Manual journal entries seem simple, but they often lead to a lot of complications. From human errors that makes the debit-credit never reach balance, to misclassified transactions, and hours wasted to check the smallest mistake like a needle in a haystack.

If you think that handling and recording assets, liabilites, and inputting them into journal entries manually is too much work, you can try out HashMicro Accounting Software. This advanced software can record, track, and generate various kinds of documents, including journal entries in a blink on an eye.

However, if you’re unsure about how a journal entry work or why they matter to a business, this article will guide you through the essentials. Furthermore, we’ll provide a practical journal entry example and introduce an easier way to simplify the process.

Key Takeaways

|

Table of Contents

What is a Journal Entry?

A journal entry in accounting records financial transactions in a company’s books. To create a journal entry, you document the transaction details in the books. This is part of the second step in the accounting cycle, where journal entries are transferred to the general ledger.

Journal entries are a key part of any accounting system and form the base of accurate records Each journal entry in the general ledger includes the transaction date, amount, affected accounts with account numbers, and a description.

Additionally, it may contain a reference number, such as a check number, along with a short note about the transaction. Every entry has a left-hand side (debit) and a right-hand side (credit) to uphold the accounting equation:

Assets = Liabilities + Equity

These entries establish a complete, chronological record, listing the transaction date, impacted accounts, amounts, and a concise description.

Where is a journal entry documented?

A journal entry is recorded in the general ledger of a business’s accounting system. This ledger serves as the primary repository for all financial transactions, ensuring that each entry is properly documented and can be referenced in financial statements.

In addition to the general ledger, journal entries may also be recorded in subsidiary ledgers, which detail specific accounts and transactions before being summarized into the general ledger. Furthermore, adjusting journal entries are often made at the end of an accounting period to ensure that income and expenses are recorded in the correct period.

Need to know!

AI automates journal entry creation, reducing errors and saving time. With Hashy, HashMicro’s AI assistant, you can generate accurate entries instantly. Hashy ensures compliance and consistency for efficient financial management.

Get a Free Demo Now!

The Purpose of a Journal Entry

Journal entries are essential for maintaining financial accuracy and enabling reliable financial reporting.

Their main objectives include:

- Recording Transactions: Each financial transaction is methodically recorded to ensure no details are missed.

- Tracking Activity: Journal entries establish a sequential log of every economic event that affects a business.

- Supporting Audit Trails: They allow auditors to trace any inconsistencies back to their source, safeguarding financial accuracy.

- Preparing Financial Statements: By promoting consistent and precise record-keeping, journal entries form the foundation for generating the income statement, balance sheet, and cash flow statement.

What Should Be Included in a Journal Entry?

An accounting journal entry consists of the following components:

- Date of the Transaction: Maintains chronological order and period accuracy.

- Account Names/Numbers: Identifies the specific accounts affected by the transaction.

- Debit and Credit Amounts: Displays the financial value involved, ensuring the accounting equation remains balanced.

- Description or Narrative: Briefly explain the transaction for context and clarity.

For example, imagine a business in the Philippines obtains a loan of ₱10,000. The journal entry would be:

- Date: [Date of Transaction]

- Debit: Cash ₱10,000

- Credit: Loans Payable ₱10,000

- Description: To record the borrowing of a ₱10,000 loan.

This entry ensures that the company’s cash (an asset, thus debited) increases, balanced by a corresponding liability (loans payable, thus credited), following the accounting equation.

Types of Journal Entries

Companies in the Philippines commonly rely on two types of journal entries: the sales journal entry and the allowance for doubtful accounts entry. Let’s break down each one:

1. Sales Journal Entry

This entry records your business’s income from selling goods or services. It captures the sales amount, any decrease in inventory due to customer purchases, and any sales tax owed. The specifics may vary slightly depending on the customer’s payment method.

2. Allowance for Doubtful Accounts Entry

Known as a contra-asset, this entry lowers the company’s receivables to account for potential credit risks and uncollectible debts. It helps estimate potential losses from accounts that may remain unpaid, which provides a more realistic view of expected revenue.

For businesses managing notes receivable, recognizing potential bad debts ensures a more accurate financial statement. Proper classification of notes receivable helps track outstanding amounts and assess repayment reliability.

