A strong finance and accounting department is essential in any business. Yet, even small accounting errors can quickly turn into costly problems, which may impact the entire organization’s stability and success. Ay, delikado ‘yan kapag walang maayos na sistema!

Without the right systems–both in the roles and the work systems themselves–in place, these mistakes can snowball. As a result, business owners are constantly fighting financial problems instead of focusing on growth and strategy.

Fortunately, there are ways to make your accounting department more effective and minimize these risks. This article will guide you in knowing which areas the accounting department needs to understand well, and several effective tips to improving efficiency.

Key Takeaways

|

Table of Contents

Functions that the Accounting Department Needs to Master

The accounting department manages daily financial transactions, recording inflows and outflows, accounts payable and receivable, and other accounting details. Since their work involves a great deal of crucial information, maintaining accuracy is the primary concern.

To support accountants and accounting departments in overcoming common accounting problems, we’ve compiled a list of eight key functions that every accounting team should master for smooth operations.

- Accounts Payable (AP): Accounts payable manages outgoing funds, pays expenses on time, and handles vendor invoices. The team also identifies savings, like early payment discounts.

- Accounts Receivable (AR): Accounts receivable tracks incoming customer payments for goods and services. The accounting department records accounts receivable as assets, including earned revenue and unpaid invoices.

- Payroll Management: Payroll management is essential in the accounting department, ensuring employees are paid on time and boosting morale. The team keeps earnings current and calculates take-home pay after deductions.

- Inventory Cost Management: The accounting department oversees inventory costs and tracks expenses like labor, raw materials, and overhead. Throughout the year, the team records purchases, including raw materials and machinery, whether financed by credit or loans.

- Cash Collections and Record Keeping: The accounting department records all cash received, ensures correct deposits, and maintains steady cash flow. Modern accounting departments use software to automate financial record-keeping tasks.

- Budgeting: The accounting department ensures other departments adhere to the company’s budget, tracking expenses and transactions to prevent overspending. Budgeting should consider both cash and accrual methods.

- Reporting and Financial Statements: The accounting department prepares key financial reports like the balance sheet, income statement, and cash flow statement. These reports support decision-making, budgeting, and investor relations, as well as helping monitor profits and losses.

Strategies to Make Your Accounting Department More Effective

A well-organized accounting department is essential for maintaining financial stability and efficiency. Clear roles and a good accounting system can prevent costly errors and enhance daily operations. Let’s explore key strategies to boost your team’s effectiveness.

1. Define Roles and Responsibilities

Establishing structured roles is vital to building a cohesive and productive accounting team. Clear roles are essential for an effective accounting department and ensure adherence to basic accounting principles. Here are some best practices:

- Role Clarity: Define each team member’s duties to prevent overlap and boost efficiency.

- Job Descriptions: Create detailed descriptions outlining tasks, goals, and expectations to reduce uncertainty.

- Accountability: Clearly assign responsibilities to promote accountability and achieve departmental goals.

- Cross-Training: Encourage skill-building through cross-training, which increases adaptability and flexibility.

- Regular Reviews: Periodically review roles to keep up with evolving needs and technology, ensuring relevance and efficiency.

2. Set Agendas for Meetings

A recent study shows that 45% of employees feel meetings often veer off track due to unrelated project discussions. To keep meetings focused, include a clear, high-level objective in each invite (e.g., Improving processes for collecting department budget data).

Creating a timed schedule is also helpful, especially if attendees need to present; it helps them stay focused. Meetings become more productive and purposeful when clear goals are communicated in advance.

3. Clear Reporting Lines

Setting up clear reporting structures is essential for a well-organized accounting department. Assigning specific responsibilities to each team member helps everyone understand their role, contributing to a more structured workflow.

Documenting reporting processes is equally essential; standardized procedures help minimize errors in financial reports. Finally, creating feedback loops allows the team to address issues promptly and enhance the reporting process over time.

4. Invest in Upskilling Your Finance Team

Competent, well-trained staff are key to effective financial management. Ensure your finance team is equipped with strong procedural knowledge and up-to-date skills in your company’s accounting system.

Regular training is essential to maximize team performance. Options include in-house seminars, industry conferences, or personalized training sessions. Cross-training is also valuable; you maintain continuity when staff are absent by teaching team members to cover each other’s roles.

Consider implementing a comprehensive financial management tools to automate routine tasks and compile reports accurately. One of the software you can use is HashMicro. With its user-friendliness and unlimited users, it’s designed to assist accountants in doing their tasks. Click the pricing calculator banner below to get a customized quote!

