As businesses rapidly expand in the Philippines, managing a sales invoice becomes increasingly critical for smooth operations and financial stability. Accurate sales tracking, timely payments, and compliance with local tax regulations are essential.

Starting in 2024, the Bureau of Internal Revenue required all major taxpayers to submit electronic invoices, including sales invoices. This could create bottlenecks in operations, leading to lost revenue and legal complications.

But does this mean your business is at risk? Hindi po! In this complete guide, we’ll explore everything you need to know about sales invoices in the Philippines, from understanding sales invoice meaning and how they function to using invoicing system for BIR-CAS-ready invoices.

By learning these aspects, you can handle your finances better and ensure compliance, helping you avoid any problems in the future.

Key Takeaways

|

Table of Contents

What is a Sales Invoice and How Does It Work?

A sales invoice is a formal document businesses give to customers, detailing the goods or services sold, the total amount due, and the payment deadline. It serves as a contract, helping both parties keep track of sales reports, payments, and any applicable taxes.

After finishing a sale, businesses send a sales invoice to ask for payment. This invoice, whether on paper or digital, lists the products or services provided, the amount owed, and payment options. Nowadays, most customer invoices are sent via email or invoicing software for faster processing.

Sales invoices do more than just request payment; they also help track transactions. Invoicing software often sends automatic updates to both the business and the customer, reminding them about any changes or upcoming due dates.

Key Elements of a Sales Invoice

For a sales invoice to be effective, it must include several key items. These elements help ensure clear communication and smooth transactions. Here’s what every invoice should have:

Contact information

Every sales invoice must include the seller’s and customer’s contact details. The top section includes the seller’s info, logo, and company details, while the customer’s contact information, such as address and phone number, is listed below.

Invoice number and date

The invoice number helps track each transaction, making it easier for businesses and customers to reference the document. The issue date is also vital, as it links directly to the payment terms and deadlines.

Description of goods or services

This section breaks down the products or services provided. A brief description, quantity, and unit price are listed for each item. Properly itemizing each service or product helps avoid misunderstandings and ensures the customer invoice is clear and accurate.

Payment terms

Clear payment terms specify when and how to pay, including accepted methods like cash, credit cards, or cryptocurrency. It also states the payment deadline, whether immediate or within 30 days, to ensure steady cash flow.

Amount due

The sales invoice must clearly state the amount due, including individual item costs, taxes, discounts, and prepayments. Providing a detailed breakdown helps avoid confusion and ensures the customer understands precisely what they are being billed for.

By ensuring these key elements are present and well-organized, you can create effective customer invoices that facilitate smooth transactions, prevent disputes, and keep your invoice in online selling business running efficiently.

Types of Sales Invoices

Understanding the different types of invoices is key to managing business transactions effectively. Here are the four main types of invoices used:

- Standard invoice

The standard invoice is the most basic and can be used for any sale. It includes key details such as the date, items or services, amount due, and payment terms, making it versatile for most transactions. - Pro-forma invoice

A pro forma invoice is issued before goods or services are delivered. It provides an estimated cost and informs the customer what to expect without requesting immediate payment. - Recurring invoice

Recurring invoices are for regular purchases like subscriptions or memberships, such as phone or software services. Invoice software can automate them for consistent and easy billing. - Commercial invoice

A commercial invoice is used for international sales and includes details for customs, such as product origin, weight, and shipping costs. It ensures smooth customs processing and shipping.

Choosing the correct type of invoice for your business needs ensures smooth transactions and accurate billing. Using these different invoice types effectively allows you to easily manage payments and documentation.

Why Sales Invoices are Important

Sales invoices do more than request payment. They help manage operations, plan effectively, and forecast accurately. They are vital for organizing accounting, tracking inventory, and analyzing sales management data.

Organized accounting

Sales invoices help keep your invoice accounting organized by tracking payments and ensuring timely collections. They reduce the hassle of chasing unpaid invoices and are essential for maintaining accurate financial records, which are crucial for taxes and legal issues.

Well-managed inventory

Invoices are vital for managing inventory, especially if you sell physical products. They help you track stock levels, forecast demand, and plan promotions effectively. This ensures you have the right amount of inventory to meet customer needs and boost sales.

Accurate analytics

Invoices provide key data for analyzing sales and planning budgets. They help you understand cash flow trends and make better financial decisions. Accurate invoicing allows you to predict future expenses and plan investments with confidence.

Effective invoicing boosts financial management, supports inventory tracking, and aids in making smart business decisions. By using sales invoices and receipt systems well, you can streamline your processes and improve decision-making.

Steps to Create a Sales Invoice

Whether you use a template or invoicing software, these steps will guide you on how to make sales invoice in a clear, simple, and effective way.

Step 1: Label clearly

Write “Invoice” in large letters at the top to make it easily recognizable. Add a date or specific deal name to distinguish it from other documents if needed.

