prioritize high-return investments.

Testing various budgeting and forecasting techniques can help identify the best fit for your organization, as the right budget type depends on the specific needs and situation of the company.

Financial Budget Template Examples

Here are some practical examples of financial budget templates that can be adapted to various business needs. These templates are designed to help you organize and manage your finances more effectively. Let’s take a look at a few options available:

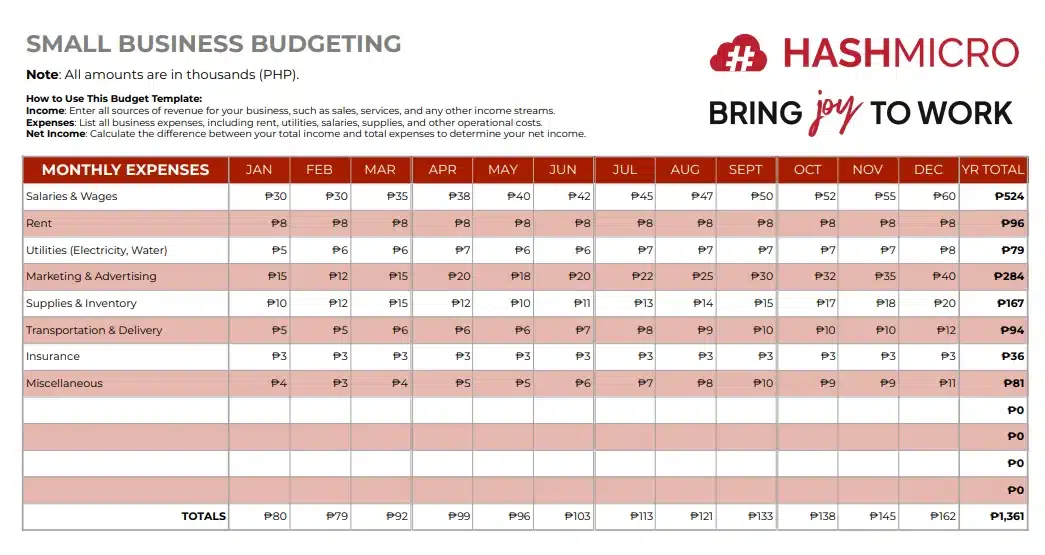

1. Small business budget template

This small business budget template is designed to help you effectively track and manage your monthly income and expenses. The template includes separate sheets for income, expenses, and a summary chart to give you a clear overview of your financial situation.

The income sheet tracks various revenue sources such as sales, service fees, seasonal promotions, corporate partnerships, and online store income, with columns for each month and a yearly total.

