What if you could instantly measure how good a company is at turning your investments into profits? That’s exactly what Return on Equity (ROE) does. It’s not just another financial term; it’s your window into a company’s performance. Curious yet?

Here’s why you should care: Companies with high ROE attract more investors, and for businesses, mastering ROE can mean the difference between growth and stagnation. But how do you truly leverage this powerful metric?

Keep reading to uncover the secrets of ROE, how to calculate it, and why it matters more than you think. Missing out could cost you critical insights into financial success.

Key Takeaways

|

Table of Contents

What is Return on Equity (ROE)?

Investors use ROE to find high-potential companies for their portfolios. A higher ROE reflects effective resource management, making it a key factor in spotting businesses ready to deliver strong returns.

Key Factors Affecting ROE

Several factors affect a company’s ROE, making it a vital tool for analyzing financial performance. These factors reveal how efficiently a business uses its resources. Understanding them helps both businesses and investors identify areas of strength and opportunities for improvement. Here are the key factors:

- Net Income: Net income, or profit after taxes, is crucial for calculating ROE. Found in financial statements, it shows how well the company generates profit.

- Shareholders’ Equity: Equity includes the owners’ claims on company assets after liabilities are subtracted. It comprises retained earnings, share capital, and dividends.

- Capital Withdrawals: Any withdrawals by business owners (prive) reduce the company’s equity and can directly impact ROE calculations.

- Operating Costs and Expenses: Higher expenses lower net income and decrease ROE. Managing costs is vital for maintaining profitability and improving ROE.

Recognizing these factors helps businesses identify where they can enhance efficiency and profitability. It also empowers investors to choose companies with promising management and growth. By mastering these elements, both parties can make smarter decisions that lead to long-term financial success.

How Return on Equity Works

Return on Equity (ROE) is a key financial metric that measures a company’s profitability in relation to shareholders’ equity. It indicates how effectively a business uses investors’ funds to generate profits.

A higher ROE suggests that a company is efficiently utilizing its equity to create value, while a lower ROE may indicate inefficiencies or financial challenges.

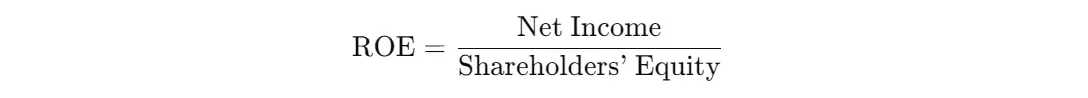

ROE is calculated by dividing net income by shareholders’ equity, typically expressed as a percentage. This metric helps investors and business owners assess financial performance, compare profitability across industries, and make informed investment decisions.

Understanding how ROE works enables companies to optimize their financial strategies and maximize returns for their shareholders.

How to Calculate Return On Equity (ROE)

Calculating ROE is simple and only needs two pieces of information: net income and shareholders’ equity. The formula is:

Here’s an example:

- Net Income: ₱1,000,000

- Shareholders’ Equity: ₱500,000

Calculation: ROE = ₱1,000,000 ÷ ₱500,000 = 2 or 200%

This means the company earns ₱2 for every peso invested, a great indicator of strong performance for investors.

The Importance of Return on Equity (ROE)

Return on Equity (ROE) is a crucial financial metric that helps businesses and investors assess a company’s profitability and efficiency in using shareholders’ funds. It provides valuable insights into how well a company generates returns relative to the equity invested by its shareholders.

A strong ROE indicates that a company is effectively utilizing its resources to drive growth and profitability, making it an attractive option for investors.

On the other hand, a consistently low ROE may signal financial inefficiencies or challenges in generating profits. By analyzing ROE, businesses can refine their financial strategies, improve operational efficiency, and enhance long-term sustainability.

Benefits of ROE for Businesses and Investors

Return on Equity (ROE) offers several benefits, making it a key metric for understanding financial health and growth opportunities. It allows businesses to measure how effectively they use shareholders’ equity to generate profits. For investors, ROE highlights which companies are worth their attention.

- Evaluates Financial Health: ROE shows how well a company uses its equity to generate profits, giving insights into its financial credibility.

- Supports Investment Decisions: Comparing ROE across companies helps investors identify the most promising opportunities within an industry.

- Assesses Profitability: ROE provides business owners with a clear understanding of how efficiently their capital is utilized to drive profits.

- Guides Expansion Plans: High ROE often signals that a company is ready for expansion, supporting long-term strategic planning.

By leveraging ROE, businesses can optimize their operations for better profitability, while investors can make smarter decisions on where to allocate their funds. Understanding this metric helps both parties achieve financial growth and success.

Using Return on Equity to Identify Risks

Return on Equity (ROE) is a valuable financial metric that not only measures a company’s profitability but also helps identify potential risks. While a high ROE may indicate strong financial performance, it is essential to analyze the underlying factors driving this number.

