Many businesses in the Philippines struggle with outdated or inefficient financial reporting software, which can obscure rather than illuminate key financial insights. This lack of clarity can lead to missed opportunities and, even worse, unexpected financial downturns. Sayang naman!

Fortunately, the best financial reporting software can turn this around. With advanced analytics, real-time data processing, and comprehensive reporting features, it offers clarity and precision in financial management. Petmalu!

However, with so many software options available, choosing the right one can take time and effort. Don’t worry, as HashMicro Financial Reporting Software provides the best and tailored specifically to business with their own requirements.

If you still want to consider other options, we’ve put together a list of the 20 best financial reporting software tools.

- HashMicro: Best overall with AI-powered features, customization, and PFRS compliance.

- Oracle NetSuite: Best for enterprises with scalable solutions and advanced automation.

- QuickBooks: Best for small businesses with a user-friendly interface and budget-friendly pricing.

- FreshBooks: Best for freelancers with simple invoicing and expense tracking.

- Insight Software: Best for advanced analytics with deep financial insights and reporting.

Key Takeaways

|

Table of Contents

What is Financial Reporting Software?

Financial reporting software is a powerful tool that automates the collection, analysis, and reporting of financial data. It simplifies complex financial tasks, ensuring accuracy and compliance with ever-changing financial regulations and reporting standards.

More than just a reporting tool, it provides real-time insights into a company’s financial health. By integrating multiple financial functions into one system, businesses can conduct in-depth analysis and generate clear, comprehensive financial reports.

Beyond basic reporting, financial reporting software also includes advanced features for budgeting, forecasting, and strategic planning. With precise financial projections and data-driven decisions, businesses can improve cash flow, enhance performance, and drive long-term growth.

Hashy AI Fact

Need to know!

Financial reporting software simplifies financial analysis and forecasting with accuracy. With Hashy AI by HashMicro, your reporting process becomes faster, and more efficient.

Get a Free Demo Now!

Which Capabilities Must Financial Reporting Tools Possess?

When considering financial reporting software, it’s important to understand the key features that differentiate the best software in the market. These features not only enhance financial management but also contribute significantly to overall business efficiency and insight.

Here’s a look at some of the standout features you should look for:

1. Financial Statement

Financial statements are crucial outputs of financial statement reporting software, providing a comprehensive overview of a company’s financial status over a specific period. These reports typically include balance sheets, income statements, and cash flow statements.

They offer critical data that stakeholders use to make informed decisions about investments, budget allocations, and business strategy. Effective financial statement reporting software automates the creation of these statements, ensuring accuracy and consistency and reducing the time spent on manual financial tasks.

2. Budget Management

Budget management features in financial reporting software allow organizations to plan, allocate, and monitor their financial resources efficiently. These tools enable businesses to set financial targets, track expenditures, and forecast future financial needs.

By comparing actual spending against planned budgets, companies can identify discrepancies and make adjustments to ensure financial objectives are met. This feature is essential for maintaining financial discipline within an organization, helping to prevent overspending and optimize financial performance.

3. E-Invoicing

E-invoicing features in financial reporting software streamline the process of generating, sending, and managing invoices electronically. This functionality facilitates faster payments and reduces the administrative burden associated with manual invoicing processes.

E-invoicing also enhances accuracy by minimizing human errors and improves compliance with tax regulations by ensuring all transactions are recorded and easily accessible for audits. For businesses dealing with a high volume of transactions, e-invoicing is vital for maintaining orderly financial records and improving cash flow management.

4. Profit and Loss Reports

Profit and loss reports summarize the revenues, costs, and expenses incurred during a specific period. These reports are fundamental for assessing the financial health of a business, showing whether it made a profit or incurred a loss.

Profit and loss reports help managers understand which areas of the business are generating income and where costs can be cut to improve profitability. Regularly reviewing these reports allows businesses to adjust their strategies in response to financial performance, ensuring sustained growth and profitability.

5. Compliance Management

Compliance management in financial reporting software ensures that a company adheres to relevant financial regulations and standards. This feature automates the tracking and reporting of financial data required by governmental and regulatory bodies, thereby reducing the risk of non-compliance penalties.

How to Choose the Best Financial Reporting Software

Accurate and timely financial insights are essential for effective decision-making. Financial reporting software and tools have become invaluable for companies, providing real-time data and automated reporting that help streamline complex financial processes.

Choosing the right solution is critical, as it enhances data accuracy, scales with your business needs, and integrates with other systems for seamless operation.

- Identify your business needs:

Before selecting software, assess your company’s unique financial reporting requirements, such as multi-entity consolidation, compliance needs, or specific financial metrics. Small businesses may need basic reporting features, while larger enterprises might require complex, customizable reports and forecasting.

- Evaluate core features:

For essential features like real-time data processing, automated reporting, integration with accounting systems, and advanced analytics. Ensure the software can handle multiple reporting types tailored to your business model, such as income statements, balance sheets, and cash flow reports.

- Scalability and customization:

Choose a solution that can grow with your business and adapt to changing financial needs. Customization options, like tailored dashboards or bespoke metrics, can be crucial for aligning the software with company goals and operational specifics.

- Integration capabilities:

The software should integrate seamlessly with your existing ERP, CRM, and accounting systems to ensure smooth data flow across platforms. Strong integration supports accurate, comprehensive reporting by pulling information from various departments.

- User-friendly interface:

An intuitive, easy-to-navigate interface improves user adoption and efficiency, reducing the learning curve and ensuring all team members can use it effectively. Check for features like drag-and-drop report building and simple data visualization options.

- Data security and compliance:

Ensure the software complies with industry security standards and data privacy regulations, such as GDPR, SOC 2, or ISO standards. Secure software with role-based access control and encrypted data handling protects sensitive financial information and ensures regulatory compliance.

- Vendor support and training:

Reliable customer support and training resources are vital for helping your team get the most out of the software. Look for vendors offering onboarding, ongoing support, and thorough documentation or training programs.

How Can The Best Financial Reporting Software Improve Your Business?

Embracing automated financial reporting software offers a multitude of advantages that can transform the financial management of any business. Here are some of the key benefits:

1. Automated Reports and Analytics

One of the primary advantages of financial reporting tools is its ability to automate the generation of reports and analytics. This automation saves considerable time and reduces the likelihood of human error.

With financial reporting software, businesses can instantly generate various financial reports such as income statements, balance sheets, and cash flow statements with just a few clicks.

2. Accurate Data Consolidation

Financial statement reporting software excels in its capacity to automatically consolidate data from multiple sources. For businesses operating across different locations or with several departments, this feature proves invaluable.

It eliminates the cumbersome and error-prone process of manually gathering and reconciling financial data. By offering a single, unified view of financial information, this software ensures that all financial reporting is accurate, consistent, and reflective of the company’s entire operations.

3. Automated Collaboration and Audit Trail

Financial reporting software enhances collaboration within teams by providing features that control access and editing permissions. This ensures that only authorized personnel can view or modify sensitive financial data, reducing the risk of unauthorized access or errors.

Moreover, these systems come equipped with comprehensive audit trails. Every entry, adjustment, or deletion is logged, providing a clear and traceable record of who made changes and when.

4. Regulation and Compliance Management

Staying compliant with financial regulations is a major challenge for many businesses. Financial statement reporting software is designed to help companies meet these regulatory requirements with less effort and more accuracy.

Financial accounting software regularly updates to reflect the latest financial regulations and standards, ensuring that all financial reporting is compliant with local and international laws.

5. Time-Saving and Avoid Human Error

Financial reporting software significantly reduces the margin for error that often accompanies manual financial processes. By automating complex calculations and data entry, the software ensures that financial reports are accurate and free of the common mistakes that can occur when data is handled manually.

Moreover, the time-saving aspect of financial statement reporting software, a key component of financial statement management, cannot be overstated. Automating routine financial tasks frees up finance teams to focus on more strategic activities rather than spending hours on data entry or error checking.

