Economic opportunity cost refers to comparing one economic option and other potential alternatives. This concept is frequently used in finance and economics, particularly when evaluating investment options, as it helps assess the consequences of choosing one investment over another. Opportunity cost represents the potential loss or gain from a particular decision.

For example, if you decide whether to buy or sell shares, selling might offer an immediate profit, but you could miss out on future gains. As a finance or accounting professional, it’s crucial to understand the concept of opportunity cost and how it arises.

Sa artikulong ito, titingnan namin nang malalim ang mga gastos sa pagkakataon na maaaring mapahusay ang iyong pag-unawa sa pagkalkula. Pasok na tayo ngayon!

Table of Contents

Key Takeaways

|

Definition of Opportunity Cost

Bago tayo sumisid ng mas malalim, talakayin muna natin ang kahulugan ng opportunity cost. Opportunity cost in economics is the value of the best opportunity that must be given up when one chooses one option over another. In business, opportunity cost helps in decision-making by considering the lost benefits of the unchosen alternative.

By understanding the meaning of opportunity cost, both individuals and companies can make more rational and informed decisions. This concept emphasizes that every decision has consequences, both direct and indirect. One example is investment; if an investor has the choice to invest their money in stocks or bonds, they must consider the opportunity cost of the decision.

Further, if they choose stocks, the opportunity cost is the possible profit from bonds, and vice versa. This helps investors understand the risks and potential returns of each option chosen. By understanding opportunity cost, individuals and companies can make more rational and informed decisions.

Therefore, understanding opportunity cost helps us assess the true value of a decision and consider all alternatives

Example of Opportunity Cost Implementation

Humans are often faced with numerous choices when dealing with various economic challenges. As individuals, we want to meet as many needs as possible. To navigate these challenges, rational thinking is essential for finding different solutions, allowing people to maximize the potential of everything around them.

One way to address economic difficulties is by optimizing the use of natural or other available resources. This concept highlights the idea behind opportunity cost. The scarcity of natural and economic resources can indeed pose challenges for your business.

In economics, when a business decides to pursue one action over another, it forfeits the benefits of the option it did not choose. Essentially, the company sacrifices potential opportunities due to the decisions it makes. This sacrifice is known as opportunity cost. Below is a more detailed explanation:

War costs

The financial burden of war can significantly impact a country’s budget. For instance, if the government allocates $870 billion toward military supplies, this allocation comes with a considerable trade-off. That $870 billion represents funds that are no longer available for other critical areas such as education, healthcare, or even tax cuts and deficit reduction.

In essence, the resources devoted to war-related expenses limit the government’s ability to invest in programs that could improve public services, support economic growth, or reduce the national debt. The opportunity cost of this decision affects immediate fiscal priorities and long-term social and economic development.

As a result, the money funneled into war efforts could lead to missed opportunities for improving the quality of life for citizens through better schools, healthcare systems, and financial stability.

Expenditures for new roads

When the government decides to invest in building new roads, the funds allocated for this project are no longer available for alternative spending options, such as improving education or healthcare services. This means that while new roads may enhance infrastructure, the opportunity cost is the potential benefits that could have been gained from investing in other essential public services.

Tax rebate

When the government opts to implement income tax cuts, it faces an opportunity cost, as the reduction in tax revenue limits its ability to fund various essential programs. Instead, the money that could have been used to support public services, infrastructure development, education, healthcare, or social welfare initiatives is directed toward tax relief.

As a result, the government’s ability to maintain or expand these services may be compromised, leading to trade-offs between immediate financial relief for citizens and long-term investments in critical sectors. This decision reflects the broader economic challenge of balancing fiscal policy with public spending priorities.

How to Calculate Opportunity Cost

An investor calculates opportunity cost by evaluating the potential returns of two different options. This can be done by predicting future earnings when making a decision. Alternatively, the opportunity cost can be assessed afterward by comparing the actual returns since the decision was made.

The opportunity cost formula below demonstrates how to calculate opportunity cost, helping investors compare the returns of various investments:

Opportunity Cost = Benefit of Chosen Investment – Benefit of Foregone Investment

Case example

When investors make decisions, they often attempt to estimate potential opportunity costs, though these calculations are more accurate in hindsight. Real data allows for easier comparison between the returns of the chosen investment and the alternatives passed over.

For instance, imagine an investor choosing between purchasing stock in Company ABC or Company XYZ. If the investor selects ABC, and a year later, ABC delivers a 5% return while XYZ achieves 9%, the opportunity cost can be calculated as 4% (9%—5 %).

While investors frequently use the concept of opportunity cost to compare investments, it can be applied to various other situations as well.

Opportunity Cost Limits

The primary challenge of calculating opportunity cost lies in the difficulty of accurately predicting future returns. While historical data can offer insights into past performance, it’s impossible to forecast investment outcomes completely.

