You see your payslip every payday, but do you really look at it? It’s more than just numbers; it helps with budgeting, big purchases, and loan approvals. Understanding it can lead to smarter financial decisions!

Also, have you noticed how creating payslips for every employee, every pay period, feels repetitive and tedious? Especially if you have to manually input the calculation one by one.

But not to worry, since you can try HashMicro HRIS software to generate the payslips in just a few clicks! No more wasting unnecessary hours just to input the same thing over and over again, and HR teams can focus more on strategic tasks.

Ready to understand everything about your payslip? Keep reading because, by the end of this article, you’ll know exactly how to use it to your advantage!

Key Takeaways

|

Table of Content

Content Lists

What is a Payslip?

A payslip, or salary slip, is more than just a piece of paper or an email attachment on payday. It’s a detailed breakdown of your earnings, showing your base salary, bonuses, deductions, and contributions like taxes, SSS, PhilHealth, and Pag-IBIG.

Each line on your payslip tells you where your money is going and what’s left as take-home pay, making it a helpful tool for managing your finances. In the Philippines, payslips are key in ensuring transparency and accountability between employers and employees.

It’s not just about seeing your net pay; it’s also about understanding how each deduction adds up. This can help you make better decisions when planning your budget or applying for a loan.

Benefits of Having a Payslip

Payslips offer employees a complete view of their income details, making it easier to understand where each portion of their earnings goes. This transparency builds trust between employees and employers and ensures employees have a clear record of their income.

- See Exactly What You Earn: Payslips show all the details of your pay, including your basic salary, overtime, and deductions like SSS and PhilHealth. This means you know exactly what you’re getting and what’s being taken out.

- Easier Loan and Credit Approvals: When you want a loan or a credit card, banks look at your payslip to check your income. A payslip makes applying easy and shows banks you’re financially stable, making you more likely to get approved.

- Power in Salary Negotiations: Your payslip proves what you earned at your last job, which can be a strong tool when asking for a higher salary in a new job.

- Qualify for Government and Other Services: Payslips help you access services like government benefits or rental agreements since they show you have a steady income.

- Stay on Top of Taxes: Payslips list all your tax deductions, making tracking what you’ve paid easy and helping you prepare for tax season without any hassle.

In summary, payslips are a powerful tool beyond just showing salary details. They assist employees with loan applications, government services, and tax management, reinforcing their financial stability and planning abilities.

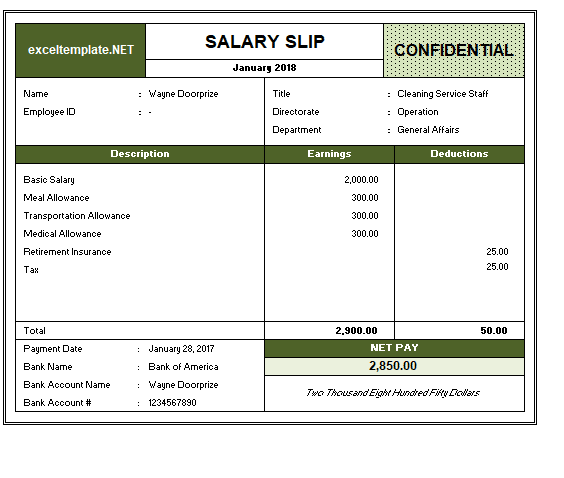

Payslip Format Example

The payslip provided offers a straightforward breakdown of an employee’s earnings and deductions, making it easy to understand where the final take-home pay comes from. Each section is designed to provide clarity on the payment details, ensuring transparency.

- Company Info: The top of the payslip lists “exceltemplate.NET,” which would typically be replaced by the actual company name for authenticity and record-keeping.

- Employee Details: Basic information, including the employee’s name (Wayne Doorprize), job title (Cleaning Service Staff), and department (General Affairs), identifies the person receiving the salary.

- Payment Date & Bank Info: The bottom left shows when and where the company paid the salary, listing the payment date (January 28, 2017), bank name (Bank of America), account name (Wayne Doorprize), and account number (1234567890).

- Earnings Breakdown: This section includes the base salary of 2,000.00 and additional allowances for meals, transportation, and medical expenses, each listed at 300.00.

- Deductions: Retirement insurance and tax deductions, each at 25.00, total to 50.00.

- Net Pay: After all deductions, the final amount received is 2,850.00, prominently shown in the “NET PAY” section.

This payslip layout gives employees a clear picture of their earnings, deductions, and actual take-home pay, making it easier to manage finances and understand compensation.

How to Create Payslips

Creating payslips requires gathering precise information on employee earnings, deductions, and contributions. This process ensures that employees understand their compensation details clearly.

- Include Basic Information: Start by listing essential details such as the company name, employee information (name, position), and the pay period.

- Itemize Earnings: Break down the earnings into sections, including base salary, bonuses, and allowances, to provide a clear overview of total income.

- Detail Deductions: List deductions like taxes, SSS, PhilHealth, and Pag-IBIG contributions to reflect the amount withheld.

- Calculate Net Pay: After accounting for deductions, show the net pay—the final amount the employee will receive.