The 20 Best Financial Reporting Tools

Selecting the right software can significantly impact your company’s efficiency and compliance. This choice isn’t just about picking a tool; it’s about choosing a partner that will help navigate through complex financial landscapes, ensure regulatory compliance, and enhance decision-making processes.

Here are our top recommendations for financial reporting software:

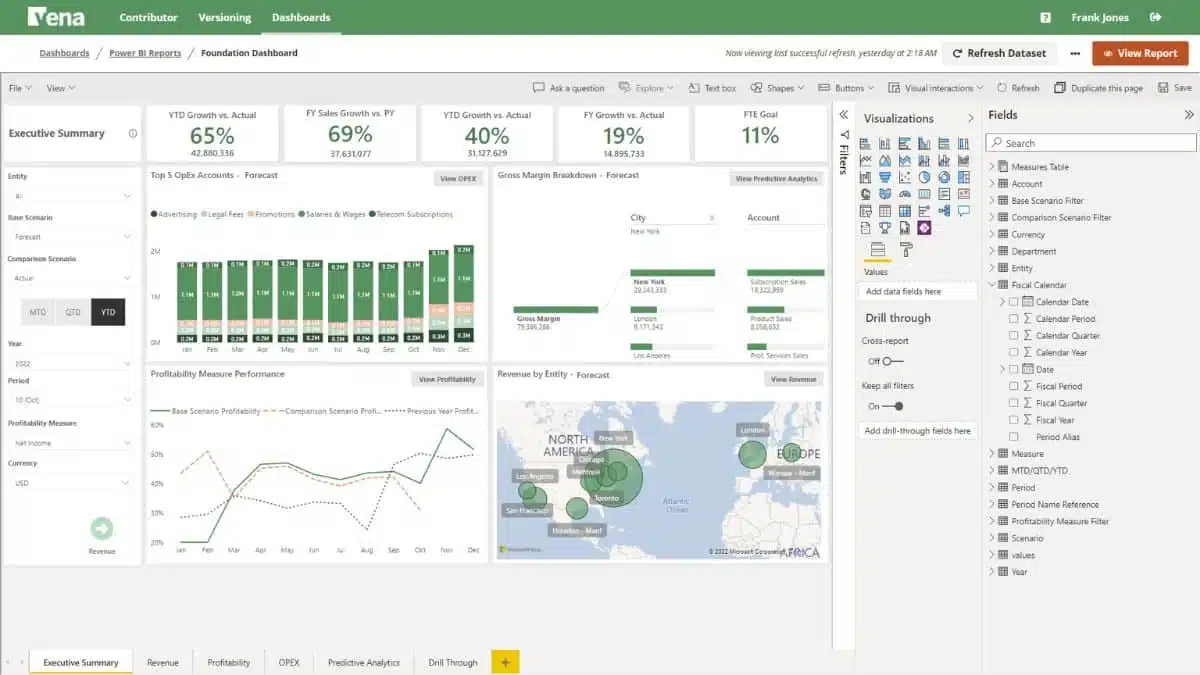

1. HashMicro

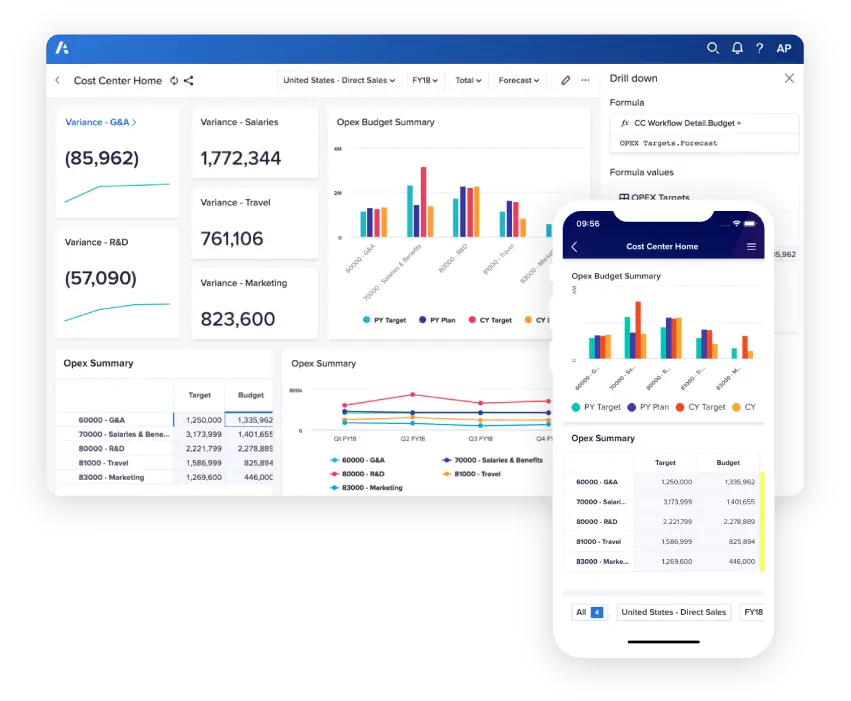

HashMicro stands out as the premier financial reporting software among all the best overall options in the Philippines, offering a robust solution equipped with cutting-edge technologies. Designed to streamline financial reporting tools, HashMicro provides an all-encompassing reporting software that enhances accuracy and efficiency in financial reporting tools.

The software features a comprehensive suite of integrated modules, including accounting, CRM, and HRM, among others. This integration allows for seamless data flow between different departments, fostering better communication and operational synergy. Interested parties can experience the power of HashMicro firsthand by signing up for a free demo.

Key features:

- Financial Statement with Budget Comparison: This feature allows users to generate financial statements that directly compare actual financial data against budgeted figures, facilitating effective budget management and variance analysis.

- Cash Flow Reports: Enables businesses to track the amount of cash flowing in and out, providing a clear picture of liquidity and financial health at any given time.

- Multi-Level Analytical: Offers deep dive analytics that allow users to break down financial data across multiple dimensions, such as departments, projects, or regions, for granular analysis.

- Equity Movement Report: Tracks changes in equity over time, detailing sources such as earnings, investments, or distributions, which is crucial for stakeholder reporting and analysis.

- Landed Costs Management: Helps businesses accurately calculate the total cost of inventory, including purchase price, transportation fees, customs, duties, and other costs associated with bringing goods to market.

- Treasury & Forecast Cash Management: Provides tools for managing and forecasting company cash positions, helping ensure liquidity and optimize investment strategies.

- Budget S Curve: This feature visualizes the cumulative cost and revenue over a project’s lifecycle compared to the planned budget, offering a graphical representation of financial progress and forecasting.

While HashMicro offers numerous advantages, weighing its strengths and potential limitations is essential for businesses considering its implementation. The following sections will delve into the detailed pros and cons of HashMicro financial reporting software.

| Pros | Cons |

|

|

HashMicro has earned the trust of numerous companies across the Philippines. By adopting HashMicro, businesses can leverage top-tier financial reporting capabilities, ensuring continued success and compliance. For more details on pricing, you can download the price scheme below.

Pricing: Custom pricing depending on modules and business size.

2. Oracle NetSuite

Oracle NetSuite is renowned for its comprehensive and intuitive financial reporting software, tailored to modern business needs. It offers a robust platform that streamlines financial processes through automation and real-time analytics.

The software’s cloud-based nature ensures that users can manage and access their financial data from anywhere, enhancing flexibility and operational efficiency.

Key features:

- Tax management

- Accounts receivable and payable

- Cash management

| Pros | Cons |

|

|

Pricing: Starts at around $99/user/month plus a base license fee of $999/month.