Small Business Budget Template

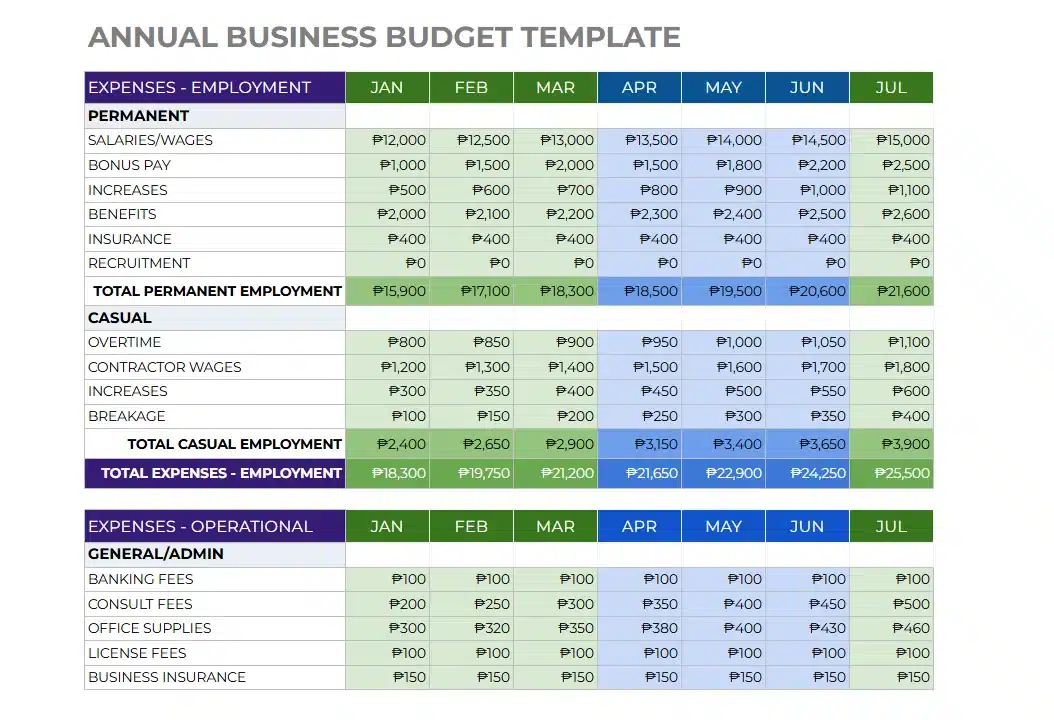

2. Annual business budget template

This business budget template offers a comprehensive financial overview for managing a company’s income and expenses. It includes different sheets: one for tracking income, another for expenses, and a summary chart visually representing the financial data.

These distinct sections allow businesses to monitor their sales, commissions, fees, and other income sources while keeping a detailed account of operational costs, marketing expenses, and other outflows.

Annual Business Budget Template

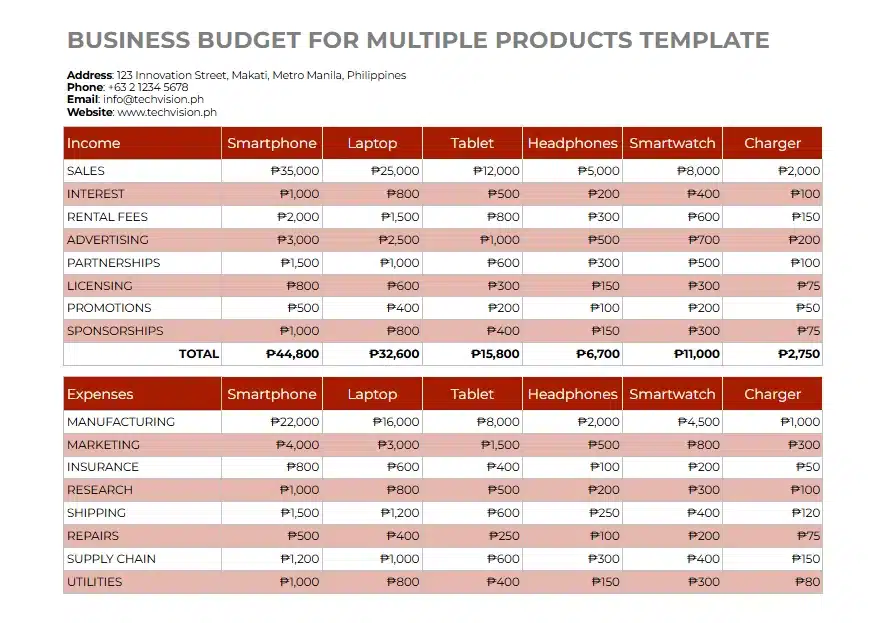

3. Business budget for multiple products

This business budget template comprehensively overviews a company’s financial planning across various products and income streams. It includes detailed categories for income and expenses.

Additionally, it covers manufacturing costs, marketing, insurance, research, shipping, and repairs. This template is an essential tool for effective financial management to monitor spending and allocate resources efficiently.

