Imagine effortlessly managing your company’s finances with precision and ease. For many managers, this ideal is far from reality as they grapple with the complexities of general ledger maintenance. However, many managers find general ledger management to be a daunting task, often leading to inefficiencies and errors.

Common challenges in general ledger management include data entry mistakes, time-consuming manual processes, and difficulties reconciling accounts. These issues can result in financial discrepancies and hinder informed decision-making.

A study on the bookkeeping practices of micro, small, and medium enterprises (MSMEs) in the Philippines, revealed that many businesses struggle with proper ledger maintenance, leading to compliance issues and financial mismanagement.

To address these challenges, this article provides 12 free ledger templates for Excel and Word that can streamline your accounting processes. By implementing these tools, you can enhance accuracy and efficiency in your financial management.

Table of Content

Content Lists

Key Takeaways

|

What is Ledger Templates?

A ledger template is a pre-designed document that simplifies the recording and monitoring of financial transactions. Using a general ledger format, businesses can track their income and expenses efficiently, ensuring their financial data remains accurate and organized.

This template is crucial in providing insights into a company’s financial health. A clear ledger account format allows you to monitor debits and credits, compare assets and liabilities, and assess whether your accounts align with your budget goals.

Ledger templates often integrate data from sub-ledgers like accounts payable, accounts receivable, and cash management. Whether you’re transitioning from a manual ledger book format or exploring a modern accounting ledger template, these tools streamline financial processes and help businesses determine whether their assets can effectively meet operating costs.

What Does a General Ledger Include?

A general ledger is the backbone of any accounting system software, capturing all the essential details of a business’s financial transactions. It organizes financial data in a structured manner to ensure accuracy and clarity, making it a vital tool in both manual and automated systems, such as an accounting ledger template.

1. Journal entry: The journal entry records the details of each transaction, including its unique entry number and the date it occurred. This information is essential in a ledger template to ensure transactions are correctly tracked and can be referenced easily.

2. Transaction description: Every journal entry includes a brief yet precise description. This helps users of the general ledger format understand the nature of each financial event without needing to consult external documents.

3. Debit and credit columns: Every transaction posts either a debit or credit to the appropriate account in a ledger account format. These columns are vital for maintaining the balance required in double-entry accounting systems, ensuring accurate financial reporting.

4. Account balances: The general ledger tracks the balance of each account after every debit or credit is posted. This data is summarized at the end of the accounting period, making it easier to review account balances using tools like a manual ledger book format or digital templates.

5. General ledger accounts (GL Accounts): A general ledger includes all accounts used in financial statements, categorized as assets, liabilities, equity, revenue, or expenses. With a comprehensive ledger template, businesses can effortlessly track these key accounts and quickly generate financial reports.

A general ledger format includes these components and provides a clear and organized view of a company’s financial health. This makes it an indispensable resource for businesses aiming to streamline their accounting processes and ensure compliance with financial standards.

Purpose of Ledger Templates

A ledger template serves as a vital tool for recording and monitoring financial transactions accurately. It ensures that your debits and credits align with your budget, providing a clear picture of your financial activity.

By using a structured general ledger format, you can track income, expenses, assets, and liabilities effectively. This not only improves your financial management but also helps you identify trends and make informed decisions about your business’s future.

Whether you prefer a manual ledger book format or an automated accounting ledger template, these tools simplify financial record-keeping. With a reliable ledger account format, you gain deeper insights into your financial health and maintain organized, error-free accounts.

To elevate your financial management further, consider leveraging software designed to streamline general ledger processes. Moreover, by trying our cost calculation tool, you can discover a tailored solution that simplifies tracking, ensures accuracy, and supports smarter business decisions!

12 Example of Ledger Templates for Business

Choosing the right ledger template can significantly enhance how businesses manage and organize their financial data. With templates designed to meet specific needs, from general accounting to specialized financial tracking, you can streamline processes and maintain accurate records effortlessly.

Below are ten examples of ledger templates tailored for business use, ensuring efficiency and clarity in managing your finances:

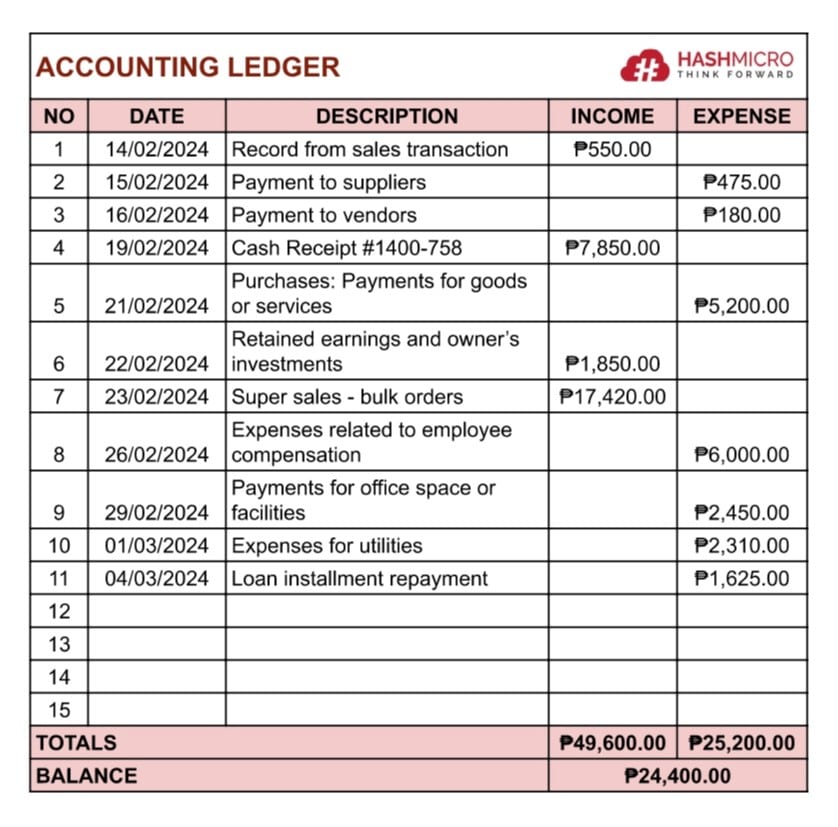

1. Accounting Ledger Template

Accounting Ledger Template

An accounting ledger template is a structured tool that records all financial transactions, including income, expenses, and account balances. It ensures your books are accurate, compliant, and ready for financial reporting.

This template is ideal for managing everyday accounting tasks, such as tracking expenses and preparing financial statements. Whether you’re a small business owner or part of a larger organization, this tool simplifies your bookkeeping process.

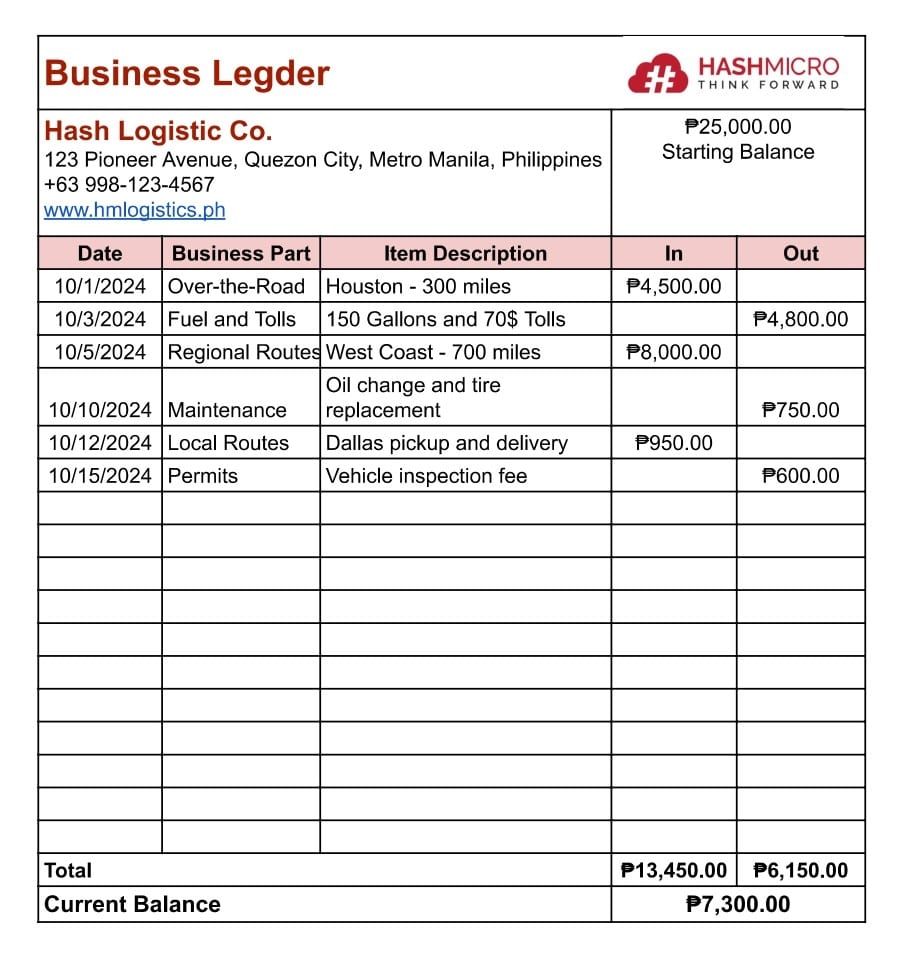

2. Business Ledger Template

Business Ledger Template

A business ledger template tracks financial activities unique to your operations, like sales, purchases, and inventory movements. It provides an overview of your business’s operational finances.

This template is perfect for businesses that need a flexible and tailored solution to manage their operational costs and revenues. It’s beneficial when aligning financial data with your company’s goals and activities.

