MYOB accounting software simplifies financial management, offering features like invoicing, expense tracking, and payroll processing. It’s ideal for small to medium-sized enterprises, ensuring compliance with local tax regulations and providing real-time financial insights through the MYOB accounting system.

MYOB software entered the Asia-Pacific market in the late 1990s. In 2000, it acquired SeaSoft Computer Services Sdn. Bhd., gaining access to an Asian distributor network, including the Philippines. This strategic move expanded MYOB’s reach in Southeast Asia to meet the rising demand for SME accounting solutions.

This article lists 10 alternatives to MYOB accounting software. One great option is HashMicro Accounting Software, which offers automation, real-time insights, and easy integration. It’s perfect for businesses looking for flexibility and efficiency.

Table of Contents

Key Takeaways

|

What is MYOB?

MYOB, which stands for Mind Your Own Business, is a renowned provider of business management solutions, primarily focusing on accounting, payroll, and retail point of sale systems.

The MYOB accounting software, an essential accounting automation tool, has been a trusted solution for many small to medium-sized enterprises (SMEs) aiming to streamline their financial operations through accounting automation.

With features like invoicing, expense tracking, payroll management, and financial reporting, the MYOB software simplifies complex accounting tasks and provides businesses with real-time insights into their financial health.

The MYOB accounting system offers both desktop and cloud-based solutions, providing flexibility and accessibility for users. Its user-friendly interface and comprehensive support make it a popular choice for businesses looking to manage their finances efficiently through accounting automation.

Additionally, the MYOB system integrates with various third-party applications, enhancing its functionality and allowing businesses to tailor the software to their specific needs.

Limitations of MYOB

While the MYOB accounting software has been a reliable solution for many, it does come with certain limitations that might affect its suitability for some businesses:

- Scalability issues: As businesses grow, they often require more advanced features and capabilities. The MYOB software may not scale effectively with rapidly expanding companies or those with complex accounting needs, potentially hindering growth.

- Limited customization: The ability to customize reports and interfaces in the MYOB accounting system is somewhat restricted. Businesses with unique requirements may find this lack of flexibility challenging.

- Integration challenges: Although the MYOB system integrates with several applications, it may not seamlessly connect with all the tools a business uses. This can lead to inefficiencies and data silos, complicating workflow processes.

- User experience: Some users find the interface of the MYOB software less intuitive compared to newer accounting solutions. This can result in a steeper learning curve and reduced productivity.

- Cost concerns: For startups and small businesses, the pricing of the MYOB accounting software might be higher compared to other alternatives that offer similar or more advanced features at a lower cost.

- Customer support limitations: Feedback from users suggests that the customer support for the MYOB system can sometimes be slow or insufficient, which can be problematic when immediate assistance is needed.

Why Look for MYOB Alternatives

Considering these limitations, businesses may seek alternatives to the MYOB accounting software for several reasons, including more advanced features like AI in Accounting to automate tasks, enhance financial analysis, and improve decision-making processes.

- Advanced features: Other accounting systems might offer more sophisticated features like enhanced automation, advanced analytics, and better inventory management that the MYOB software lacks.

- Better integration: Alternatives may provide seamless integration with a broader range of business tools and platforms, promoting efficiency and data consistency across systems.

- Improved user experience: A more modern and intuitive interface can enhance user satisfaction and reduce training time for new employees.

- Cost efficiency: Some MYOB alternatives offer more competitive pricing structures or provide greater value for the investment, which is crucial for budget-conscious businesses.

- Scalability and customization: Businesses seeking software that can adapt to their growth and be customized to their unique processes may find better options outside the MYOB system.

10 Best MYOB Accounting Software Alternatives

Although MYOB accounting is popular, local software providers may offer MYOB accounting software alternatives that better match your business needs. Exploring these alternatives could lead to finding the perfect fit for your company’s specific requirements in the local market.

1. HashMicro Accounting Software

HashMicro’s Accounting Software offers a comprehensive solution for Philippines businesses, featuring automated financial management, real-time reporting, and compliance with BIR CAS. It’s designed to streamline operations for companies of all sizes, ensuring accuracy and efficiency.

HashMicro Accounting software simplifies tasks such as invoicing, tracking expenses, and generating reports, saving time and improving accuracy. To understand these benefits, check out our comprehensive guide to accounting software.

Why we choose this software: HashMicro Accounting Software stands out with AI-powered financial analytics, extensive automation, and real-time collaboration tools, all designed to align with accounting principles. Its powerful automation, real-time insights, and customizable modules provide unmatched flexibility and efficiency.