5. Leverage Batch Processing

Handling invoices or receipts one by one drains time and resources. Instead, encourage your finance team to gather all invoices and process them in batches for greater efficiency.

Therefore, it’s best to ask all your staff to submit their invoices or claims for reimbursement at a designed time so that the finance staff can process it all at the same time.

6. Use Accounting Software

Implementing one of the best accounting platforms for Philippine businesses you can find in the Philippines is one of the simplest ways to boost your department’s effectiveness. Software tools can handle repetitive, time-consuming tasks—processing invoices, managing payroll, and tracking expenses—so your team can focus on more strategic work.

Besides saving time, automation accounting software reduces human error. You can be confident that your financial records are accurate with automated calculations and real-time updates. Plus, many programs come with features for reporting, budgeting, and forecasting, giving you insights into your finances at a glance.

If you’re not using accounting software yet, look for one that aligns with your company’s needs. A good software should integrate easily with other systems, allow secure access, and scale as your business grows.

7. Prepare for the New Lease Accounting Standard

In the Philippines, the new lease accounting standard, Philippine Financial Reporting Standard (PFRS) 16, has been effective since January 1, 2019. This standard requires lessees to recognize most leases on their balance sheets, recording a right-of-use asset and a corresponding lease liability.

To ensure compliance, consider the following steps:

- Inventory Your Leases: Compile a comprehensive list of all lease agreements, including terms and payment schedules.

- Establish Internal Policies: Develop clear guidelines for lease classification, measurement, and reporting in line with PFRS 16 requirements.

- Evaluate Accounting Software: Assess whether your current accounting system can handle the complexities of lease accounting under the new standard. If not, consider investing in specialized lease accounting software.

Your company can transition smoothly to the new lease accounting requirements by proactively addressing these areas.

Improve Your Accounting Department Efficiency with HashMicro Accounting Software

Aside from mastering the necessary skills, your accounting team also needs a powerful system to back up their work and ensure everything runs smoothly. Naku, hindi biro ang trabaho ng accounting!