Other than the two main types, here are other types of journal entries:

- Opening Entries: These entries set the initial balances in various ledger accounts.

- Transfer Entries: These entries move amounts between accounts for an accurate impact on the financial statements.

- Closing Entry: Recorded at the end of the accounting period to shift balances from temporary to permanent accounts.

- Adjusting Entries: Prepared before finalizing financial statements, these entries adjust for items not yet recorded by period-end.

- Compound Entries: Multiple accounts with several debits, credits, or both in a single entry.

- Reversing Entries: Made at the start of a new period, these reversing entries undo certain prior-period adjustments.

Each type of journal entry aligns with specific accounting methods, which are suited to specific situations and requirements.

Best Practices for a Journal Entry

Preparing journal entries efficiently and documenting them accurately can be challenging. Here are some recommended best practices:

- Avoid High-Volume Transactions: Generally, refrain from using journal entries for high-volume transactions like customer billings or supplier invoices. Such transactions are better managed through specialized accounting software that provides standardized online forms. Once completed, these forms automatically generate the necessary accounting records, making journal entries unnecessary for these frequent activities.

-

Utilize a Journal Entry Template: Creating a template within your accounting software for recurring journal entries is beneficial. This template should include the accounts typically debited and credited, allowing for quick and easy completion of new entries. Using templates not only enhances efficiency but also minimizes the risk of errors.

-

Establish a Retention Policy: Journal entries and their accompanying documentation should be retained for several years, at least until the business’s financial statements no longer need to be audited. The corporate archiving policy should clearly outline the minimum retention period for journal entries.

Methods of Making a Journal Entry

There are two primary bookkeeping methods—and, consequently, two ways to make journal entries: single-entry and double-entry.

The double-entry bookkeeping method can be compared to a GPS showing where your money comes from and where it’s headed. It records both sides of a transaction, giving a full picture of financial movement.

Single-entry bookkeeping, on the other hand, is straightforward. If you spend money on office supplies, you simply record it. If you make a sale, you log it. There’s no need to specify the account funding the purchase or where sales deposits go.

While single-entry bookkeeping is simpler, double-entry bookkeeping is far more common today because it provides a comprehensive view of a business’s financial health. If you struggle with double-entry bookkeeping, having a reliable tool like accounting software Philippines will help a lot.

Besides, such software also has other functions that accounting teams can use for a complete financial process. Ano pa hinihintay mo? Try out the free demo by clicking on the banner below.

How to Track Journal Entry

Accurate journal entries lay the groundwork for dependable financial records and meaningful reporting. Following a few key steps can help keep things consistent. Here’s how to prepare a journal entry:

- Organize Transaction Information: Collect and verify all relevant transaction documents, such as invoices and receipts.

- Analyze Transactions: Determine which accounts are affected and assess the transaction amount.

- Apply the Accounting Equation: Confirm that Assets = Liabilities + Equity after each transaction.

- Apply Debit and Credit Rules: Identify which account requires a debit and which a credit.

- Record the Entry: Enter the transaction into the journal with all relevant details.

- Review: Regularly review journal entries to maintain accuracy and consistency in financial records.

Effective journal entry tracking ensures that financial records remain accurate and support reliable decision-making. Proper methods enhance transparency and simplify future audits. Therefore, regular tracking is needed to keep the records intact.

Strategies include:

- Use Accounting Software: Leverage modern accounting tools that simplify data entry, tracking, and comprehensive reporting.

- Conduct Regular Audits: Plan regular internal audits to verify entries, ensuring accuracy and completeness.

- Assign Unique Reference Numbers: Give each entry a distinct reference number, enabling quick retrieval and verification.

- Maintain Detailed Documentation: Keep comprehensive documentation for each transaction to support the corresponding journal entries.

Debit and Credit in Journal Entry

In accounting, debit and credit form the foundation of any journal entry definition. These entries represent the dual aspects of every transaction, ensuring that the accounting equation remains balanced. A debit increases assets or expenses, while a credit increases liabilities, equity, or revenue.