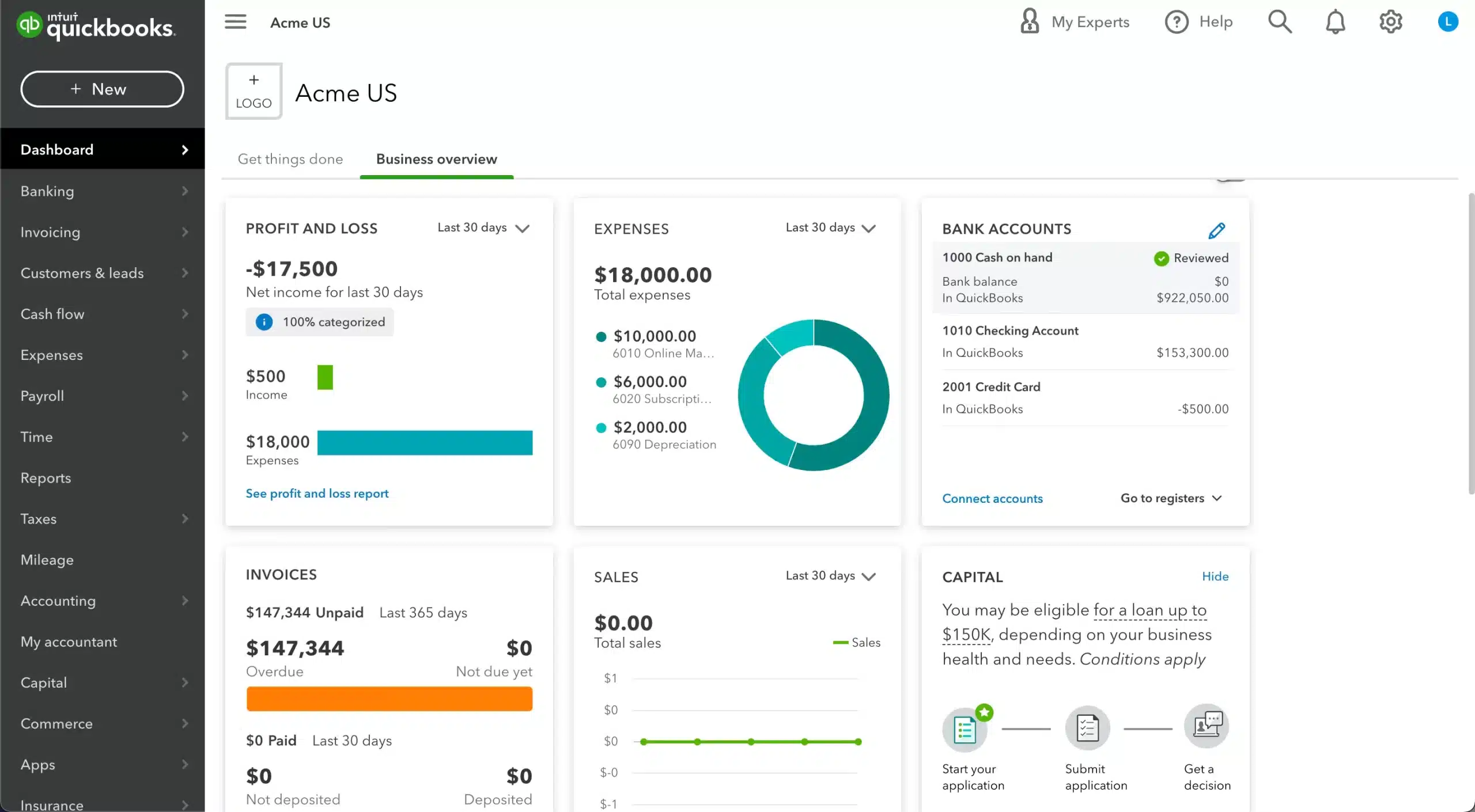

3. QuickBooks

QuickBooks serves as an ideal entry-level financial reporting software, particularly suited for freelancers and small or growing businesses. Recognized globally as one of the most popular accounting solutions, QuickBooks primarily focuses on essential financial tasks but may not suffice for larger organizations seeking advanced and customizable financial reporting software capabilities.

Key features:

- Invoicing

- Expenses and expense management

- VAT and GST

| Pros | Cons |

|

|

Pricing: Starts at $30/month for Simple Start, up to $200/month for Advanced.

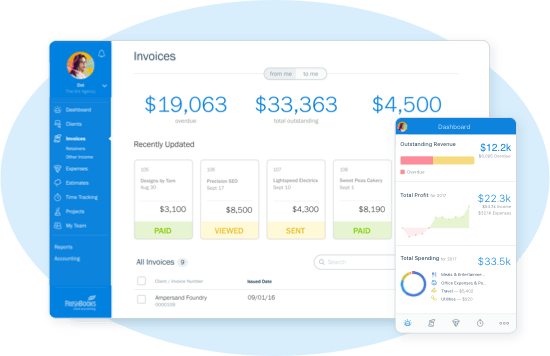

4. FreshBooks

FreshBooks is financial reporting software that is specifically designed for freelancers and small businesses, primarily serving as an effective invoicing tool. While it allows the generation of seven types of reports, its capabilities in customization remain somewhat limited.

Despite its highly user-friendly interface and affordability, some users report issues with frequent crashes and slow loading times.

Key features:

- Budget and sales tax summaries

- Profit and loss reports

- Expense reports

| Pros | Cons |

|

|

Pricing: Starts at $19/month (Lite), with plans up to $60/month (Premium).

