Entrepreneurs, are you aware that managing your financial ratios manually may signal that your business isn’t keeping up with modern advancements? A study found that the use of an automatic financial ratio through accounting software can reduce 90% of manual errors.

As it is important to manage the accounting process automatically, you may know that the importance of financial ratio analysis is crucial for businesses in the Philippines. Therefore, if you want to know more about what is financial ratio, its formula, and its type, you come to the right place.

This article will give you a complete guide of accounting ratio analysis. Entrepreneurs, nang hindi na magpatumpik-tumpik pa, simulan na natin ang talakayan sa ibaba. Huwag palampasin ang mahalagang impormasyon na makakatulong sa inyong negosyo!

Key Takeaways

|

Table of Content

Content Lists

What is a Financial Ratio?

A financial ratio is a numerical comparison of various aspects of a company’s financial performance, typically derived from its financial statements. These ratios help assess a business’s profitability, efficiency, and solvency, offering insights into its overall financial health.

Financial ratio examples include the current ratio, return on equity, and debt-to-equity ratio. Ratio analysis is an essential tool for investors, managers, and analysts to make informed decisions regarding a company’s stability and growth potential.

Functions of Financial Ratios You Should Know

Financial ratios serve several important purposes. As part of an accounting system software, they quickly identify a company’s potential issues, whether related to growth or decline. Its functionalities such as:

- Profitability: Measures profit generation efficiency (e.g., gross profit margin, return on assets).

- Liquidity: Evaluates ability to meet short-term liabilities (e.g., current ratio, quick ratio).

- Solvency: Assesses long-term financial stability (e.g., debt-to-equity, interest coverage ratio).

- Efficiency: Tracks resource utilization (e.g., inventory turnover, asset turnover).

- Performance comparison: Standardizes comparisons over time or against competitors.

Types of Financial Ratios and Formulas

According to Darmawan (2020) in his book “Basics of Understanding Financial Ratios and Statements,” there are several types of financial ratio analysis inside the accounting system. Below is an explanation of each type and its formula:

1. Profitability Ratio

Profitability ratios measure how well a company can generate profit over a specific period by analyzing sales, cash, capital, and the workforce. Here are some financial ratio examples you can use:

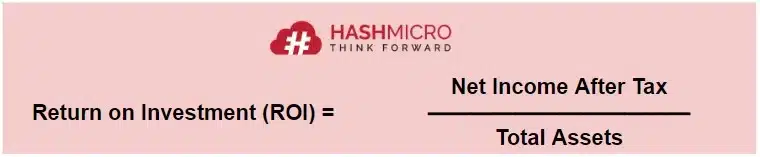

- Return on Investment (ROI): This ratio shows a company’s ability to generate profit based on its assets. ROI formula:

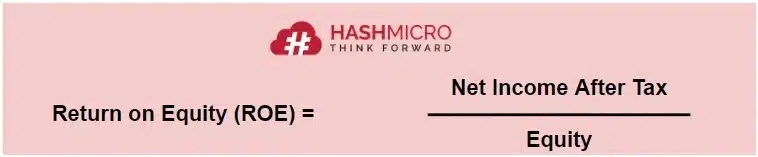

- Return on Equity (ROE): This ratio calculates net income after tax by using the company’s capital. ROE formula:

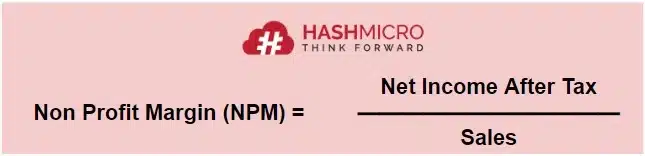

- Net Profit Margin (NPM): This ratio measures the company’s efficiency by comparing net income to sales. NPM formula:

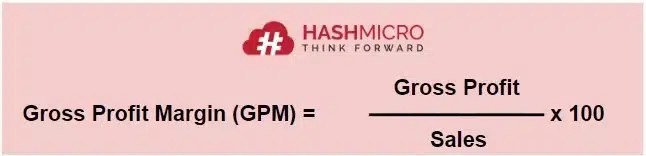

- Gross Profit Margin: This ratio calculates the percentage of gross profit to sales, indicating the company’s efficiency in managing production costs. GPM formula:

2. Liquidity Ratio

Liquidity ratios evaluate a company’s ability to pay short-term financial obligations using available assets. A company is considered “liquid” if it can meet its obligations on time. Some common liquidity in financial ratio examples include:

- Current ratio: This ratio compares current assets to current liabilities, showing a company’s ability to pay short-term debts. Current ratio formula:

- Quick ratio: Often called the acid test ratio, it measures a company’s ability to meet its obligations without relying on inventory. Formula:

- Cash ratio: This ratio evaluates the company’s cash position relative to current debts. Formula:

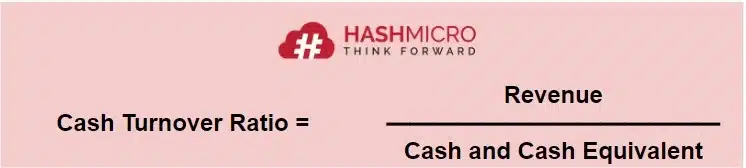

- Cash turnover ratio: This ratio shows the relative value of net sales to net working capital. Formula:

3. Solvency Ratio

Solvency ratios measure a company’s ability to meet long-term obligations, especially if it faces liquidation. These ratios focus on how much of the company’s assets are funded by debt. Key solvency ratios include:

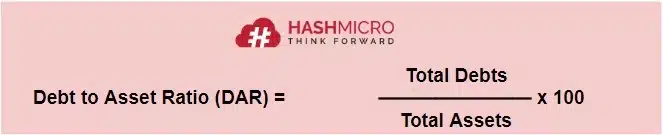

- Debt to Asset Ratio (DAR): This ratio compares total liabilities to total assets. Financial ratios formula:

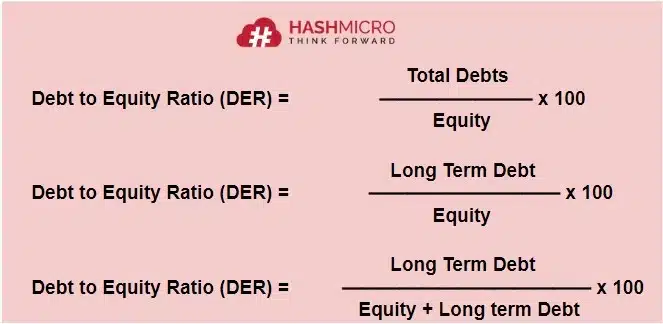

- Debt to Equity Ratio (DER): This ratio shows the proportion of debt to equity used in the company’s financing. Formula:

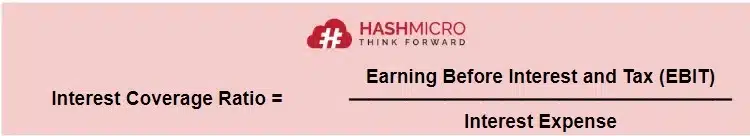

- Interest Coverage Ratio (IC): This ratio measures the company’s ability to pay interest on its debts. Financial ratios formula:

4. Activity Ratio

Activity ratios assess how efficiently a company uses its assets and liabilities to generate sales and increase profit. Important activity ratios include:

- Accounts receivable turnover: This ratio measures how efficiently a company collects payments from customers. Accounts receivable turnover in a financial ratios formula:

- Merchandise inventory turnover: This ratio shows how often a company sells and replaces its inventory in a given period. Financial ratios formula:

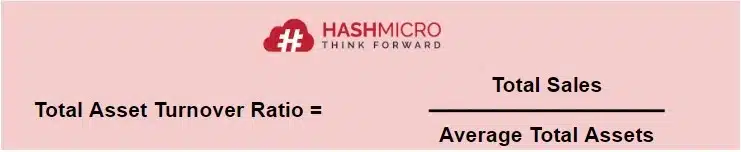

- Total asset turnover: This ratio measures how effectively a company uses its assets to generate revenue. Financial ratios formula:

Transform Your Manual Financial Ratio to Automatic Accounting Software from HashMicro

Bilang isang negosyante o accountant sa Pilipinas, ang pagtutok sa iba’t ibang pormula ay maaaring maging labis na nakaka-overwhelm. Ngunit, ang mga komplikasyon na ito ay magiging mas madali sa pamamagitan ng paggamit ng HashMicro accounting software.

Bilang isang negosyante o accountant sa Pilipinas, ang pagtutok sa iba’t ibang pormula ay maaaring maging labis na nakaka-overwhelm. Ngunit, ang mga komplikasyon na ito ay magiging mas madali sa pamamagitan ng paggamit ng HashMicro accounting software.

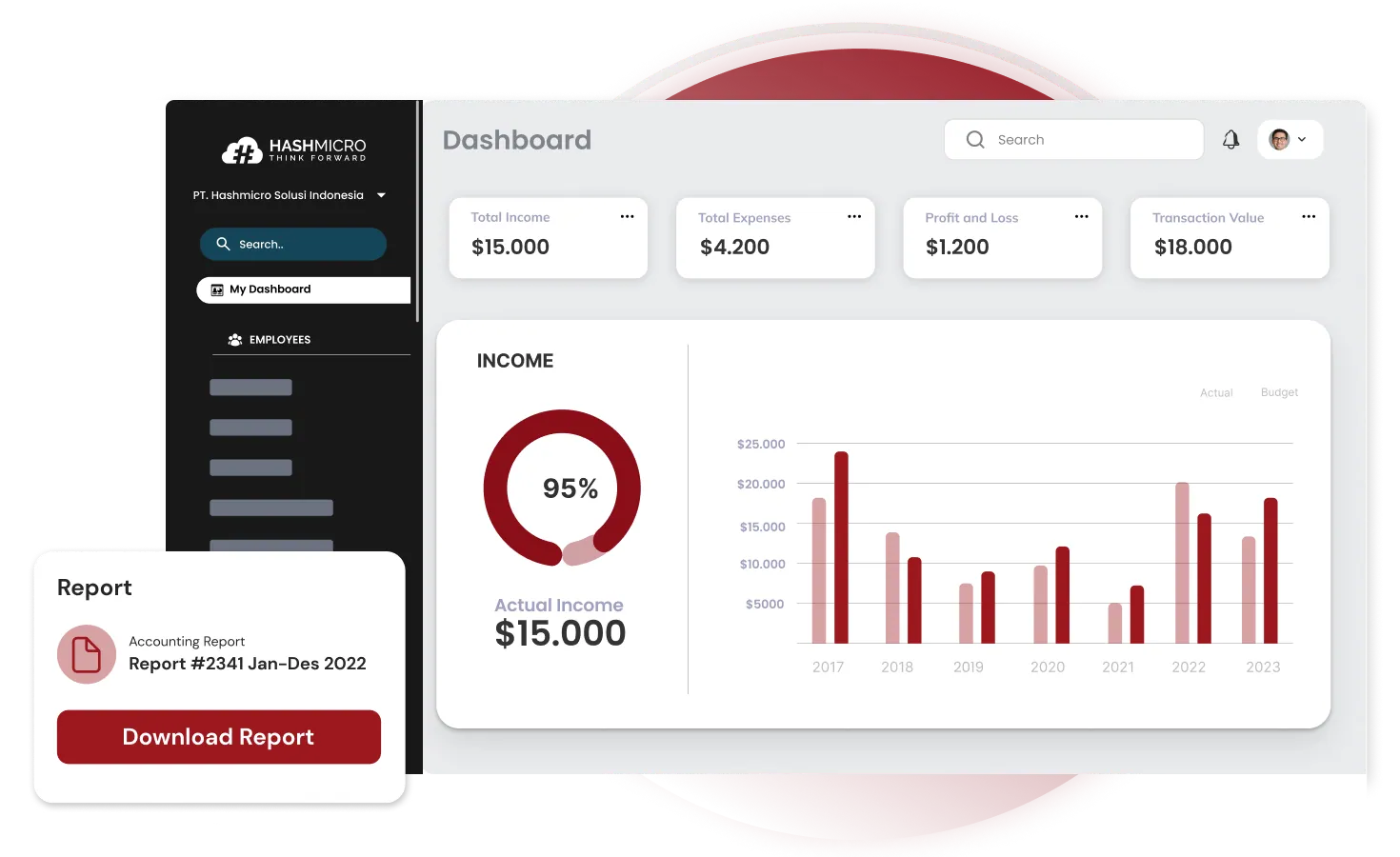

HashMicro is the best accounting software vendor in Southeast Asia. Established in 2015, HashMicro is the favorite choice of more than 1750 businesses. The features in the system automate the audit process and financial ratio calculation with ease.

HashMicro provides various benefits to its customers, such as free demos, interactive UI/UX displays, free customization, and also free user fees. HashMicro’s features are also comprehensive and can help you calculate your financial ratio, such as:

- Financial ratio: This feature provides automatic calculation for various important financial metrics such as liquidity ratios, profitability ratios, debt ratios, etc.

- Multi-level analytical: Know the trend or insight of all financial transactions in real-time and can be filtered based on various categories (project, branch, etc.)

- Cash flow reports: Track the company’s cash inflows and outflows using financial reporting tools to maintain liquidity, effectively plan finances, and address potential issues early.

- Budget S curve: Visually track and understand the distribution of expenses in a project, enabling faster decision-making.

- Custom printout system: Make it easy to print invoices for various needs and formats or displays that match the business identity.

- Forecast budget: Predict future budgets based on historical data to help plan finances, allocate resources efficiently, and make better strategic decisions.

Conclusion

Financial ratios play a vital role in assessing a company’s performance and overall financial health. While these financial metrics may seem overwhelming, utilizing the right tools can make the process more efficient and accurate.

