Managing your business finances can feel like navigating through Manila during rush hour—overwhelming, tricky, and sometimes downright chaotic. But what if you had a roadmap in the form of a purchase journal to streamline every financial detour? That’s right, well-organized purchase journals can turn your accounting nightmares into a walk in Rizal Park!

Attention all savvy business owners and financial warriors in the Philippines! Ever wonder how you can keep track of every peso that goes out as quickly as it came in? Cue the purchase journal, your new financial best friend. Read on to discover how this powerful tool not only keeps your books tidy but also gives you back control over your business finances. After all, who doesn’t want to be the captain of their own ship in the bustling seas of commerce?

Key Takeaways

|

Table of Contents

What are Purchase Journals?

A purchase journal, also known as a purchase day book, is a specialized accounting ledger used to record all purchase transactions a company makes on credit. This financial tool plays a crucial role in keeping a detailed log of unpaid purchases, enabling businesses to actively track what they owe to suppliers. Its primary purpose is to simplify the management of accounts payable and to provide a clear, chronological overview of all credit purchases.

For business owners in the Philippines, utilizing a purchase journal is crucial. It not only helps maintain a solid grasp of cash flow and financial commitments but also plays a vital role in managing day-to-day operations effectively. By systematically recording every transaction, including purchases that affect the Cost of Goods Sold (COGS), Filipino entrepreneurs can avoid financial discrepancies while significantly enhancing the accuracy of their financial reporting.

Also read: Closing Entry in Accounting: Definitions, Types, and Examples

Key Components of a Purchase Journal Entry

Every entry in a purchase journal involves meticulous documentation and attention to detail, serving as the cornerstone of effective financial management for businesses in the Philippines. From ensuring the accuracy of financial records to maintaining healthy supplier relationships, the strategic use of a purchase journal can significantly enhance operational efficiency.

Key Components:

- Two Parties Involved: Buyer and Supplier Roles – Each transaction records details from both the buyer and the supplier, including names, transaction dates, and terms. This clarity not only aids in account reconciliation but also strengthens business relationships through transparent communication.

- Credit Purchases: Recording Transactions on Credit – These entries detail goods or services received before payment is made, a common practice among local businesses to maintain liquidity and build trust.

- Invoice Details: Importance of Accurate Invoice Records – Critical for audit trails, each entry must meticulously include the invoice number, the amount due, and the transaction date to prevent errors and ensure compliance with tax regulations.

- Role of the Purchase Department: Managing Entries – The purchase department actively authorizes and records all purchases, safeguarding the company from financial discrepancies.

- Credit Note: Handling Returns and Allowances – Credit notes directly adjust accounts payable by rectifying records when suppliers accept returned goods or provide concessions.

- Purchase Book: Complementing the Journal – Works alongside the purchase journal to provide a full account of all transactions, ensuring a comprehensive financial analysis and aiding in the decision-making process.

The purchase journal and purchase book together form a robust framework for managing business finances. For Filipino business owners, mastering these tools means not just surviving the fiscal challenges of today’s market, but thriving in them.

By keeping detailed and accurate records, businesses can navigate the complexities of financial management with confidence, ensuring a solid foundation for future growth and success.

Also read: What are Adjusting Journal Entries in Accounting?

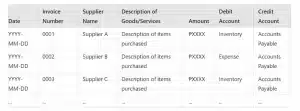

Understanding the Format of a Purchase Journal

The format of a purchase journal usually includes columns for date, invoice number, supplier name, and amount. Customization options, like adding columns for payment terms or discounts, allow for more detailed tracking.

Organizing entries methodically by arranging transactions chronologically and categorizing them by supplier or expense type streamlines financial management. This organization aids in quick information retrieval and simplifies audits. Customizing the journal format further helps with regulatory compliance while enhancing the strategic use of financial data.

A well-structured purchase journal supports better decision-making by aligning with specific business needs. By tailoring it to include relevant details, businesses can ensure comprehensive tracking and improved financial clarity.

Posting the Purchasing Journal

After recording every transaction in the purchase journal, the next step is to post these entries to the general ledger. This process accurately reflects all financial activities in your primary accounting records.

- Review the Purchase Journal: Check that all entries are accurate, including supplier names, invoice numbers, dates, and amounts.

- Determine Affected Accounts: Identify which general ledger accounts, like accounts payable or inventory, will be impacted by each transaction.

- Record Debits and Credits: Enter the corresponding debit and credit in the general ledger, ensuring the totals remain balanced.

- Update Regularly: Regularly update the general ledger to avoid errors and keep your financial records accurate.

- Reconcile with Supplier Statements: Periodically compare your ledger with supplier statements to identify and resolve discrepancies early.

- Audit Your Records: Regular audits ensure that transactions posted from the purchase journal are compliant with accounting standards system.

By meticulously following these steps, Filipino business owners can ensure that their financial records remain accurate and up-to-date.

However, have you ever felt that creating a purchase journal, or special journal, from scratch takes up too much time and effort? And that you have to input the data manually each time you want to reconcile the journal with the general ledger?

Huwag kayong mag-alala! A good purchase system can automate the tasks, integrate with every aspect of purchasing without much effort, and all in all ease up your tasks. If you’re interested in knowing the recommendation for such software, head to this article about the best PO software in the Philippines.

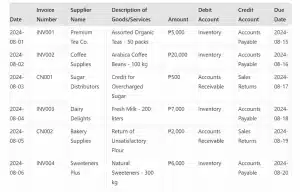

Example of a Purchase Journal Entry

- Date: The date when the invoice was received, say “2024-08-02.”

- Invoice Number: The unique identifier for the invoice, like “INV002.”

- Supplier Name: The name of the supplier is “Coffee Supplies.”

- Description of Goods/Services: A brief description of what was purchased, such as “Arabica Coffee Beans – 100 kg.”

- Amount: The total cost of the purchase, is listed as “₱20,000.”

- Debit Account: This would typically be “Inventory,” reflecting the addition to stock.

- Credit Account: “Accounts Payable,” indicating the amount owed to the supplier.

- Due Date: The date by which payment is expected, like “2024-08-16.”

Advantages of Using Purchase Journals

Purchase journals provide several significant advantages to Filipino business owners, particularly in generating accurate purchasing reports for better financial oversight.

- Improved Financial Organization: These journals help systematically organize financial transactions, making it easier to access and review financial data.

- Easier Tracking of Expenses: By segregating credit transactions from other financial activities, purchase journals simplify the monitoring of debts and the management of cash flows.

- Enhanced Strategic Decision-Making: The critical data captured in purchase journals support strategic decision-making and effective financial planning, essential for business growth and stability.

Also read: Sales Journal: Definition, Types, Format and Examples

Disadvantages of Purchase Journals

Purchase journals, while beneficial, present several disadvantages that Filipino business owners should consider:

Automate Purchase Journal Creation with HashMicro’s Accounting Software

Conclusion

FAQ Around Purchase Journals

-

Which entries are recorded in the purchase journal?

The purchase journal records all credit purchases made by a business. Entries typically include the transaction date, supplier’s name, invoice number, description of goods or services, and the total amount owed. This journal helps track and manage outstanding payables efficiently.

-

What is entered in purchase journals?

The purchase journal captures key details like transaction dates, supplier names, invoice numbers, descriptions of purchased goods or services, and total credit amounts. It focuses on credit purchases, allowing businesses to actively track liabilities and maintain accurate financial records.

-

Why does a business use a purchases journal?