Mistakes in manual payroll management system can quickly spiral into costly errors and disorganized records. Missteps in calculations, leave tracking, or attendance lead to financial losses and unnecessary stress. No business can afford that.

Sticking to outdated, manual payroll methods only makes things worse. They waste time, increase the risk of mistakes, and pile on admin headaches. No wonder McKinsey reports that up to 50% of HR tasks in the Philippines can be automated. And that’s exactly the kind of game-changer your business needs.

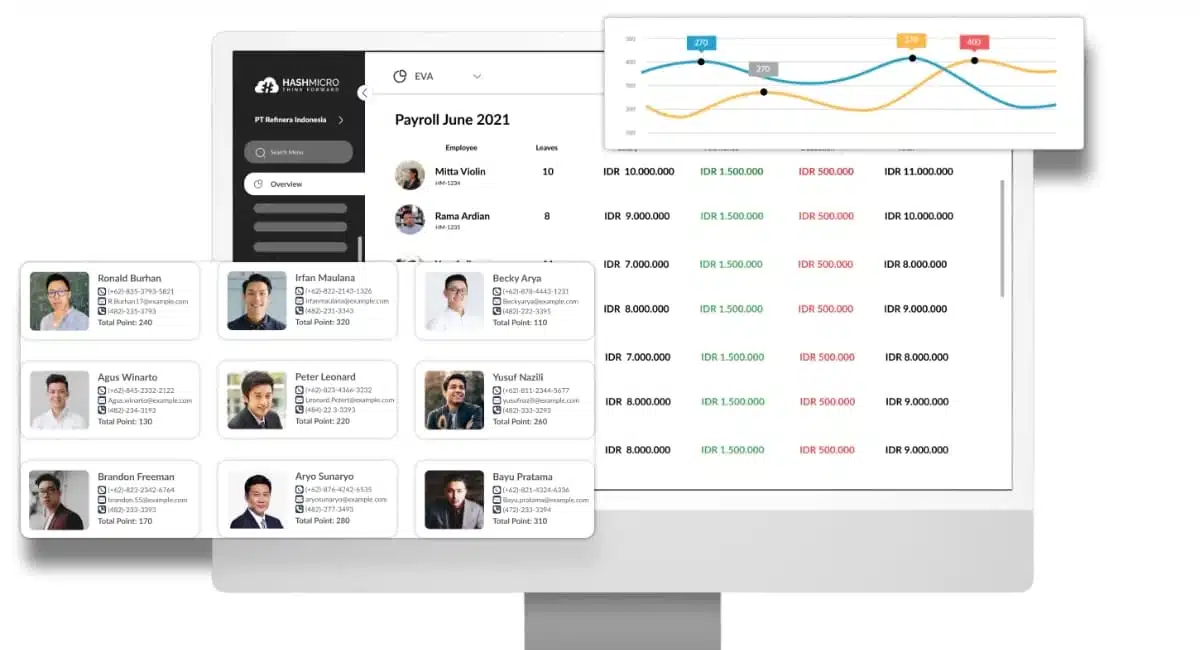

That’s where you should try HashMicro Payroll Management System. Its fully BIR-approved payroll system takes care of tax calculations, SSS, PhilHealth, Pag-IBIG contributions, and generates BIR-compliant reports—all in one place.

Ready to take the stress out of payroll? In this article, we’ll explore how a good payroll management system can boost accuracy, save time, and keep your business comply fully.

Key Takeaways

|

Table of Contents

What is a Payroll Management System?

A payroll management system refers to specialized software that enables companies to streamline and automate payroll tasks, such as calculating take-home pay and taxes. This helps save time for employers and reduces the likelihood of errors.

This payroll system also helps companies easily track finances, which are usually done manually and are time-consuming. Thus, companies utilise the advancement of cloud-based technology in payroll management systems to improve their performance management, efficiency and accuracy in financial management.