Step 2: Add contact information

In the header, provide your company’s name, address, phone number, and email. Adding your logo is optional but adds a professional touch. Below, include the customer’s contact details, both email and physical address.

Step 3: Assign invoice number and date

Include a unique number for tracking each invoice, like Invoice #001, #002, etc. Date the invoice to prevent confusion and indicate when payment is due.

Step 4: Detail items or services provided

Describe each item or service provided, listing them separately. Use item numbers if helpful but keep descriptions clear and concise. Attach any related documents, like purchase orders, if necessary.

Step 5: Explain payment terms

Specify how and when you expect payment. Include accepted payment methods and any late fees for overdue invoices. State the exact due date to ensure timely payment.

Step 6: Clearly state the amount due

Show the total amount due, including any deposits, discounts, and taxes. Break down each cost clearly and list the total amount at the bottom for easy reference.

These steps can help you create clear and effective sales invoices to streamline your payment processes. For an even easier and faster solution, consider using invoicing software.

Automating the invoice creation process saves you time and minimizes errors, allowing you to focus on growing your business.

Click the banner below to explore HashMicro’s Invoicing System pricing and find the perfect solution tailored to your needs.

Sales Invoice Example

Let’s look at a practical example to understand better how a sales invoice functions. This example will show you how to format your invoice, what details to include, and how to make it clear and effective for both your business and your clients:

Although creating sales invoices might seem challenging, but automating the process with invoicing software makes it much easier. These tools offer flexible customization to meet your specific business needs.

To streamline your invoicing, explore the best invoicing software and find the best solution.

What’s The Difference Between Sales Invoice and Other Sales Documents?

Besides invoices, the three most common sales documents are purchase orders, sales orders, and bills.

- Sales invoices are sent after providing goods or services to request payment. They include details on what was provided, how much is owed, and when the payment is due.

- Purchase orders are used by buyers to list what they want to buy from a seller. They detail the items, delivery preferences, and payment methods before the sale happens.

- Sales orders are sent by sellers after receiving a purchase order. They confirm that the seller can meet the buyer’s request and may adjust details like delivery times if needed.

- Bills are like invoices but are used for immediate payment. They generally don’t include detailed information or future payment terms and are often used for quick transactions.

Knowing how sales invoices differ from other documents helps you send the correct paperwork to the right clients, speeding up payments.