Business Budget for Multiple Products

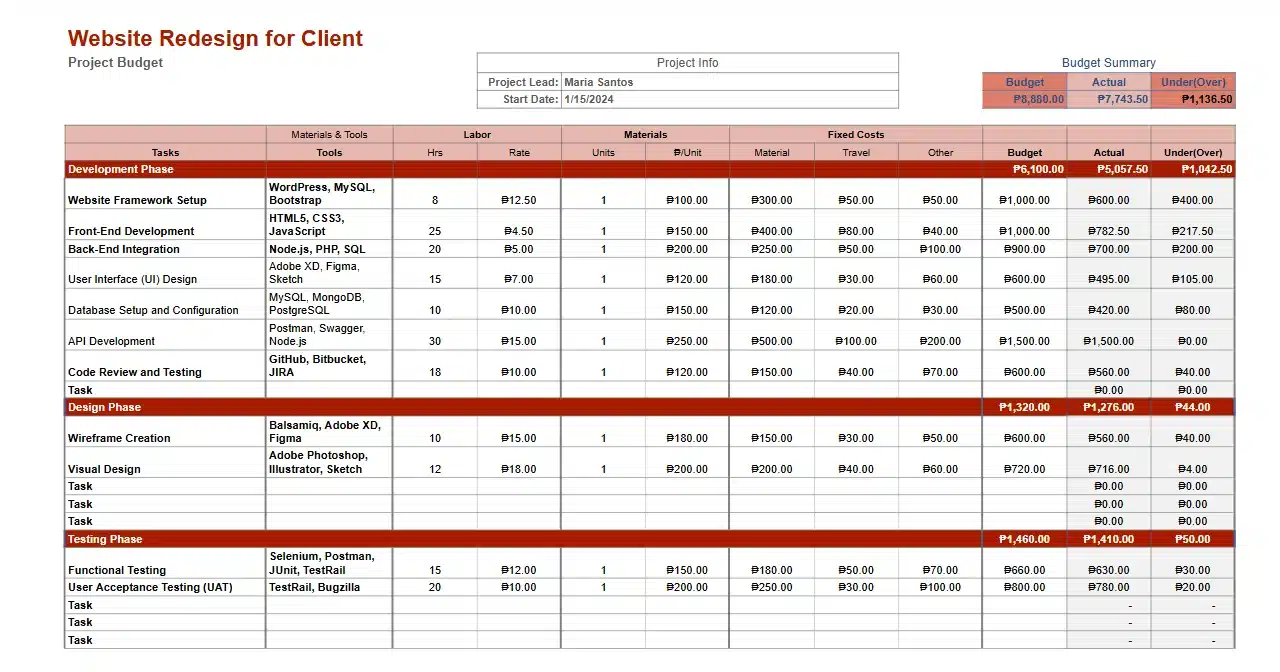

4. Project financial budgeting template

The project budget template is designed to provide a detailed financial overview of any project, ensuring all potential costs are accounted for. It includes sections for different project phases, such as development and design, each broken down into specific tasks.

For each task, the template lists required hours, labor rates, material costs, and any additional fixed costs like travel expenses.

Project Financial Budgeting

5. Start-up financial budget template

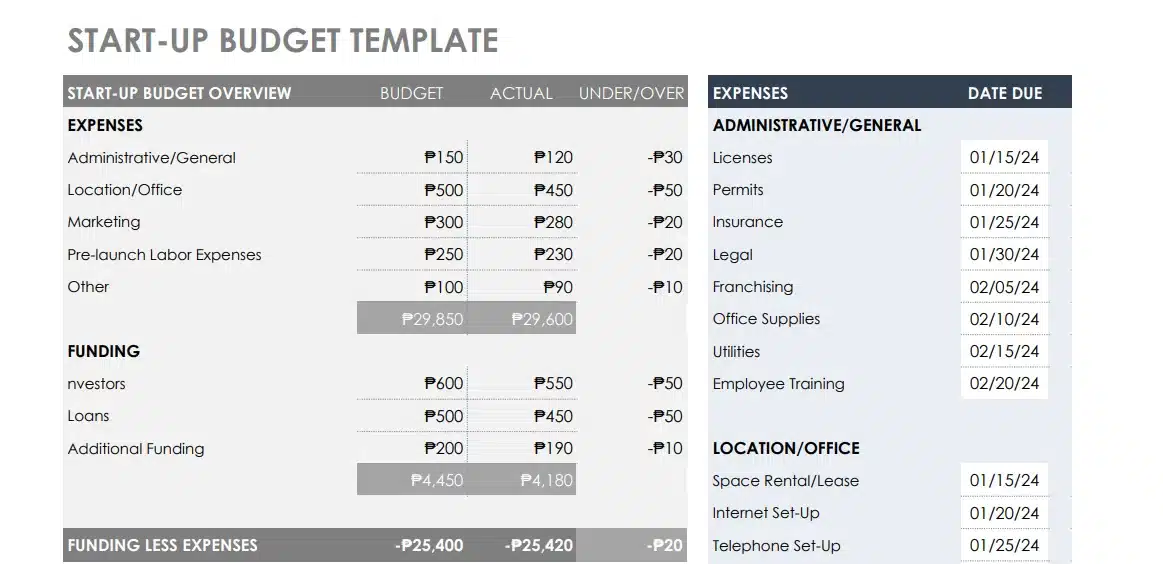

This template is designed to help new businesses manage their budget effectively. It is divided into several key sections:

- Start-Up Budget Overview:

- Lists and compares budgeted and actual expenses in various categories, such as Administrative/General, Location/Office, Marketing, Pre-launch Labor Expenses, and Other.

