Running a business has its ups and downs, right? One thing that often gets overlooked is understanding inventory costs. Your business may be thriving, pero yung mga hidden costs na nakatali sa inventory, unti-unti palang kinakain yung kita mo.

It’s a common issue many business owners in the Philippines face, many of which lead to unexpected financial headaches. But don’t stress—by understanding inventory costs and learning to manage them, you can keep your business on track and thriving.

Whether you’re running a small shop or managing a big manufacturing setup, inventory costs are a big deal. If not properly managed, they can pile up, chip away at your profit margins, and cause serious financial strain. But don’t worry—by the end of this, you’ll have a solid grasp of what inventory costs are, why they matter, and how you can take practical steps to keep them in check and protect your bottom line.

Key Takeaways

|

Table of Contents

What is Inventory Cost?

Inventory costs are the expenses associated with storing, managing, and maintaining your stock of goods. These costs are a critical component of business management, especially for companies that deal with physical products. From the moment you place an inventory order to the time it is sold or used, various costs accumulate that can significantly affect your business’s financial performance.

Understanding this is crucial because it directly impacts your profitability. If not managed properly, high inventory costs can lead to reduced profit margins, cash flow issues, and even financial instability.

By keeping a close eye on these costs and implementing other related software, you can make informed decisions that help you optimize your inventory levels, reduce unnecessary expenses, and improve your overall financial health.

Types of Inventory Cost

Before we dive into managing inventory costs effectively, it’s important to first understand the different types of costs that can impact your bottom line. Each type of inventory cost plays a unique role in your overall expenses, and being aware of them can help you make more informed decisions.

Let’s examine these different types more closely so you can better understand where your money is going.

- Ordering: Include expenses like administrative fees, shipping, and time spent managing orders. In the Philippines, where logistics can be challenging, optimizing order quantity and frequency is essential to manage escalating costs.

- Carrying: Also known as holding costs, including warehousing, insurance, taxes, and inventory depreciation. In space-limited areas of the Philippines, keeping inventory lean through optimized turnover rates and just-in-time practices can significantly reduce these costs.

- Stockout: Occurs when you run out of inventory to meet demand, leading to lost sales and dissatisfied customers. In the competitive Philippine market, using inventory management techniques and accurate demand forecasting is vital to avoid stockouts and maintain steady product availability.

- Spoilage: Arise when inventory becomes obsolete, damaged, or expired, especially with perishable goods. In the Philippines, where product quality can be affected by humidity and temperature, proper inventory rotation and regular inspections are crucial to minimize spoilage costs.

- Capital: Reflect the financial impact of tying up funds in inventory, including interest on loans and opportunity costs. Balancing inventory levels with cash flow is essential to optimize turnover rates and free up capital for strategic investments.

How to Calculate Inventory Costs

Calculating inventory costs involves adding up all the expenses associated with acquiring, storing, and managing your inventory. A simple formula to calculate the total value is:

Suppose you’re managing a business that deals with retail goods, and you want to calculate your total inventory costs for a specific period. Here’s how you could break it down:

- Ordering Costs: Administrative costs associated with processing purchase orders, including staff time and resources, amount to ₱5,000 per period. Additionally, shipping fees for transporting goods from your supplier to your warehouse total ₱10,000. Therefore, the total ordering costs come to ₱15,000 (₱5,000 for administrative costs + ₱10,000 for shipping fees).

- Carrying Costs: Warehousing costs, which include rent, utilities, and security, are ₱20,000. Insurance and taxes related to inventory amount to ₱3,000, and depreciation, representing the loss of inventory value over time, is calculated at ₱2,000. The total carrying costs, therefore, add up to ₱25,000 (₱20,000 for warehousing + ₱3,000 for insurance and taxes + ₱2,000 for depreciation).

- Stockout Costs: Costs incurred from not having enough inventory to meet customer demand, leading to missed sales opportunities, are estimated at ₱8,000. Hence, the total stockout costs amount to ₱8,000.

- Spoilage Costs: Obsolete goods, which become outdated or unsellable, result in a cost of ₱4,000, while damaged goods during storage or handling cost an additional ₱2,000. The total spoilage costs therefore amount to ₱6,000 (₱4,000 for obsolete goods + ₱2,000 for damaged goods).

- Capital Costs: Interest on loans borrowed to purchase inventory amounts to ₱1,500. Additionally, the opportunity cost, representing potential profit lost from not investing that capital elsewhere, is estimated at ₱3,500.