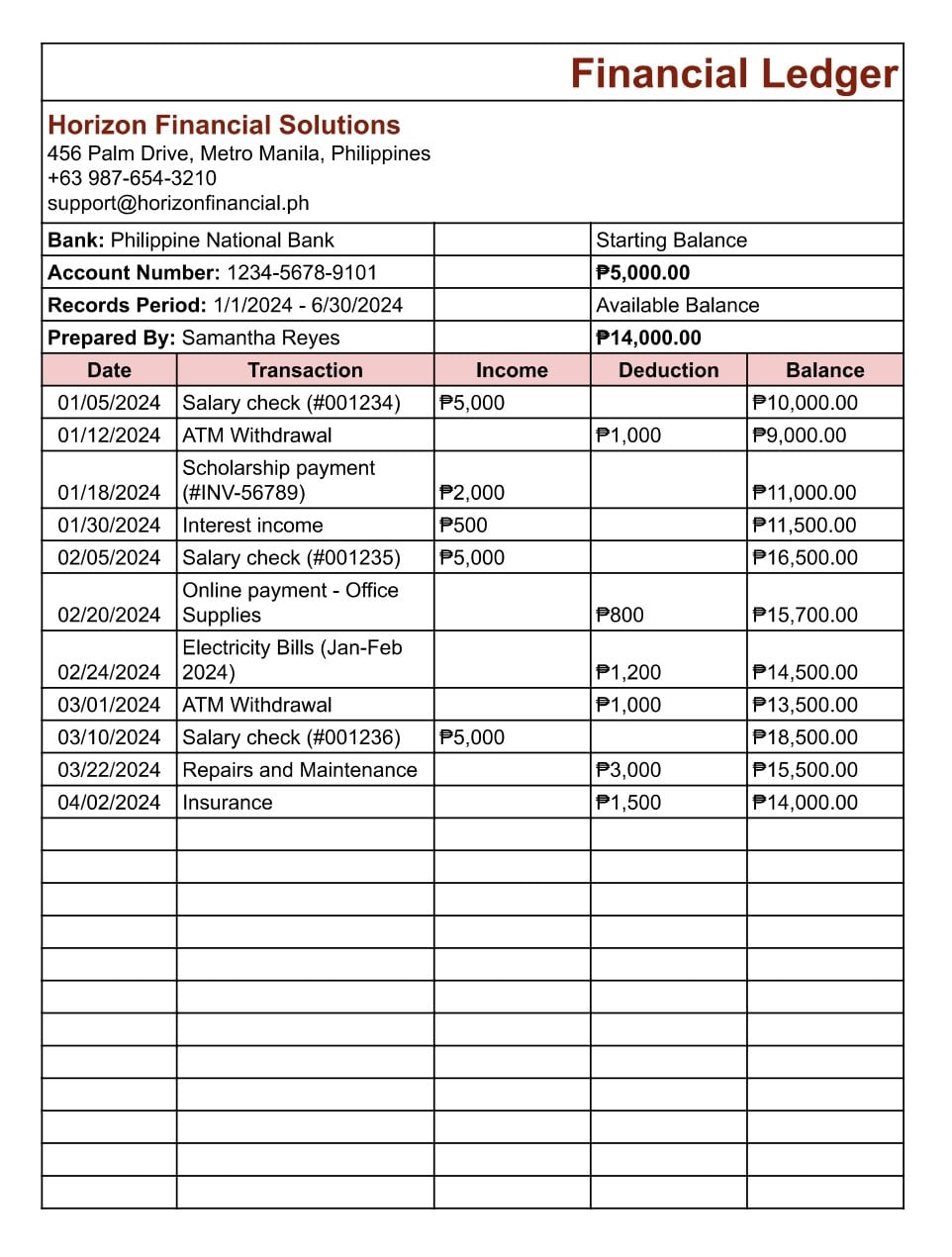

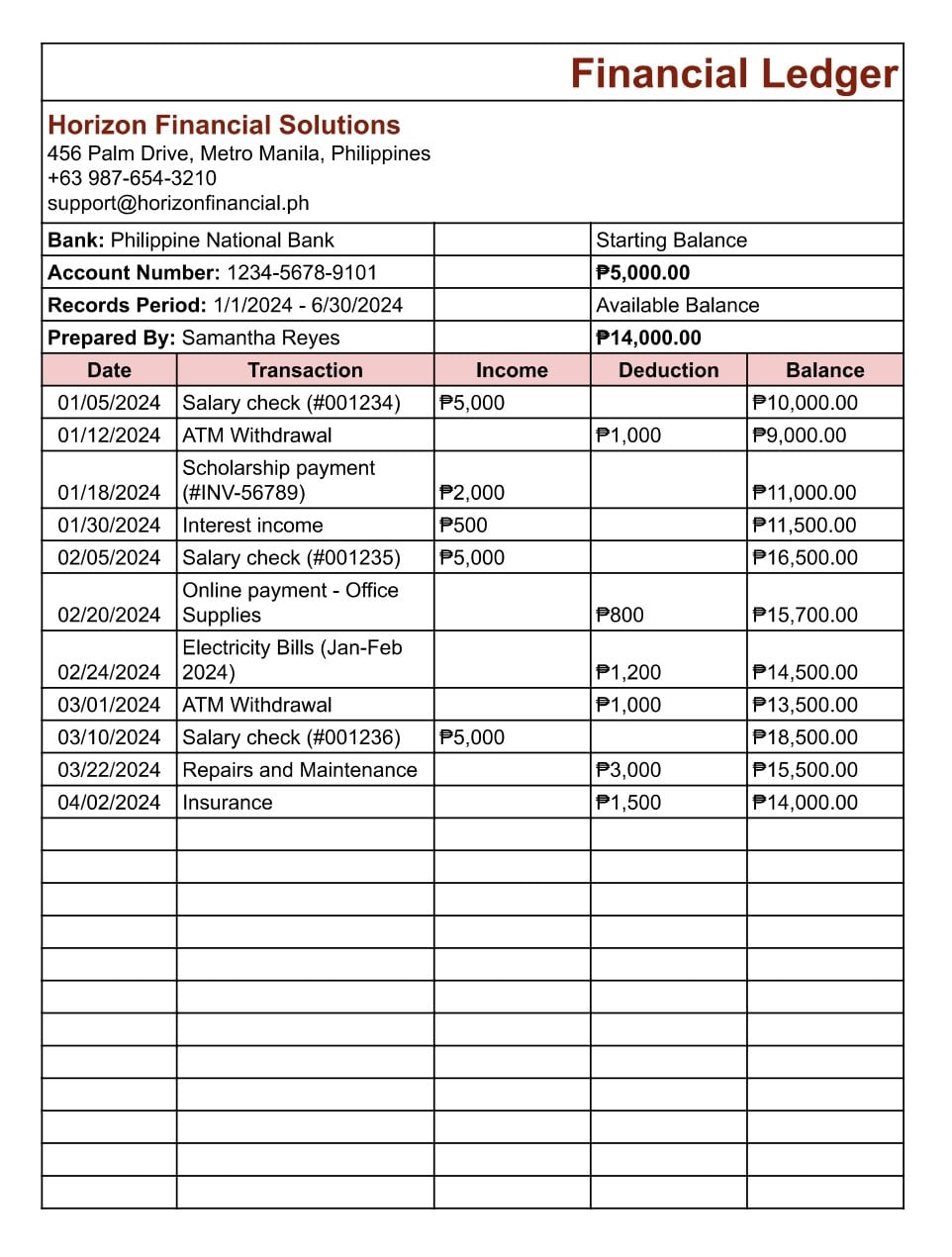

3. Financial Ledger Template

Financial Ledger Template

A financial ledger template consolidates all financial data, such as assets, liabilities, equity, revenue, and expenses, into one organized document. It provides a clear snapshot of your overall financial health.

This template generates comprehensive reports during financial reviews or audits, such as balance sheets or trial balances. It’s a reliable tool for businesses seeking to streamline decision-making with accurate data.

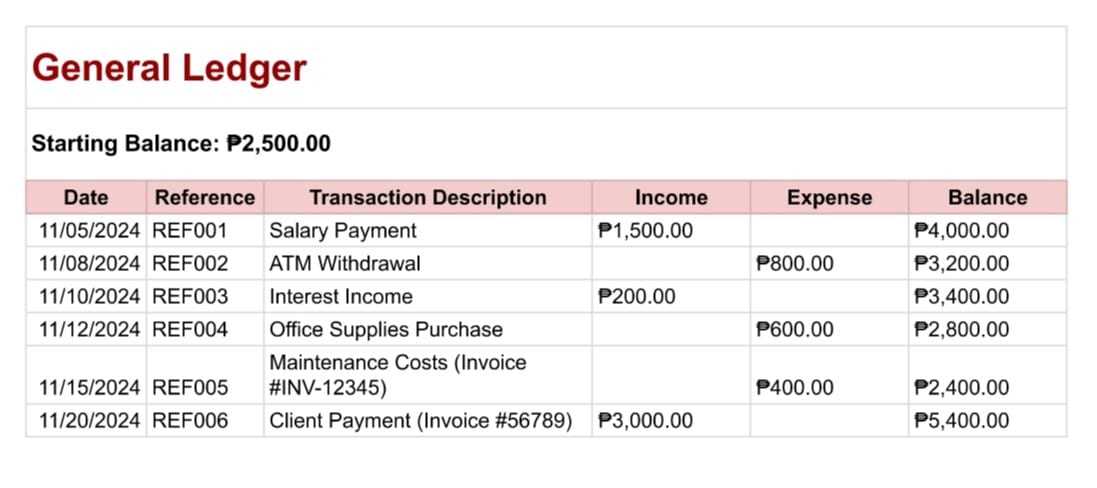

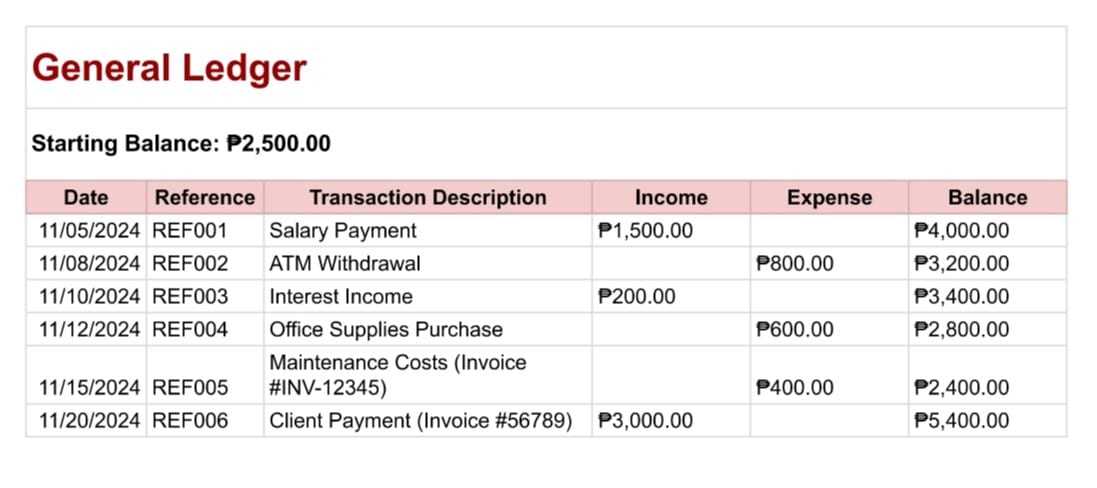

4. General Ledger Template

General Ledger Template

A general ledger template is the backbone of any accounting system. It summarises all transactions, including debits, credits, and balances, and aligns with a standardized general ledger format to ensure consistency.