- Displays total expenses and funding sources, like investors and loans, to provide a comprehensive financial snapshot.

- Administrative/General:

- Details specific expenses, such as licenses, permits, insurance, legal fees, franchising, office supplies, utilities, and employee training, with due dates and budget comparisons.

- Location/Office:

- Covers office-related costs including space rental/lease, internet setup, telephone setup, and furniture expenses, with budgeted vs. actual costs.

- Projected Average Monthly Costs:

- Projects ongoing monthly costs such as office rent, utilities, office supplies, telephone and internet, staff salaries, employee benefits, advertising/marketing, legal fees, and insurance, showing budgeted and actual amounts.

Start Up Financial Budgeting

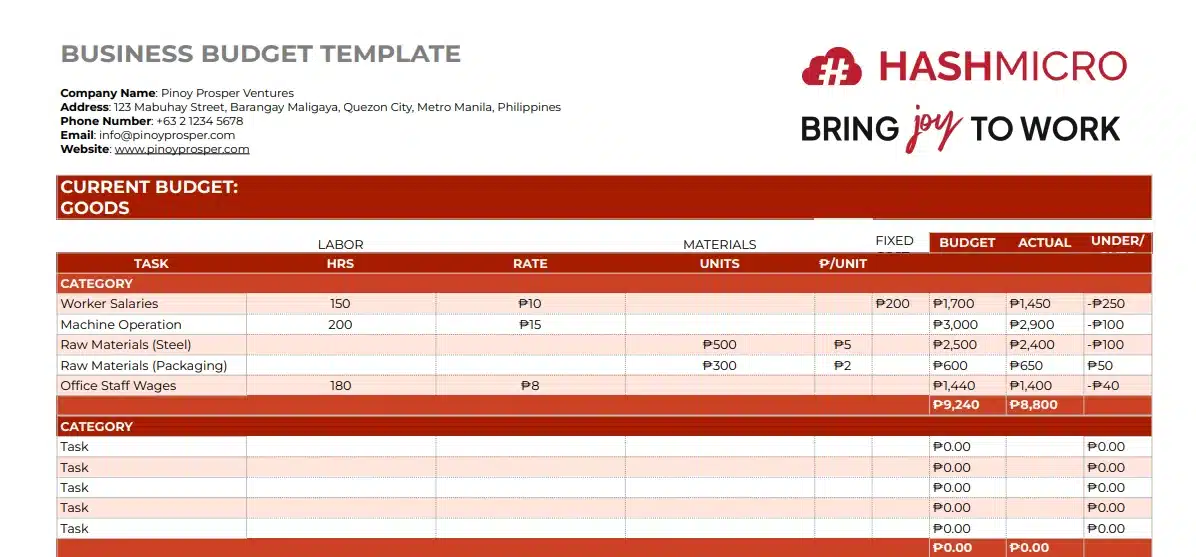

6. Standard business budget template

This business budget template provides a detailed and organized overview of a company’s financial planning. It categorizes various expenses such as salaries, operational, material, and administrative expenses.

Each category includes specifics on labor hours, rates, material costs, and any fixed expenses. The template allows for comparing budgeted amounts and actual expenditures, highlighting differences to help manage finances effectively.

Financial budgeting can be tough, especially with the need to comply with strict regulations like BIR’s e-Filing and e-Payment systems, and other tax requirements. To ensure compliance and avoid penalties, businesses in the Philippines must use BIR-authorized accounting software.