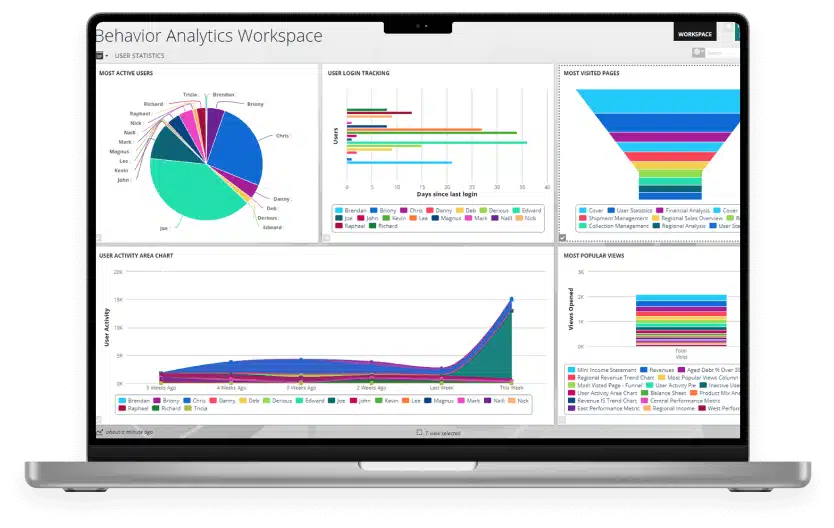

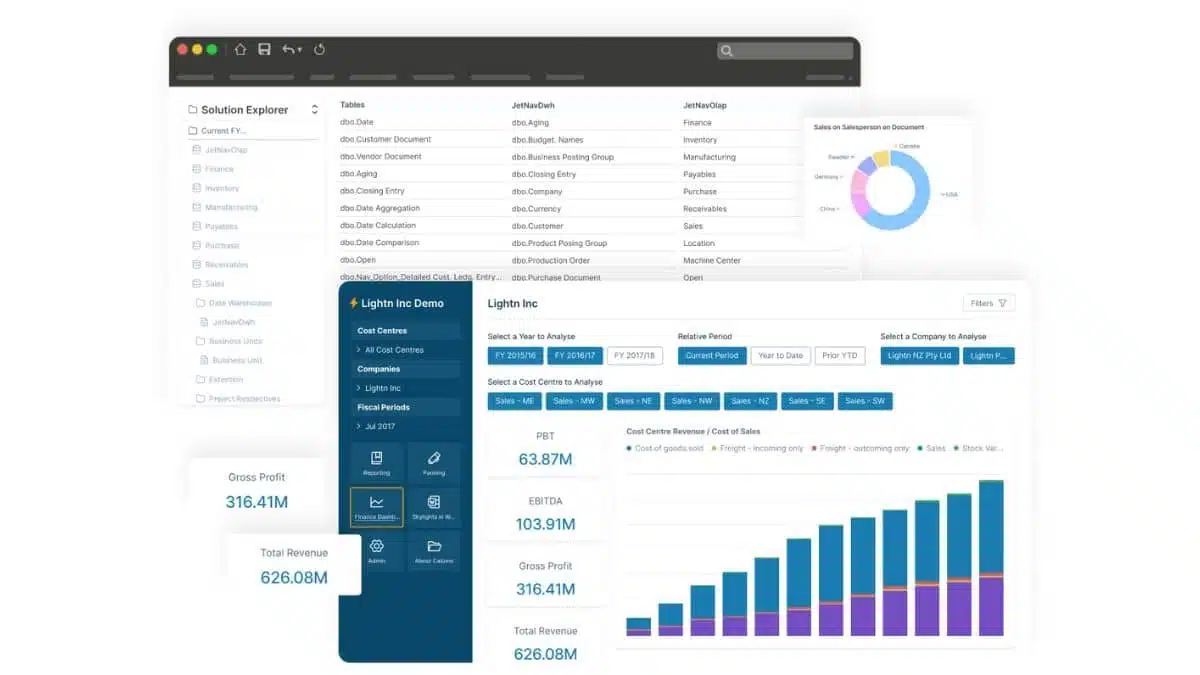

5. Insight Software

Insight Software, a French tech company, commits to streamlining financial processes, promising to reduce closing and reporting times by up to 50%. Known for its robust financial reporting software with custom report capabilities and seamless Excel integrations, Insight Software adjusts its pricing based on the tier of features, which are aligned with claims of improved efficiency.

Key features:

- ERP to Excel data export

- Spreadsheet server reporting

- Custom reports

| Pros | Cons |

|

|

Pricing: Available on request.

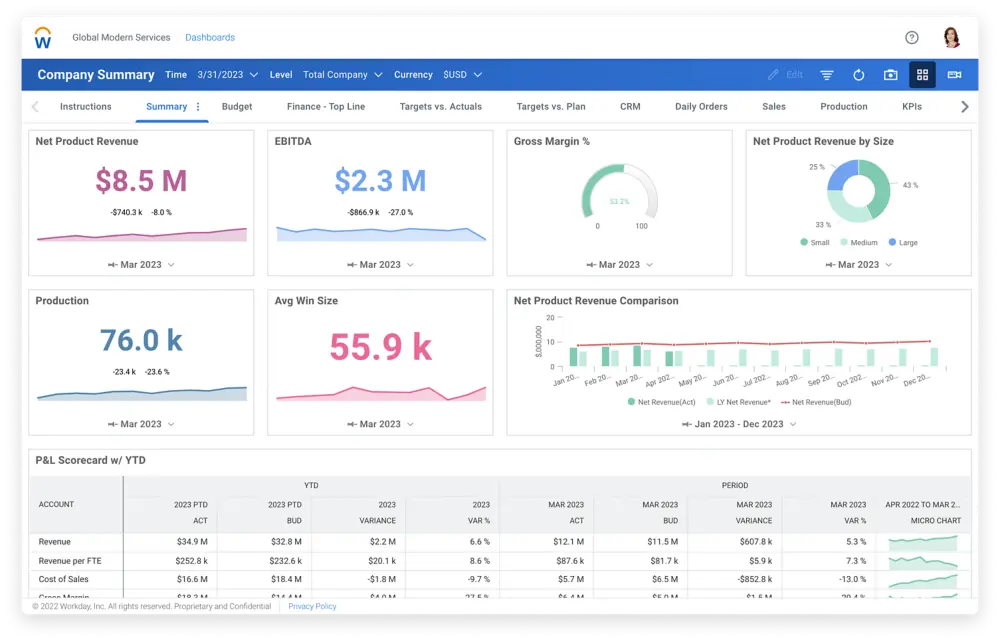

6. Workday

Workday Adaptive Planning offers rapid, visible insights with a single click, complemented financial reporting software. It is particularly praised for its predictive models and seamless cloud-based accounting software for construction operations.

However, some users express challenges in conveying complex financial data to non-financial audiences, highlighting a potential learning curve.

Key features:

- Budgeting and forecasting

- Analytics and reporting

- Scenario planning

| Pros | Cons |

|

|

Pricing: Starts around $100K/year, depending on modules.

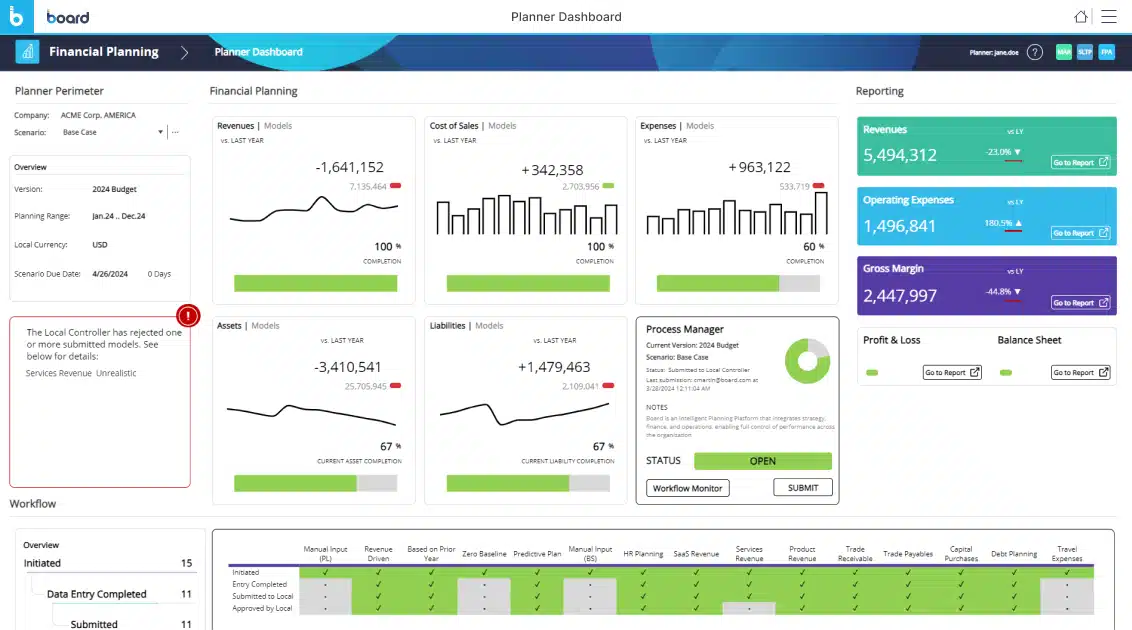

7. Board

Board is designed to enhance business financial reporting, offering powerful financial reporting software for custom planning and analysis. The software stands out by integrating calculated metrics, analytics, and reports into a unified platform, enabling users to create comprehensive dashboards and real-time models without needing extensive technical expertise.