Here are the essential features of HashMicro:

- Multi-Level Analytical: HashMicro Accounting Software provides multi-tiered financial analysis, enabling businesses to compare and analyze data across various projects, branches, or departments for deeper insights.

- BIR CAS Integration: The software seamlessly integrates with the Bureau of Internal Revenue’s Computerized Accounting System (BIR CAS), ensuring compliance with Philippine tax regulations.

- Customizable Reports: HashMicro allows businesses to create tailored financial reports, adjusting parameters to meet specific business needs and providing greater flexibility in data presentation.

- Automated Bank Reconciliation: The software automatically matches bank transactions with accounting records, reducing manual errors and speeding up the reconciliation process. Read detailed information about bank reconciliation here.

- Budget Forecast: With HashMicro, businesses can forecast budgets accurately by analyzing historical data and trends, aiding in better financial planning and decision-making.

| Pro | Cons |

|---|---|

| Intuitive Interface | Its advanced features might not suit businesses with simple needs. |

| No Extra Cost for Additional Users | The free demo service might take longer because many people are requesting it. |

| Flexible Customization | |

| Effortless Integration | |

| IoT-Enabled Features | |

| Lifetime Support and Maintenance |

2. Xero

Xero Accounting is a cloud-based software designed for small businesses, offering features like invoicing, payroll, and bank reconciliation. It provides real-time financial data, making it easy to track expenses and manage cash flow. With its user-friendly interface, Xero simplifies accounting tasks.

Why we choose this software:

Xero has a user-friendly interface, real-time financial updates, and seamless cloud-based access. With its powerful account reconciliation software, Xero simplifies invoicing, payroll, and bank reconciliation, making accounting tasks easier and more efficient.

Features:

- Multi-Currency Support

- Bank Integration

- Reporting and Customization

- Automatic Bank Reconciliation

| Pro | Cons |

|---|---|

| Offers additional options for creating various reports. | The software lacks features for managing inventory assembly. |

| Able to manage the most recent tax forms. | Time tracking can only be done when associated with specific projects. |

| Maintains detailed records for all contacts. | The interface and navigation might be confusing for users. |

| The mobile apps are intuitive and highly efficient to use. | Personalized support is limited to email, without real-time interaction options. |

3. SAP S/4HANA

SAP HANA Accounting is an in-memory platform that combines real-time financial processing with analytics. It streamlines accounting tasks like ledger management, financial reporting, and cash flow analysis, offering businesses accuracy, and powerful data insights for better decision-making.

Why we choose this software:

SAP offers comprehensive, scalable solutions that integrate seamlessly across all business functions. It offers scalable solutions that boost efficiency and drive your business forward.

Features:

- Real-Time Financial Reporting

- Analytics and Reporting

- Integrated Financial Management

- Automated Financial Closing

| Pro | Cons |

|---|---|

| The software includes advanced features. | The software comes with a high price tag. |

| Provides a valuable overview page with essential insights. | Certain features involve complex accounting concepts. |

| Navigation is simple and easy to use. | Customization options for contact and product records are limited. |