These tools simplify the budgeting process by automatically updating tax deductions and generating BIR-compliant financial reports (such as BIR Form 1701, 1702, etc.). Click on the banner below to try out one of these software:

How to Create Financial Budgeting

The process of creating an annual corporate financial budget typically takes between three to six months. This confidential process often involves the following steps:

1. Set and communicate management targets and objectives

Sa hakbang na ito, kailangan itakda ang mga malinaw na layuning pinansyal at operasyon para sa susunod na taon. Management typically sets targets related to revenue, profit margins, cost reduction, capital expenditures, and other key performance indicators (KPIs).

Once the targets are determined, they are communicated across all relevant departments to ensure alignment and understanding of organizational priorities.

2. Develop the final financial budgeting aligned with the targets

In this phase, the finance team creates a detailed budget that reflects the company’s targets and objectives. This involves estimating revenue, expenses, investments, and savings.

The final budget will include essential financial statements such as the balance sheet (which shows assets, liabilities, and equity), the income statement (which reflects profits and losses), and the cash flow statement (which tracks incoming and outgoing cash).

3. Finalize employee compensation plans

Employee compensation plans, including salaries, bonuses, and benefits, are an integral part of the budgeting process. HR and finance departments work together to finalize compensation details for all employees.

This includes salary adjustments, incentive structures, healthcare plans, retirement contributions, and any other related expenses.

4. Adjust the budget model and performance metrics

The budget model must be flexible enough to accommodate changes throughout the year. During this step, the finance team refines the model, incorporating performance metrics that will allow management to track progress towards the established goals.

These metrics might include sales performance, operating expenses, return on investment (ROI), and other specific KPIs that help monitor financial health.

5. Review and make necessary revisions

After drafting the budget, senior management and relevant stakeholders thoroughly review it. This is an opportunity to identify any discrepancies, inconsistencies, or adjustments that need to be made.

For example, management might find that some departments require more funding or that projected revenues are overestimated. Changes may also be made to align the budget with updated market conditions, new business priorities, or unforeseen challenges.

6. Obtain approval for the financial budgeting

Once the budget has been reviewed and revised, it must be formally approved by the board of directors, senior executives, or other relevant governing bodies within the organization.

This step typically involves presenting the budget and its assumptions in detail, with supporting financial documents. Approval may require several rounds of discussion and modification before final consent is granted.

7. Distribute departmental or business unit financial budgeting

After approval, the final budget is shared with department heads and business unit leaders. This allows them to plan and allocate resources accordingly. These leaders manage their respective budgets and report on their progress throughout the year.

Financial budgeting helps a team execute a business plan effectively, turning corporate goals into action through a well-defined roadmap and measurable metrics.

