Keeping accurate inventory record is a must, especially if your company is in either manufacturing, retail, or export/import. One key document the Bureau of Internal Revenue (BIR) requires is the inventory list, but what makes it so important, and what should it include?

For many businesses, preparing this list feels overwhelming. From understanding the annual inventory list BIR format to knowing the deadline, there are multiple factors to consider.

That’s why, this article serves as a guide to know about BIR inventory listing; what to include, what to avoid, and how to stay compliant without the stress. But before you read on more, if you want to find a system that is accredited with the BIR system, you can try HashMicro BIR Accredited Inventory Software first.

Let’s get started and find out!

Table of Contents

Key Takeaways

|

What is the Inventory List?

The inventory list is a key record of a company’s stock, covering raw materials, work-in-progress, finished goods, and other inventories at financial year-end. In the Philippines, the BIR requires businesses to submit this annually for tax compliance.

More than just a formality, this document supports financial records and ensures transparency over business assets. Many companies struggle with the inventory list format BIR mandates, as it affects how they organize and present their data.

Why Compliance Matters in Submitting Inventory List

BIR Inventory List compliance is important and mandatory, as it helps companies avoid legal issues, plan finances effectively, and stay in good standing with the BIR.

A well-prepared inventory list to BIR keeps records precise, so companies can minimize the risk of penalties and financial mismanagement. While the BIR inventory list format may seem complex, following it properly leads to better tax compliance and long-term stability.

Penalties for Non-Compliance with Inventory List BIR Requirements

Ignoring BIR Inventory List requirements might cost you, and it’s a risk companies shouldn’t take. The BIR enforces strict rules on inventory reporting, and missing deadlines or submitting incorrect data can lead to serious consequences:

- Fines and penalties: Late submissions or inaccurate records can result in hefty charges.

- Legal trouble: Non-compliance may trigger audits or even legal action from the BIR.

- Damaged reputation: Repeated violations can hurt your company’s credibility with tax authorities.

- Business disruptions: Compliance issues might delay licensing, tax clearance, or even daily operations.

Hence, companies should comply if they want their operations go without a hitch.

What Should Be Included in the Inventory List?

When preparing an inventory list BIR requires, it’s crucial to include specific types of inventory to avoid discrepancies or omissions. Generally, the inventory system list should contain:

- Description of goods or inventories

- Quantity on hand

- Inventory types

- Unit measurements

- Total cost of all items at year-end

In 2023, the BIR introduced updates through RMC No. 8-2023, revising the rules from RMC No. 57-2015. These changes aim to streamline submissions by embracing digital processes and reducing paperwork. Key updates include:

- Eliminating Hard Copies: Businesses no longer need to submit printed inventory lists and change them to digital submissions.

- USB Flash Drive Submissions: Companies can now submit inventory data via USB, making the process more convenient.

- Submission Guidelines: Inventory lists must be saved on properly labeled USB drives, accompanied by a notarized Sworn Declaration signed by an authorized representative.

- If a third party is handling the submission, a Special Power of Attorney, Secretary’s Certificate, or Board Resolution is required.

Manually sorting through Annex A to C reports, spreadsheets, and documents can take hours. If manually filling out the BIR inventory list eats up your day, why not switch to inventory software and get it done faster?

It can simplify the process by selecting the right form for your industry and ensuring the correct format and calculations. Just enter your data once, and the system handles the rest. Try it out—click the free demo banner below!

What Should Not Be Included in the Inventory List?

The BIR Inventory List should be accurate and focused, meaning certain items must be excluded to avoid reporting errors. Adding non-inventory items can cause confusion in financial records, so it’s important to know what doesn’t belong in your submission.

- Office supplies: Stationery, cleaning materials, and consumables used for daily operations shouldn’t be listed since they’re not for sale or production.

- Capital assets: Machinery, buildings, and office furniture fall under fixed assets, not inventory.

- Depreciated assets: Items written off due to depreciation or not part of sales operations shouldn’t be included.