| Boasts a visually appealing and user-friendly interface. |

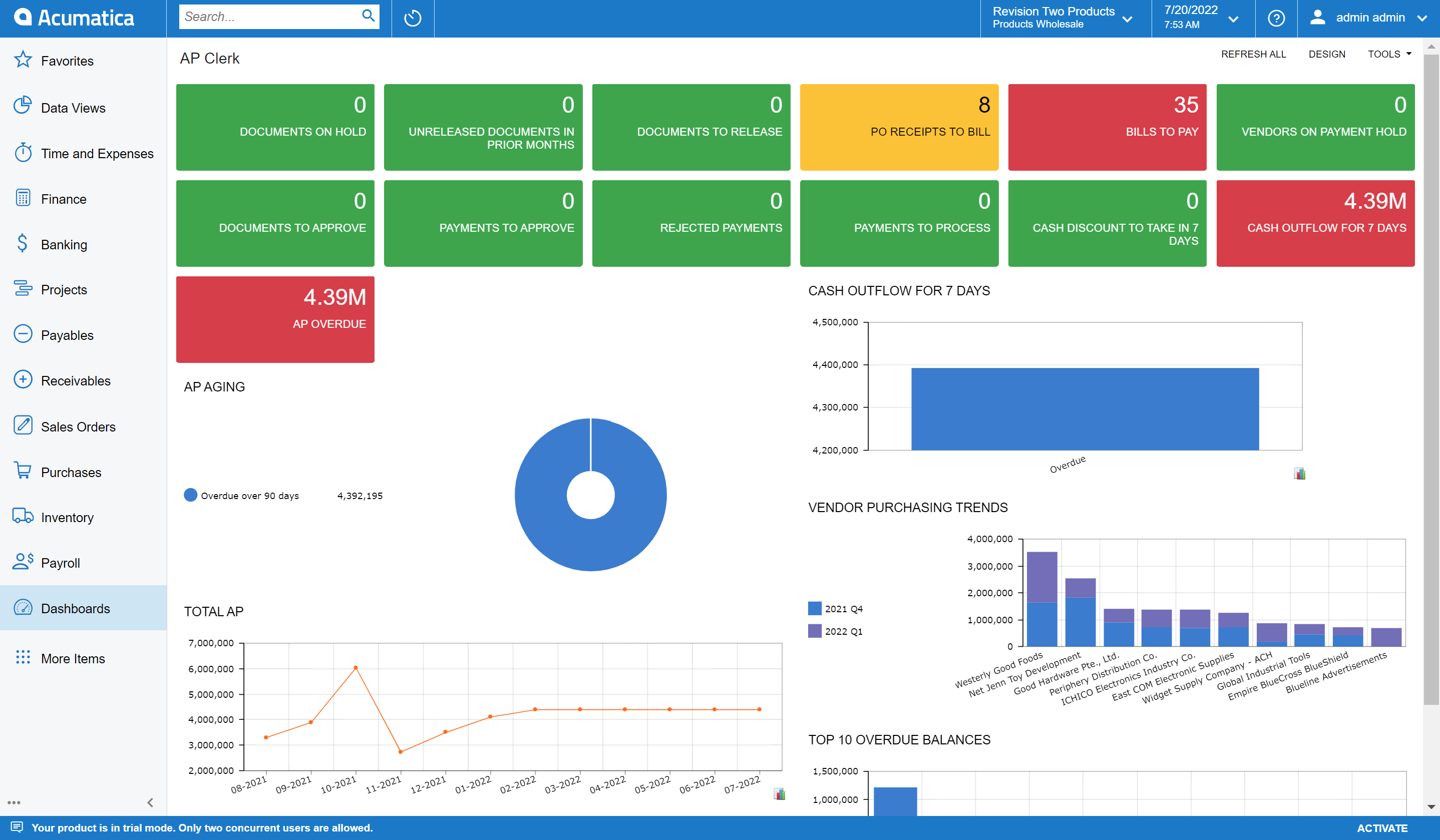

4. Acumatica

Acumatica system is a cloud-based ERP solution designed for small to mid-sized businesses. It offers robust features like financial management, CRM, and project accounting. With its flexible and scalable platform, it enables real-time collaboration and insights to drive business growth.

Why we choose this software:

Acumatica ERP stands out for its user-friendly interface, making it easy for businesses to manage complex operations without extensive IT resources. Its modular approach allows companies to scale as they grow and as needed.

Features:

- Automated Financial Processes

- Multi-Currency Support

- Real-Time Financial Reporting

- Expense Management

| Pro | Cons |

|---|---|

| Provides precise reporting. | Non-transparent pricing and package options. |

| Browser-based application. | Limited industry support. |

| Easy-to-use navigation. | Standard report filters require customization. |

| Robust API for fast integration | Reliance on third-party add-ons. |

5. Sage

Sage Accounting is a cloud-based software designed for small businesses. It offers essential features like invoicing, expense tracking, and bank reconciliation. It simplifies financial management with real-time data and accurate reporting, making bookkeeping easier and more efficient.

Why we choose this software:

It’s designed to meet the needs of small businesses, offering user-friendly features like automated invoicing, expense tracking, and accurate financial reporting. With real-time data access, Sage helps streamline your bookkeeping processes, saving you time and reducing errors.

Features:

- Customizable Invoices

- Expense Recording

- Tax Compliance

- Real-Time Cash Flow

| Pro | Cons |

|---|---|

| Comprehensive reporting for tax and financial purposes. | It takes longer to implement. |

| User-friendly interface. | Complex features result in a steep learning curve. |

| Cloud-based system for remote teams. | Customization requires additional costs. |

| Saves time and costs on repetitive tasks. |

6. NetSuite

NetSuite Accounting is a cloud-based solution offering real-time financial management, including invoicing, tax management, and automated reporting. It integrates seamlessly with other business functions like CRM and inventory to manage financial processes efficiently.

Why we choose this software:

NetSuite Accounting offers real-time financial data, automates tasks like invoicing and reporting, and ensures accurate tax compliance. Its seamless integration with other business systems, such as CRM and inventory, improves overall efficiency.