This template is essential for tracking all financial accounts, making it indispensable for businesses using double-entry accounting. It’s perfect for maintaining organized records and reconciling accounts at the end of an accounting period.

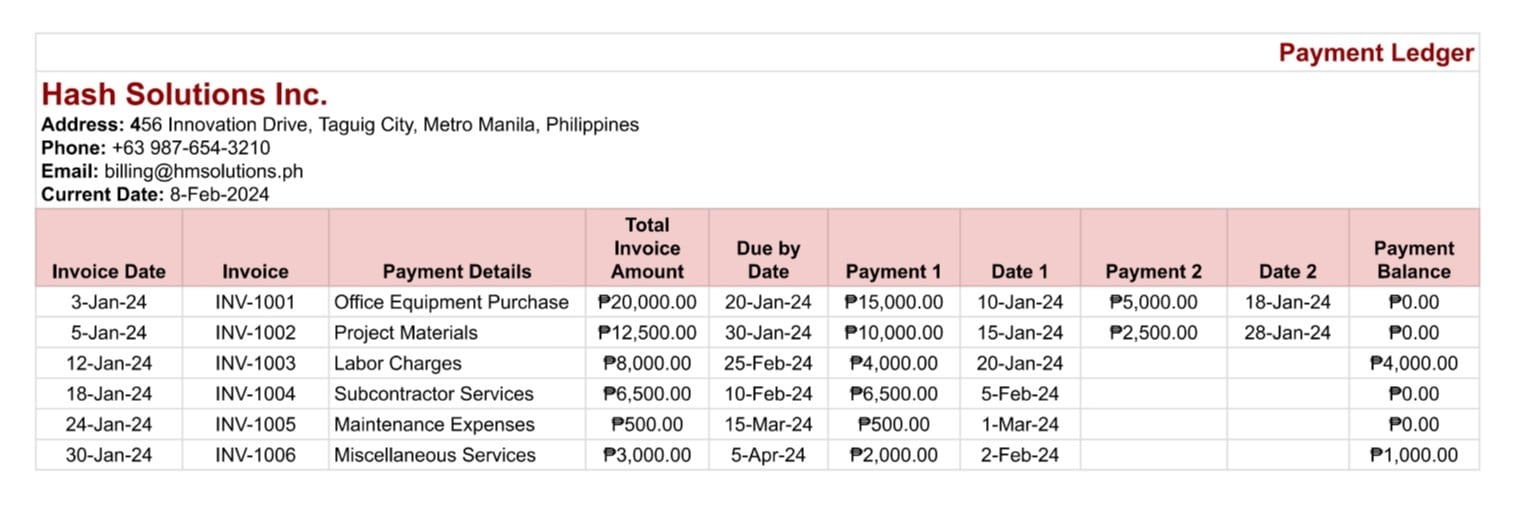

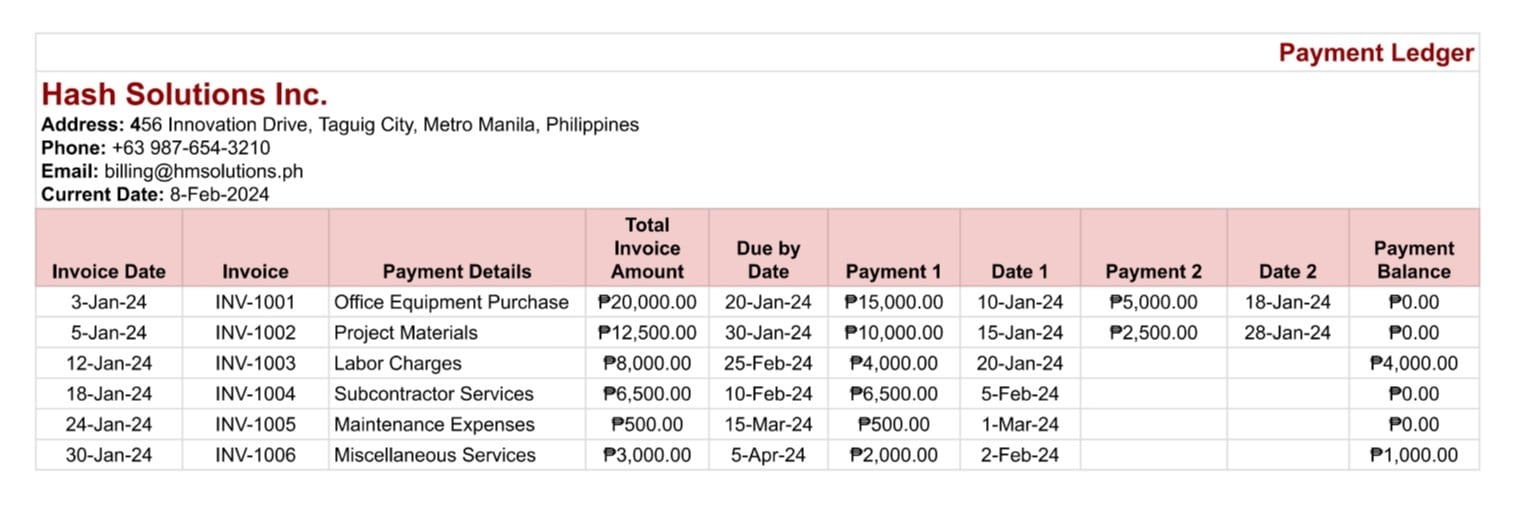

5. Payment Ledger Template

Payment Ledger Template

A payment ledger template records all payments made and received, helping you track cash flows and payment statuses. It ensures a clear payment history for every transaction.

This template is ideal for businesses tracking outgoing and incoming payments precisely. It helps avoid payment errors or delays and is precious for reconciling accounts and maintaining accurate cash flow records.