Keeping these items out of your BIR inventory list helps meet reporting standards and makes the review process smoother, reducing the risk of errors. Proper categorization also improves financial tracking.

When Should the Inventory List Be Submitted?

The submission of the inventory list to the Bureau of Internal Revenue (BIR) is a crucial annual requirement for businesses in the Philippines. Inventory lists must be submitted within 30 days after the end of the company’s financial year.

For businesses following the regular calendar year, the deadline is typically January 30th of the following year, aligning with the submission of annual financial reports. However, companies with a different fiscal year should adjust their submission date accordingly.

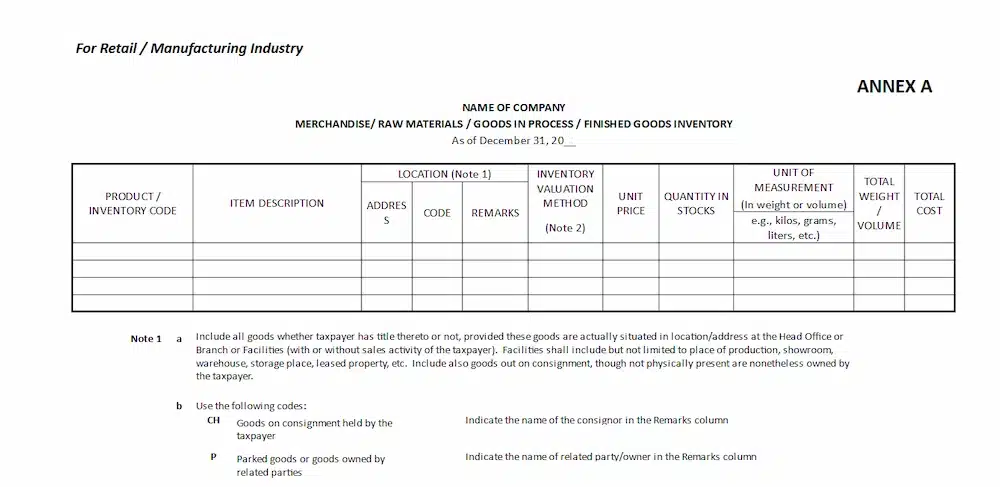

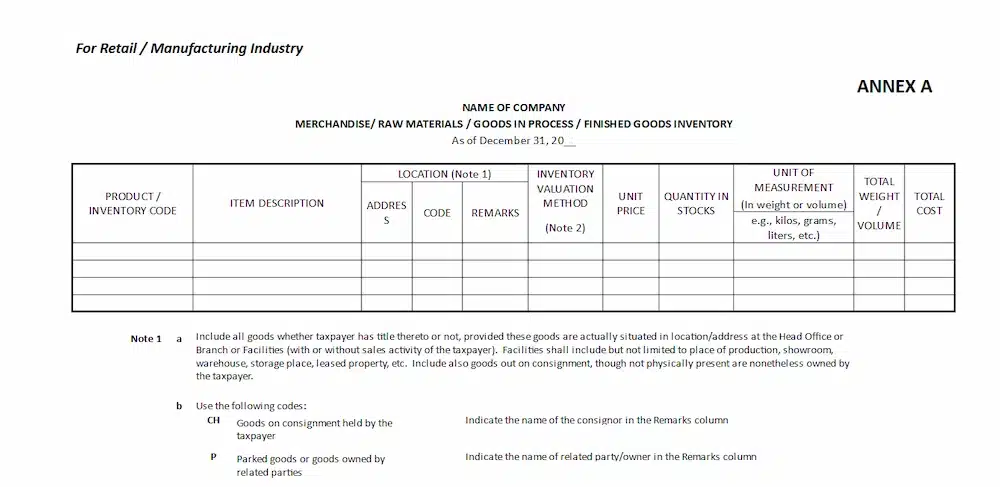

The BIR has provided sample templates for the inventory reports and notices, which can be downloaded from their website, or download here, as we’ve also provided samples for Annex A and C:

Download BIR Inventory List Template

You can submit your inventory report and/or notice in one of these ways:

- Through the BIR’s online Taxpayer Registration-Related Applications (TRRA Portal).

