Did you know that the total cost of importing goods can often be up to 20% higher than the initial price you pay? This additional expense, known as “landed cost,” can significantly impact your profit margins if not carefully managed. Landed costs include hidden fees like shipping, insurance, customs duties, and taxes, all of which can add up quickly and erode your bottom line.

In today’s increasingly competitive global market, understanding and controlling your landed costs is essential for staying profitable. Ignoring these costs can lead to pricing mistakes, unexpected expenses, and reduced competitiveness. Businesses that accurately calculate their landed costs are better equipped to set the right prices, negotiate with suppliers, and plan more efficiently.

In this guide, we’ll take a closer look at what landed cost entails, why it’s so important for businesses, and how to calculate it effectively using straightforward software solutions. By the end, you’ll be well-prepared to optimize your importing processes, reduce unnecessary costs, and enhance your profitability in the Philippine market.

Key Takeaways

|

Table of Contents

What is Landed Cost

Landed cost is the total cost of getting a product from where it’s made to your location. This includes the price of the product and other costs like shipping, insurance, customs fees, and taxes. Knowing this cost helps you make smarter financial choices by showing you the true cost of importing goods.

The main benefit of knowing this cost is that it helps you set the right price and plan your budget correctly. Instead of only thinking about the product’s price, businesses can include all hidden costs to make sure they’re still making a profit. Without knowing these costs, companies might set the wrong price or lose money because of surprise fees.

In simple terms, landed cost is the complete cost to move a product from the supplier to the buyer, including all the extra fees along the way. By tracking these costs, businesses can better manage their supply chain and financial plans.

Why is Landed Cost Important

Understanding your landed cost is key for smart business choices. It helps you set the right prices, talk better deals with suppliers, and enhance your import plans. If you ignore hidden costs, you might face unexpected expenses that cut into your profits.

Here’s why the this cost impact matters for your business:

- Accurate Pricing: Knowing your total cost lets you price your products right. If you guess wrong, you could lose money or miss out on sales.

- Better Supplier Negotiations: With exact cost info, you can bargain better with suppliers. This can get you better deals and discounts.

- Improved Import Strategy: Looking at your costs can show you how to save money. You might find cheaper shipping options or better suppliers.

- Reduced Surprises: Missing hidden costs can lead to unexpected bills. Knowing your cost helps you prepare for these costs.

The importance of landed cost is clear. It gives you a full picture of your import costs. This lets you make smart choices and keep your profits up.

First Cost vs Landed Cost

Understanding the difference between first and landed costs is key when importing products. First cost is the initial price you pay for an item. It includes all extra costs to get that item to your door.

Knowing the difference helps you price your products right and manage your money well. It shows your total import costs. This helps you plan your supply chain and pricing better.

The main difference is the extra costs included in landed cost. These are Shipping and freight charges, Customs duties and taxes, Insurance and risk coverage expenses, and Overhead costs of the import process.

Next, we’ll explore these main components of it. We’ll show you how to calculate it to improve your import operations.

The Main Factors Components of Landed Cost

Understanding the true cost of your imported goods is key. It involves knowing all the factors that add up to your landed cost. From shipping fees to customs duties, each part is crucial for the final price you pay. Let’s look at the main elements that make up your landed cost.

1. Product

The cost of the product itself is the base of your landed cost. This includes what the maker or supplier charges, plus any discounts or deals you’ve made.

2. Shiping

Shipping costs can change a lot. They depend on how you ship, the size and weight of your items, and how far they go. Things like fuel surcharges, insurance, and handling fees also affect your costs.

3. Customs

Customs duties, taxes, and brokerage fees can really impact your cost. These fees are based on the product’s value, type, and where it’s from. Knowing the rules in your market is key.

4. Risk Coverage Cost

It’s important to protect your shipment with insurance. The cost of this insurance should be included in your landed cost.

5. Overhead Costs

Remember the costs of handling and storing your imports. This includes the cost of storage, managing inventory, and labor for handling and processing.

By understanding each landed cost factor and component of it, you can make better import decisions. This way, you know the real cost of your goods.

How to Calculate Landing Cost

Understanding the landed cost of importing goods is key. The formula helps you figure out the total cost per unit. This includes all expenses. Knowing this can help you make better choices and improve your supply chain.

Landed Cost Formula

The formula for landed cost is:

Landed Cost = (Unit Cost + Freight + Insurance + Customs Duties + Taxes + Other Fees) / Quantity

Let’s look at what each part of the formula means:

- Unit Cost: The price for each item.

- Freight: The cost to move the goods to you.

- Insurance: The cost to protect the shipment.

- Customs Duties: Fees for bringing the goods into your country.

- Taxes: Taxes like VAT or sales tax.

- Other Fees: Extra costs, like brokerage fees.

- Quantity: The number of items bought.

Landed Cost Example

Let’s say you buy 500 units of a product. Each costs $10. The shipping is $500, insurance is $100, customs duties are $300, and taxes are $200. There are also $50 in other fees.

