Magandang araw, Entrepreneurs! Are you here to learn the difference between managerial accounting vs financial accounting? Then, you have come to the right place.

The managerial vs financial accounting is a hot topic among business owners in the Philippines. It’s becoming popular because over 50% of businesses already use managerial or financial accounting through computerized systems.

Sadly, the understanding of financial accounting vs managerial accounting still needs to improve. Therefore, this article will give you a complete guide about what it is, key differences, and which solution, whether managerial or financial, is better for you.

Key Takeaways

|

Table of Contents

What is Financial Accounting?

Financial accounting is the process of recording, summarizing, and reporting a company’s financial transactions over a specific period. It’s typically included in financial statements such as the balance sheet, income statement, and cash flow statement.

The primary purpose of financial accounting is to provide accurate and reliable information to external stakeholders, such as investors, regulators, and creditors, through finance reporting software to help them make informed decisions about the business.

What is Managerial Accounting?

Management accounting, or managerial accounting, involves preparing, analyzing, and presenting financial data to assist internal management in making informed business decisions. It provides insights that help managers optimize resources, control costs, and enhance overall business performance.

Unlike financial accounting, which is aimed at external stakeholders, management accounting provides managers with detailed financial reporting software and non-financial information for planning, controlling, and decision-making purposes. This includes budgeting, forecasting, performance analysis, and cost management.

What are the Key Differences Between Managerial Accounting and Financial Accounting?

Managerial accounting vs financial accounting serve different purposes within a business, both adhering to essential accounting principles. Below is a table outlining the differences between managerial accounting and financial accounting:

|

Aspect |

Managerial Accounting |

Financial Accounting |

| Purpose | Provides information for internal decision-making | Provides financial data for external reporting |

| Audience | Internal management and executives | External stakeholders such as investors, creditors, and regulators |

| Reporting Frequency | Reports are generated as needed, often daily or weekly | Reports are produced periodically, usually quarterly or annually |

| Regulations | Not governed by any formal standards (non-compulsory) | Must comply with accounting standards like GAAP or IFRS |

| Focus | Focuses on future projections, budgeting, and cost control | Focuses on historical financial performance and financial position |

| Detail Level | Provides highly detailed and specific data for management needs | Presents summarized financial data in standardized formats |

| Time Orientation | Future-oriented, emphasizes forecasting and planning | Past-oriented, focuses on historical data |

| Reports | Tailored reports for specific internal needs (e.g., budget reports) | Standardized reports like balance sheets, income statements, etc. |

After knowing the difference between managerial accounting vs financial accounting, you might be curious: do the two systems have different implementation prices? You can check the pricing schemes for both financial management software through the following banner to answer that question.

Which Sytems that Suits Filipino Businesses Well?

Para sa mga negosyante sa Pilipinas, ang tamang accounting system ay depende sa laki at uri ng negosyo. Small to medium enterprises often benefit from cloud accounting because they are affordable and easy to use. These management accounting vs accountancy systems offer features like invoicing and expense tracking.

For larger businesses with more complex needs, more advanced financial accounting vs managerial accounting systems with real-time reporting, multi-currency support, and integration with other business tools are more suitable. These systems help optimize operations and improve overall efficiency.

While choosing the accounting software Philippines might be daunting, let’s explore the best financial and managerial accounting solution that might meet your business needs in the Philippines down below.

Transform Your Financial Processes with HashMicro’s Accounting Software

Entrepreneurs, narinig mo na ba ang HashMicro? Inaprubahan ng mahigit 1,750 negosyo sa Southeast Asia, alamin kung bakit ito ang pinakamainam na accounting system para sa iyong negosyo.

Entrepreneurs, narinig mo na ba ang HashMicro? Inaprubahan ng mahigit 1,750 negosyo sa Southeast Asia, alamin kung bakit ito ang pinakamainam na accounting system para sa iyong negosyo.