- By emailing the Compliance Section of your Revenue District Office (RDO).

- By manually submitting it in person to the Compliance Section of your RDO.

These rules came into effect on June 14, 2024, after being published on the BIR’s website.

Additional Reporting Requirements

Beyond the annual inventory list BIR submission, companies in industries like manufacturing, retail, real estate, and construction must also meet additional reporting requirements under RMC No. 57-2015. The key reports and formats include:

- Monthly or Quarterly Inventory Summaries: Businesses, especially those with large stock volumes or in regulated sectors, may need to submit periodic inventory movement reports.

- Inventory Valuation Reports: Disclosures on valuation methods, such as FIFO, LIFO, or weighted average, are required to maintain consistency with inventory data.

- Sector-Specific Reports and Formats:

- Annex A (Manufacturing, Merchandising, or Retailing): Inventory of merchandise, raw materials, goods in process, and finished goods.

- Annex B-1 (Real Estate): Inventory of saleable units, including costs per project, and trade receivables reconciliation.

- Annex C (Construction): Schedules of outstanding receivables (beginning and ending) and realized gross profit per project.

4. Supporting Documentation: Businesses should retain records such as purchase receipts, invoices, and delivery notes to validate their submissions.

5. Submission of Soft Copies: Reports must be submitted on a properly labeled DVD-R, accompanied by a Notarized Certification signed by an authorized representative. This certification confirms the accuracy of the data, as per the provided template in RMC No. 57-2015.

Keeping up with these requirements and maintaining well-organized records is essential for smooth compliance. Using automated solutions can simplify inventory tracking and generate BIR-compliant reports, reducing manual effort and minimizing errors.