In addition, this cloud-based payroll system has better security than manual processes. You can also ensure that private employee data is protected. The system can also be integrated with attendance management, benefits administration, and tax filing. These integrations can help reduce errors and administrative tasks, making the payroll processing more efficient.

Why is the Payroll System Important?

A payroll system is an essential tool for businesses of all sizes. It automates and streamlines the process of managing employee compensation, ensuring accuracy, compliance, and efficiency. Here’s why a payroll system is crucial for your business:

- Ensures accurate employee compensation: A payroll system eliminates manual errors by automating salary calculations, deductions, and overtime pay. This ensures employees are paid accurately and on time, boosting morale and trust.

- Simplifies tax compliance: With built-in tax calculation features, a payroll system helps businesses comply with government regulations. It ensures timely filing of taxes and generates accurate reports, reducing the risk of penalties.

- Saves time and increases efficiency: Automating payroll processes significantly reduces the time spent on manual calculations. This allows HR teams to focus on strategic tasks rather than administrative work.

- Enhances data security: A reliable payroll system protects sensitive employee data, such as salaries and bank account details. Most systems have secure access controls to prevent unauthorized access and breaches.

- Improves record-keeping: Payroll systems maintain comprehensive employee payments, taxes, and benefits records. This simplifies audits and ensures transparency in financial management.

- Supports scalability: As businesses grow, managing payroll manually can become overwhelming. A payroll system scales with the organization, accommodating new employees and complex structures effortlessly.

- Facilitates employee benefits management: Payroll systems integrate seamlessly with benefits administration, helping businesses manage health insurance, retirement plans, and other perks. This ensures employees receive the correct entitlements.

- Customizable features for business needs: Modern payroll systems offer customizable features that can be tailored to meet specific business requirements. This includes multi-currency payments, custom reports, and compliance with local laws.

- Reduces administrative costs: Automating payroll tasks saves businesses on administrative expenses related to manual processes and error correction, making the payroll system cost-effective.

- Promotes employee satisfaction: Employees who are paid accurately and on time are more satisfied and loyal. A payroll system ensures a smooth payment process, fostering a positive workplace environment.

By investing in a reliable payroll system, businesses can streamline operations, ensure compliance, and focus on growth while keeping employees happy and motivated.

Types of Payroll Management Systems

Understanding the different types of payroll systems is crucial for businesses to select the most suitable solution that aligns with their specific needs and resources. Here are the primary types of payroll systems available:

1. Manual payroll systems

Manual payroll systems are the traditional method of processing payroll using spreadsheets, paper records, or calculators. While this approach may be feasible for very small businesses with a limited number of employees, it has several drawbacks:

- Time-consuming: Manual calculations for taxes, deductions, and net pay require significant time and effort.

- High error rate: The likelihood of human errors increases with manual data entry and calculations, leading to inaccurate payroll processing.

- Limited scalability: As the business grows, managing payroll manually becomes increasingly complex and inefficient.

- Compliance challenges: Keeping up with changing tax laws and regulations manually can be difficult, increasing the risk of non-compliance.

2. Outsourced payroll services

Outsourced payroll services involve hiring external firms to handle all aspects of payroll processing. This option offers several benefits:

- Expertise and compliance: Professional payroll service providers are well-versed in tax laws and regulations, ensuring accurate and compliant payroll processing.

- Time savings: Outsourcing eliminates the need for in-house payroll administration, allowing businesses to focus on core operations.

- Scalability: Payroll service providers can easily accommodate business growth and handle fluctuations in payroll volume.

- Access to advanced tools: Many outsourced services offer access to sophisticated payroll software and reporting tools without the need for businesses to invest in them directly.

3. Automated payroll management systems

Automated payroll management systems are software solutions that streamline and automate the entire payroll process. These systems offer a wide range of features, including:

- Automated calculations: Accurate computation of wages, taxes, deductions, and benefits based on predefined rules.

- Direct deposits: Facilitates electronic payments directly to employees’ bank accounts, reducing the need for physical checks.