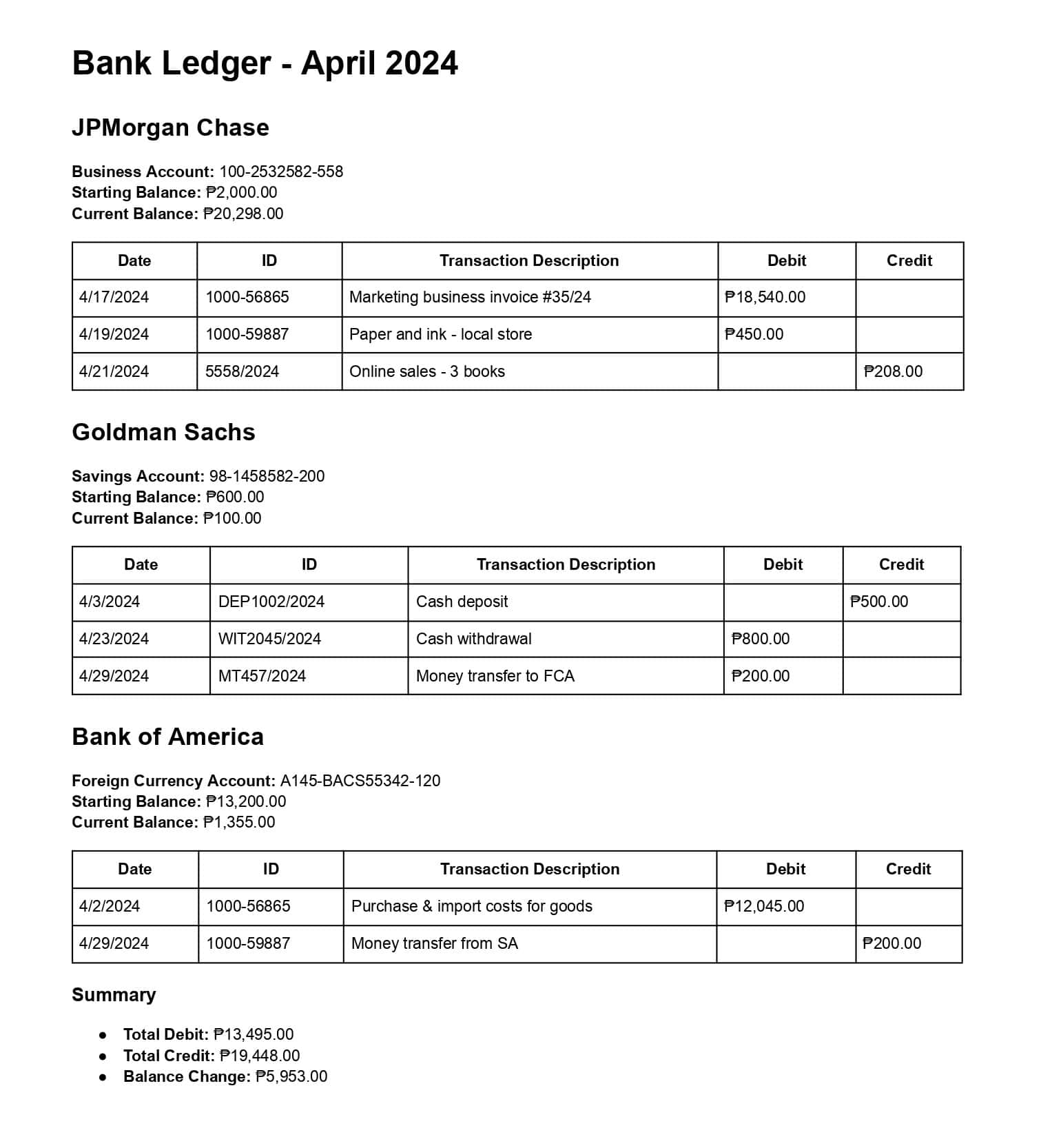

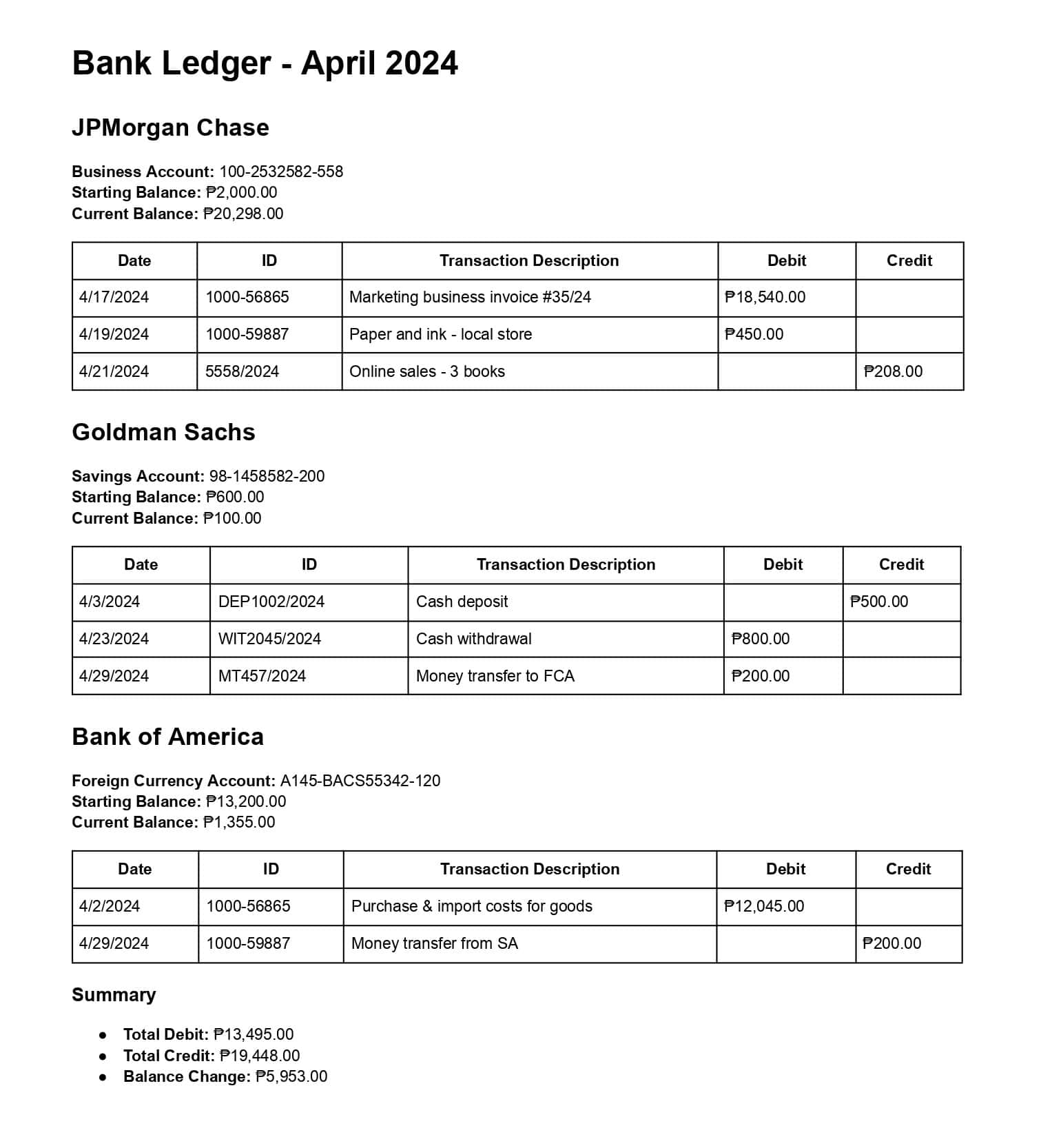

6. Bank Ledger Template

Bank Ledger Template

A bank ledger template specializes in managing transactions with your bank, such as deposits, withdrawals, and fees. It bridges the gap between your internal records and bank statements.

Use this template during account reconciliations or monthly reviews to ensure your financial records match your bank statements. It’s crucial for businesses aiming to prevent discrepancies and maintain accurate cash management.

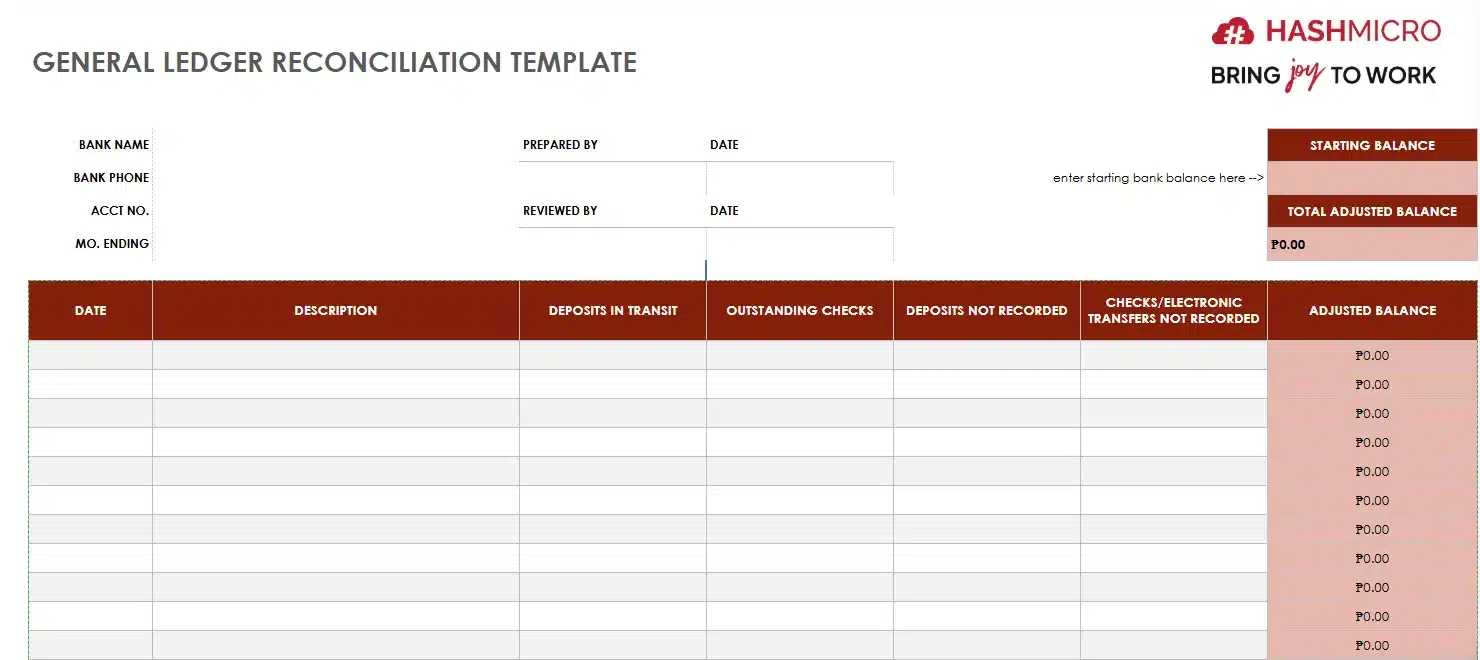

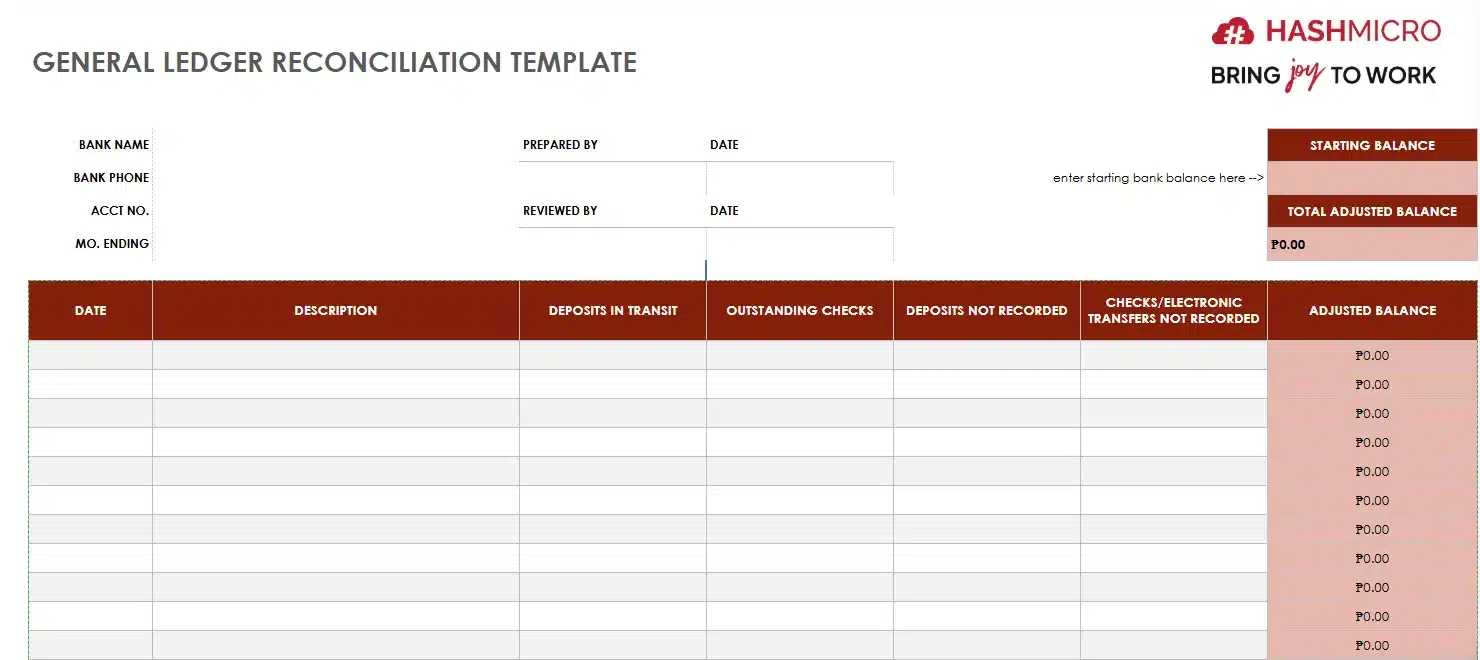

7. General Ledger Reconciliation Template

General Ledger Reconciliation Template

The General Ledger Reconciliation Template helps match a company’s bank account balance with its general ledger to ensure both records are accurate. It identifies any differences so they can be fixed quickly.