Total Capital Costs = ₱1,500 (Interest) + ₱3,500 (Opportunity Cost) = ₱5,000

Final calculation

Now, you can plug these values into the Total Inventory Costs formula:

Total Inventory Costs = ₱15,000 (Ordering) + ₱25,000 (Carrying) + ₱8,000 (Stockout) + ₱6,000 (Spoilage) + ₱5,000 (Capital)

Total Inventory Costs = ₱59,000

Managing inventory costs manually can be time-consuming and prone to errors. Fortunately, several tools and software solutions are available to help you track and manage this more accurately. These tools allow you to automate the calculation of inventory costs, monitor stock levels in real time, and generate detailed reports that provide insights into your inventory management practices.

Factors Affecting Inventory Cost

Before diving into strategies for managing inventory costs, it’s essential to understand the key factors that can influence these expenses. By recognizing these factors, you’ll be better equipped to make informed decisions that help control costs and optimize your inventory management.

Let’s explore the main factors that can affect your inventory costs:

- Transit delays in the Philippines can significantly impact inventory costs by causing stockouts, increasing ordering costs, and disrupting production schedules. To mitigate these issues, work with reliable suppliers, maintain a safe stock of critical items, and plan for potential supply chain disruptions.

- Sudden shifts in customer demand can lead to higher inventory costs through rush orders or overstocking. Managing these risks involves closely monitoring market trends, using demand forecasting tools, and maintaining flexible inventory levels to adjust your strategy as needed.

- Low warehouse vacancy rates in the Philippines can increase carrying costs due to higher storage fees, impacting profit margins. Optimize your existing space, consider outsourcing, or use shared warehouse options to reduce these costs and manage your storage needs efficiently.

By implementing manufacturing inventory software, it can help a company to minimize those factors.

Common Mistakes in Managing Inventory Costs

Managing inventory costs can be challenging, and even with the best strategies, mistakes can still happen. Understanding these common pitfalls can help you avoid costly errors and keep your business running smoothly. Below are some of the most common mistakes:

-

- Neglecting to include expenses in financial forecasts is a common mistake that can lead to inaccurate profit projections and cash flow issues, particularly in the Philippines, where businesses often operate on tight margins. To ensure financial stability and valuation, always incorporate inventory costs into your forecasting and budgeting processes for more accurate planning.

- Overstocking, while tempting for bulk discounts, can result in excessive carrying costs and increased spoilage, especially in the Philippines, where storage space is limited and expensive. Focus on accurate demand forecasting and just-in-time inventory practices to reduce unnecessary costs and overstocking for other needs.

- Underestimating inventory management software can lead to inefficiencies and errors in managing inventory costs, putting you at a competitive disadvantage in the fast-paced Philippine market. Investing in the right software helps automate tasks, reduce costs, and improve decision-making, ultimately enhancing your business operations.

Tips to Reduce Inventory Costs

Before diving into specific strategies for reducing inventory costs, it’s important to recognize that even small adjustments can make a significant impact on your bottom line. With the right approach, you can streamline your operations, improve efficiency, and ultimately save money. Let’s explore some practical tips:

- Optimizing reorder levels is essential for reducing inventory costs by ensuring you have enough stock to meet demand without overstocking. By setting the right reorder points based on lead time, and demand variability, avoiding inventory aging, you can balance stock availability with cost efficiency, avoiding stockouts, and minimizing carrying costs.

- Deadstock, which includes outdated, damaged, or unsellable inventory, ties up valuable storage space and capital, especially in the space-limited Philippines. Regularly reviewing inventory report to remove dead stock through discounts or donations can reduce carrying expenses and improve cash flow.

- Leveraging inventory management tools reduces expenses by providing real-time visibility into inventory levels, allowing data-driven decisions to optimize stock. Investing in an inventory management system automates tasks like order tracking and cost calculation. This streamlines operations, giving your business a significant competitive edge.