Key features:

- Calculated metrics

- Analytics

- Real-time modeling

| Pros | Cons |

|

|

Pricing: Pricing is customizable, depending on modules and scale

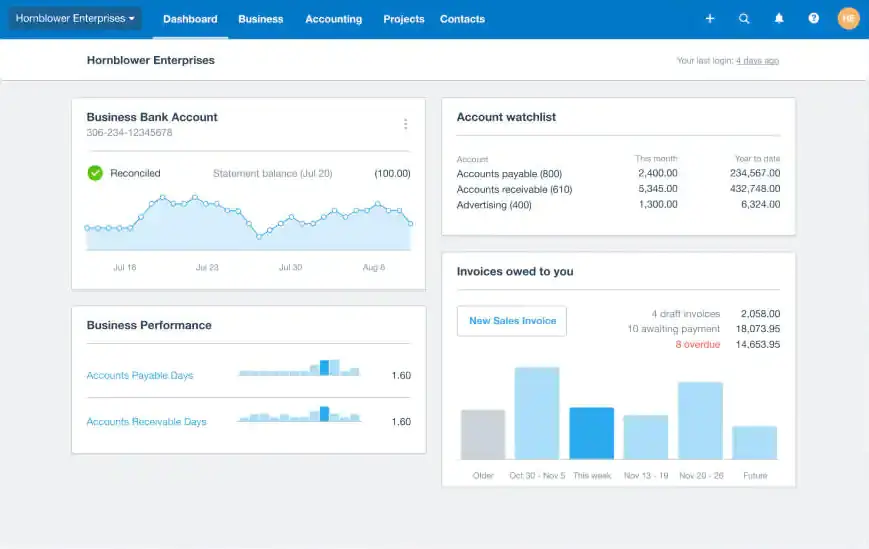

8. Xero

Xero offers robust financial reporting tools performance reporting software with valuable reporting features, making it a favorite among small to medium-sized enterprises. While primarily focusing on payroll, expenses, and invoicing, Xero also excels in providing tools for tracking bills, managing payroll, and integrating bank connections for comprehensive financial oversight.

Key features:

- Collaboration capabilities

- Customizable reports

- Formulas to compare budgets with actuals

| Pros | Cons |

|

|

Pricing: Starts at $15/month (Early), $42/month (Growing), $78/month (Established).

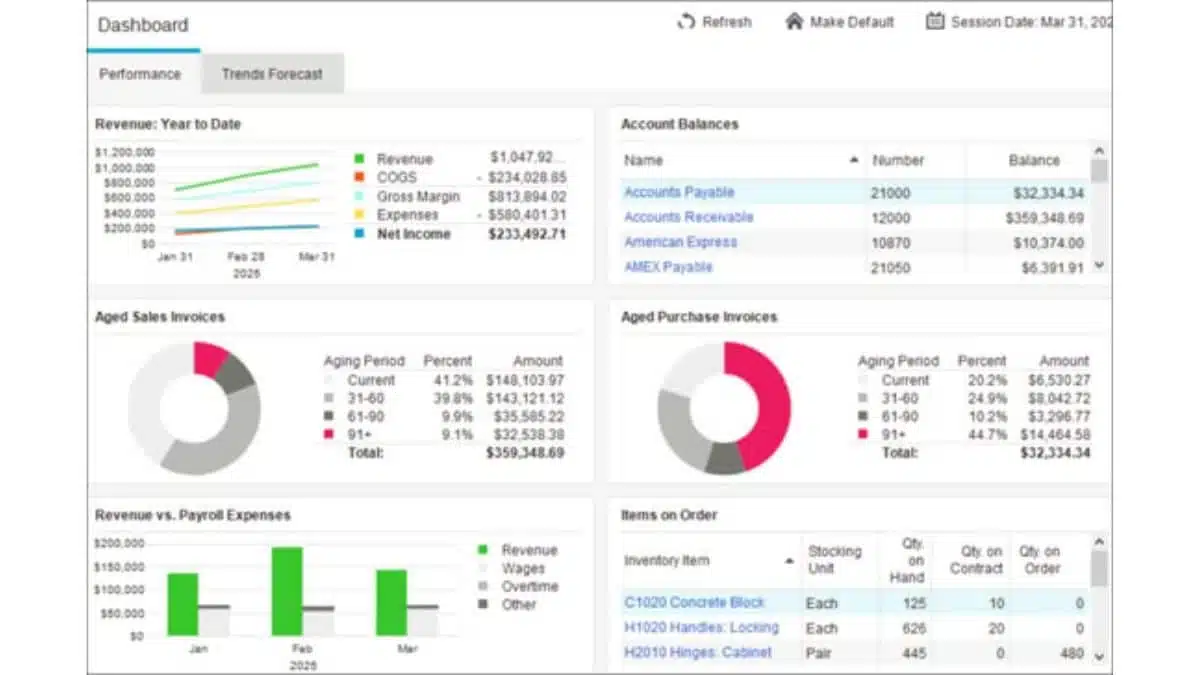

9. Sage 50

Sage 50 extends the capabilities of Sage Intacct into a cloud-based environment, allowing users to access their financial files from anywhere. It offers robust financial reporting software, including advanced budgeting and seamless Microsoft 365 integration, making it a solid choice for companies that require compatibility with Microsoft products.

Key features:

- Advanced budgeting and reporting

- Audit trails

- Inventory management

| Pros | Cons |

|

|

Pricing: Starts at $58.92/month (Pro), $96.58/month (Premium), and $160/month (Quantum).

10. Vena Solutions

Vena Solutions stands out as an automated financial reporting software that enhances businesses’ capabilities to integrate advanced reporting with Excel data seamlessly. As a cloud-based solution, Vena is designed to facilitate sophisticated scenario planning and budget forecasting, making it a powerful tool for financial management and strategic planning.

Key features:

- Financial management

- Financial and ad-hoc reporting

- Analytics and real-time insights

| Pros | Cons |

|

|

Pricing: Pricing is customizable, average cost is around $50,000/year or more.

11. Planful

Planful, previously branded as Host Analytics, leverages the expertise of professionals seasoned in enterprise software, HR, and growth strategies. The financial reporting software is appreciated for its user-friendly interface, though it sometimes faces criticism for accuracy issues, particularly when updating formulas and reports.

Key features:

- Excel reporting and integrations

- Data visualizations

- Personalized dashboards

| Pros | Cons |

|

|

Pricing: Average cost is between $30,000–$100,000/year.

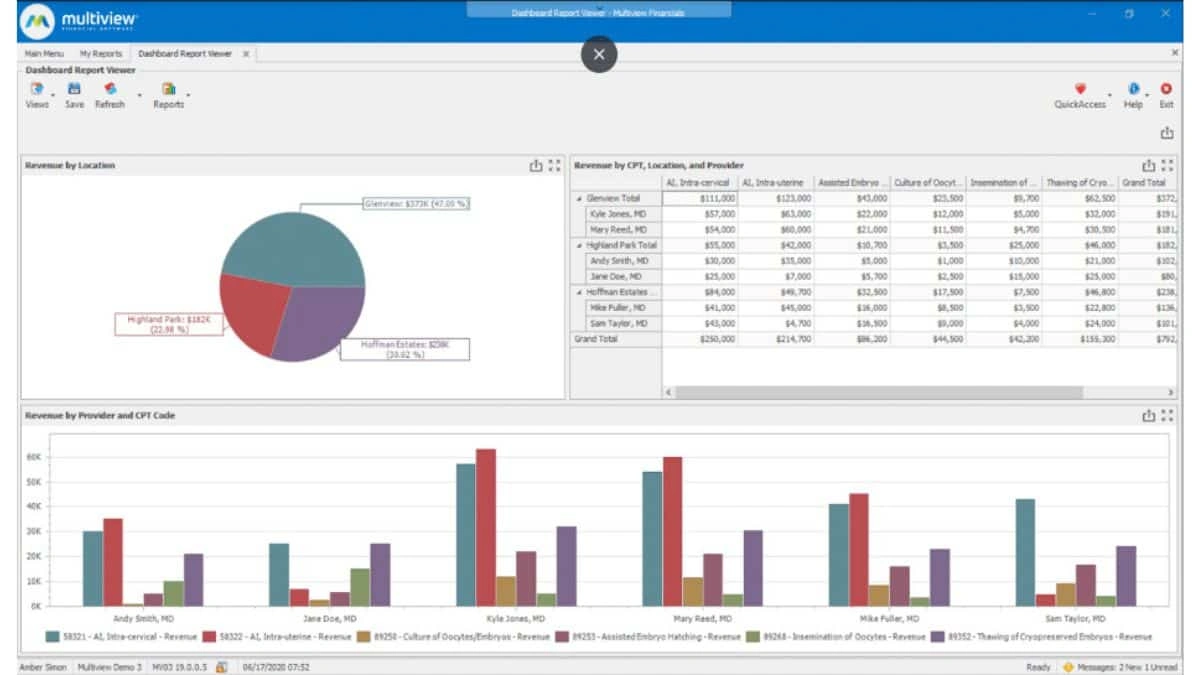

12. Multiview

Multiview stands out in the ERP and financial reporting software landscape with its dedication to supporting businesses through both its technology and customer service teams. It excels in providing detailed financial insights and robust data handling capabilities, offering tools that cater to a wide range of financial functions from core accounting to advanced business analytics.