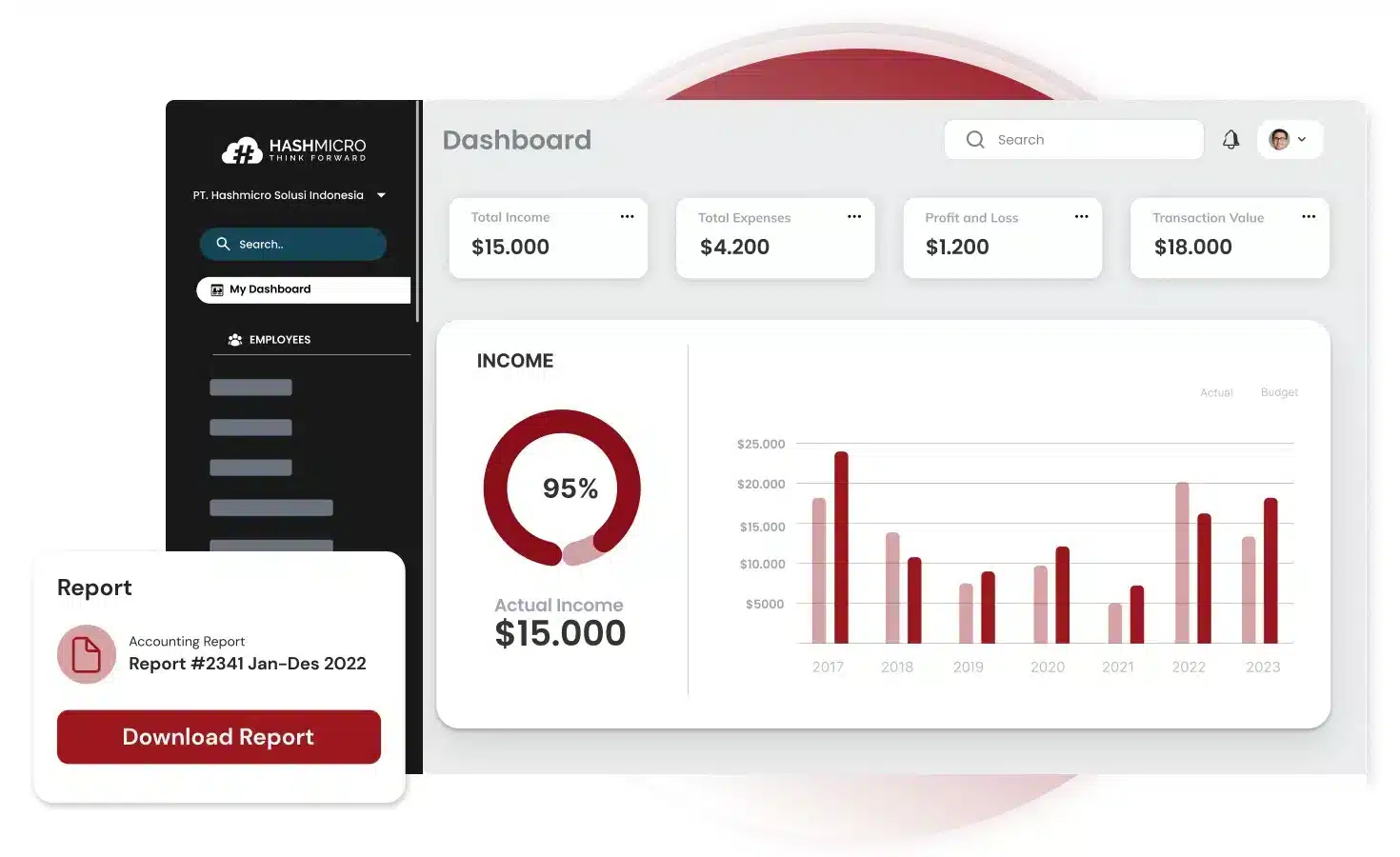

That’s where HashMicro Accounting Software comes in: an ideal choice for businesses in the Philippines! It’s already BIR-CAS accredited, fully customizable, allows unlimited users, and is super user-friendly. Ayos na ayos! Plus, it has a dedicated support team to help with anything you need!

Here’s a list of HashMicro AI Accounting Software features to cater to your needs:

- Complete Financial Statement (GL, TB, P&L, BS) with Period Comparison: Access comprehensive financial statements, including general ledger, trial balance, profit & loss, and balance sheet, with easy period-to-period comparisons.

- Multi-level analytical (Compare FS per project, branch, etc.): Analyze financial statements across different levels, such as projects or branches, to gain detailed insights into performance variations.

- BIR CAS Integration: Automatically format reports to comply with BIR CAS standards, saving time and ensuring tax compliance without manual adjustments.

- Chart of Accounts Hierarchy: Organize accounts clearly, allowing accurate categorization and simplified tracking of income and expenses.

- Automated Currency Update: Keep financial records accurate with real-time currency updates, which is ideal for businesses dealing with multiple currencies.

- Multi-Company with Inter-Company Transaction and Consolidation Reports: Consolidate income statements and track inter-company transactions effortlessly for businesses with multiple entities.

- In-Depth Accounting Reports: Access advanced accounting reports, including financial ratios and partner aging, to support detailed financial analysis and planning.

- Bank Reconciliation: Matches internal records with bank statements to identify discrepancies and ensure accuracy. Integration with bank reconciliation software enables automatic data import, real-time matching, and faster error detection.

Conclusion

To improve your accounting department’s effectiveness, start by clearly defining each team member’s role and setting up a straightforward reporting system. Use reliable tools to help organize and simplify tasks.

With HashMicro’s accounting software, you’re not just automating tasks; you’re reducing errors and gaining real-time insights that fuel smarter financial decisions. Say goodbye to manual hassles and hello to seamless integration across your entire organization!

Curious about how HashMicro can simplify your accounting process and grow with your business? Try the free demo and let your team focus on driving strategic success!

FAQ About Accounting Department

-

How can technology integration improve accounting processes?

Integrating technology, such as cloud-based accounting software and automation tools, streamlines financial operations, reduces manual errors, and provides real-time data access, thereby enhancing overall efficiency.

-

What are the benefits of continuous improvement practices in accounting?

Embracing continuous improvement methodologies, like Lean Accounting, helps identify and eliminate inefficiencies, leading to more streamlined processes and better financial performance.

-

What role does data analytics play in modern accounting departments?

Utilizing data analytics enables accounting teams to gain deeper insights into financial trends, improve decision-making, and proactively address potential issues, thereby increasing the department’s strategic value.

-

How does effective communication within the accounting team impact performance?

Clear and open communication fosters collaboration, ensures alignment on goals, and reduces misunderstandings, which collectively enhance the department’s productivity and accuracy.