HashMicro’s accounting software can help automate the calculation and analysis of financial ratios. With its advanced features, the software simplifies tasks, allowing you to make data-driven decisions with confidence. Sign up for a free demo to explore how HashMicro can support your business.

FAQ About Financial Ratio

-

What is a good current ratio?

The current ratio evaluates a company’s ability to meet its short-term obligations within a year. It compares the company’s current assets to its current liabilities. A favorable current ratio generally falls between 1.5 and 3.

-

Why are financial ratios important?

Financial ratios provide entrepreneurs with a tool to assess their company’s performance and benchmark it against others in the same industry. These ratios analyze the relationship between different elements of financial statements and are most valuable when used to compare results across multiple periods.

-

Why do investors use financial ratio analysis?

Evaluating your company’s financial ratios offers valuable insights into areas like profitability, liquidity, and efficiency. These ratios allow you to see how your business has performed over a specific period.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “What is a good current ratio?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The current ratio evaluates a company’s ability to meet its short-term obligations within a year. It compares the company’s current assets to its current liabilities. A favorable current ratio generally falls between 1.5 and 3.”

}

},{

“@type”: “Question”,

“name”: “Why are financial ratios important?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Financial ratios provide entrepreneurs with a tool to assess their company’s performance and benchmark it against others in the same industry. These ratios analyze the relationship between different elements of financial statements and are most valuable when used to compare results across multiple periods.”

}

},{

“@type”: “Question”,

“name”: “Why do investors use financial ratio analysis?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Evaluating your company’s financial ratios offers valuable insights into areas like profitability, liquidity, and efficiency. These ratios allow you to see how your business has performed over a specific period.”

}

}]

}