Key features:

- Asset management

- General ledger

- Accounts payable and receivable

| Pros | Cons |

|

|

Pricing: Custom pricing only; based on organization size and usage.

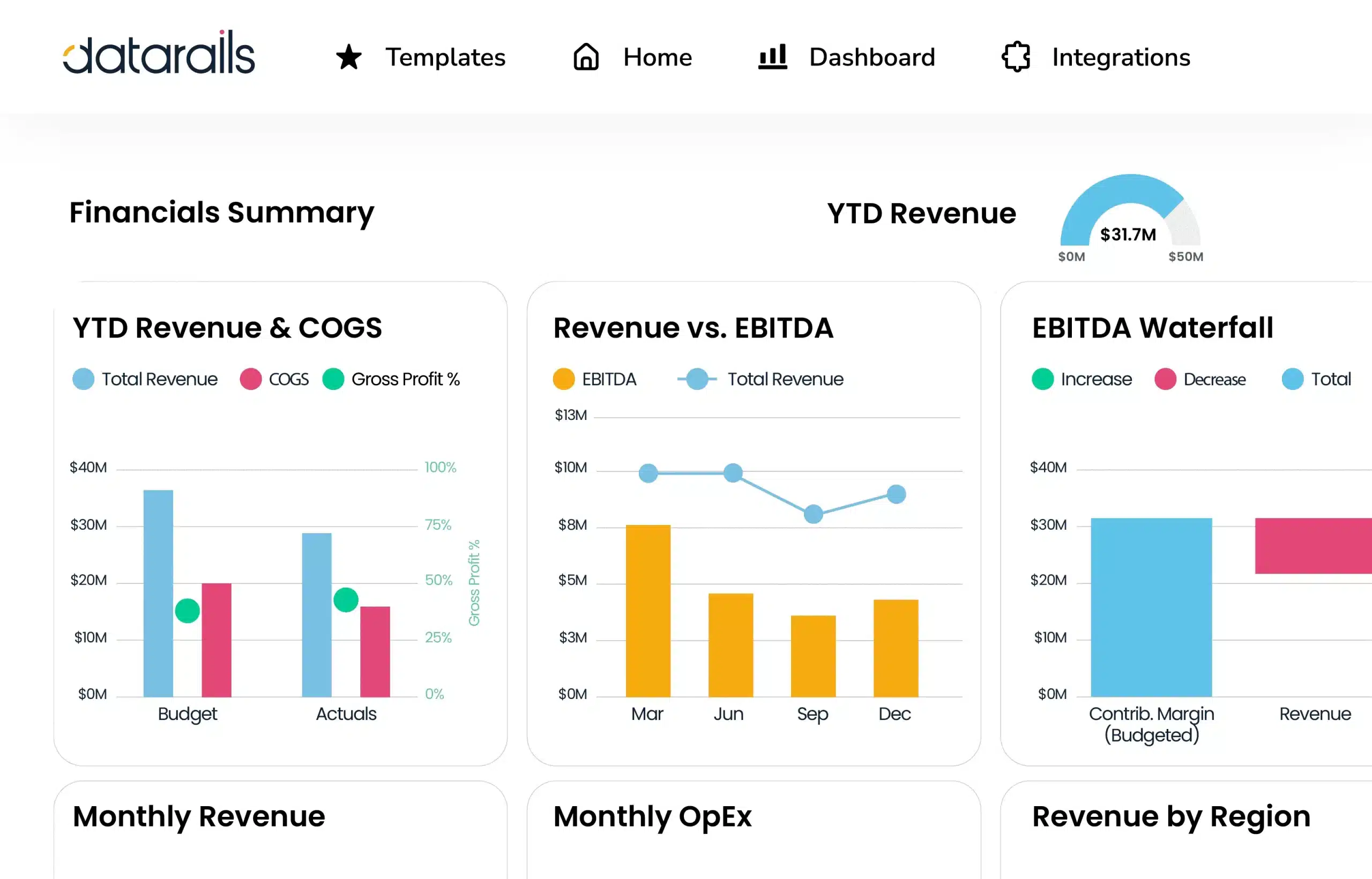

13. Datarails

DataRails is a financial reporting software that enhances financial planning and operations for small to mid-sized businesses by integrating deeply with the familiar environment of Excel. It is particularly valued by teams that require robust forecasting capabilities without leaving the Excel ecosystem.

Key features:

- Automatic backup and version management

- Logical version comparison

- Detailed cell drill down

| Pros | Cons |

|

|

Pricing: Starts at approximately $27,000/year, can go up to $88,000+ based on usage.