Features:

- Budget Tracking

- Tax Management

- E-commerce Integration

- Automated Journal Entries

| Pro | Cons |

|---|---|

| Customizable to fit unique business requirements. | Need extra charges for add-ons and customization. |

| Strong business intelligence tools. | Customer support quality is not the best. |

| Efficient in handling workflows and human resources. | The system might not be affordable or easily accessible for all businesses. |

7. Microsoft Dynamics 365

Microsoft Dynamics 365 is a cloud-based enterprise resource planning and customer relationship management solution. Its accounting module, part of the Finance and Operations suite, is designed to streamline financial processes and provide real-time insights into a company’s financial health.

Why we choose this software:

Microsoft Dynamics 365 has real-time financial tracking, task automation, and advanced budgeting. Its seamless integration and powerful analytics enhance efficiency and decision-making, making it perfect for growing businesses.

Features:

- Real-time Ledger Management

- Automated Invoicing

- Budget Management

- Financial Reporting and Analysis

| Pro | Cons |

|---|---|

| Provides real-time financial data and advanced analytics. | Setup and subscription fees can be too expensive for small businesses. |

| Integrates well with other Microsoft products. | Integrating with non-Microsoft products can be challenging. |

| Facilitates efficient recording and management of financial transactions. | Advanced features may require significant training for non-technical users. |

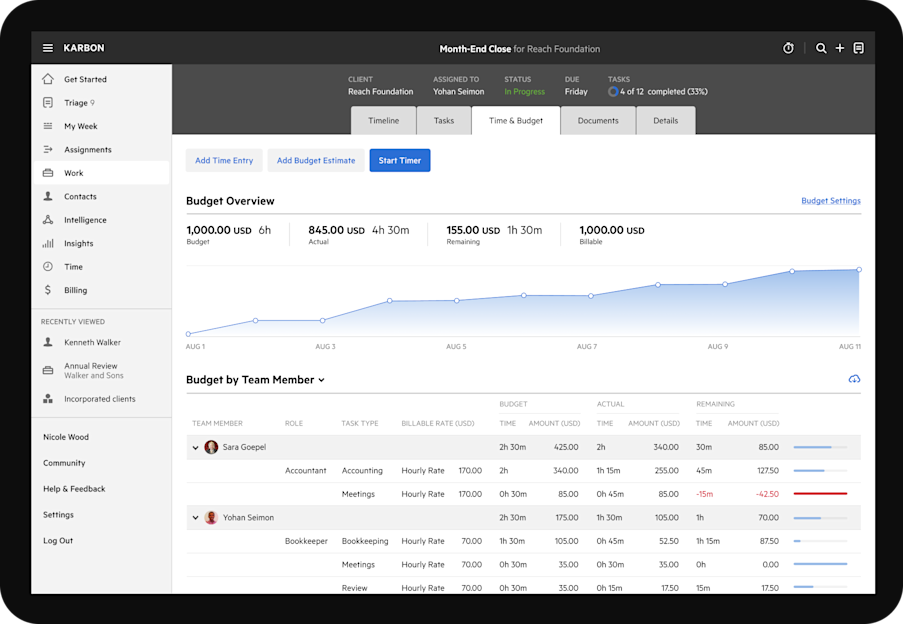

8. Karbon

Karbon is a cloud-based accounting practice management software designed for accounting firms. It streamlines workflows, enhances team collaboration, and automates client communication. Karbon integrates task management, emails, and time tracking, helping firms improve productivity and efficiency.

Why we choose this software:

Karbon has powerful workflow automation, seamless team collaboration, and integrated task management. It enhances productivity by centralizing communication, tracking time, and managing client relationships, making it an ideal solution for accounting firms.

Features:

- Client Management

- Document Management

- Customizable Template

- Budget vs Actual Reporting

| Pro | Cons |

|---|---|

| User-friendly interface. | Difficult to set up for basic workflow. |

| Seamless email integration. | No automated proposal-to-payment features. |

| Access to over 250 templates. | The system is more suitable for enterprise businesses. |

9. QuickBooks

QuickBooks is an accounting tools designed for small to medium-sized businesses. It simplifies invoicing, expense tracking, payroll, and financial reporting tasks. With its user-friendly interface and cloud-based features, QuickBooks accounting software helps companies to manage finances efficiently and stay organized.

Why we choose this software:

QuickBooks for its user-friendly interface, comprehensive features like invoicing, expense tracking, and payroll, and cloud-based accessibility. It’s ideal for small to medium-sized businesses looking for an efficient, affordable solution to manage finances and streamline accounting tasks.