To illustrate, consider a simple example of a journal entry: when a business purchases office supplies for cash, the supplies account is debited, and the cash account is credited. This dual entry ensures both the acquisition of supplies and the reduction in cash are accurately recorded. Such journal entry examples are essential for maintaining transparent and error-free financial records.

Using an accounting journal example can help businesses understand how debits and credits are applied in real-world scenarios. Mastering debit and credit principles is key to accurate accounting and effective financial management, from recording daily expenses to managing complex transactions.

Journal Entry Examples

These transactions are from Luna Tech Solutions, a fictional small IT services and equipment supply business based in Manila. Luna Tech Solutions provides tech support to local businesses, sells IT equipment, and manages its own inventory.

The following general journal entries illustrate how the company records common business transactions to ensure its financial records remain accurate and well-organized.

Example 1: Purchasing Inventory on Credit

Date: January 5, 2023

- Debit: Inventory ₱15,000

- Credit: Accounts Payable ₱15,000

- Description: Purchased 10 units of computer monitors on credit.

Explanation:

Luna Tech Solutions bought computer monitors to add to their inventory but hasn’t paid the supplier yet. The “Inventory” account is debited (increased) by ₱15,000 to reflect the new stock, and “Accounts Payable” is credited to show the amount owed to the supplier.

Example 2: Recording Depreciation

Date: January 31, 2023

- Debit: Depreciation Expense ₱2,500

- Credit: Accumulated Depreciation ₱2,500

- Description: Monthly depreciation recorded for office equipment.

Explanation:

Each month, Luna Tech Solutions records depreciation for its office equipment, like computers and printers. “Depreciation Expense” is debited to reflect the monthly cost of equipment wear and tear, while “Accumulated Depreciation” is credited to track the total depreciation amount on the equipment.

Example 3: Service Revenue Earned and Received in Cash

Date: February 2, 2023

- Debit: Cash ₱10,000

- Credit: Service Revenue ₱10,000

- Description: Received payment in cash for on-site tech support provided to a corporate client.

Explanation:

Luna Tech Solutions received cash from a client for providing on-site tech support services. “Cash” is debited (increased) by ₱10,000 for the received amount, and “Service Revenue” is credited to reflect income from the service provided.

Example 4: Employee Salary Payment

Date: February 15, 2023

- Debit: Salaries Expense ₱20,000

- Credit: Cash ₱20,000

- Description: Paid employee salaries for the first half of February.

Explanation:

Luna Tech Solutions pays out ₱20,000 in employee salaries for the first half of the month. “Salaries Expense” is debited to show this as a cost, while “Cash” is credited, indicating a reduction in the company’s cash for this expense.

Example 5: Loan Payment with Interest

Date: February 20, 2023

- Debit: Loans Payable ₱8,000

- Debit: Interest Expense ₱500

- Credit: Cash ₱8,500

- Description: Partial loan repayment with interest.

Explanation:

Luna Tech Solutions pays ₱8,500 toward a loan, which includes ₱8,000 in principal and ₱500 in interest. “Loans Payable” is debited to decrease the loan balance, “Interest Expense” is debited for the cost of interest, and “Cash” is credited to show the cash outflow.

Journal Entry Examples with Tables

The transactions in this lesson relate to Juan’s Car Repair Shop, our fictional small business in Manila. Please note that all transactions are simplified examples to aid learning.

Let’s get started.

Transaction #1: On January 1, 2023, Juan invested ₱500,000 to start Juan’s Car Repair Shop. The journal entry should increase the company’s Cash and establish Juan’s capital account.

| Date | Particulars | Debit | Credit |

| Jan 1 | Cash | 500,000 | |

| Juan, Capital | 500,000 |

Transaction #2: On January 5, Juan’s Car Repair Shop paid registration fees of ₱18,000.

| Date | Particulars | Debit | Credit |

| Jan 5 | Registration Expense | 18,000 | |

| Cash | 18,000 |

Transaction #3: On January 8, the shop purchased tools and equipment for ₱150,000, paid in cash.

| Date | Particulars | Debit | Credit |

| Jan 8 | Tools and Equipment | 150,000 | |

| Cash | 150,000 |

Transaction #4: On January 10, the shop bought supplies worth ₱25,000 on credit.