Also read: What is Inventory Aging Report & How to Calculate It

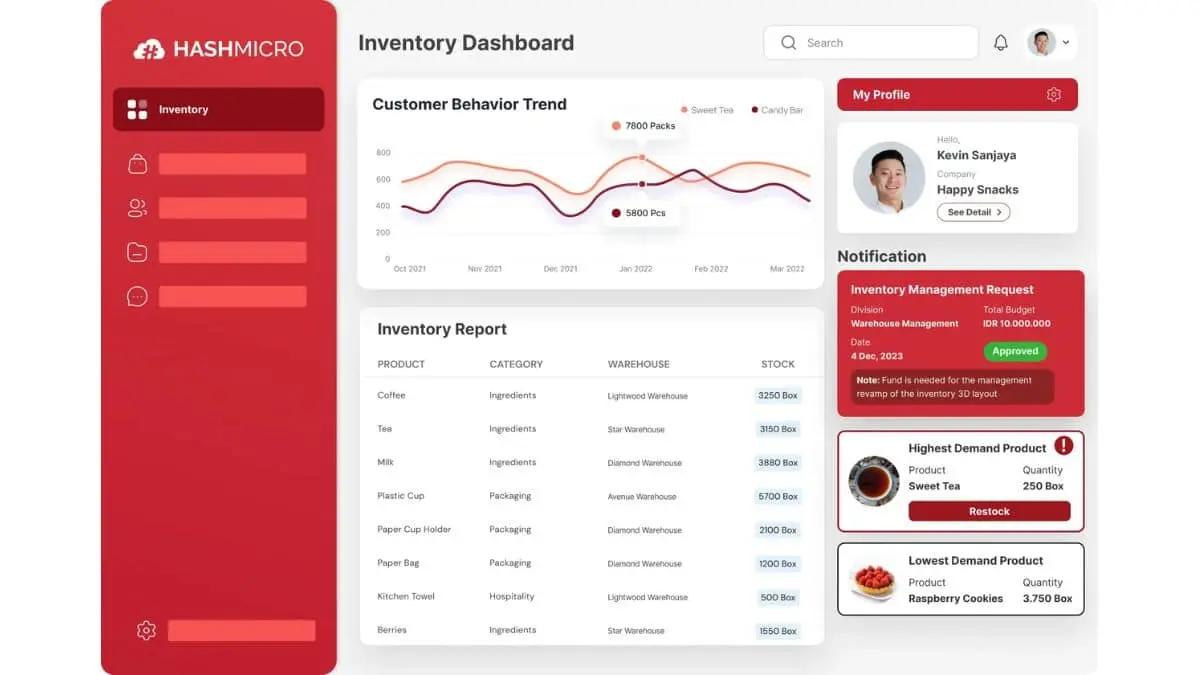

HashMicro’s Inventory Software to Automate Cost Calculation

Managing inventory costs can be a complex task, but with the right tools, you can automate much of the process and gain better control over your expenses. HashMicro’s Inventory Software is designed to simplify and optimize the cost calculation process, making it easier for businesses to maintain profitability.

This software offers several unique selling points (USPs) that directly address the challenges associated with inventory costs. Key Features of HashMicro’s Cloud Inventory Software:

- Real-Time Inventory Tracking: Monitor your stock levels in real-time to avoid overstocking and stockouts, ensuring you only reorder what’s needed.

- Automated Cost Calculation: Automatically calculate carrying costs, ordering costs, and other expenses, reducing the likelihood of errors and saving time.

- Demand Forecasting: Leverage advanced analytics to predict customer demand and adjust your inventory levels accordingly, minimizing excess inventory.

- Comprehensive Reporting: Generate detailed reports that provide insights into your inventory costs, helping you make data-driven decisions to improve cost efficiency.

- Integrated Financial Management: Seamlessly connect inventory management with your accounting system to ensure that your financial statements accurately reflect all inventory costs.

With countless software options available, HashMicro stands out as one of the best choices for streamlining inventory management. By integrating HashMicro’s Inventory Software, you can automate tedious cost calculations, allowing you to focus on more strategic business areas. This reduces unnecessary expenses and enhances overall efficiency, keeping your business competitive and profitable.

Conclusion

We’ve explored the critical role inventory costs play in business profitability, especially in the competitive Philippine market. Understanding various inventory costs and common management mistakes highlights the need for effective inventory management. By optimizing reorder levels and utilizing advanced tools like HashMicro’s Inventory Software, businesses can enhance financial stability and operational efficiency.

HashMicro’s Inventory Software excels in automating and simplifying inventory cost management. With features like real-time tracking and automated cost calculation, it supports businesses in maintaining profitability. Ready to take control of your finances and enhance your business efficiency? Try our free demo today and experience these transformative benefits firsthand.

Frequently Asked Questions

-

What are common inventory costs?

Common inventory costs include ordering costs related to placing and receiving orders and carrying costs for storing and maintaining inventory. They also involve stockout costs from running out of stock, spoilage costs from expired or damaged goods, and capital costs representing the opportunity cost of funds tied up in inventory.

-

What are inventory out costs?

Inventory out costs, or stockout costs, refer to expenses and losses when a business runs out of stock. These costs include lost sales, customer dissatisfaction, and potential brand reputation damage due to unmet demand, which can significantly impact a business’s profitability.

-

Why are inventory costs important?

Inventory costs are crucial as they directly impact a business’s profitability and cash flow. Proper management optimizes inventory levels, reduces waste, and prevents stockouts, ensuring businesses meet customer demand while maintaining financial stability and operational efficiency.