By understanding how ROE reflects financial stability and operational efficiency, businesses and investors can detect warning signs and mitigate risks effectively. Here are key ways to use ROE in risk assessment:

- Over reliance on debt: A company with a high ROE may be heavily dependent on debt rather than operational efficiency. If ROE is driven by excessive borrowing, it increases financial risk and potential instability.

- Inconsistent or volatile ROE: Significant fluctuations in ROE over time may indicate unstable profitability, operational inefficiencies, or external market challenges. Consistency in ROE is a key factor in assessing long-term financial health.

- Declining shareholders’ equity: If a company reports a rising ROE while shareholders’ equity is decreasing, it could signal financial distress or aggressive share buybacks that may not be sustainable in the long run.

- Unsustainable profit margins: A company with an unusually high ROE compared to industry peers may be benefiting from short-term gains rather than sustainable business practices. This can indicate risks related to pricing strategies, cost management, or market positioning.

- Comparing ROE with other financial metrics: ROE should not be analyzed in isolation. Comparing it with Return on Assets (ROA) and Return on Investment (ROI) helps determine whether a company’s profitability is genuinely strong or artificially inflated.

ROE vs. ROA: What’s the Difference?

ROE helps investors see how well a company uses equity to generate profits, while ROA provides a broader view of asset efficiency. Using both metrics together can give a complete picture of a company’s financial health. Here are the differences between them:

| Aspect | ROE (Return on Equity) | ROA (Return on Assets) |

|---|---|---|

| Definition | Measures profitability based on shareholders’ equity only. | Measures profitability based on total assets, including debts. |

| Focus | Equity efficiency (no debts involved). | Total asset efficiency (includes both equity and debts). |

| Calculation | Net Income ÷ Shareholders’ Equity | Net Income ÷ Total Assets |

| Best Use Case | Identifying shareholder value and management efficiency. | Evaluating overall asset utilization and operational efficiency. |

Difference between ROE and ROIC

Return on Equity (ROE) and Return on Invested Capital (ROIC) are both essential financial metrics used to evaluate a company’s profitability and efficiency. While they may seem similar, they serve different purposes in financial analysis.

ROE measures how well a company generates profits using shareholders’ equity, whereas ROIC provides a broader view by assessing returns on all invested capital, including both equity and debt.

Understanding the key differences between these metrics can help businesses and investors make more informed financial decisions.

| Aspect | Return on Equity (ROE) | Return on Invested Capital (ROIC) |

| Definition | Measures profitability relative to shareholders’ equity. | Measures profitability relative to total invested capital (equity + debt). |

| Focus | Evaluates returns generated for shareholders. | Assesses how efficiently a company utilizes all sources of capital. |

| Debt Consideration | Does not account for debt in the calculation. | Includes both equity and debt, providing a comprehensive view of capital efficiency. |

| Risk Indicator | Can be inflated by high financial leverage. | Provides a more balanced view by factoring in both equity and debt financing. |

Automate ROE Calculation with HashMicro’s Accounting Software

Tracking Return on Equity (ROE) can feel overwhelming, but HashMicro’s accounting software makes it a breeze. This powerful tool takes care of calculations and delivers clear insights to help your business thrive. Say goodbye to manual work and hello to smarter financial management. Here are four features you will love:

- Financial Ratio Analysis

Quickly see how your company is performing with automatic ROE and other ratio calculations. - Profit and Loss Comparison

Check your profits against budgets and forecasts to stay on track with your goals. - Equity Movement Reports

Keep an eye on equity changes over time to make better financial decisions with confidence. - Multi-Level Analytics

Compare data across branches or departments to spot opportunities and improve performance.

With an accounting system, managing your finances feels simple and effective. It saves time, boosts accuracy, and helps you make smarter choices for your business. If you want to stay ahead, this is the tool you need to turn your financial data into real results.

Conclusion

Return on Equity (ROE) shows how well a company uses shareholders’ equity to generate profits. This key financial metric helps investors identify high-performing businesses and allows companies to assess management efficiency. By understanding ROE, both investors and business owners can make smarter financial decisions.

Calculating and optimizing ROE becomes effortless with best accounting software. It saves time, ensures accuracy, and provides actionable insights for better business performance. Take your financial management to the next level by trying a free demo of HashMicro’s accounting software today and see how it can transform your business!

FAQ Around Return on Equity (ROE)

-

What does return on equity tell you?

Return on Equity (ROE) shows how effectively a company uses shareholders’ equity to generate profit. It indicates management efficiency and helps investors evaluate business performance.

-

What is ROE and why is it important?

ROE measures a company’s ability to generate returns using shareholders’ equity. It’s important because it highlights financial health and helps investors identify profitable companies.

-

What does a 20% ROE mean?

A 20% ROE means the company earns ₱0.20 in profit for every ₱1 of equity. It indicates strong performance and efficient use of shareholder investments.