Send Sales Invoices That Get Paid Faster with HashMicro E-Invoicing

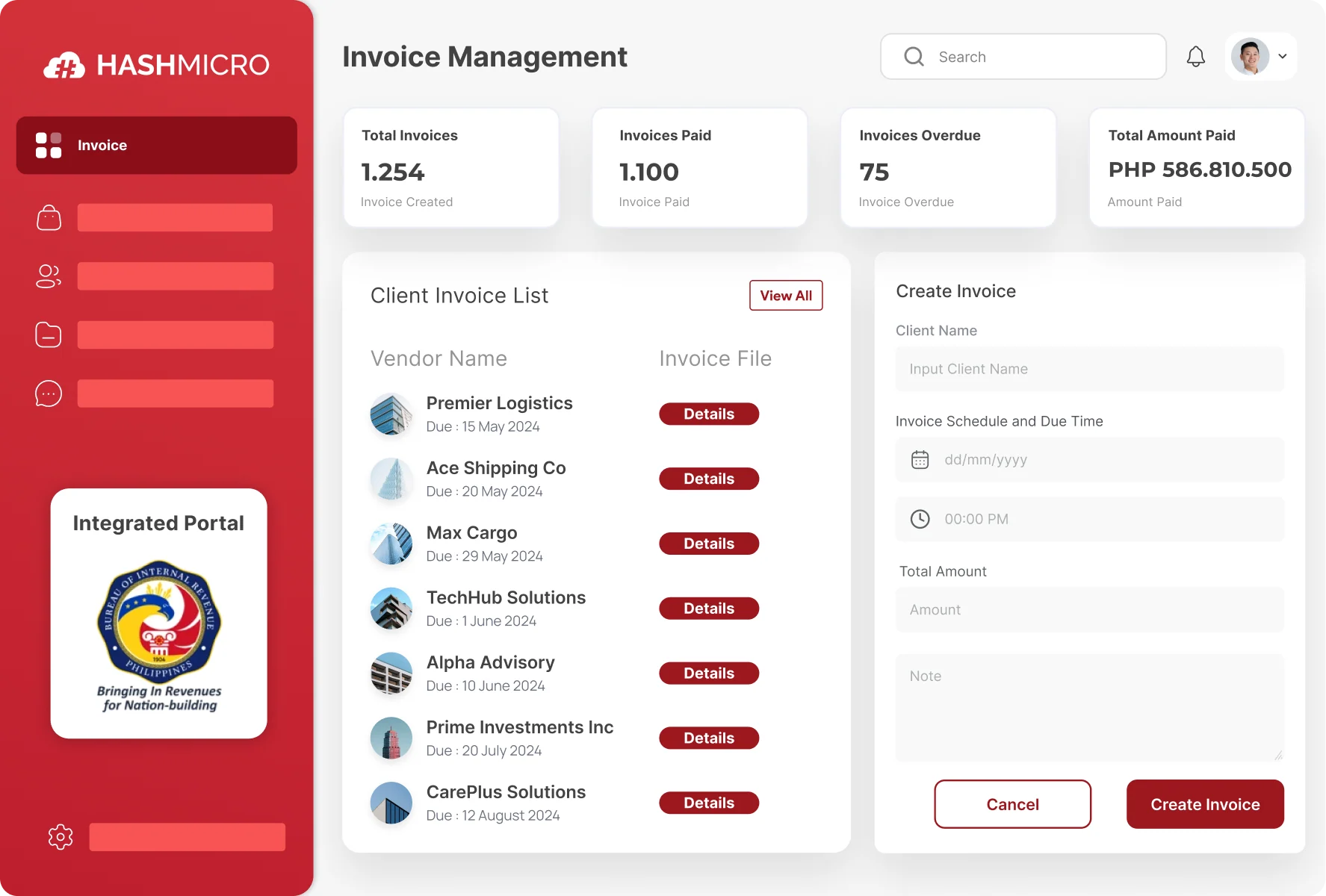

Speeding up payments starts with making the invoicing process smoother, and one of the best ways to do this is by using invoicing software. Hashy AI by HashMicro enhances this process by automating invoice management and follow-ups, ensuring no payment slips through the cracks.

With its smart capabilities, Hashy AI tracks invoices in real-time and sends timely reminders, helping businesses maintain a steady cash flow without manual intervention. Here’s how you can encourage quicker payment from your customers with HashMicro’s Invoicing Software:

- Quick invoice delivery: Send invoices swiftly via WhatsApp or email, ensuring they reach your clients without delay.

- Automated payment reminders: Automatically manage and send payment reminders to customers, keeping payments on track.

- Multiple payment options: Allow clients to pay through various methods, such as Virtual Accounts and QRIS, offering flexibility in how they settle invoices.

- Customisable templates: Design and tailor invoice templates to fit your company’s needs, making your invoices clear and professional.

These are the features and benefits that you will get if you use HashMicro’s Invoicing Software. You can streamline invoice creation, track payments, and automate reminders. This not only helps you get paid faster but also improves your overall financial management.

HashMicro also offers a free demo and consultation to show how their software can fit your invoicing needs. You can try out the system’s features and make sure it’s the right choice for managing your sales invoices effectively.

Moreover, HashMicro’s system follows BIR-CAS rules and connects directly with the EIS system. This makes tax reporting easier and ensures you follow local tax laws. With this compliance, your tax processes are simpler, and you stay up-to-date with all necessary regulations.

Conclusion

Managing your invoices well is important for keeping your business finances smooth. HashMicro’s Invoicing Software helps you create invoices automatically, track payments, and follow local tax rules, making the process easier and reducing mistakes.

With features like fast invoice delivery, automatic payment reminders, and customizable templates, you can get paid faster and manage your finances better. The software also makes tax reporting simpler by connecting with the EIS system.

Try a free demo of HashMicro’s Invoicing Software today. See how it can improve your invoicing process, help you get paid on time, and give you better control over your business finances.

Frequently Asked Questions About Sales Invoice

-

What is sales invoice vs official receipt?

A sales invoice usually contains details like the seller’s and buyer’s names, contact information, item descriptions, quantities, prices, and any relevant taxes. Meanwhile, an official receipt is a document the seller provides to the buyer as proof of payment.

-

Who gives the sales invoice?

A sales invoice is a document issued by a seller to request payment for goods or services delivered. It aids the seller in monitoring their income.

-

When to issue a sales invoice?

When a taxpayer sells goods or properties, they must issue a sales invoice at the time of the sale, regardless of whether it’s a cash or credit transaction. If the sale is on credit, the seller will provide a collection receipt once payment is received from the buyer.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “What is sales invoice vs official receipt?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “A sales invoice usually contains details like the seller’s and buyer’s names, contact information, item descriptions, quantities, prices, and any relevant taxes. Meanwhile, an official receipt is a document the seller provides to the buyer as proof of payment.”

}

},{

“@type”: “Question”,

“name”: “Who gives the sales invoice?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “A sales invoice is a document issued by a seller to request payment for goods or services delivered. It aids the seller in monitoring their income.”

}

},{

“@type”: “Question”,

“name”: “When to issue a sales invoice?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “When a taxpayer sells goods or properties, they must issue a sales invoice at the time of the sale, regardless of whether it’s a cash or credit transaction. If the sale is on credit, the seller will provide a collection receipt once payment is received from the buyer.”

}

}]

}