- Tax Filing and compliance: Automatically calculates and withholds the appropriate taxes, generates tax forms, and submits filings to relevant authorities.

- Integration capabilities: Seamlessly integrates with other business systems such as accounting, HR, and time-tracking software.

- Employee self-service: Provides portals for employees to access pay stubs, update personal information, and manage benefits.

- Reporting and analytics: Generates comprehensive reports and analytics to support financial planning and decision-making.

4. Cloud-based payroll systems

A subset of automated payroll management systems, cloud-based payroll systems offer additional benefits by leveraging cloud technology:

- Accessibility: Accessible from anywhere with an internet connection, allowing for remote management and flexibility.

- Automatic updates: Cloud providers handle software updates and maintenance, ensuring the system remains current with the latest features and compliance requirements.

- Data security: Advanced security measures, including encryption and regular backups, protect sensitive payroll data.

- Cost-effectiveness: Typically offered as subscription-based services, reducing the need for significant upfront investments in hardware and software.

Cloud-based payroll systems are ideal for businesses seeking flexibility, scalability, and the latest technological advancements without the burden of managing the infrastructure themselves.

The Benefits of Payroll Management System

Businesses need payroll systems to improve accuracy by automating complex calculations related to employee salaries, taxes, and deductions, thereby reducing the risk of errors.

Here are some of the importance of the payroll system and benefits for your company:

1. Compliance with Philippine laws

A payroll system ensures your business complies with Philippine labor and tax laws. The Bureau of Internal Revenue (BIR) and the Department of Labor and Employment (DOLE) have specific regulations regarding employee compensation, tax deductions, and contributions to social security systems like SSS, PhilHealth, and Pag-IBIG.

A great payroll system automatically updates to reflect changes in these laws, ensuring that all calculations are accurate and compliant. A good system understands that payroll Philippines rules must be adhered to carefully.

2. Automated payroll processing

Automated payroll processing saves time and reduces errors. Manual payroll tasks such as calculating salaries, deducting taxes, and creating payslips can be time-consuming and prone to errors. Automation will allow your HR and accounting teams to focus on more strategic tasks, thus increasing overall productivity.

3. Integration with other systems

Payroll systems that integrate with other business systems, such as accounting systems and HR, can streamline operations. With this integration, data can be synchronised in one system, reducing the need for manual data entry and minimising errors. Therefore, using software in business management will improve accuracy and efficiency across departments.

To get these integration capabilities, you can start considering choosing payroll software from HashMicro. Calculate the software price immediately by clicking the banner below!

4. Secure data management

Payroll systems offer secure storage and management of sensitive employee data. With advanced encryption and access controls, these systems protect personal and financial information from unauthorized access and data breaches. Secure data management is crucial for maintaining employee privacy and complying with data protection regulations.

5. Improved reporting and analytics

Payroll systems provide reporting and analytics capabilities, allowing businesses to generate detailed reports on labor costs, payroll deduction, and employee attendance. These insights help in financial planning, budgeting, and decision-making. Real-time data access enables businesses to monitor payroll trends and make strategic decisions.

6. Minimizes errors

When you run payroll manually, all sorts of human errors can occur. These errors can result in employee dissatisfaction or tax noncompliance. The best payroll software can complete complex calculations quickly, saving you time and minimizing the chance of human error. Many payroll companies even offer penalty protection if you incur a tax penalty.

Key Features of Payroll System

When choosing the best payroll system for your business, it is important to consider various features that can improve efficiency, accuracy, and compliance. Consider the following features to ensure your payroll operations run smoothly and effectively.

1. Calculation of insurance, taxes, and bank payroll

The right payroll system can automate calculating insurance and taxes, as well as managing direct deposits into employee bank accounts. This feature ensures compliance with regulatory requirements and reduces the risk of errors. Automating these calculations can save time and improve accuracy, which is crucial for any company.