How HashMicro Helps with BIR Inventory List Submission

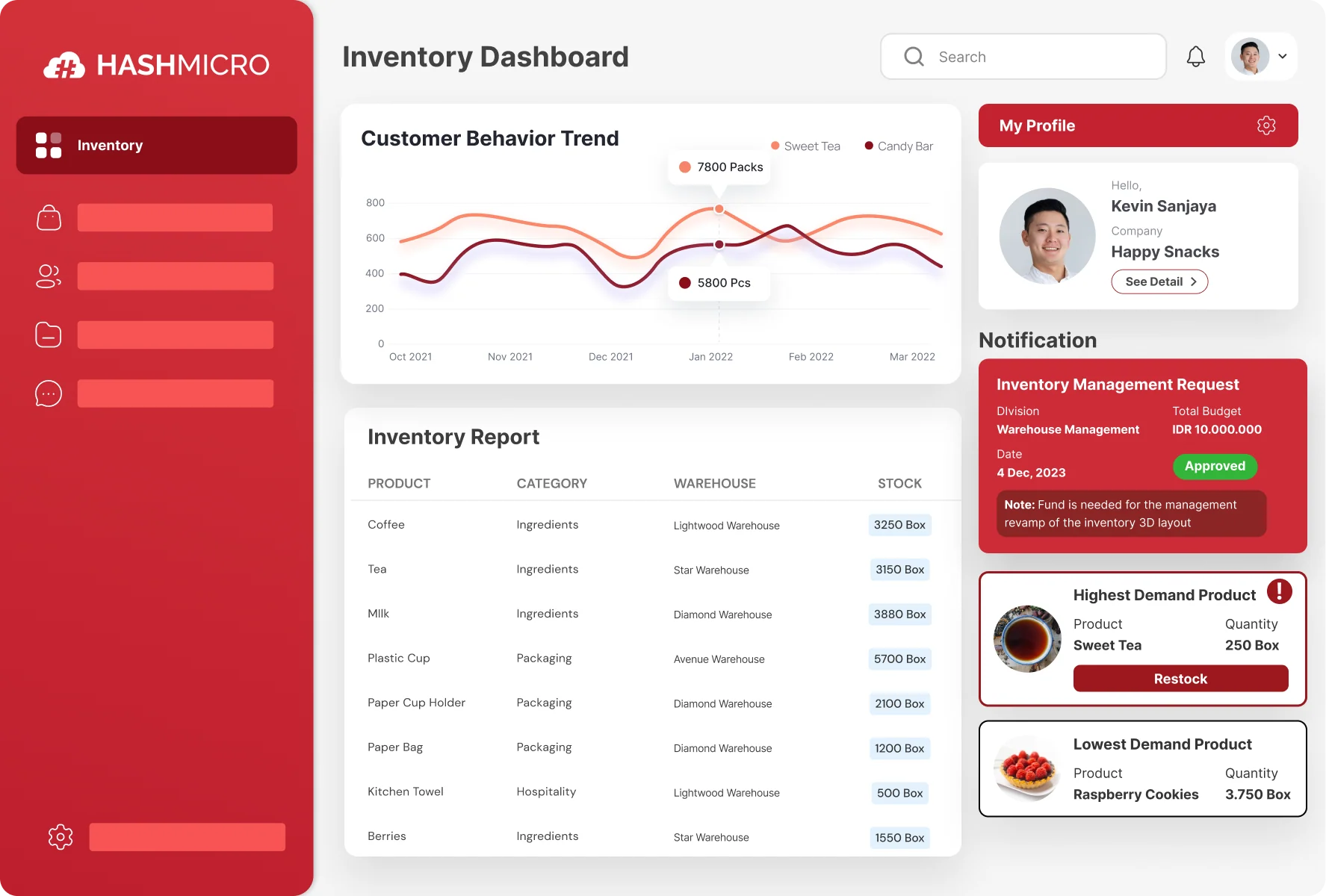

Submitting inventory reports to the Bureau of Internal Revenue (BIR) can be time-consuming and confusing. With HashMicro’s Inventory Software, you can make this process faster and easier. Ang system namin ay kayang mag-track ng inventory mo in real-time at gumawa ng accurate reports automatically.

Instead of manually preparing your inventory list, HashMicro automates the entire process. The system allows you to keep accurate records, customize your inventory reports based on BIR templates, and submit them in the required format. This ensures compliance with BIR regulations without any hassle.

By using HashMicro, you save time, reduce errors, and focus on growing your business. With features like real-time tracking and automated reporting, you get everything you need to meet BIR requirements effortlessly.

Conclusion

In summary, the inventory list BIR requirement is more than just another compliance checkbox; it plays a crucial role in financial transparency and operational accuracy for your business. Understanding what to include, what to omit, and when to submit your inventory list helps you maintain compliance and avoid unnecessary penalties.

Automating your inventory management with reliable software like HashMicro’s Inventory software can make this compliance process seamless.

Our inventory management software not only keeps your records accurate but also provides real-time insights, customized reporting, and automated reminders to help you stay ahead of submission deadlines.

If you’re ready to streamline your inventory management and avoid compliance hassles, consider a free demo of HashMicro’s solution today!

Frequently Asked Questions (FAQ) about Inventory List of BIR

-

What is an inventory list for BIR?

The inventory list for BIR is an official record that provides a detailed breakdown of a company’s inventory at the end of the fiscal year. It’s required to ensure accurate reporting for tax purposes.

-

Can I submit the inventory list digitally?

Yes, the BIR allows digital submissions, but the format and labeling must adhere to their requirements.

-

How can HashMicro help with inventory list compliance?

HashMicro’s Inventory Management System automates inventory tracking, provides customized reports, and offers reminders for compliance deadlines, making it easier to prepare an accurate BIR-compliant inventory list. Aside from that, HashMicro also provides BIR POS and accounting software for end-to-end business processes.

-

What should not be included in the BIR inventory list?

Items such as office supplies, capital assets, and depreciated assets should not be included as they do not qualify as inventory.