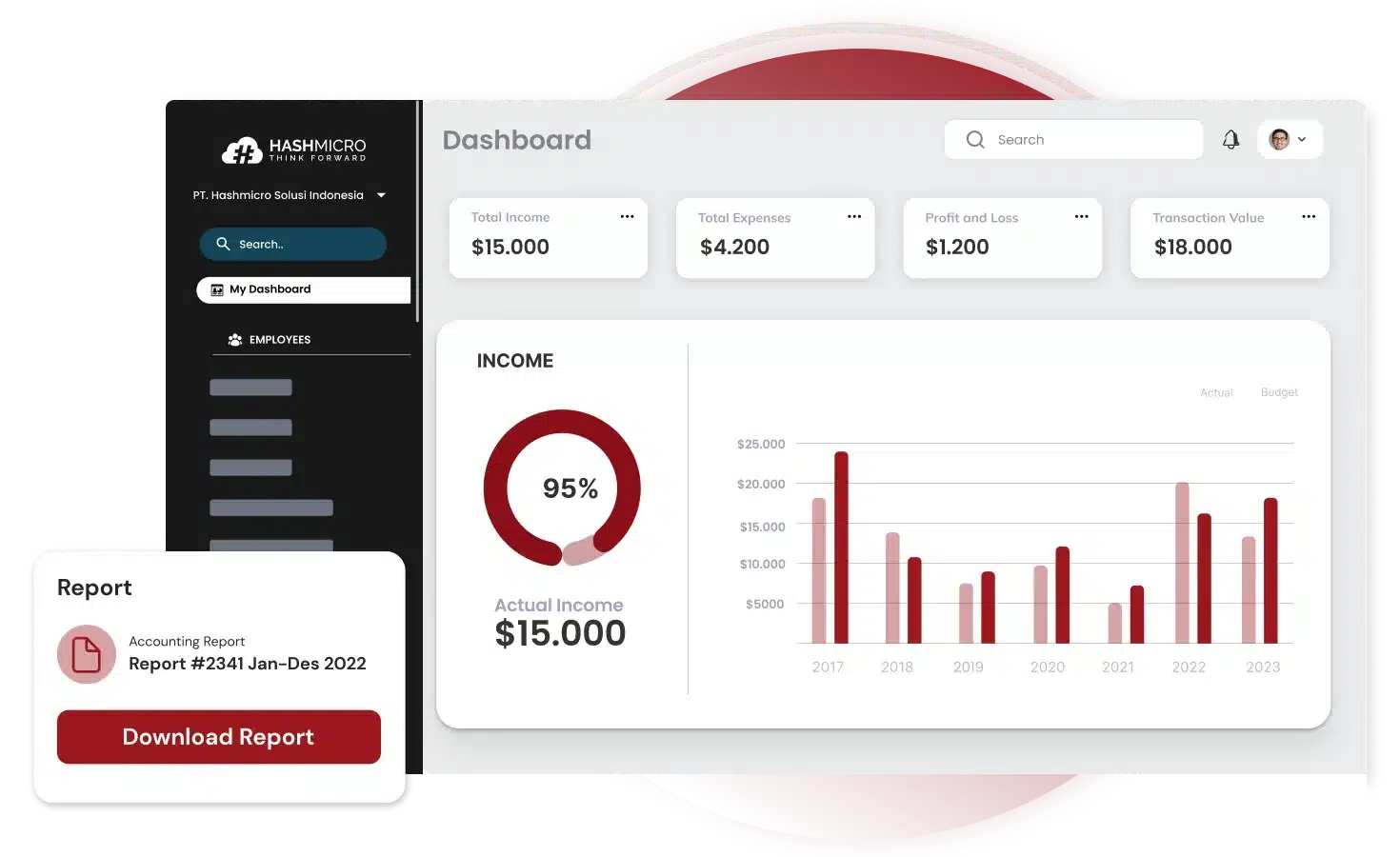

HashMicro’s accounting software is the solution to the managerial accounting vs financial accounting battle. This happens because HashMicro’s system covers both types of accounting without exception. As the best vendor in Southeast Asia, HashMicro is the latest smart business solution in the Philippines.

Offering free demos, free user add-ons, flexible customization, and extensive scalability options, HashMicro has attracted many businesses looking for the best accounting solution. The system is easy to use, so anyone can operate it, even if they are not tech-savvy.

So, whether you need an internal audit from managerial accounting or a financial report for external uses by financial accounting, HashMicro ideally provides all of these things. Some of its key features are:

- Bank integration: Automatic matching process between transaction data recorded in the bank and internal bookkeeping in the system.

- Multi-level analytical: Know the real-time trend or insight of all financial transactions. These can be filtered based on various categories (project, branch, etc.).

- Profit & loss: A report comparing gains and losses’ value with the original budget and previous estimates.

- Cash flow reports: Monitor the company’s cash inflows and outflows to ensure sufficient liquidity.

- Forecast budget: Use historical data to predict future budgets, plan finances, allocate resources efficiently, and make better decisions.

Conclusion

Understanding the differences between managerial accounting vs financial accounting is key to choosing the right financial tools for your business. For Filipino entrepreneurs, selecting between financial accounting vs management accounting that parts of financial management is crucial to improve efficiency.

HashMicro’s accounting system provides a complete managerial and financial accounting solution designed for the unique needs of Filipino entrepreneurs. To help entrepreneurs in the Philippines experience its benefits firsthand, HashMicro offers a free demo that you can try starting from now.

FAQ About Managerial Accounting vs Financial Accounting

-

What is the main difference between financial management and financial accounting?

Accounting involves documenting and reporting past financial transactions and events. In contrast, financial management focuses on managing a company’s assets and liabilities to plan for future growth. Key users of accounting information include management, shareholders, regulators, analysts, and creditors.

-

What are the similarities between financial accounting and management accounting?

Financial and managerial accounting are both essential types of accounting that share common aspects, such as data management, record-keeping, financial statements, adherence to GAAP, and their role in decision-making.

-

Who uses managerial accounting?

Managerial accounting is aimed at internal users, such as executives, product managers, sales managers, and other team members within the organization who rely on accounting data to make key decisions.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “What is the main difference between financial management and financial accounting?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Accounting involves documenting and reporting past financial transactions and events. In contrast, financial management focuses on managing a company’s assets and liabilities to plan for future growth. Key users of accounting information include management, shareholders, regulators, analysts, and creditors.”

}

},{

“@type”: “Question”,

“name”: “What are the similarities between financial accounting and management accounting?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Financial and managerial accounting are both essential types of accounting that share common aspects, such as data management, record-keeping, financial statements, adherence to GAAP, and their role in decision-making.”

}

},{

“@type”: “Question”,

“name”: “Who uses managerial accounting?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Managerial accounting is aimed at internal users, such as executives, product managers, sales managers, and other team members within the organization who rely on accounting data to make key decisions.”

}

}]

}