At the top of the template, you’ll find basic bank details, such as the Bank Name, Account Number, and Bank Phone Number, as well as the Month Ending period. There are also fields for the Preparer and Reviewer, including their names and dates, to track who worked on the reconciliation.

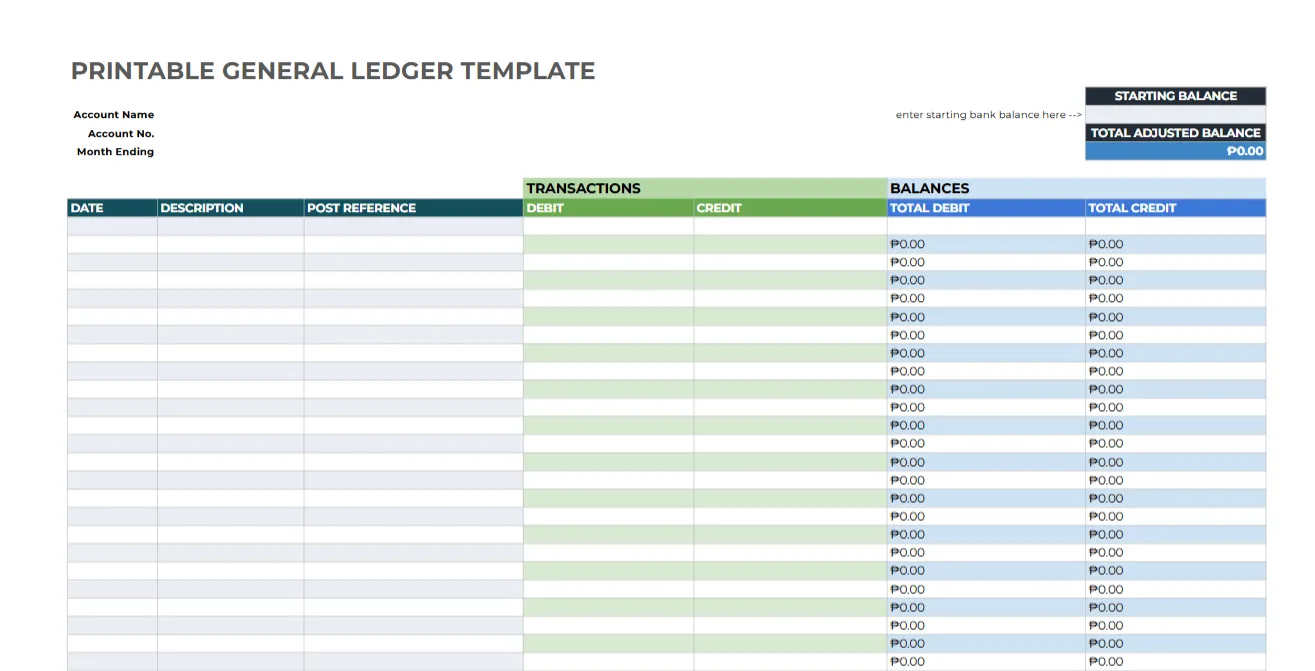

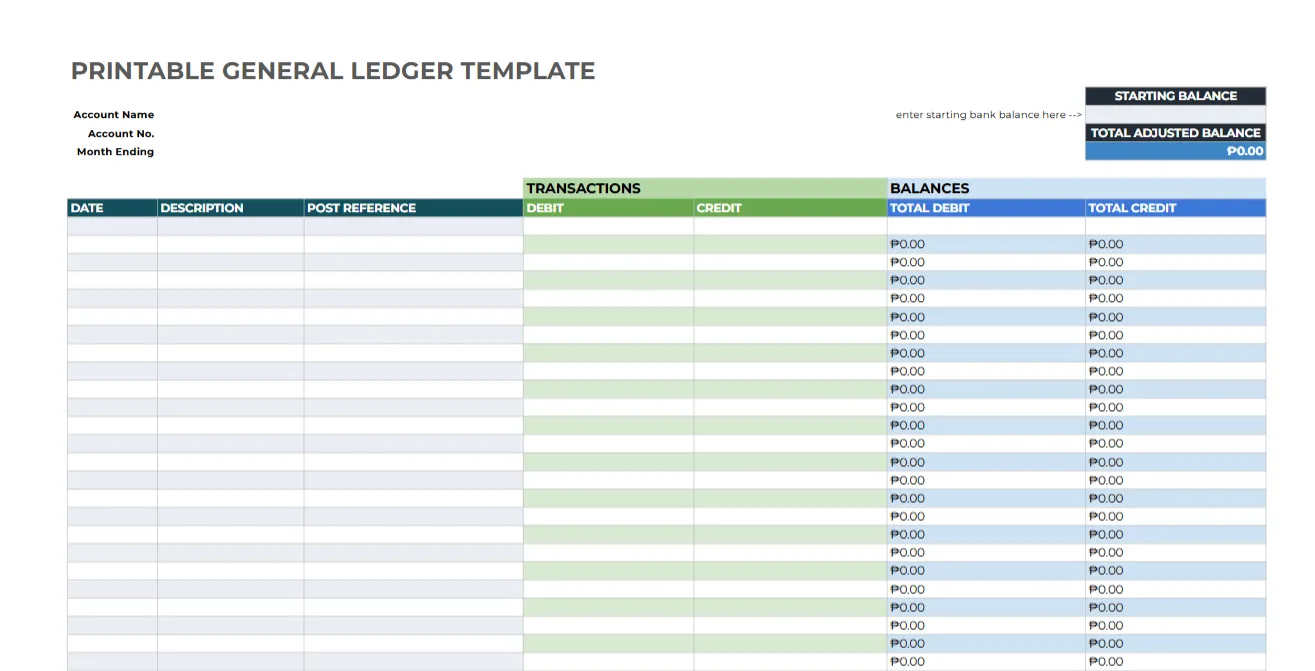

8. Printable General Ledger Template

Printable General Ledger Template

The Printable General Ledger Template is a simple and organized tool for tracking financial transactions and balances for a specific account. It helps businesses record all debits and credits to maintain accurate and up-to-date financial records.

At the top, the template includes fields for essential details such as the Account Name, Account Number, and the Month Ending period. It also has a space to enter the Starting Balance, which is the initial balance of the account at the beginning of the period.

Once all transactions are recorded, the Total Adjusted Balance reflects the updated balance after accounting for all debits and credits.

