A profit and loss forecast is key to steering your business through uncertain waters, yet most CFOs face challenges that go beyond mere capacity constraints. Surprisingly, based on Deloitte data 84% of CFOs say their biggest hurdle isn’t time or resources. Talaga?

It’s the capability to quickly model business decisions, adapt to external events, or plan for disruptions. With financial planning processes often bogged down by manual effort, the ability to swiftly update or adjust forecasts becomes a game changer.

In this article, we will take an in-depth look at what a profit and loss forecast is, why it is so important for businesses, and how to utilize it to support financial success.

Key Takeaways

|

Table of Contents

What is Profit and Loss Forecast?

A profit and loss forecast tracks a business’s cash flow over a set period, showing earnings, expenses, and overall profit or loss. In accounting, financial activities have consequences, and the profit and loss statement reveals whether these lead to a profit or a loss.

As one of the most important financial reports (3-way forecasting), the P&L (also called the income statement) shows a business’s different transactions and the gains or losses from those transactions.

Also, the profit and loss forecast shows non-cash gains and losses, such as when the value of investments increases or the value of equipment decreases over time. All of this information goes straight to the profit and loss statement.

While the profit and loss includes these non-cash transactions not shown in the cash flow forecast, it also leaves out cash transactions where there is no gain or loss—like buying a car worth PHP 250,000 for PHP 250,000, which doesn’t result in any profit or loss.

Why is Profit and Loss Forecast Essential for Business?

The Profit and Loss (P&L) Forecast is a critical tool for managing a business’s finances. Here’s why it’s so important:

1. Better decision-making

By predicting future income and expenses, business owners can make informed decisions. For example, if a retailer’s P&L forecast shows strong sales in the months leading up to Christmas, the business owner may decide to invest in more inventory in advance.

Conversely, if the forecast shows a drop in sales, the owner might delay expanding the store or increase marketing efforts to boost sales.

2. Managing cash flow

Cash flow is crucial to keeping a business running smoothly. A P&L forecast helps business owners predict when money will come in and when expenses are due.

For instance, if a small business owner knows that a large payment from a client will come in during the first week of the month, but a major utility bill is due in the second week, they can plan to pay the bill without risking cash shortages.

3. Setting targets and KPIs

A P&L forecast helps businesses set realistic financial targets. For example, if the forecast shows an expected profit of PHP 500,000 for the year, the business owner can set monthly revenue targets of PHP 40,000 to reach that goal.

They can also track key performance indicators (KPIs) like gross profit margin or expenses as a percentage of revenue, which helps them assess if they are on track or if adjustments are needed to improve profitability.

4. Securing funding

Lenders and investors often request a P&L forecast when seeking loans or investments. For example, if a startup restaurant owner is looking for a PHP 1 million loan to open a new branch, having a detailed P&L forecast can help.

The forecast should show projected revenue from meals, expected costs for ingredients, and staffing expenses. Without a realistic forecast, the business might struggle to secure the necessary funding.

5. Identifying opportunities and risks

The P&L forecast helps business owners spot areas for improvement or growth. For instance, if the forecast shows that labor costs are higher than expected in a construction business, the owner might take action.

They could look for ways to reduce inefficiencies, such as scheduling workers more strategically or renegotiating supplier contracts. On the other hand, if the forecast shows increased demand for a product, the owner might decide to invest in marketing or expand production to capitalize on that growth.

The Components of Profit and Loss Forecast

The profit and loss (P&L) statement, also known as the income statement, provides a summary of the company’s financial performance, highlighting these key areas:

- Revenue/Sales: This is the total income generated from selling goods, services, or other business activities within a specific period. The revenue definition refers to the overall earnings a company receives before deducting any expenses.

- Cost of Goods Sold (COGS): These are the direct costs associated with producing or acquiring goods or services, including raw materials, labor, and manufacturing expenses.

- Gross Profit: The difference between sales and COGS, representing the profit made before considering operating expenses.

- Operating Expenses: These are the costs involved in running the business day-to-day, such as rent, utilities, and administrative expenses.

- Operating Profit: This is the result after subtracting operating expenses from gross profit, reflecting the profitability of the business’s primary activities.

- Other Income and Expenses: These include non-core financial items, such as gains or losses from asset sales, interest income or expense, and taxes.

