Have you considered how manufacturing overhead costs could be impacting your bottom line? Manufacturing overhead is a significant part of production expenses that can influence a company’s profitability.

Understanding manufacturing overhead meaning is essential, as these indirect costs often remain unnoticed but can accumulate and significantly affect overall financial performance. These costs include utilities, rent, and salaries for support staff, which are essential for operations but not directly tied to production.

Knowing how to get factory overhead accurately calculated is crucial for any business looking to optimize its financial performance.

By calculating and managing production overhead effectively, businesses can budget more effectively and identify areas for improvement. Companies can enhance efficiency and drive profitability by exploring strategies to reduce factory overhead.

Sa artikulong ito, tatalakayin natin ang mga batayan ng pagmamanupaktura sa overhead, kasama ang kahulugan nito at mga karaniwang halimbawa.

Table of Contents

Key Takeaways

|

What is Manufacturing Overhead?

Recognizing what manufacturing overhead includes is essential for accurately assessing total manufacturing costs.

Manufacturing overhead encompasses the indirect costs associated with production that cannot be directly traced to specific products. This includes expenses such as utilities, maintenance, and supervisory salaries.

Furthermore, understanding the factory overhead meaning is crucial, as it is closely linked to manufacturing overhead and includes all indirect costs related to factory operations.

Efficient management of factory overhead is necessary for businesses to create competitive pricing strategies while maintaining profitability.

Implementing robust manufacturing ERP software guarantees that all expenses are tracked and improves financial performance. Manufacturing Execution System can effectively managing these indirect costs, so companies can enhance operational efficiency and minimize waste, contributing to overall business health.

Understanding manufacturing overhead is crucial for precise product costing and maintaining market competitiveness. By grasping the complexities of factory overhead, businesses can optimize their processes, paving the way for long-term success.

Examples of Manufacturing Overhead

Understanding the various examples of manufacturing overhead is essential, as these costs—such as factory rent, utilities, and maintenance—play a critical role in sustaining efficient production operations. Here are several examples of manufacturing overhead.

1. Factory rent

Rent paid for the factory building represents a significant portion of manufacturing overhead. This cost is incurred regardless of the production level, making it essential for providing a space where manufacturing operations can occur.

Although it does not directly contribute to producing goods, the facility houses machinery, storage, and employee activities. Thus, allocating this expense to the cost of products is necessary, often based on production volume or other relevant metrics.

2. Utilities

Utility costs, such as electricity, water, and gas used within the manufacturing facility, also fall under manufacturing overhead. These expenses are vital for maintaining an operational production environment.

For instance, electricity powers machinery and lighting, while water may be required for cooling processes or cleaning.

Similar to rent, utility expenses are not tied directly to specific production units but are crucial for the overall functioning of manufacturing operations.

3. Depreciation of machinery

Depreciation expenses for manufacturing equipment and machinery are also categorized as manufacturing overhead. As machinery is utilized over time, its value diminishes, necessitating an accounting for this cost in overall production expenses.

Although machinery may not continuously produce goods, investing in such assets is essential for manufacturing. Spreading the cost of machinery over its helpful life helps companies better understand total production costs.

4. Indirect labor

Wages paid to employees who support the production process without directly producing goods represent indirect labor costs. Roles such as maintenance workers, quality control inspectors, and supervisors are included here.

While these employees play a crucial role in enhancing the efficiency and effectiveness of manufacturing operations, their costs are not directly traceable to specific products.

5. Supplies and materials

Necessary supplies such as lubricants, cleaning agents, and tools used in the manufacturing process are categorized as manufacturing overhead.

These materials are essential for maintaining equipment and ensuring smooth production but are not incorporated directly into the final product.

For example, a factory may require specialized lubricants to keep machinery operating optimally. Although these supplies are critical, they are not part of the manufactured physical product.

6. Insurance

Insurance costs associated with the manufacturing facility and equipment also belong to manufacturing overhead. This includes property insurance, liability insurance, and workers’ compensation expenses.

Such coverage protects the business against unforeseen accidents, theft, or natural disasters. Allocating a portion of insurance costs to each production unit reflects the risk management aspect inherent in running a manufacturing operation.

7. Maintenance and repairs

The costs related to maintaining and repairing manufacturing equipment are considered manufacturing overhead. Regular maintenance is essential to prevent equipment breakdowns, which can lead to production delays and increased costs.

Additionally, repair costs can significantly impact overall production efficiency when equipment fails.

Incorporating these costs into manufacturing overhead ensures that businesses account for all necessary expenses to keep the production process running smoothly, even when such costs are not directly linked to a specific product.