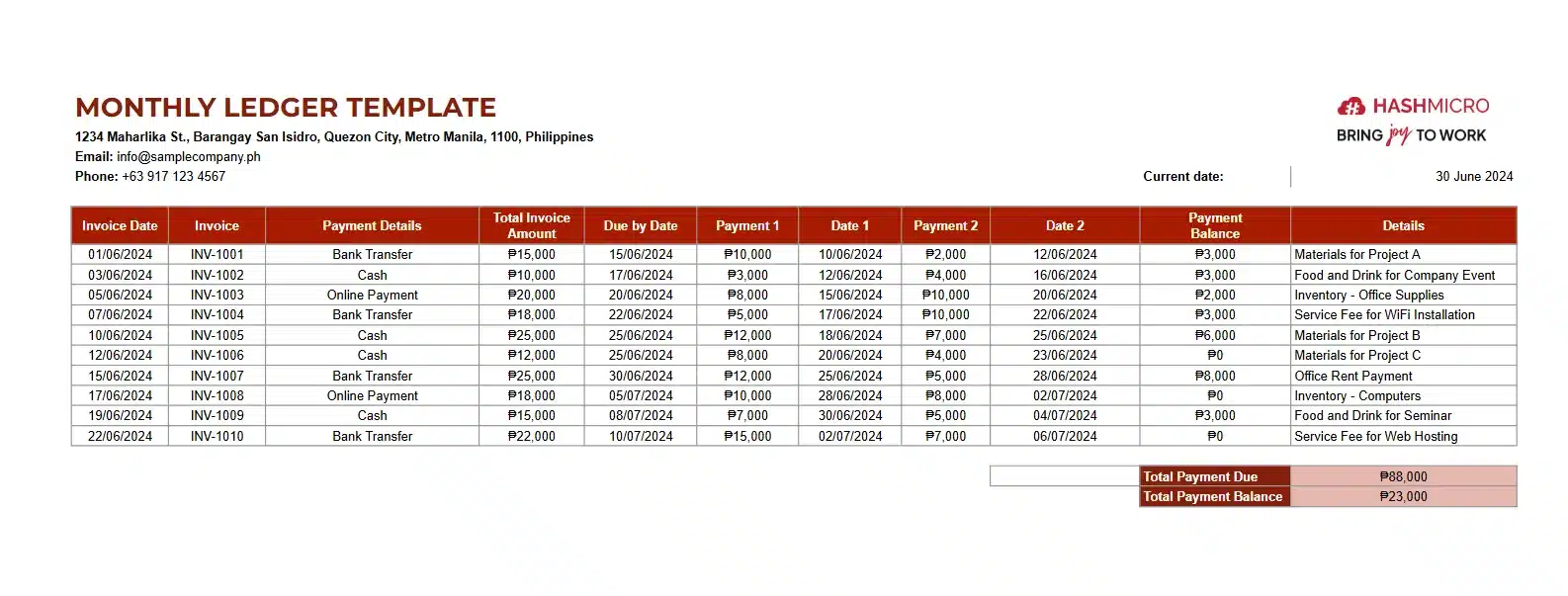

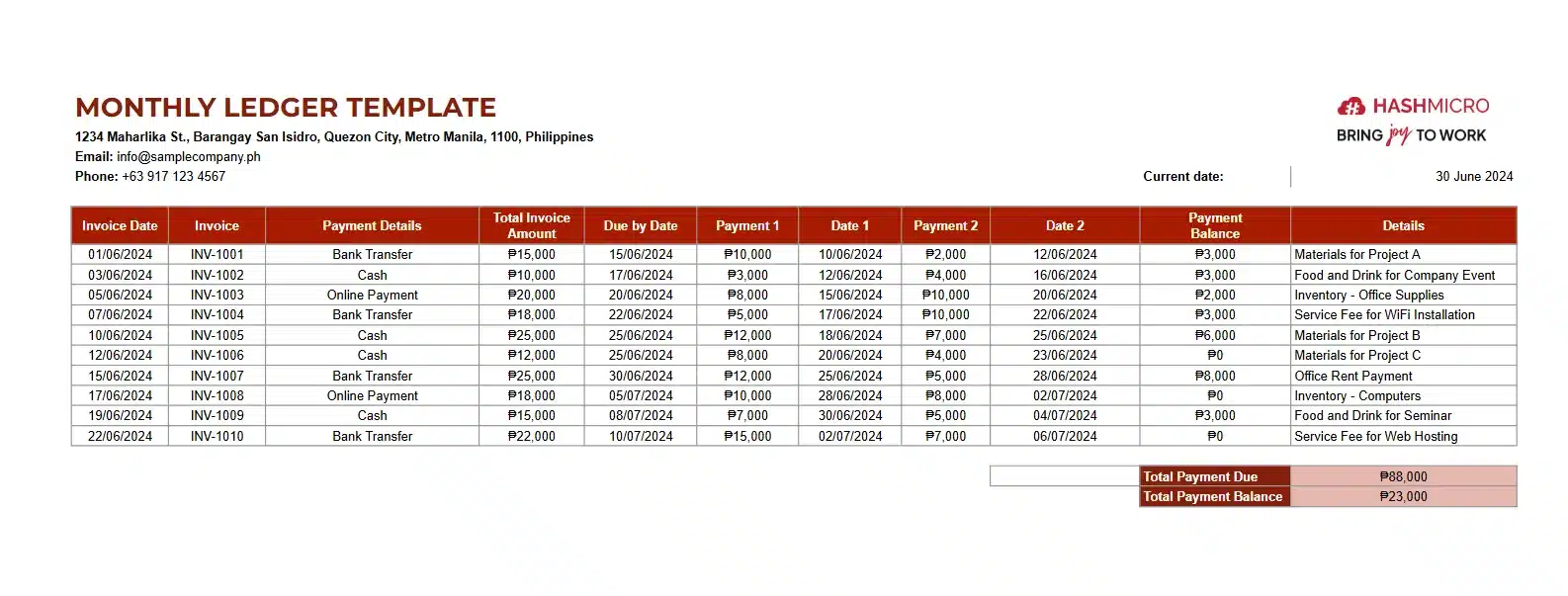

9. Monthly Ledger Template

Monthly Ledger Template

The Monthly Ledger Template is a useful tool for businesses to keep track of their financial transactions on a monthly basis. It helps ensure that all invoices are accounted for, payments are recorded, and any remaining balances are easily identified.

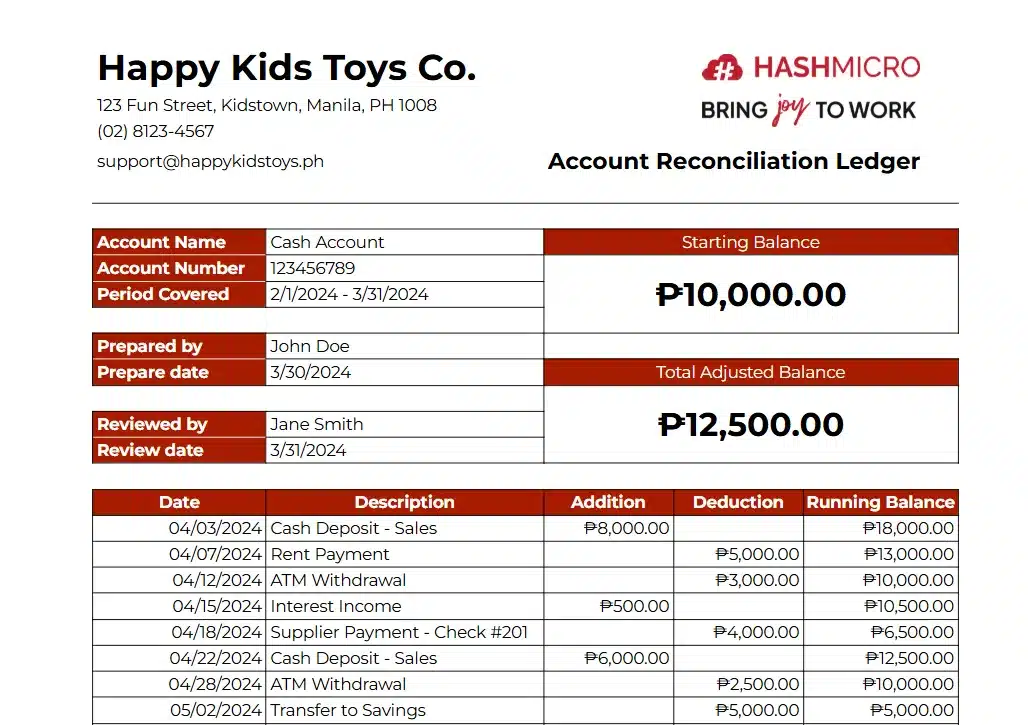

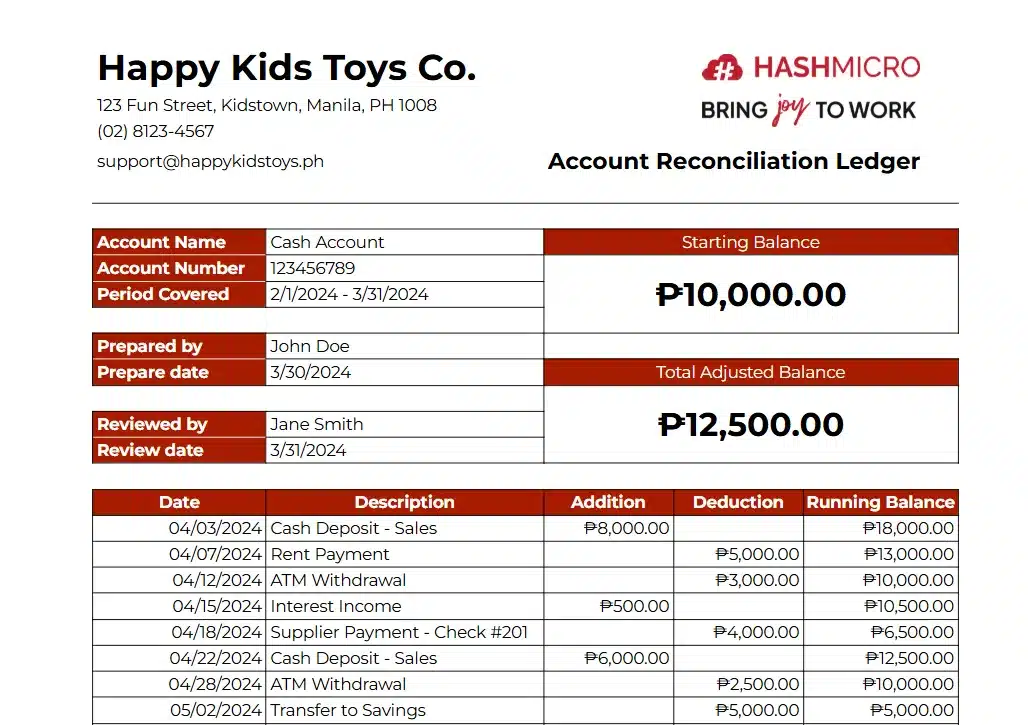

10. Account Reconciliation Ledger Template

Account Reconciliation Ledger Template

The Account Reconciliation Ledger template is a simple tool used to track and balance financial transactions for a specific account over a set period of time. It helps businesses or individuals monitor their cash flow by recording all money coming in (additions) and going out (deductions), ensuring the account balance is accurate.