Consider using HRIS software to automate payslip creation for an easier, more efficient process, ensuring accuracy and saving time.

How to Manage Payslip

Effectively managing employee payslips using a payroll system is essential for businesses to maintain transparency, build trust, and ensure accurate payroll records. Here’s how companies can streamline the process of handling payslips with the right payroll system in place.

- Regularly Review Payslip Accuracy: For each pay cycle, verify that all payslips reflect the correct salary, deductions, and allowances. Ensuring accuracy builds trust with employees and reduces the likelihood of payroll disputes.

- Store Digital Records Securely: Maintain a secure digital record of each payslip. This will facilitate employee access and simplify compliance with financial and legal audits.

- Clarify Deductions and Contributions: Make sure employees understand their deductions, including taxes, health insurance, and retirement contributions. Clear communication helps employees feel confident about their compensation.

- Utilize HRIS Software: Implementing HRIS (Human Resources Information System) software can automate the generation, distribution, and management of payslips. This reduces manual errors, saves time, and ensures employees can easily access their payslip information.

- Provide Clear Channels for Queries: Establish a straightforward process for employees to reach HR with any payslip-related questions. This fosters a transparent workplace and enhances employee satisfaction.

By managing payslips efficiently with the help of HRIS software, businesses can strengthen employee trust and ensure compliance. This maintains accurate financial records that benefit both the organization and its workforce.

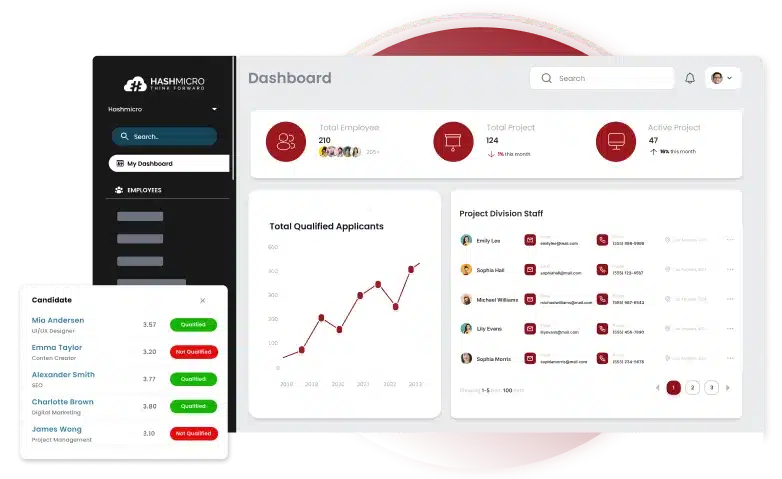

Efficiently Manage Payslip Using HashMicro’s HRIS

HashMicro’s HRIS software makes managing payslips easy and efficient. It simplifies payroll, saves time, and helps companies stay organized. With handy tools for tracking attendance, calculating pay, and handling documents, HashMicro’s HRIS is a powerful solution for any business.

Here are some key features for smooth payslip management:

- Face Recognition and GPS Attendance with Fake GPS Checking: This feature uses face recognition and GPS to track attendance accurately. It also detects fake GPS attempts, giving companies reliable data for payroll.

- Payslip Management for Daily and Hourly Workers: HashMicro’s HRIS easily calculates pay for daily and hourly workers. It generates accurate payslips based on actual hours worked, making payroll simple for flexible schedules.

- Professional Templates for Payslips and Contracts: The software includes ready-to-use templates for payslips and contracts. This keeps documents professional and consistent, meeting legal standards and company branding.

- Localized Payroll with Automatic Tax Calculations: HashMicro’s HRIS handles payroll with built-in tax calculations. This ensures compliance with local rules and keeps the payroll processing smooth and easy.

HashMicro’s HRIS not only ensures compliance with local payroll regulations but also keeps employees well-informed by providing clear and accurate pay records. Ultimately, using an HR system will boost overall satisfaction by making payroll processes easier and enhancing employee confidence in their compensation.

document.addEventListener(“DOMContentLoaded”, () => {

document.getElementById(‘slipgaji-hashmicro’).innerHTML =

”;

});

Conclusion

Efficiently managing payslips is essential for both employees and businesses. Payslips offer transparency, helping employees understand their earnings, deductions, and take-home pay. For companies, clear and accurate payslips foster trust, enhance payroll efficiency, and ensure compliance with local regulations.

HashMicro’s HRIS software simplifies the entire payslip process and ensures employees have easy access to their pay records. By adopting HashMicro’s HRIS, your company can enjoy a smoother, saving time and improving employee satisfaction. Ready to see the difference? Try our free demo today!

Frequently Asked Questions

-

What is the purpose of a payslip?

A payslip provides a detailed record of an employee’s earnings, deductions, and contributions. It ensures transparency and helps employees track income for budgeting, loans, and taxes.

-

How do I make a payslip?

To make a payslip, include details like company name, employee info, earnings, and deductions. Using HRIS software simplifies this process, ensuring accuracy and saving time.

-

How to record bad debts?

In many regions, issuing a payslip is mandatory for transparency and legal compliance. It benefits employees by providing proof of income and ensuring accurate compensation records.