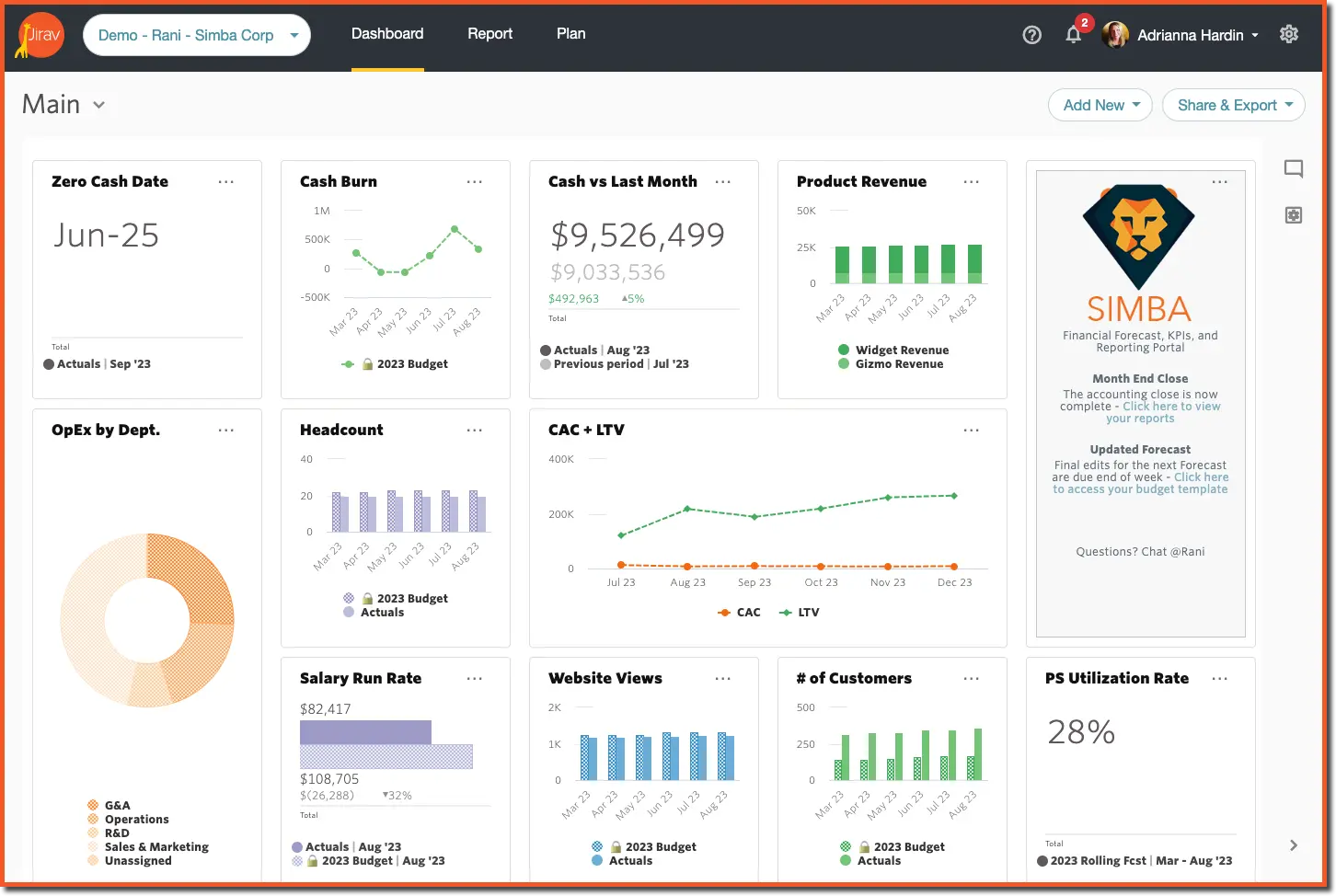

14. Jirav

Jirav presents itself as a financial reporting software for Financial Planning and Analysis (FP&A) teams, particularly those looking to move away from traditional spreadsheet models. This platform is especially suited for finance professionals who prioritize driver-based planning and are looking for a purely cloud-based system.

Key features:

- Comprehensive driver-based planning

- Combination of templated and custom reporting

- Easily shareable dashboards

| Pros | Cons |

|

|

Pricing: Starts at $10,000/year (Starter), $15,000/year (Pro), with custom enterprise pricing.

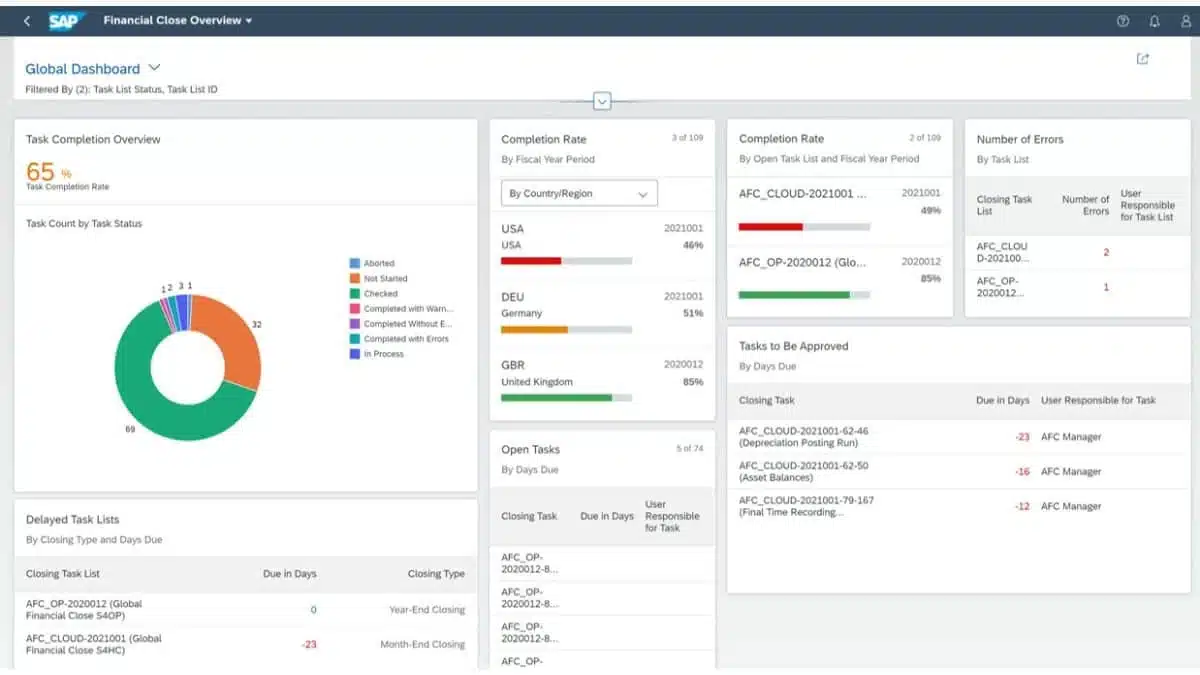

15. SAP S/4HANA Finance

SAP S/4HANA Finance is a specialized financial reporting tools tailored for businesses deeply integrated into the SAP ecosystem. It’s designed to streamline both financial consolidation and the close processes by integrating operational and group reporting into a cohesive system.

Key features:

- Flexible deployment options: on-premise, cloud, or hybrid

- Unified entity and group close reporting

- Continuous accounting functionality

| Pros | Cons |

|

|

Pricing: Licensing starts at $25,000/year/user, total implementation may exceed $250K–$1M+.

16. Sypnotix

Synoptix is a financial reporting tools that aims to move businesses away from traditional Excel-based reporting to a more integrated system. This tool is recognized for its capability to centralize and streamline financial reporting, especially for creating recurring financial statements.

Key features:

- Dashboards highlighting key performance indicators (KPIs)

- Capability for custom reports

- Real-time analytics with drill-down details

| Pros | Cons |

|

|

Pricing: Custom pricing only – based on organization size and usage

17. Cube

Cube is a financial reporting software designed to enhance business reporting, planning, and overall performance without altering existing workflows. Its seamless integration with both Excel and Google Sheets makes it a versatile tool, enabling users to generate reports in one platform and share them effortlessly across others.

Key features:

- Automated data consolidation

- Multi-scenario analysis

- Native excel and google sheets integration

| Pros | Cons |

|

|

Pricing: Ranges from $1,500–$2,800/month, with median costs around $21,500/year.

18. Sage Intacct

Sage Intacct is a robust financial reporting software that excels in enhancing user efficiency through its customizable reporting capabilities.

Sage Intacct offers a more dynamic and flexible environment compared to Sage 50cloud. While both platforms provide cloud solutions, Sage Intacct is tailored more towards mid-sized to large businesses that require detailed, customizable reports and multi-entity consolidation.

Key features:

- Quick multi-entity consolidation

- Cloud-based solution

- Comprehensive integration options, including salesforce

| Pros | Cons |

|

|

Pricing: Starts at around $400/user/month, totaling $15,000–$60,000/year.