Using the formula, we get:

Landed Cost = ($10 + $500 + $100 + $300 + $200 + $50) / 500 = $2.32 per unit

This shows the real cost of each unit. It helps you make smarter buying choices.

Also read: Implicit Cost: Definition and Examples

How HashMicro Distribution Software Simplifies Landed Cost Management

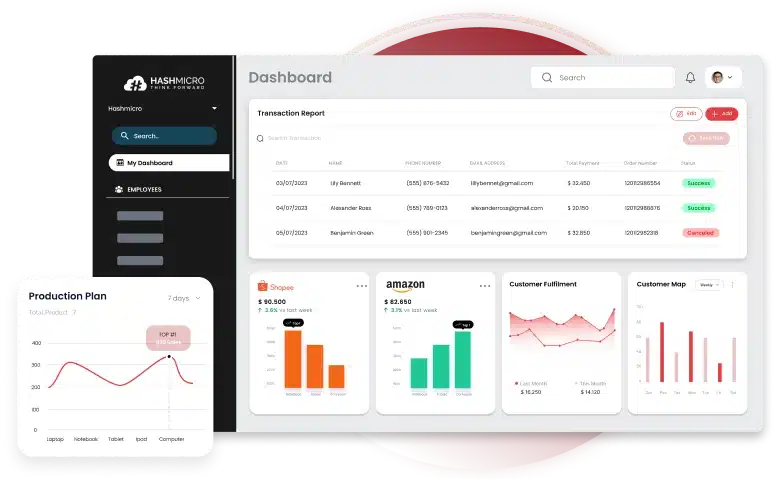

In the complex world of importing and distributing goods, businesses often struggle with hidden costs and inefficient cost management. HashMicro’s Wholesale Distribution Software provides a powerful solution to streamline the calculation and management of landed costs, helping businesses boost profitability:

- Automated Landed Cost Calculation: HashMicro simplifies the complex task of calculating this costs by automating the process. The software integrates real-time data for shipping, taxes, insurance, and other fees, ensuring precise calculations without manual errors.

- Cost Transparency and Compliance: Ensuring full visibility over every import expense is key to profitability. HashMicro’s software tracks all the components, providing detailed audit trails and ensuring compliance with import regulations, making it easier to manage your costs effectively.

- Customizable Pricing and Profit Margins: With accurate data, HashMicro allows businesses to set optimal prices by factoring in all hidden costs. This ensures competitive pricing and healthy profit margins, even with fluctuating fees like shipping or customs duties.

- Real-Time Data Integration: Businesses benefit from real-time cost updates, which help them track changes in shipping or customs fees instantly. This allows for quicker decision-making and better control over overall expenses.

- Detailed Reporting and Analytics: HashMicro’s software generates comprehensive reports that break down every element of the landed cost, empowering businesses to analyze their import costs and optimize their supply chain strategies for better profitability.

Discover how HashMicro’s Wholesale Distribution Software can help you master landed cost management, optimize your pricing, and improve your bottom line. Try the free demo today and see the difference for yourself!

Conclusion

Managing landed costs is critical for any business involved in importing goods. From shipping fees to customs duties, knowing the true cost of imported products allows businesses to set competitive prices, negotiate better deals, and maintain profitability. Accurately calculating it ensures a clear understanding of every expense, helping businesses make informed decisions.

HashMicro’s Trading & Distribution Management Software is designed to automate and simplify landed cost management, offering real-time cost tracking, compliance support, and detailed reporting. With this software, businesses can optimize their pricing and boost profitability by managing all hidden costs effectively.

Experience the benefits of better cost control—try HashMicro’s free demo today!

Frequently Asked Questions

-

What is the other name for landed cost?

Another name for landed cost is “total delivered cost.” This term refers to the full expenses associated with getting a product from the seller to the buyer, including shipping, customs, and fees.

-

Who pays for landed costs?

The buyer or importer usually pays It. These costs include the product price, shipping fees, customs duties, taxes, insurance, and other expenses incurred to bring goods to their final destination.

-

What is the difference between FOB and landed cost?

FOB (Free on Board) covers only the cost of shipping the goods to the port of departure. Landed cost, on the other hand, includes all additional charges such as shipping, insurance, customs, and taxes to the buyer’s location.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “What is the other name for landed cost?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Another name for landed cost is \”total delivered cost.\” This term refers to the full expenses associated with getting a product from the seller to the buyer, including shipping, customs, and fees.”

}

},{

“@type”: “Question”,

“name”: “Who pays for landed costs?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The buyer or importer usually pays for the landed costs. These costs include the product price, shipping fees, customs duties, taxes, insurance, and other expenses incurred to bring goods to their final destination.”

}

},{

“@type”: “Question”,

“name”: “What is the difference between FOB and landed cost?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “FOB (Free on Board) covers only the cost of shipping the goods to the port of departure. Landed cost, on the other hand, includes all additional charges such as shipping, insurance, customs, and taxes to the buyer’s location.”

}

}]

}