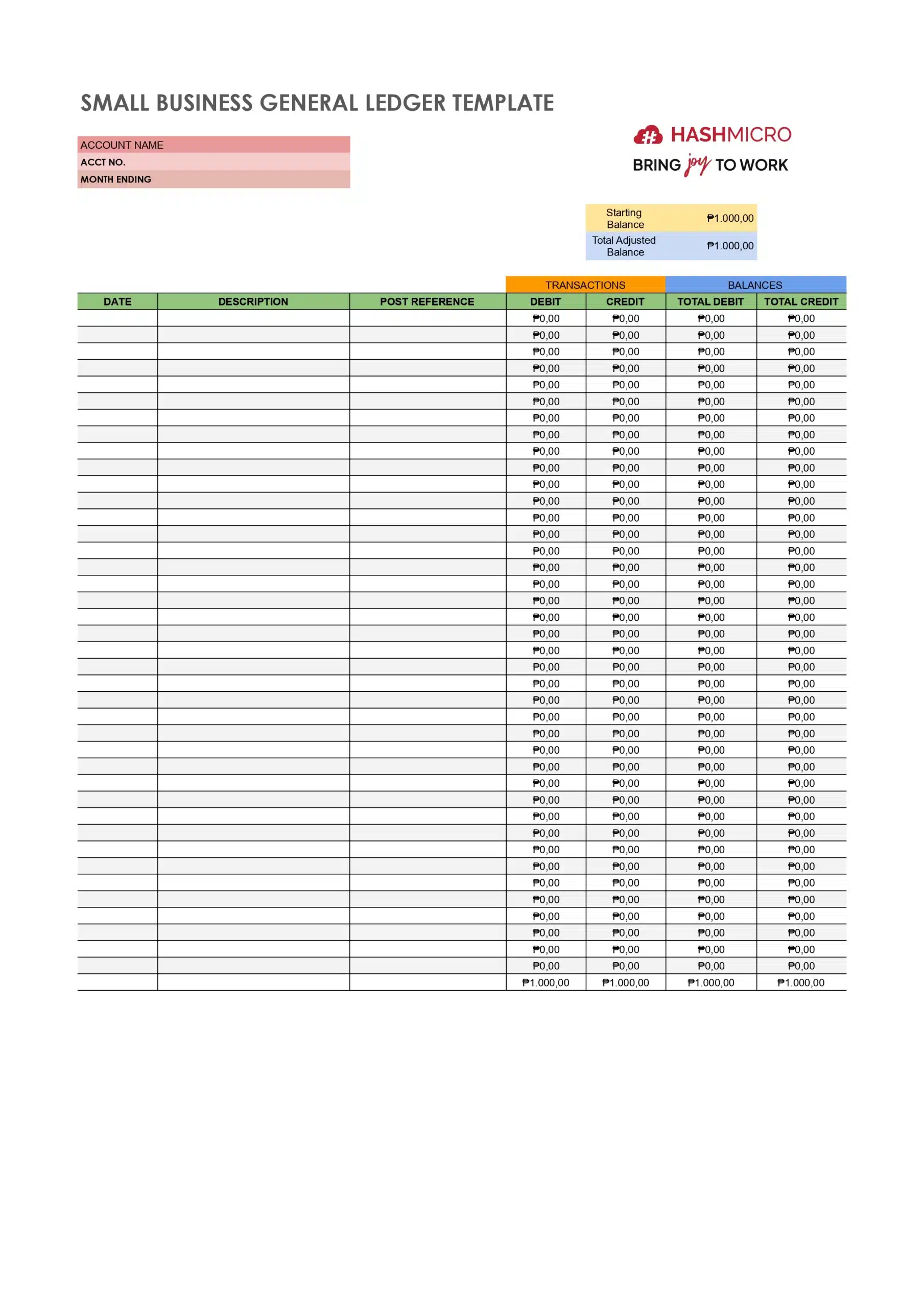

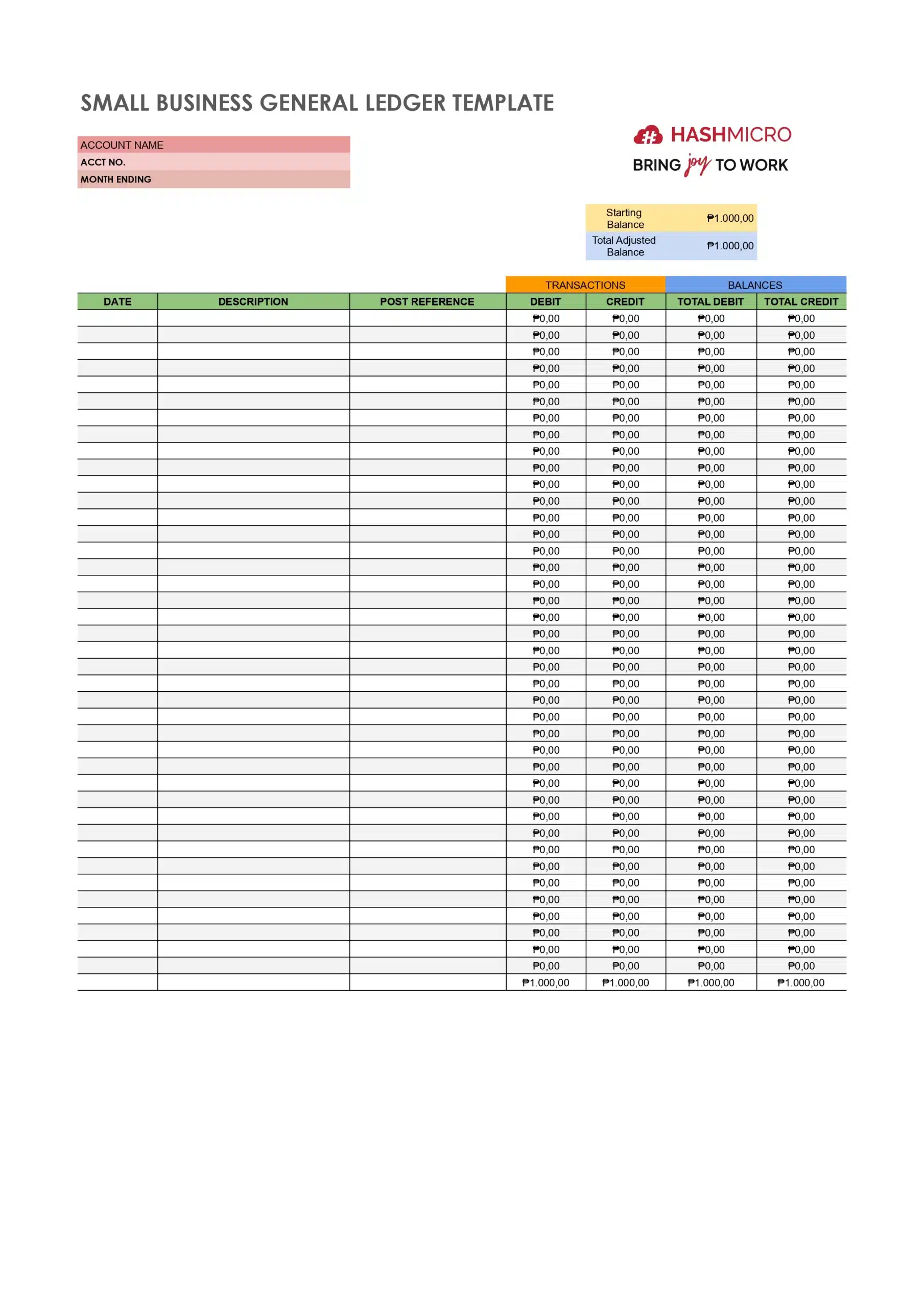

11. Small Business General Ledger Template

Small Business General Ledger Template

A Small Business General Ledger Template is a tool that helps business owners track and organize all financial transactions. It records details of each transaction, such as dates, amounts, and accounts involved, ensuring a clear and accurate financial overview. By using this template, small businesses can efficiently manage their accounting records, making it easier to generate financial statements and stay compliant with tax regulations.