Opportunity cost remains a critical factor in decision-making. Still, its accuracy can only be truly assessed once a decision is made and the actual performance of both investments is compared in hindsight. Although the concept applies to all decisions, it becomes more complex when intangible factors are involved.

For example, consider two investment options: one offers modest returns but requires your money to be tied up for only two years, while the other provides higher returns but locks your funds for 10 years with slightly more risk. In this scenario, part of the opportunity cost involves the difference in liquidity between the two investments.

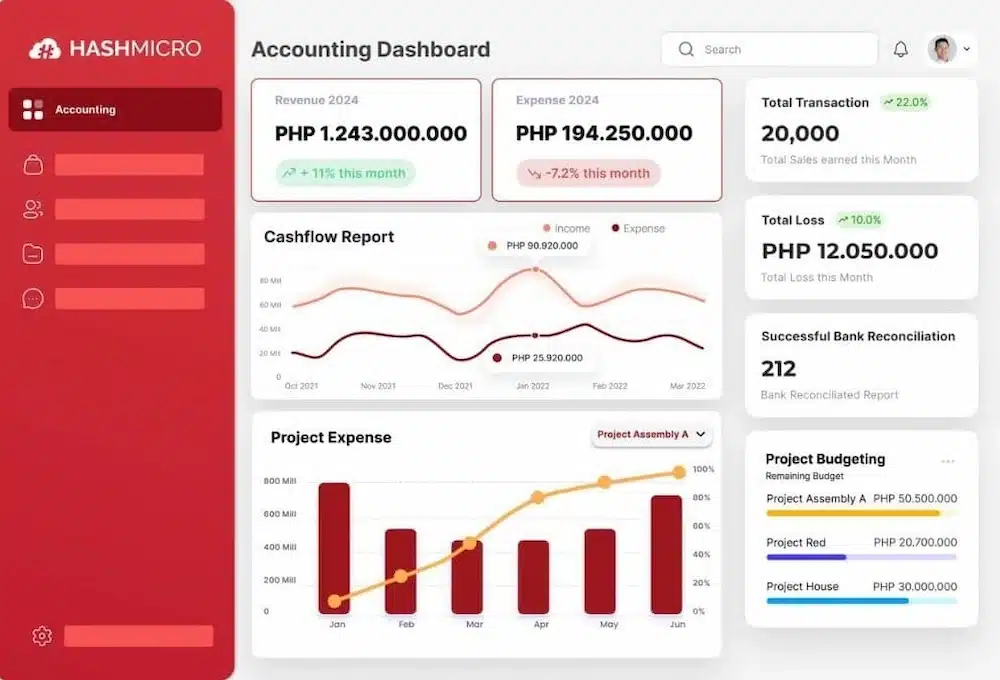

Managing Opportunity Cost Effectiveness with the Implementation of HashMicro Accounting System

Calculating opportunity cost manually comes with several risks, one of which is errors in calculation, especially if there are many variables to consider. Humans are more prone to miscalculating relevant factors without automated tools or systems. This is why you must use an accounting system like HashMicro.

HashMicro’s accounting system can improve the effectiveness of opportunity cost calculations by providing accurate and real-time data. With direct access to financial statements and historical data, companies can easily analyze the performance of various investments or business options to make more accurate comparisons.

In addition, HashMicro facilitates the integration of various departments, such as finance, inventory, and human resources, enabling faster decision-making. Its automated system helps minimize the risk of manual calculation errors, making the opportunity cost analysis more precise and in-depth.

Here are the top features provided by HashMicro’s Accounting System:

- Cash Flow Reports: Monitor the company’s cash inflows and outflows to ensure sufficient liquidity, make appropriate financial plans, and identify and address potential financial issues.

- Forecast Budget: Predict future budgets based on historical data to help with financial planning, allocating resources efficiently

- Financial Ratio: This tool helps users quickly and accurately analyze the company’s financial health and understand financial performance in more depth to support strategic decision-making.

- Financial Statement with Budget Comparison: Provides a clear picture of how the company’s actual financial performance matches the plan to identify deviations and make necessary adjustments to achieve financial goals.

You can read our previous article, which discusses the best accounting software in the Philippines, to get more insight into the highest-quality accounting systems.

Conclusions

Opportunity cost refers to the potential gains that are lost when choosing one investment or business path over another. When comparing multiple options, it represents the value of the alternatives that must be sacrificed in order to pursue a particular choice. No matter the decision, the unchosen option will always carry a cost.

In business development, for instance, it’s essential to track every expense, including opportunity costs. Examples include purchasing advanced equipment, hiring experts to develop new products, and making other similar decisions that involve trade-offs.

Integrated with the accounting system from HashMicro, it can be an effective solution for proper application. The HashMicro system provides a free demo that can be accessed at any time to give you the opportunity to learn how the system works.

Schedule your free demo now!