Imagine this: your business is thriving, orders are flooding in, and production is booming—but profits are mysteriously nahuhuli. Ever wondered why adding a few more units to the production line doesn’t always lead to more profit? Often, the unseen culprit lies in one overlooked metric: marginal cost.

This essential figure is more than just a number; it’s the key to identifying the tipping point between growth and loss, a secret weapon that helps keep your costs in check while maximizing profitability.

Now, don’t let this remain a blind spot in your strategy. Marginal cost isn’t just for economists—understanding it can empower you to make smarter pricing and production decisions, ensuring every unit you produce adds to your profit, not your expenses. Read on to discover more about this!

Key Takeaways

|

Table of Content

Content Lists

What is Marginal Cost?

Marginal cost is an important concept in understanding the costs in any business. It refers to the extra cost of making one more unit of a product. This cost isn’t fixed; it can change due to factors like material prices, labor, and efficiency, which may go up or down as production increases.

Understanding this cost helps business owners see how production levels impact total expenses. It reveals when costs start rising faster than the increase in production, guiding businesses to make decisions that avoid unprofitable growth.

By tracking marginal costs, businesses can adjust their production levels to maximize profits while keeping expenses in check. Accounting software can simplify this process, making it easy to calculate costs and gain insights that support smart production decisions.

Why is it Important?

For businesses, especially those in competitive markets, knowing this cost helps in setting the right prices for their products. If the marginal cost is lower than the selling price, producing more can be profitable. But if it’s higher, then increasing production may lead to losses.

This information guides business owners to make decisions that protect their profits, avoid unnecessary costs, and maintain financial health. Marginal cost also plays a crucial role in efficient resource management.

Without accounting software, tracking these costs can lead to accounting problems, making it hard to maintain accuracy. For instance, without automated cost monitoring, a company may unknowingly exceed optimal production levels, leading to errors, overspending, and missed profit opportunities.

How to Calculate Marginal Cost

Calculating marginal cost involves a few simple steps that help business owners understand the cost of producing one additional unit. Following these steps will make the process clearer and provide accurate results, making it easier to make informed production decisions.

Here are the steps:

- Identify Total Costs at Each Production Level: Start by determining the total costs before and after the production increase. For example, if you’re producing 100 units initially, note the total production cost at that level. Then, record the new total cost after increasing production to, say, 105 units.

- Find the Change in Quantity and Change in Cost: Calculate the change in quantity by subtracting the initial quantity from the new quantity. Then, find the change in total cost by subtracting the initial total cost from the new total cost.

- Apply the Marginal Cost Formula: Now, plug these values into the formula: divide the change in total cost by the change in quantity. This final step will give you the marginal cost, revealing the expense of producing one additional unit.

Following these steps makes it easy to calculate marginal cost and provides a clearer view of how production changes impact costs. This information supports smarter pricing, production adjustments, and overall cost management in any business setting.

Marginal Cost Formula

Calculating marginal cost is a straightforward process that can reveal valuable insights into production costs. It represents the extra expense of producing one additional unit, and it helps businesses understand when increasing production might yield lower returns.

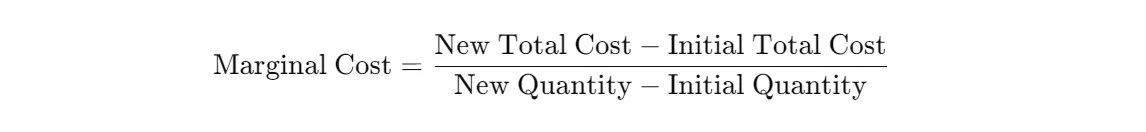

The formula for Marginal Cost:

Example:

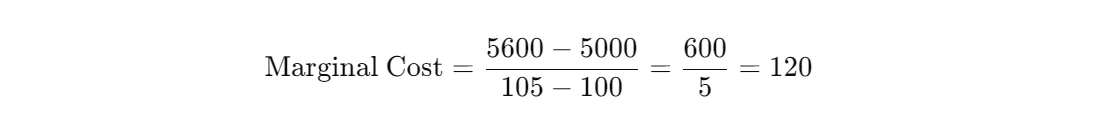

Imagine a business in the Philippines that produces handmade chairs. The business currently produces 100 chairs, with a total cost of PHP 5,000. After receiving a new bulk order, the business increased production to 105 chairs. Yet, due to additional materials and more, the new total cost rises to PHP 5,600.

- New Total Cost = 5,600

- Initial Total Cost = 5,000

- New Quantity = 105

- Initial Quantity = 100

Plugging these values into the formula:

In this case, the business can assess whether producing each extra chair at PHP 120 still allows for a profitable sale. If the selling price per chair is above PHP 120, producing more chairs is financially beneficial; if not, the business may reconsider increasing production.

Also read: Implicit Cost: Definition and Examples

Easily Calculate Marginal Cost with HashMicro’s Accounting Software

HashMicro’s Accounting Software is equipped with a variety of features designed to simplify financial management, including the calculation of marginal cost. With these powerful tools, business owners can make informed decisions and improve their cost-efficiency with ease.

- Multi-Level Analytical Tools: This feature allows users to compare financial statements across different projects, branches, or divisions. It provides a deeper understanding of costs and profitability across various business segments.

- Profit & Loss vs. Budget & Forecast: By comparing profit and loss against budget and forecast, users can track financial performance and adjust strategies as needed. This feature helps understand how marginal costs align with projected financial goals.

- Automated Currency Updates: The software automatically updates currency rates, making it easy to manage transactions in multiple currencies. This feature is beneficial for businesses with international operations, helping them calculate accurate costs across regions.

- Treasury & Forecast Cash Management: This tool enables businesses to manage cash flow efficiently and forecast future cash needs. Companies can better plan production levels and related marginal costs by knowing cash inflows and outflows.

- Easy-to-Use Comprehensive Invoicing System: With customizable invoicing options, HashMicro’s software streamlines billing for various types of transactions. This feature simplifies financial management and ensures accurate documentation of revenue and costs.

Using comprehensive accounting software Philippines, such as HashMicro, businesses can calculate marginal costs easily and gain deeper insights into financial performance. Its features support comprehensive financial management, making it an ideal choice for optimizing production and maintaining profitability.

Conclusion

Understanding and calculating marginal cost is essential for businesses seeking to maximize profitability. By knowing the true cost of producing each additional unit, companies can make better pricing and production decisions, protecting profits and avoiding unnecessary expenses.

HashMicro’s Accounting Software offers an easy solution for calculating marginal costs accurately, with features designed to simplify financial management. Its features help businesses stay on top of their production costs and optimize resources effectively. Try out the free demo today and experience the difference firsthand!

Frequently Asked Questions

-

What is the meaning of marginal cost?

It is the additional expense incurred to produce one extra unit of a product. It helps businesses decide if increasing production will add to profits or losses.

-

What does it mean if marginal cost is high?

A high marginal cost means producing additional units is expensive, potentially reducing profitability. This could indicate resource strain or inefficiencies in production.

-

Why does marginal cost always go down then up?

It often decreases initially due to efficiencies gained as production rises. Eventually, it increases as resources become strained, leading to higher per-unit costs.