- Net Income/Loss: The overall profit or loss after all expenses, giving a complete picture of the company’s financial outcome.

Profit Forecast vs. Profit and Loss Forecast

In business, “profit forecast” and “profit and loss forecast” are often used interchangeably. They both refer to a financial projection that predicts the expected profit or loss over a specific period—usually a year.

So, what’s the difference between a profit and loss forecast and a general forecast?

The key difference lies in their focus and scope.

A profit and loss forecast zooms in on the business’s financial health, a snapshot of your company’s profitability using standard accounting methods.

It looks at key elements like projected sales, production costs, operating expenses, and any other activities that affect the bottom line. In short, the profit and loss forecast predicts how much you’ll earn versus how much you’ll spend.

On the other hand, a general forecast casts a wider net. While it can touch on financial elements, it’s more about the big picture. It includes predictions about market trends, customer behaviors, industry shifts, or emerging technologies.

How to Calculate Profit and Loss Forecast

Calculating a profit and loss forecast is a crucial step in planning your business finances. This process involves several stages to ensure the projections are accurate. Here’s an example of a profit and loss forecast, along with the steps to calculate your profit and loss estimate:

1. Set the projection period

The first step is to determine the time period for your forecast—monthly, quarterly, or yearly. For example, let’s say you’re planning to forecast your restaurant’s finances over one year for easier data-gathering and calculations.

2. Gather historical revenue data

Analyze revenue data from previous periods. For instance, if your restaurant made PHP 3,000,000 in total sales in the previous year, you would use this as a base to predict future sales. Look at trends—did sales spike during certain months, like holidays or special events?

Historical data gives you insights into revenue patterns and helps make more accurate projections.

3. Estimate revenue for the forecast period

Based on historical data and market trends, estimate the revenue for the forecast period. For example, if your sales have grown by 5% each year, you could forecast PHP 3,150,000 in revenue for the upcoming year.

Alternatively, if you plan to open a new branch, you might estimate an additional PHP 500,000 in sales, bringing your total projected revenue to PHP 3,650,000.

4. Calculate the cost of goods sold (COGS)

Next, estimate the cost of sales for the forecast period. If your restaurant’s COGS in the past year was 40% of total revenue, calculate this by multiplying your projected revenue (PHP 3,650,000) by 40%.

This would give you a COGS of PHP 1,460,000. These costs include things like ingredients, packaging, and direct labor.

5. Determine operating expenses

Calculate the forecasted period’s expected operating expenses, including salaries, rent, utilities, and marketing costs. For example:

- Salaries: PHP 800,000

- Rent: PHP 150,000

- Utilities: PHP 50,000

- Marketing: PHP 100,000

Total operating expenses would be PHP 1,100,000. These are fixed and variable costs you expect to incur regardless of how much you sell.

6. Calculate gross profit

After calculating revenue and COGS, determine the gross profit by subtracting COGS from revenue. Using our earlier numbers:

- Revenue: PHP 3,650,000

- COGS: PHP 1,460,000

Gross Profit = PHP 3,650,000 – PHP 1,460,000 = PHP 2,190,000

7. Calculate operating profit

Next, subtract operating expenses from gross profit to get the operating profit. Using the operating expenses of PHP 1,100,000:

- Gross Profit: PHP 2,190,000

- Operating Expenses: PHP 1,100,000

Operating Profit = PHP 2,190,000 – PHP 1,100,000 = PHP 1,090,000

8. Calculate net profit

Finally, to calculate the net profit, subtract all expenses, including taxes and interest, from total revenue. For example:

- Operating Profit: PHP 1,090,000

- Taxes: PHP 150,000

- Interest: PHP 50,000

Net Profit = PHP 1,090,000 – PHP 150,000 – PHP 50,000 = PHP 890,000

By following these steps, you’ll be able to create an accurate and informative profit and loss forecast that will help you manage your business finances more effectively. The top accounting solutions can help with creating accurate profit and loss forecasts with just a few clicks, which can save hours of your time.

Tips to Conduct Forecasting

Performing accurate forecasting is key to successfully planning for the business’s future. This process requires careful analysis and a systematic approach. Here are some tips to help you do better forecasting:

1. Use historical data

Historical data is an important foundation for making projections. Gather financial data from previous periods, including revenue, costs, and market trends. Analyzing this data will help you understand patterns and make more realistic estimates for the future.