| Date | Particulars | Debit | Credit |

| Jan 10 | Supplies | 25,000 | |

| Accounts Payable | 25,000 |

Transaction #5: On January 12, the shop earned ₱80,000 in repair service revenue, receiving cash.

| Date | Particulars | Debit | Credit |

| Jan 12 | Cash | 80,000 | |

| Service Revenue | 80,000 |

Transaction #6: On January 15, Juan contributed an additional ₱200,000 to the business.

| Date | Particulars | Debit | Credit |

| Jan 15 | Cash | 200,000 | |

| Juan, Capital | 200,000 |

Transaction #7: On January 20, the shop rendered services to a corporate client for ₱120,000 on account, due in 30 days.

| Date | Particulars | Debit | Credit |

| Jan 20 | Accounts Receivable | 120,000 | |

| Service Revenue | 120,000 |

Transaction #8: On January 25, the shop collected ₱60,000 from a previous account receivable.

| Date | Particulars | Debit | Credit |

| Jan 25 | Cash | 60,000 | |

| Accounts Receivable | 60,000 |

Transaction #9: On January 28, Juan withdrew ₱50,000 for personal use.

| Date | Particulars | Debit | Credit |

| Jan 28 | Juan, Withdrawals | 50,000 | |

| Cash | 50,000 |

Transaction #10: On January 31, the shop paid ₱45,000 in salaries to employees.

| Date | Particulars | Debit | Credit |

| Jan 31 | Salaries Expense | 45,000 | |

| Cash | 45,000 |

These transactions are a practical guide to recording journal entries for a small business in the Philippines.

Making Journal Entry Easier with HashMicro Accounting Software

Let’s face it: doing accounting by hand can be exhausting. It takes time, mistakes happen, and losing track of records is easy. Nakakabaliw, di ba? These issues make managing finances a real struggle for many business owners.

With HashMicro Accounting Software, these worries fade away. The software handles the details for you, reducing errors and saving you work hours. Your records stay organized, accurate, and ready when you need them.