2. Overtime management linked with attendance and payroll

Integrating overtime management with attendance tracking and payroll processing is essential. This feature allows the payroll system to automatically calculate overtime pay based on attendance data. Moreover, it also ensures that employees are compensated for their extra working hours and simplifies the payroll process for the HR department.

3. Expense management

This feature allows the recording, approval, and reimbursement of employee expenses such as travel expenses and office supplies. By integrating expense management with payroll, businesses can streamline the expense reimbursement process, ensure timely payments, and maintain accurate financial records.

4. Manage bonuses, allowances and deductions

An effective payroll system should manage various elements of compensation beyond the regular salary, including bonuses, allowances, and deductions. This feature enables automatic calculation and distribution of additional payments and deductions. Moreover, it also helps in keeping accurate and detailed records of all compensation-related transactions.

5. Payroll auditing and error reporting

This feature allows the system to audit payroll transactions, identify discrepancies, and generate error reports. This helps you to address issues quickly and ensure that payroll data is accurate and compliant with regulatory standards. Regular audits also help prevent fraud and improve payroll efficiency in the company.

6. Compensation management

Payroll systems also have features to manage and analyse compensation data, helping businesses to develop competitive and fair compensation strategies. This feature supports decision-making regarding salary adjustments, promotions, and benefits, ensuring that the company remains competitive in the labour market.

7. General ledger mapping

This feature integrates payroll data with the company’s accounting system and ensures that all payroll transactions are accurately reflected in the financial statements. You can simplify the process of updating the general ledger with payroll costs, reduce the need for manual entries. The right general ledger mapping helps maintain accurate financial records and supports financial reporting and analysis.

Step by Step How a Payroll Management System Works

Managing payroll ensures employees are paid accurately, a critical task for businesses. In the Philippines, complex regulations on overtime, leave, wages, taxes, social security, health insurance, and deductions make manual payroll handling inefficient and prone to errors.

Without effective payroll and rostering software, this process can get complicated and messy fast. Managing payroll by hand becomes incredibly difficult and exhausting for businesses with more than a few employees. That’s why having a reliable payroll system is essential.

Many business owners look to automate their payroll processes to save time and cut costs. A sound payroll management system can boost operational efficiency and ensure companies comply with all regulations in the Philippines. By implementing such a system, businesses can focus more on growth and less on administrative hassles.

Three Stages of Payroll Process: A Step-by-Step Guide

Given the complexities of payroll management, understanding the stages involved can help businesses streamline the process effectively. Let’s explore these stages step by step to understand how a payroll management system simplifies them.

Stage 1: Pre-Payroll Activities

The pre-payroll stage involves preparatory tasks to ensure accurate payroll processing.

- Defining Payroll Policy

- Establish clear payroll policies, including salary structures, benefits, leave policies, and deductions.

- These policies act as a framework to guide payroll calculations and ensure compliance with company standards.

2. Gathering Inputs

- Collect necessary data such as attendance records, overtime hours, tax declarations, and employee benefits.

- Accurate inputs are essential to ensure precise calculations during the actual payroll stage.

3. Input Validation

- Verify the accuracy and completeness of the data collected before processing payroll.

- This step minimizes errors and ensures that the payroll process runs smoothly.

Stage 2: Actual Payroll Process

The actual payroll stage is where calculations and payouts are determined.

4. Payroll Calculation

- Process the payroll by calculating salaries, taxes, and deductions based on the validated inputs.

- This step involves using payroll software or manual methods to ensure employees receive the correct compensation.

Stage 3: Post-Payroll Process

The post-payroll stage focuses on compliance, accounting, and reporting.

5. Statutory Compliance

- Deduct and deposit taxes, social security contributions, and other mandatory payments with government authorities.

- Ensure compliance with local labor laws and tax regulations to avoid penalties.

6. Payroll Accounting

- Record payroll accounting expenses in the company’s financial system to maintain accurate accounting records.

- This step ensures transparency and simplifies financial audits.