Read More: Top Manufacturing Asset Management Software

How to Calculate Manufacturing Overhead Cost

The manufacturing overhead formula helps businesses accurately allocate indirect costs associated with production. Here’s how to use it effectively:

1. Identify overhead costs

List all indirect costs associated with manufacturing. Common categories include:

- Utilities: Electricity, water, and gas for the manufacturing facility.

- Depreciation: Wear and tear on equipment and machinery.

- Salaries and Wages: Compensation for supervisory and support staff.

- Maintenance and Repairs: Costs for maintaining equipment and the facility.

- Supplies: Indirect materials used in production (e.g., lubricants, cleaning supplies).

- Rent: Cost of leasing manufacturing space.

2. Gather data

Collect data for each category identified. This may involve:

- Reviewing invoices and bills.

- Accessing payroll records.

- Analyzing historical data to estimate costs.

3. Total overhead costs

Add together all identified costs to calculate the total manufacturing overhead:

Total Overhead Cost= Utilities+Depreciation+Salaries+Maintenance+Supplies+Rent+…

4. Determine allocation base

Choose an appropriate allocation base to distribute overhead costs. Common bases include:

- Direct Labor Hours: Hours worked directly on manufacturing.

- Machine Hours: Hours machines are operational.

- Units Produced: Total number of units manufactured.

5. Calculate the overhead rate

To find the overhead rate, divide total manufacturing overhead costs by the total number of units or hours in your allocation base:

Overhead Rate= Total Overhead Cost/Total Allocation base

For example, if total overhead costs are ₱93,500 and you produced 8,500 units, the overhead rate would be:

Overhead Rate= 93,500/8,500 = 11 per unit

6. Apply overhead costs to products

Multiply the overhead rate by the number of units produced or hours worked for specific products to allocate overhead costs accordingly. For instance, if a product requires 6 hours of labor:

Allocated Overhead= Overhead Rate×Hours Worked

In our example, if the overhead rate is ₱11 per unit:

Allocated Overhead= 11×5 = 55

Calculating manufacturing overhead costs is essential for accurate product costing and profitability analysis. Businesses can better understand their cost structure and make informed financial decisions by identifying, summarizing, and allocating these costs.

Are you struggling to calculate manufacturing overhead costs? Streamlining your process with Financial management systems can significantly enhance accuracy and efficiency. Use Hashmicro accounting software to simplify complex calculations and focus on growing your business.

Huwag mag-atubiling makipag-ugnay sa amin ngayon!

How to Reduce Your Manufacturing Overhead

To effectively reduce manufacturing overhead, it’s important to explore various strategies that can streamline operations, cut costs, and enhance overall efficiency. Here are several tips to reduce manufacturing overhead.

1. Choose the depreciation method

Selecting the appropriate depreciation method is crucial for managing your financials effectively. The straight-line depreciation method spreads the asset’s cost evenly across its useful life, making budgeting predictable and straightforward.

In contrast, accelerated depreciation allows for more significant deductions in the early years of an asset’s life, which can help reduce taxable income initially but may lead to higher expenses later on.

2. Optimize asset lifespan

Extending the useful life of machinery and equipment can significantly lower overall depreciation costs.

By implementing a regular maintenance schedule, businesses can prevent equipment breakdowns and enhance performance, delaying the need for costly replacements.

Investing in higher-quality equipment may also pay off in the long run, as these assets often come with longer lifespans and require fewer repairs, thus reducing the annual depreciation burden.

3. Review asset valuation

Regularly reassessing the value of your assets ensures that depreciation accurately reflects their current worth. Market conditions can change, affecting asset value and the depreciation you report.

If you find that certain assets are underperforming or becoming obsolete, consider selling or upgrading them. This helps reduce depreciation costs and frees up capital that can be reinvested in more efficient technologies.

4. Invest in technology

Incorporating modern technology like manufacturing accounting software can significantly improve operational efficiency and reduce wear and tear on existing equipment. Advanced machinery often comes with better durability and features that minimize downtime.

While the initial investment may be higher, the long-term benefits of increased productivity and lower maintenance costs can outweigh these expenses, ultimately reducing depreciation costs over time.

5. Lease instead of purchase

Leasing equipment can be a smart financial move for businesses looking to minimize upfront costs.

By opting for leases, companies can spread the expense over time, reducing the immediate impact on cash flow and minimizing depreciation recorded on financial statements.

Leasing also provides flexibility, allowing businesses to upgrade equipment more frequently without the burden of large capital expenditures.

6. Consider tax incentives

Businesses should explore tax credits and incentives associated with asset purchases to mitigate effective costs and depreciation impacts. Various governmental programs exist that reward investments in certain types of equipment or technologies.

By staying informed about available incentives, companies can lower their taxable income and enhance cash flow, which can help offset depreciation expenses, ultimately improving the accuracy of their production cost report.