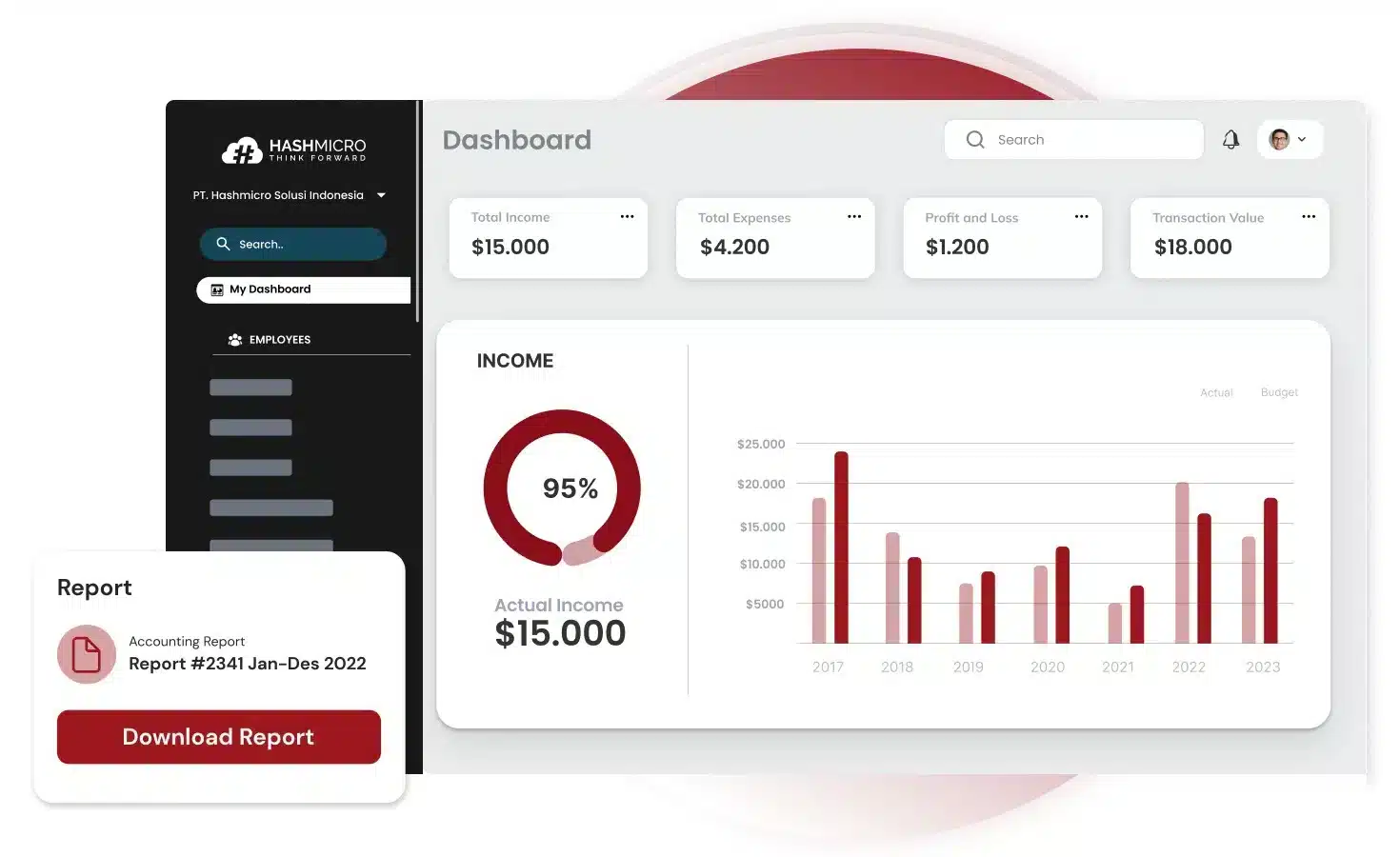

HashMicro provides several features to help with making journal entries:

- Bank Integration – Auto Reconciliation: This feature is ideal because it automatically matches bank transactions with internal records.

- Multi-Level Analytical (Compare FS per Project, Branch, etc.): Journal entries are often categorized by projects, branches, or specific accounts. This feature provides in-depth analysis across various levels.

- Cash Flow Reports: Since journal entries contribute to cash flow records, it is valuable to have real-time cash flow reports directly linked to them.

- Financial Statement with Budget Comparison: Journal entries impact financial statements, so a feature that compares actual finances against the budget provides valuable insights.

- Profit & Loss vs Budget & Forecast: This feature showcases how journal entries affect profitability and budgeting. Users can gauge financial health and adjust journal entries accordingly to meet business goals.

Conclusion

Journal entries are essential records of every financial transaction, ensuring businesses keep accurate, organized books. Each entry documents the transaction date, accounts affected, and the debit and credit amounts.

Managing journal entries manually, however, can be time-consuming and error-prone, making accounting software a valuable tool. HashMicro Accounting Software simplifies this process by automating entries, reconciling bank transactions, and providing real-time reports.

Managing finances has never been easier with HashMicro’s features like auto-reconciliation, multi-level analysis, and financial statements. Walang kahirap-hirap, di ba? The software’s intelligent automation makes tracking and updating journal entries simpler and less time-consuming.

Don’t just take our word for it; try out the free demo and contact our expert team!

FAQ About Journal Entry Example

-

What is the difference between a journal entry and a ledger entry?

A journal entry is where you first record a financial transaction in detail, while a ledger entry organizes those transactions into specific accounts to help create financial reports.

-

How do adjusting entries differ from regular journal entries?

Adjusting entries are made at the end of a reporting period to update account balances for unpaid bills or earned income that has yet to be recorded. Regular journal entries are made whenever transactions happen.

-

Why is it important to include a description in a journal entry?

Including a description or narrative in a journal entry provides context for the transaction, aiding in future reference and understanding. It helps accountants and auditors comprehend the nature of the transaction, ensuring transparency and facilitating accurate financial reporting.

-

What are compound journal entries?

Compound journal entries involve more than two accounts, with multiple debits and/or credits in a single entry. They are used when a transaction affects several accounts simultaneously. For example, recording payroll might involve debiting salary expenses and various tax expenses while crediting cash and tax-payable accounts.