2. Apply the appropriate method

Choose the forecasting method that best suits your business type and needs. Quantitative methods, such as regression analysis or time series methods, are useful for data that is measurable and has patterns.

3. Consider external factors

In addition to historical data, it is important to consider external factors that may affect your business. These include economic conditions, industry trends, policy changes, and consumer behavior.

4. Involve a diverse team

Involving various stakeholders in the forecasting process can provide a broader perspective. A diverse team can provide different insights and help identify risks and opportunities that may have been missed.

5. Use tools and technology

Utilize available accounting system and forecasting tools to improve efficiency and accuracy. Many applications offer advanced data analysis features, making it easier for you to make projections and keep financial records in an organized manner.

6. Set clear goals

Make sure to set clear and measurable goals when forecasting. These goals will provide a clear direction and make it easier for you to assess your business performance and decide on the steps you need to take to achieve the desired results.

Applying these tips will help you perform more effective forecasting and help your business succeed in the future.

Enhance Your Profit and Loss Forecasting with HashMicro Accounting Software

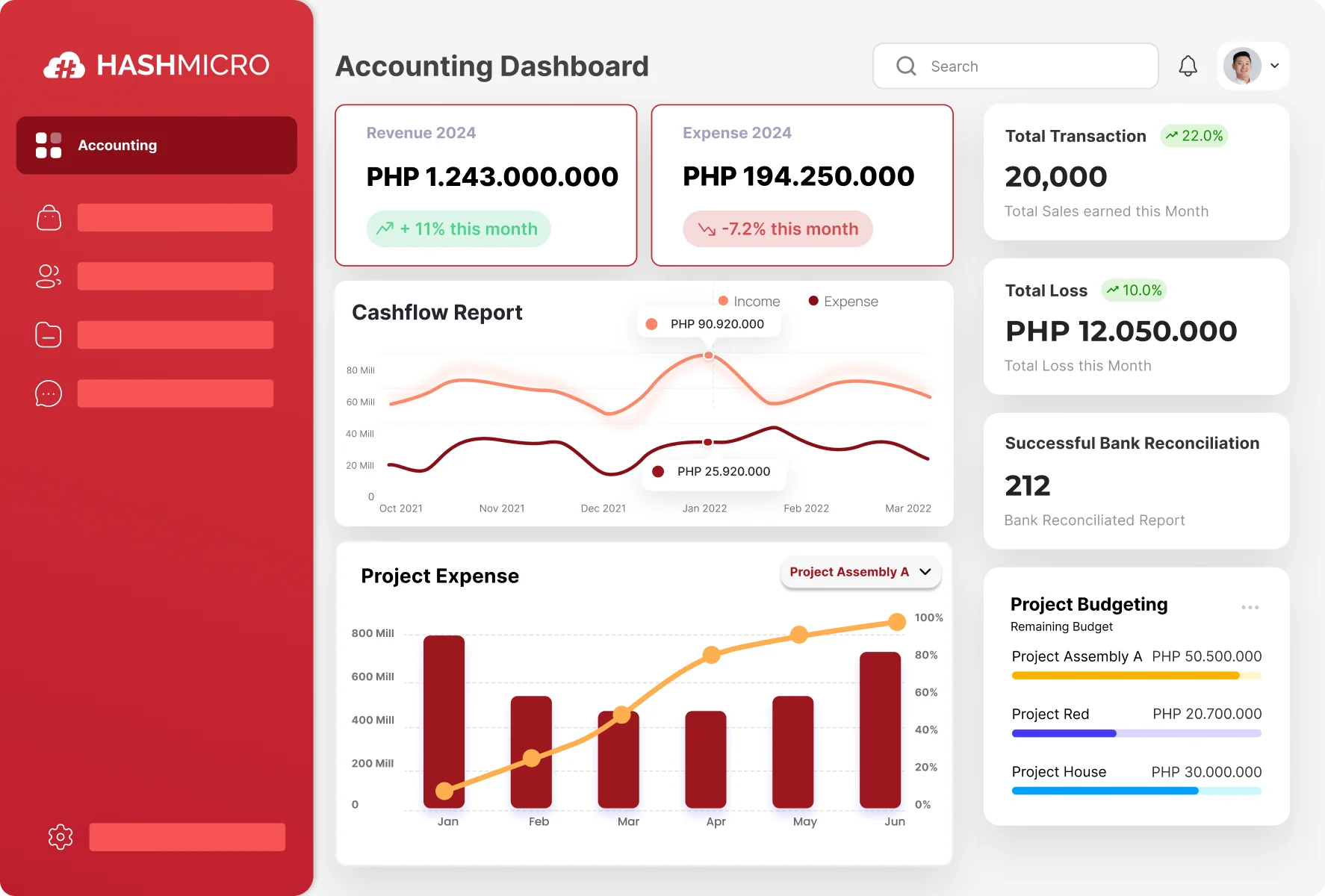

HashMicro Accounting Software offers significant advantages in accounting management and profit and loss forecast calculation. One of its key features is automation, which reduces manual workload and enables high-accuracy real-time transaction recording.

Para kang may katuwang sa bawat hakbang in managing your finances. On top of that, HashMicro enables the integration of data from various sources, which results in more comprehensive information.

Walang sayang na datos, you can try the free demo to see how the system works.

Here are HashMicro’s top features that can help with budget management in your business.

- Profit & Loss vs Budget & Forecast: Compares actual profit and loss with budget to evaluate financial performance. It enables identification of any differences and necessary adjustments.

- Cash Flow Reports: Depicts money flow in and out, which is essential for confirming liquidity. It helps to plan funding needs better.

- Forecast Budget: Develops budgets based on historical data and trends to forecast future revenues and expenses. It enables adjustment of business strategies based on predicted changes.

- Financial Ratio: Evaluate the company’s health and operational performance through financial ratio analysis. Assist management in making better decisions and identifying areas for improvement.

- Bank Integration – Auto Reconciliation: Automatically align accounting records with bank statements to reduce the risk of errors. Save time and improve accuracy of financial statements.