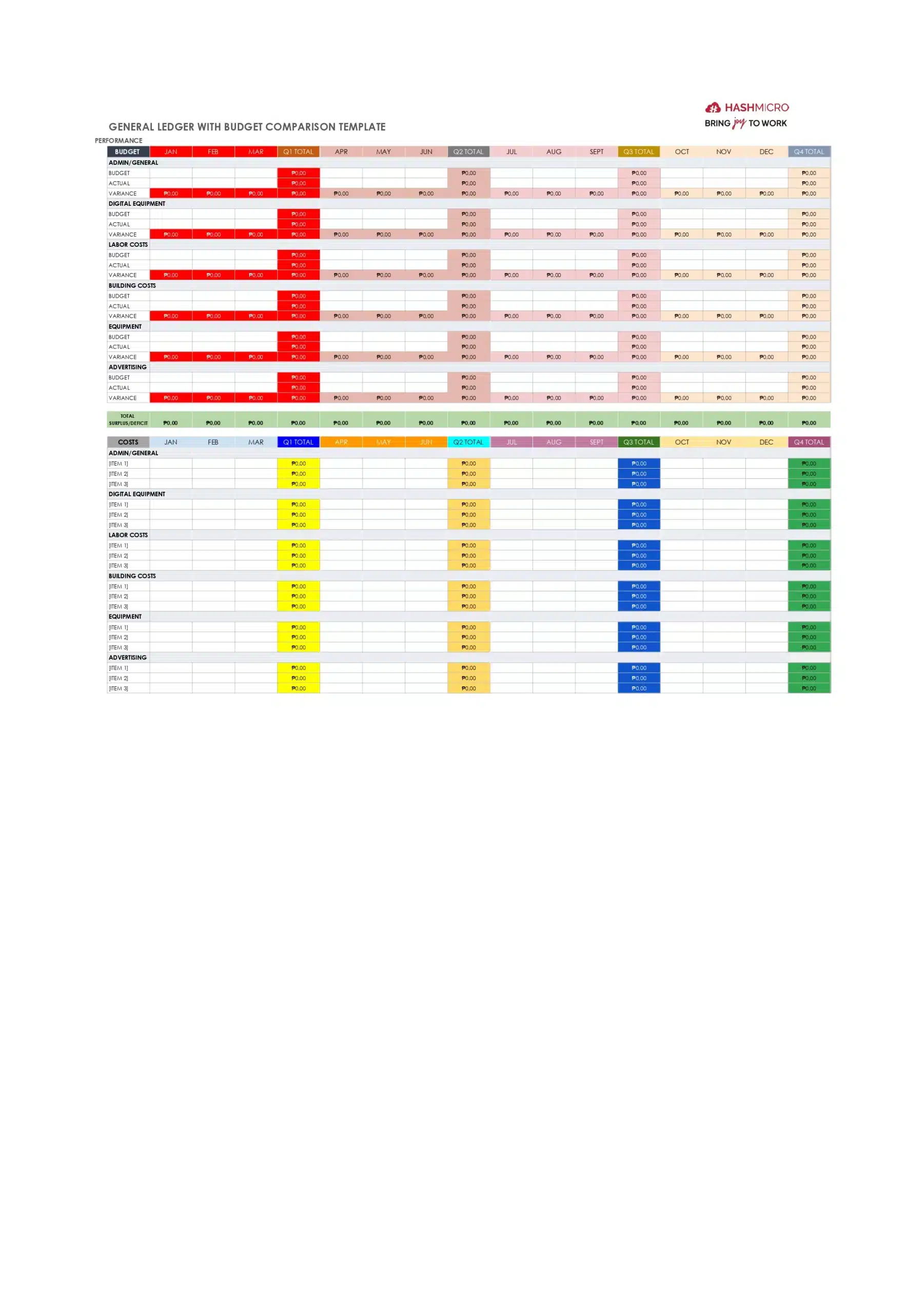

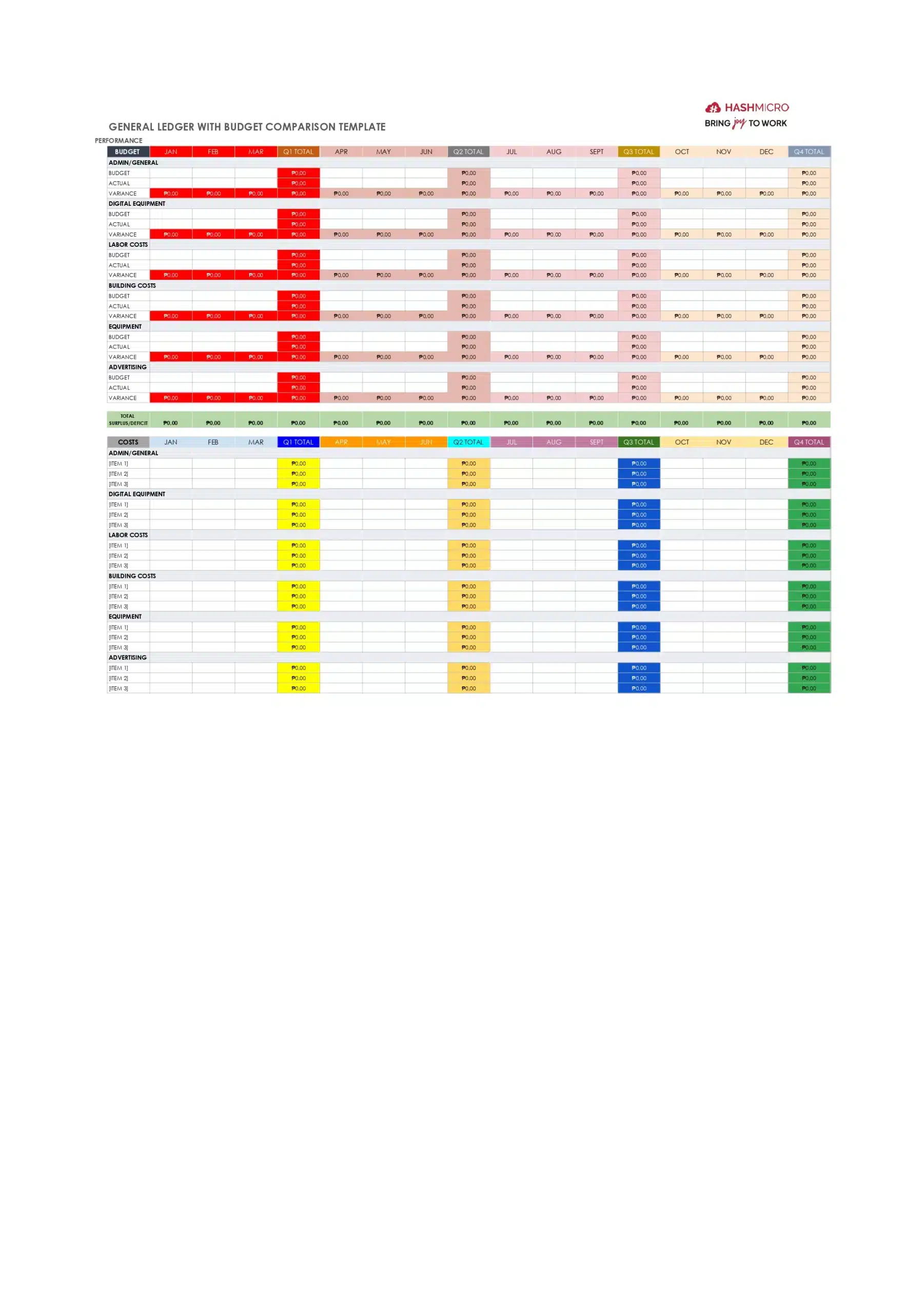

12. General Ledger with Budget Comparison Template

General Ledger with Budget Comparison Template

The General Ledger with Budget Comparison Template is a comprehensive tool designed to help you track and manage your financial transactions while comparing them against your budgeted amounts. This template provides clear insights into your organization’s actual spending versus planned allocations, enabling better financial oversight and informed decision-making.

These ledger templates are designed to simplify financial tracking and organization, whether using a manual ledger book format or a digital ledger account format. By selecting the suitable template, you can streamline your accounting processes, gain deeper insights into your business’s finances, and confidently focus on growth.

How to Choose the Best Ledger Template for Your Business

Selecting the suitable ledger template ensures your financial records are accurate, organized, and tailored to your business needs. The ideal template should fit your operational requirements, simplify accounting processes, and improve efficiency.

Here are the key factors to consider:

- Identify your business’s specific needs: The first step is understanding what your business requires from a ledger account format. Whether you need to manage daily transactions, track assets, or monitor liabilities, choose a general ledger format that caters to those goals.

- Opt for customizable features: Flexibility is essential when selecting a ledger template. A customizable format allows you to adjust categories, columns, and layouts, ensuring it aligns with your business processes without unnecessary clutter.

- Ensure It supports digital and print options: A template that accommodates digital and physical formats, such as a manual ledger book format, adds versatility. You can maintain digital records for real-time updates while having the option to print for audits or presentations.

- Choose a template that’s easy to use: An effective accounting ledger template should be intuitive and beginner-friendly. Look for features like pre-filled columns, example entries, or user guides that simplify starting without extensive training.

- Consider industry-specific templates: Different industries have unique accounting needs, so it’s advantageous to find a ledger template designed for your sector. Choose a template with relevant fields and functions to streamline your retail, manufacturing, or service workflows.

- Look for additional tools and integration: Advanced templates often include tools that integrate with BIR-authorized Accounting Software for seamless financial management. Opt for a general ledger format that can export data to spreadsheets or sync with your existing systems for maximum efficiency.

Focusing on these factors will help you find a ledger template that enhances your financial management, keeps your accounts accurate, and adapts to your growing business needs.

Maximize your Ledger Management with HashMicro’s Accounting Software

Bakit namin ito pinili: HashMicro’s accounting software simplifies general ledger management by automating transaction tracking, ensuring accuracy, and meeting BIR and CAS compliance standards.

HashMicro’s Accounting Software is a BIR-accredited, CAS-ready solution designed to optimize general ledger management for businesses in the Philippines. By automating accounting processes, companies can maintain accurate general ledger records, ensuring compliance with BIR and CAS standards while simplifying financial oversight and decision-making.

To give potential clients a firsthand experience of its capabilities, HashMicro provides free demo access to its accounting software. This allows businesses to explore other features without initial commitment, helping them make a well-informed decision.

The following are some of the features provided by HashMicro accounting software that will enhance general ledger management:

- Chart of Accounts Hierarchy: A well-organized chart of accounts simplifies the categorization of financial transactions, ensuring every entry is accurate and easily traceable. This feature creates a clear structure that enhances financial reporting and decision-making.

- Multi-level analytical (Compare FS per project, branch, etc.): Gain deeper insights by comparing financial statements across multiple dimensions, such as projects, branches, or departments. This empowers businesses to evaluate performance and make data-driven decisions with precision.

- Complete Financial Statements with Period Comparison: Track and compare financial performance over different periods to identify trends and growth opportunities. This feature ensures your reporting is thorough, accurate, and ready for audits or reviews.

- Bank Integrations – Auto Reconciliation: Automate reconciliation by matching bank transactions with ledger entries, saving time and eliminating errors. This feature ensures your financial records stay consistent and up-to-date.

- Budget & Realization: Easily track actual spending against budgeted amounts to maintain control over financial planning. This functionality helps businesses identify variances and adjust strategies proactively.

- Financial Statement with Budget Comparison: Compare financial results with budgeted projections for better forecasting and analysis. This streamlines evaluation processes and improves financial accountability.

- Profit & Loss vs Budget & Forecast: Monitor profitability by comparing actual results with budgeted and forecasted figures. This ensures your financial goals remain on track and supports more intelligent decision-making.

- Multi-Company with Inter-Company Transactions and Consolidation: Manage multiple entities effortlessly with consolidated reporting and streamlined inter-company transactions. This feature simplifies financial oversight across complex organizational structures.

- Automated Currency Update: Keep your ledger accurate with real-time updates on currency exchange rates. This is essential for businesses handling multi-currency transactions. It saves time and reduces the risk of errors in currency conversions.

- Treasury & Forecast Cash Management: Enhance cash flow management with tools to forecast and oversee cash movements effectively. This feature allows businesses to plan for future needs and maintain financial stability.

In addition to these features, the software supports unlimited users, offers flexible customization options, and integrates seamlessly with other modules or third-party applications. Its seamless integration with other modules and customizable features make it an adaptable solution for businesses of any size.

Conclusion

Managing a general ledger is critical to maintaining accurate financial records, yet it can be overwhelming without the right tools. Manual processes or inefficient systems often lead to errors, delays, and financial discrepancies, making it difficult for managers to ensure compliance and gain actionable insights from their data.

One effective solution is HashMicro’s Accounting Software, a BIR-accredited platform specifically designed to address the unique needs of businesses in the Philippines. With automated processes, customizable templates, and seamless integration with other financial tools, HashMicro simplifies general ledger management, enhancing accuracy and efficiency across your organization.

Handa ka na bang maranasan ang mga benepisyo ng mas pinadaling pamamahala ng pananalapi? Sign up for a free demo of HashMicro’s accounting software today and see how it can transform your general ledger processes.

FAQ About Ledger Template

-

Does Excel have a general ledger template?

Yes, Excel does offer general ledger templates, which can be easily customized for your business needs. These templates typically include pre-defined columns for date, description, debit, credit, and balance, helping you track all financial transactions efficiently.

Using an Excel general ledger template is a cost-effective and convenient way to manage your financial records without needing complex accounting software.

-

How do I create a general ledger?

To create a general ledger, start by setting up accounts for different categories such as assets, liabilities, equity, revenues, and expenses. Then, record each financial transaction with a corresponding debit or credit in the appropriate account.

A general ledger typically includes the date, description, account number, and balance, ensuring all your financial data is organized and easy to reference for accurate reporting and analysis.

-

What are the 5 parts of the general ledger?

The five key parts of a general ledger are:

1.Account Titles: The names of the accounts where transactions are recorded (e.g., cash, accounts payable).

2. Debit Entries: Amounts recorded on the left side of the ledger, representing increases in assets or expenses and decreases in liabilities or equity.

3. Credit Entries: Amounts recorded on the right side, representing increases in liabilities or equity and decreases in assets or expenses.

4. Date: The date each transaction takes place, helping you track the timing of financial events.

5. Balance: The running total of each account after every debit and credit entry, reflecting the current financial status of the account.