7. Payout

- Disburse salaries to employees via bank transfers, checks, or other approved payment methods.

- Ensure timely payouts to maintain employee trust and satisfaction.

8. Reporting

- Generate detailed payroll reports, including summaries of salaries, deductions, and compliance filings.

- These reports help the HR and finance departments analyze payroll trends and make informed decisions.

By following these step-by-step processes, businesses can ensure an accurate, compliant, and efficient payroll management system.

Main Approaches to Payroll Management System

Choosing the right payroll management system is crucial for businesses to ensure accuracy, compliance, and efficiency in handling employee compensation. Below are the main approaches to payroll management, each offering distinct advantages based on a company’s size, complexity, and operational needs.

1. Manual payroll management: This method requires calculating salaries, taxes, and deductions by hand or using spreadsheets. While it works for small businesses, it’s time-consuming and prone to human errors.

2. In-house payroll software: Companies use payroll and/or HRIS software internally to automate salary calculations and compliance. This approach gives complete control over payroll data but requires IT resources for maintenance.

3. Cloud-based payroll system: Cloud-based payroll systems allow businesses to manage payroll securely online with real-time access. These systems are scalable, convenient, and ideal for businesses with remote teams.

4. Outsourced payroll services: By outsourcing payroll, businesses delegate all calculations and compliance to a third-party provider. This saves time and ensures accuracy, but sensitive data is managed externally.

5. Hybrid payroll system: A hybrid system combines internal payroll processes with external service providers for added flexibility. It allows companies to control key tasks while leveraging external expertise for complex operations.

6. Integrated payroll system with HR tools: This approach integrates payroll with HR systems like attendance and benefits tracking. It streamlines operations and provides a holistic view of employee management.

Each approach offers unique benefits, enabling businesses to choose the best solution based on their needs and resources.

Key Features of Payroll Software

Here’s a list of key features to look for when choosing payroll software for your organization:

- Support for multiple employee types: Ensure the software handles different employee classifications like salaried, hourly, and contractors, with flexible categorization options.

- Easy integration with other systems: The software should integrate seamlessly with HRIS, accounting, time tracking, and other necessary systems.

- Tax calculation and submission: Check if the software calculates, withholds, and submits taxes accurately, while handling garnishments and ensuring compliance.

- Direct deposit: The software should offer direct deposit for employee payments, a feature preferred by most employees.

- Flexible payroll options: Look for software that allows you to run payroll on different frequencies (weekly, biweekly, monthly) and offers on-demand pay options.

- Support for multiple locations: Ensure the software can calculate and distribute pay based on employees’ work locations, especially if your business operates across different territories.

- Scalable pricing plans: Consider whether the pricing plans can scale with your business size, and if there are options for small to large organizations.

- Security measures: Ensure the software includes security features like PCI compliance, multi-factor authentication, data encryption, and password protections.

- Customer support: Check for strong customer service options, such as helpful resources, support lines, and access to in-house payroll experts.

- Customizability: The software should be adaptable to your unique business needs, with customizable settings for payroll timing, currencies, and tax rules.

HashMicro as the Payroll System Solution for Your Philippines Company

HashMicro is the best Payroll System provider in the Philippines. It has proven its commitment to providing customers the best and most reliable solutions. HashMicro has been trusted by many Southeast Asian companies as the best business partner. HashMicro offers leading-edge technology in Enterprise Resource Planning (ERP) systems and is dedicated to providing services that fully understand customer needs and expectations.

HashMicro is software with various modules to help manage businesses in an integrated manner. One of the modules is a payroll system that is very useful for HR management. This system can help save time and reduce the risk of errors in the complex employee payroll process.

HashMicro is the best HRIS software to help companies in the Philippines improve efficiency in employee payroll. With advanced features such as salary calculation automation, time and attendance management, and compliance with local regulations, HashMicro ensures a smooth and accurate payroll process. HashMicro’s software has various superior features, such as:

- Fully Localized Payroll with Tax Calculation: A fully localized payroll system with accurate tax calculations can help you comply with local tax laws and regulations, including in the Philippines. This tax calculation automation can ensure that all deductions and contributions are made correctly and follow applicable regulations, reducing the risk of errors and penalties arising from non-compliance.