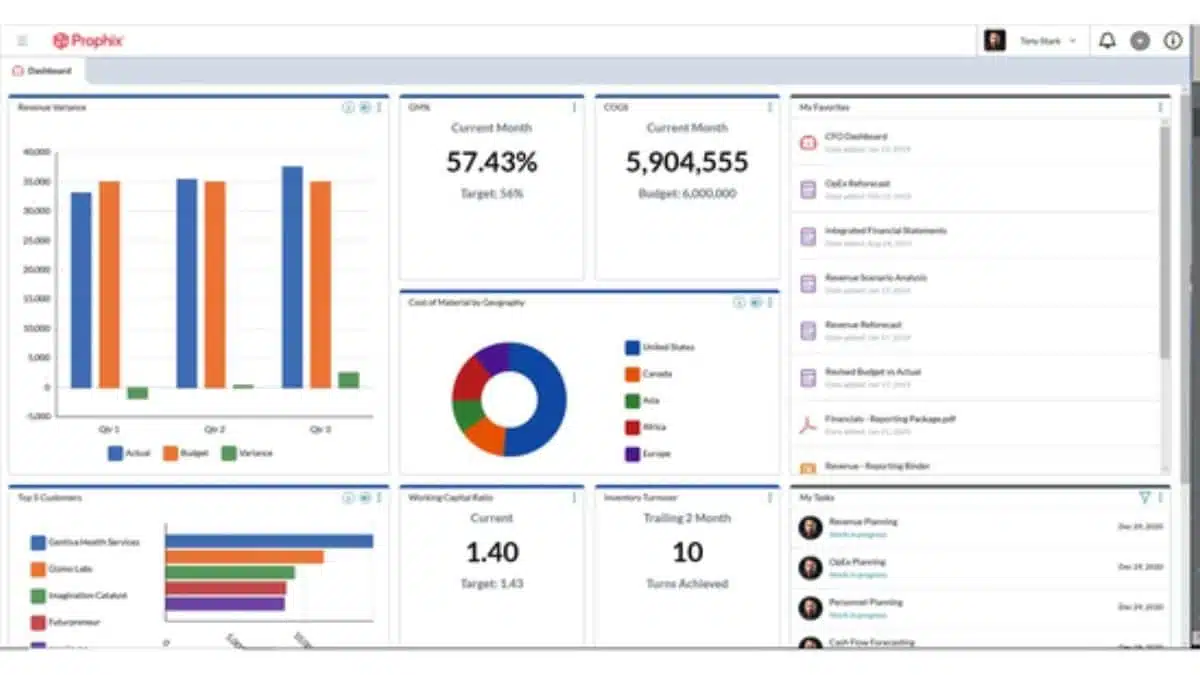

19. Prophix

Prophix stands out as an automated financial reporting software, designed to enhance organizational efficiency in budgeting, planning, forecasting, reporting, and analysis. It is particularly favored by medium-sized and large businesses seeking to eliminate time-consuming manual reporting tasks.

Key features:

- Automates labor-intensive reporting tasks

- Currency conversion capabilities

- Advanced security features and role-based access permissions to reports

| Pros | Cons |

|

|

Pricing: Varies from $50,000–$500,000/year based on implementation size.

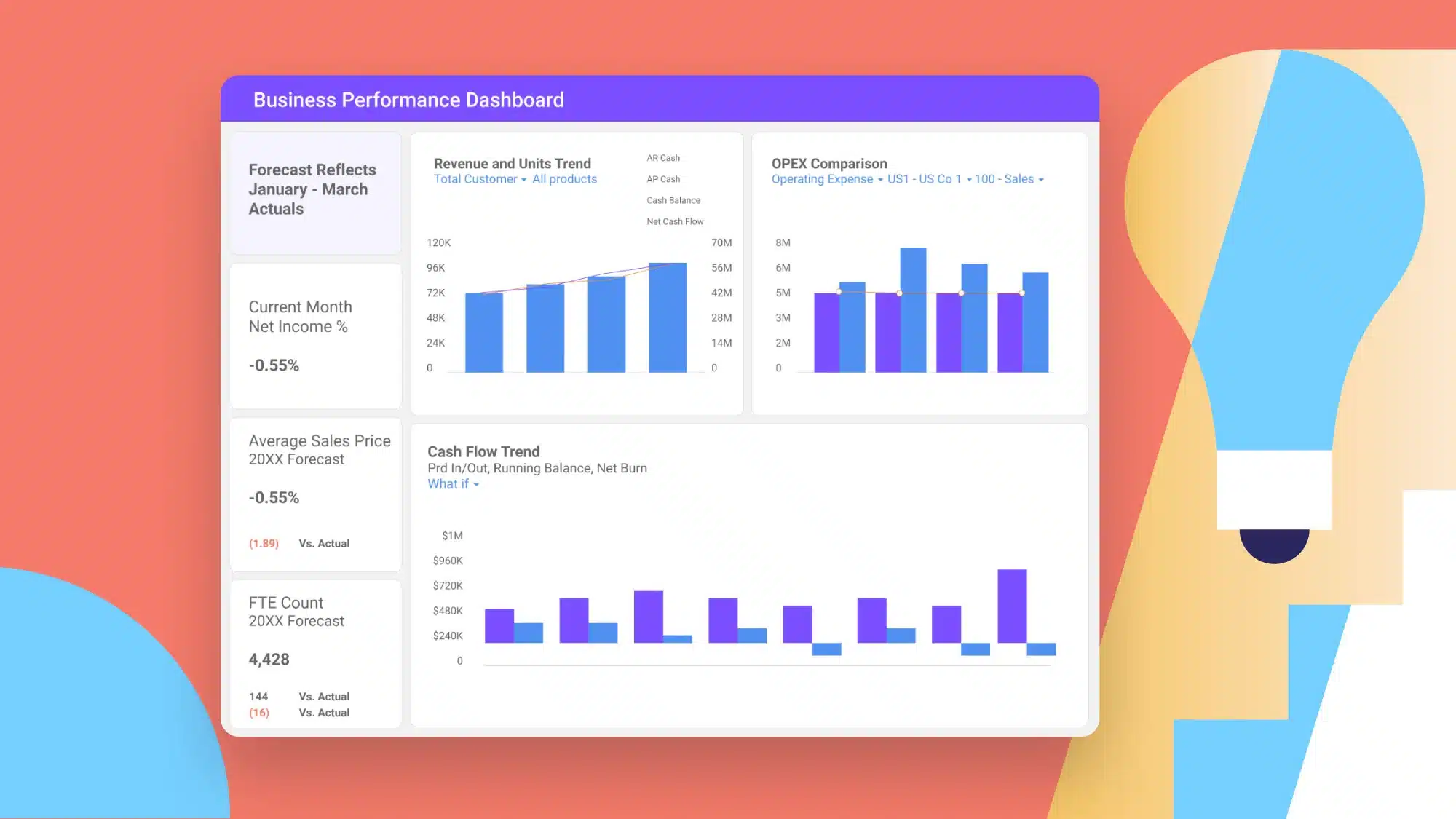

20. Anaplan

Anaplan is a cloud-based automated financial reporting software designed for planning and performance management, known for its agility in connecting data and automating various business processes. This platform is especially beneficial for companies aiming to enhance their financial and operational workflows.

Key features:

- Business performance monitoring

- Facilitates detailed reporting and analysis of critical KPIs to senior management

- App hub with a wide range of use cases to drive business solutions

| Pros | Cons |

|

|

Pricing: Starts around $50,000/year, with median cost approx. $102,000/year.

Conclusion

Implementing financial reporting tools is a crucial step for any business looking to enhance its financial management and decision-making processes. As such, selecting the best financial reporting software is as important as the implementation itself, ensuring that the chosen software meets the unique needs and challenges of your business.

HashMicro stands out as the best financial reporting software in the Philippines. With its user-friendly interface, advanced features, and dedicated support, HashMicro enhances financial transparency and operational efficiency. Choosing HashMicro means investing in a software solution that will drive your business forward.

Explore HashMicro’s offerings today to see how they can transform your financial reporting processes by trying the free demo service!

FAQ

-

What is a financial reporting software?

Financial reporting software is a tool that helps businesses generate, organize, and analyze financial data. It automates tasks like creating balance sheets, profit and loss statements, and cash flow reports to ensure accurate and efficient financial management.

-

Is Excel a financial reporting tools?

Yes, Excel can be used as a basic financial reporting tools. However, it requires manual entry and lacks automation features compared to dedicated financial reporting tools, which offers real-time insights and minimizes human error.

-

What are the 4 types of financial reporting?

The four main types of financial reporting are:

1. Income Statement: Shows a company’s profitability over a specific period.

2. Balance Sheet: Displays the company’s financial position, including assets, liabilities, and equity.

3. Cash Flow Statement: Tracks the cash inflows and outflows to measure liquidity.

4. Statement of Shareholders’ Equity: Highlights changes in equity, including retained earnings and issued shares.