Features:

- Financial Reporting

- Bank Reconciliation

- Expense Management

- Invoicing

| Pro | Cons |

|---|---|

| A variety of reports can be tailored to suit individual requirements. | Requires a significant time investment in learning and setup. |

| It offers project management, payroll capabilities, and supports integration with numerous add-ons. | The system is tailored for specific industries. |

| The mobile apps are intuitive and effective. | Limited custom reports. |

10. SAP Business One

SAP Business One’s accounting module is designed for small to mid-sized businesses. It integrates with other business functions to provide real-time financial insights, streamline processes, and ensure compliance with local regulations.

Why we choose this software:

It is an all-in-one solution that integrates accounting with other business functions, offering real-time financial insights. It streamlines operations, supports compliance, and is scalable, making it ideal for growing small to mid-sized businesses seeking efficiency and accuracy.

Features:

- General Ledger Management

- Accounts Payable/Receivable

- Automated Financial Reporting.

| Pro | Cons |

|---|---|

| Accounting software SAP includes advanced features. | The software comes at a high price. |

| It provides a helpful overview page for key insights. | Certain elements involve advanced accounting concepts. |

| The navigation is simple and user-friendly. | Customization options for contact and product records are limited. |

| The interface is visually appealing and intuitive. |

How to Choose the Right Accounting System for Your Business

Selecting the ideal accounting software requires careful consideration of your business needs and the features offered by different systems. Here’s a guide to help you make an informed decision:

- Assess Your Business Needs:

- Size and complexity: Consider the size of your business and the complexity of your financial transactions. Larger businesses or those with more complex accounting needs may require advanced features not offered by the MYOB accounting software.

- Specific features: Identify the must-have features for your business, such as multi-currency support, inventory management, project accounting, or advanced reporting capabilities.

- Scalability:

- Choose an accounting system that can grow with your business. Ensure the software can handle an increasing number of transactions, users, and data volume without compromising performance.

- Integration capabilities:

- Ensure the new accounting software integrates seamlessly with your existing business tools like CRM, ERP, e-commerce platforms, and payment gateways. This integration is crucial for maintaining efficiency and data accuracy.

- User experience and accessibility:

- Opt for software with an intuitive user interface and easy navigation. Cloud-based solutions offer the advantage of accessing financial data anytime, anywhere, which can be beneficial for remote teams.

- Security and compliance:

- Verify that the software adheres to the highest security standards to protect your financial data. Also, ensure it complies with relevant accounting regulations and tax laws in your country.

- Cost and budget:

- Evaluate the pricing models of different MYOB alternatives. Consider not just the initial cost but also ongoing expenses like subscription fees, maintenance, and potential upgrade costs.

- Customer support and training:

- Reliable customer support is essential for resolving issues promptly. Check if the provider offers comprehensive support, including tutorials, webinars, and personalized training sessions.

- Reviews and testimonials:

- Research user reviews and case studies to understand the experiences of other businesses similar to yours. This feedback can provide insights into the software’s reliability and the vendor’s reputation.

- Trial Periods and demos:

- Take advantage of free trials or demos offered by software providers. This hands-on experience can help you assess the software’s suitability for your business processes.

- Vendor reputation and longevity:

- Choose a vendor with a proven track record and a commitment to ongoing development. A reputable vendor is more likely to provide consistent updates and improvements to their software.

Conclusion

Founded in the late 1980s, MYOB accounting software has long been trusted. However, as business needs grow more complex, the MYOB accounting system may not address all challenges, such as automation and advanced integrations. Companies today require more flexible, scalable solutions.

HashMicro Accounting Software provides a comprehensive alternative with AI-driven analytics, real-time financial tracking, and seamless integration across business modules. Its powerful automation and scalability make it an ideal choice for businesses looking to improve efficiency and meet growing demands.

Get a free demo of HashMicro Accounting Software! Discover how its features, real-time data, and easy integration can simplify your accounting tasks and boost your business efficiency.

Frequently Asked Question about MYOB Accounting Software

-

Is MYOB an ERP system?

MYOB provides a robust cloud-based ERP system tailored for both small businesses and large enterprises. With MYOB, you’ll have access to essential data and insights to make informed business decisions, along with the tools and features to bring those decisions to life.

-

What type of system is MYOB?

-

What is the database for MYOB?

MYOB Advanced uses MySQL as its database, which is hosted on Amazon Web Services (AWS). Direct access to the database isn’t allowed because a configuration layer is placed between the database and the software.