- Employee Training Management: HashMicro’s feature allows companies to plan, execute, and track employee training programs effectively. Management can ensure that every employee receives the necessary training to improve their skills and performance.

- In-depth Leaves, Payroll, Expenses, Overtime, and Attendance Reporting: This feature enables management to gain comprehensive insights into human resources and payroll aspects. Detailed and accurate reports help in strategic decision-making, budget planning, and performance evaluation. With real-time access to this data, companies can improve transparency, accuracy, and overall operational efficiency.

- Roster & Dynamic Employee Working Schedule Management: One of the leading features is roster and dynamic employee working schedule management, which allows companies to manage employee working schedules dynamically and flexibly. This feature ensures that each employee’s shift and tasks are organized optimally, reducing schedule conflicts and increasing productivity.

These advantages make HashMicro’s HRIS Software a highly effective solution for companies looking to improve efficiency and compliance in payroll and human resource management. In addition, HashMicro has the flexibility to customize according to company needs and integrate with other systems to support efficiency in businesses with complex management.

Conclusion

In conclusion, modern payroll systems is no longer optional – it’s essential for any business. It cuts down on errors, saves valuable time, and ensures employees get paid accurately and on time. As such, you can automate complex processes, stay compliant, and simplify your payroll management for smoother, more efficient operations.

Not only improving effectiveness in payroll management, HashMicro HRIS software provides an all-in-one solution in HR management to manage employee administration data, recruitment, and talent management.

Schedule a free demo immediately to learn more about HRIS software in payroll management for your Philippine company!

FAQ About Succession Planning

-

-

What Do You Mean by Payroll Management System?

A payroll system is a software solution designed to manage, organize, and automate the process of paying employees within an organization. It handles tasks such as calculating wages, withholding taxes and deductions, generating paychecks or direct deposits, and maintaining records of each payment cycle. By streamlining these processes, a payroll system ensures accuracy, compliance with tax laws, and timely compensation for employees.

-

Which Software Is Used for Payroll?

Several software options are available for payroll management, each catering to different business sizes and needs. Some of the most popular payroll management systems include:

– HashMicro

– SAP SuccessFactors

– ZenefitsThese systems offer features like automated payroll processing, tax filing, direct deposit, employee self-service portals, and integration with other business systems. The choice of software depends on factors such as company size, budget, required features, and ease of use.

-

How Do You Create a Payroll System?

Creating a payroll system involves several steps. First, assess your company’s payroll requirements, including the number of employees and types of compensation. Next, select a suitable payroll management system that fits your budget and needs. Gather all necessary employee information, such as personal details, tax withholding forms, and bank account information for direct deposits.

-

What Is the Function of the Payroll System?

The primary functions of a payroll system include:

– Calculating Employee Compensation: Accurately computes gross pay based on hours worked, salaries, overtime, bonuses, and commissions.

– Tax Withholding and Deductions: Automatically calculates and withholds the correct amount of taxes and other deductions such as insurance premiums, retirement contributions, and garnishments.

– Disbursing Payments: Facilitates timely payment to employees through checks, direct deposits, or other payment methods.

– Compliance Management: Ensures adherence to federal, state, and local tax laws and labor regulations, reducing the risk of legal penalties. -

What Is The Purpose of the Payroll System?

A payroll system is designed to automate and manage the process of compensating employees accurately and on time. It calculates wages based on hours worked, applies necessary deductions, and ensures compliance with tax regulations and labor laws. By integrating with time and attendance systems, it minimizes errors and reduces manual intervention. Additionally, a payroll system maintains comprehensive records, facilitates reporting, and provides real-time access to payroll data, aiding in strategic decision-making and efficient resource management.

-