Effortless Financial Budgeting with HashMicro Accounting Software

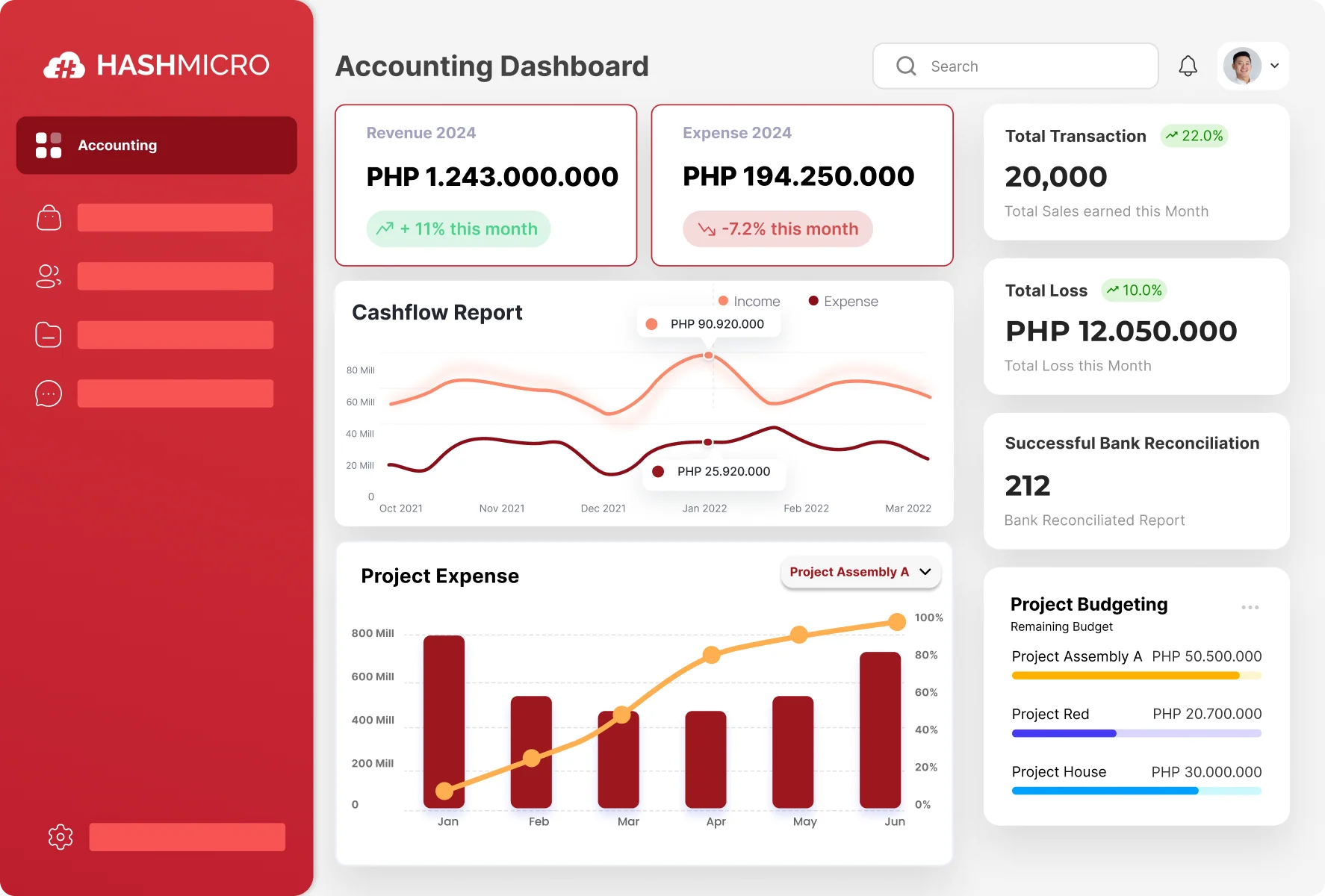

Managing your company’s financial budget doesn’t have to be overwhelming. With HashMicro Accounting Software, you get a solution that adapts to your business’s unique needs.

Imagine being able to allocate your budget with just a few clicks, knowing it’s fully adjusted to BIR standards. This is exactly what HashMicro’s accounting software offers.

What’s more, HashMicro is BIR-authorized, meaning you can generate tax-compliant reports directly from the system, without the need for manual adjustments. This software also provides a free demo for companies who want to ask questions and see what the system is capable of.

Once your budget is set up, you can trust that it’s fully aligned with BIR regulations, which saves time and reduces errors. With this all-in-one solution, financial budgeting becomes simpler, more efficient, and entirely stress-free.

Here are the key features of HashMicro Accounting Software to help with financial budgeting, including but not limited to:

- Bank Integration – Auto Reconciliation: Automatically matches bank transactions with internal records, flagging discrepancies for review.

- Multi-level Analytical (Compare FS per project, branch, etc.): Breaks down financial statements by project, branch, or department for detailed comparison.

- Profit & Loss vs Budget & Forecast: Compares actual profit and loss with the budget and forecasts, highlighting variances.

- Cash Flow Reports: Tracks incoming and outgoing cash, updating the business’s cash position in real time.

- Forecast Budget: Predicts future financials based on historical data, with regular updates for adjustments.

- Budget S Curve: Visualizes project or budget expenditure progress through a graphical curve.

- Financial Statement with Budget Comparison: Compares actual financial statements with the set budget, highlighting differences.

Conclusion

Financial budgeting is essential for businesses to plan, allocate resources, and achieve financial goals. It ensures that companies can track their performance against projections and make adjustments as necessary.

HashMicro Accounting Software makes budgeting a breeze, offering flexible tools designed to adapt to your business’s unique needs. It simplifies financial planning, giving you full control and peace of mind.

Moreover, with its BIR-authorized status, you can confidently generate tax-compliant reports, without worrying about manual adjustments. Sa tulong ng HashMicro, parang may katulong kang matalino sa bawat hakbang ng iyong negosyo.

Try out the free demo now!