7. Evaluate asset utilization

Maximizing asset utilization is essential for reducing unnecessary overhead costs. Ensuring that all equipment and machinery are fully operational prevents resource wastage and minimizes the financial burden of depreciation on idle assets.

Regularly analyzing usage patterns can help identify underperforming equipment, allowing businesses to make informed decisions about upgrades, sales, or reallocations to improve overall efficiency.

What are the Different Types of Indirect Costs Related to Manufacturing Overhead?

1. Indirect Labor Costs

Indirect labor costs refer to the wages and benefits paid to employees not directly involved in producing goods. This includes staff such as maintenance workers, supervisors, and quality control inspectors.

While these employees do not physically create the products, their roles are vital for ensuring the manufacturing process runs smoothly and efficiently.

For instance, maintenance staff keep machines in working order, which prevents costly downtime. Supervisors oversee the production process and ensure that quality standards are met, indirectly contributing to overall productivity and effectiveness of manufacturing operations.

2. Indirect Material Costs

Indirect material costs are expenses associated with materials that are not directly traceable to specific products but are necessary for manufacturing.

These materials might include items like lubricants for machinery, cleaning supplies, or tools that support production but are not part of the final product.

Although these materials may seem minor compared to direct materials, they are crucial for maintaining the production environment and ensuring that operations can proceed without interruption.

Effective management of indirect material costs can contribute to overall efficiency and cost control within manufacturing.

3. Maintenance and Repairs

Maintenance and repair costs encompass expenses related to the upkeep of machinery and equipment used in production.

While these costs are not directly linked to product creation, they are essential for keeping production lines running efficiently. Neglecting maintenance can lead to equipment failure, resulting in costly downtime and production delays.

4. Depreciation of Manufacturing Equipment

The depreciation of manufacturing equipment represents the gradual reduction in the value of machinery and equipment used in the production process over time.

Instead, it reflects the wear and tear on equipment that supports the entire manufacturing operation. By recognizing depreciation as a part of overhead, companies can allocate a portion of this cost to the products they manufacture, providing a more accurate picture of total production costs. Manufacturing inventory software can help track depreciation more systematically.

5. Utilities

Utility costs are another significant category of indirect manufacturing overhead. These costs include electricity, water, gas, and other services necessary for running a manufacturing facility.

Utilities are essential for powering machinery, heating or cooling workspaces, and maintaining operational conditions. Effective utility consumption management can lead to substantial savings, contributing to the overall efficiency of manufacturing operations.

6. Rent and Facility Costs

Rent and facility costs pertain to the expenses associated with leasing or maintaining the physical space where manufacturing occurs. These costs are classified as indirect because they support the production environment but are not directly tied to any specific product.

Companies must carefully analyze these expenses to ensure that they operate cost-effectively, which can influence pricing strategies and overall profitability.

7. Insurance

Insurance costs protect manufacturing operations against accidents, natural disasters, and liability claims. This includes property insurance for equipment and facilities and liability insurance to cover potential damages or injuries.

Companies need to budget adequately for insurance as it is a critical component of risk management, ensuring that operations can continue smoothly in the face of unforeseen events.