- Multi Level Analytical: Evaluate performance based on different aspects of the business, such as departments or products. Helps identify factors that affect performance and make appropriate decisions.

With these tools, companies can conduct more in-depth analyses and make more informed decisions to achieve their financial targets.

Conclusion

A profit and loss forecast is a crucial financial tool that helps businesses predict their future earnings and expenses. It provides a snapshot of a company’s financial health, allowing leaders to make informed decisions. With this tool, you’re not just predicting the future; you’re preparing for it.

HashMicro Accounting Software takes the guesswork out of profit and loss forecasting, automating complex processes to save you time and effort. Whether you’re tracking budget deviations or generating precise forecasts, it gives you the confidence to make informed financial decisions.

Handa ka na bang hawakan ang financial future mo? HashMicro’s powerful features, like budget forecasting and cash flow reports, make financial planning a breeze.

Huwag lang basta maniwala, explore the free demo today and discover how HashMicro can transform your business’s financial management for good!

FAQ on Profit and Loss Forecast

-

How often should I update my profit and loss forecast?

The frequency of updating your forecast depends on various factors, including the volatility of your industry, the level of detail required, and your specific business needs. Generally, it’s recommended to review and update your forecast at least quarterly. However, for businesses in highly dynamic industries or those experiencing significant changes, more frequent updates may be necessary.

-

What are some common mistakes businesses make when creating a profit and loss forecast?

Some common mistakes in profit and loss forecasting include underestimating costs, such as unforeseen maintenance or rising supply chain expenses, and overestimating revenue, especially during uncertain economic periods. Another mistake is ignoring external factors like market trends, economic changes, or competition.

-

What is the difference between a profit and loss forecast and a cash flow forecast?

While both are important financial tools, they focus on different aspects of a business’s financial health. A profit and loss forecast projects a company’s revenue and expenses over a specific period, highlighting profitability. A cash flow forecast, on the other hand, predicts the inflow and outflow of cash, focusing on liquidity.

-

How can I improve the accuracy of my profit and loss forecast?

To improve accuracy, start by analyzing historical data to identify trends and patterns. Compare your business’s performance with industry benchmarks to highlight areas that need improvement. Conduct sensitivity analysis to understand how different factors could affect your forecast.