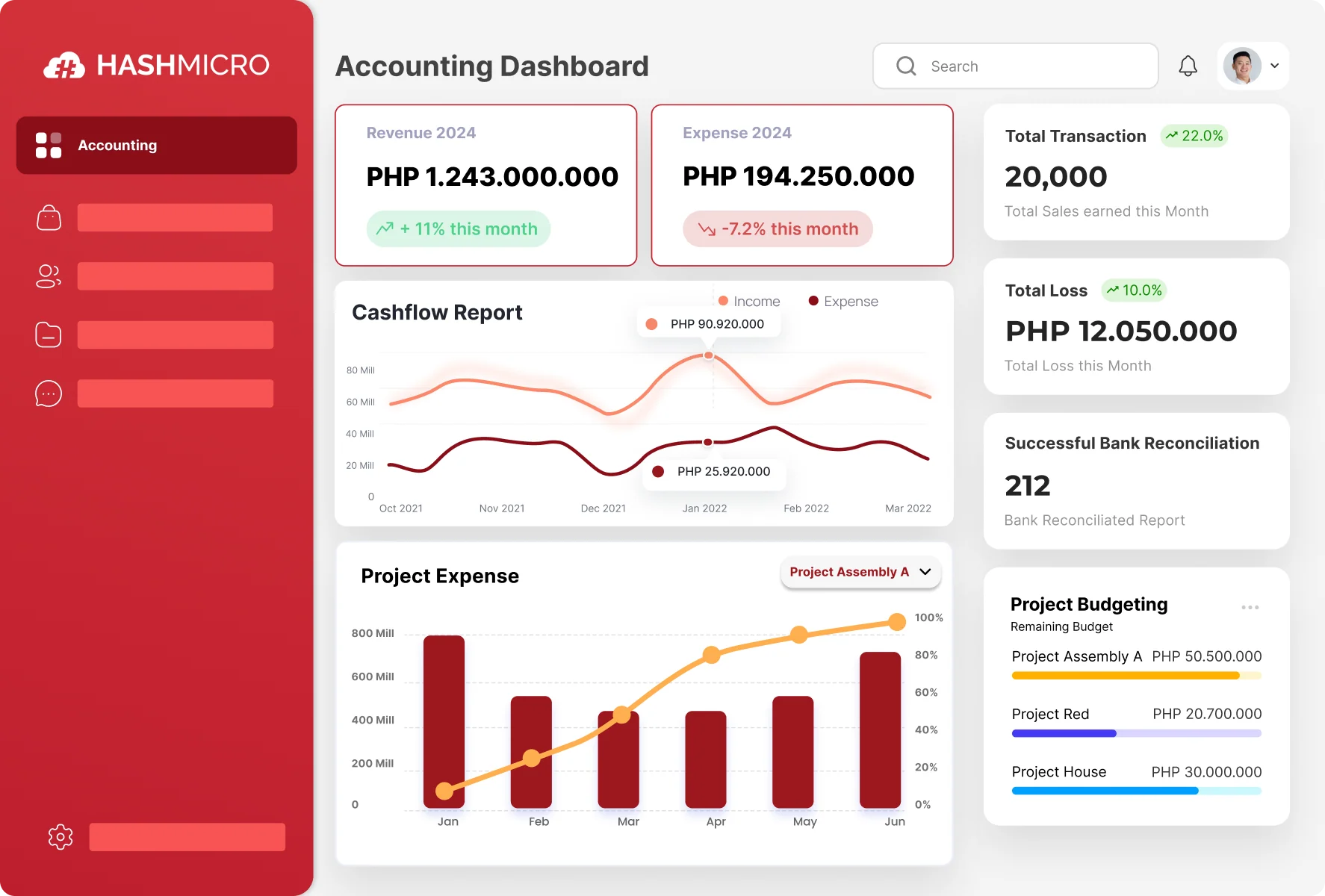

Manage Manufacturing Overhead Costs Effectively with HashMicro Accounting System!

Are you struggling to keep track of your manufacturing overhead? With HashMicro Accounting Software, you can efficiently monitor and optimize your overhead costs for better profitability.

Using HashMicro’s accounting software is essential for effectively managing manufacturing overhead. It enables precise tracking of costs in real time and offers comprehensive analysis tools that reveal insights into spending patterns.

Key Features

- Bank Integration – Auto Reconciliation: This feature ensures that the balances recorded in the company’s internal bookkeeping match those reported by the bank.

- Bank Integration—Auto Payment: This feature processes scheduled payments automatically, ensuring they are made on time without manual intervention.

- Multi-Level Analytical: This tool provides real-time insights into financial transaction trends, allowing users to analyze data across various categories such as projects or branches.

- Profit & Loss vs Budget & Forecast: This feature generates detailed reports that compare the actual profit/loss figures with those projected in the budget.

- Cash Flow: reports track the company’s cash inflows and outflows to ensure sufficient liquidity.

- Forecast Budget: This feature utilizes historical data to predict future budget needs, aiding in comprehensive financial planning.

- Budget S Curve: The Budget S Curve visually represents the distribution of expenditures across projects, making it easier to track spending patterns.

With HashMicro’s accounting software, you can efficiently manage your manufacturing overhead through accurate tracking and detailed analysis tools. Our robust features simplify your financial processes, helping you pinpoint and eliminate unnecessary costs to enhance your profitability.

Conclusion

Manufacturing overhead is a critical aspect of total production costs, comprising all indirect expenses that cannot be directly attributed to specific products. Proper management of these overhead costs is vital for businesses to establish competitive pricing and ensure profitability.

Effective tracking and control measures can enhance operational efficiency, minimize waste, and improve financial performance. Using the best manufacturing software will significantly assist in managing the calculation of manufacturing overhead costs.

Don’t miss out on the best offers—get in touch with us today. Mag-book ng libreng demo para makita kung paano mababago ng aming mga solusyon ang iyong negosyo!

FAQ

-

What does manufacturing overhead consist of?

Manufacturing overhead includes indirect costs that cannot be directly traced to specific products, such as factory rent, utilities, and maintenance expenses.

-

How can you calculate manufacturing overhead?

Manufacturing overhead can be calculated by adding all indirect manufacturing costs, then dividing by an appropriate allocation base, like direct labor hours or machine hours, to determine the overhead rate.

-

What are the key components of manufacturing overhead?

The three main components of manufacturing overhead are indirect materials, indirect labor, and other indirect costs associated with the manufacturing process, such as depreciation and insurance.