A tax invoice is crucial for recording sales transactions under tax laws. The P&A Grant Thornton mentioned that the Philippines updated its rules in 2024 to require VAT-registered businesses to issue electronic VAT invoices to ensure accurate reporting, reduce fraud, and avoid penalties.

Moreover, more than 100 of the largest taxpayers are already mandated to report sales data electronically by 2024, making these regulations crucial for all businesses. Adapting to these changes ensures your business stays compliant and avoids costly errors.

In this article, we will cover tax invoicing, its purpose, requirements, and types. You’ll also learn how HashMicro’s invoicing software can streamline the process, ensuring compliance and improving efficiency.

Key Takeaways

|

Table of Contents

What is a Tax Invoice?

In the Philippines, a tax invoice is crucial for documenting sales between buyers and sellers. Required by the BIR, it ensures that all sales details, including price, quantity, and taxes, are accurately reported for VAT compliance.

Accordingly, this document includes key information like the description, quantity, value of goods or services, and the tax charged. Businesses must provide this documentation for tax-registered customers to claim purchase credits.

Beyond recording sales, these invoices support accurate accounting and tax reporting. They are vital for businesses to claim input tax credits, especially in VAT or GST systems, ensuring compliance and proper financial management.

When is it Required?

A tax invoice is essential whenever a business sells goods or services subject to VAT. Consequently, businesses registered for VAT must give a sales invoice to the buyer for every sale. This is because the BIR requires it, and as a result, failing to do so can result in penalties.

Who Issues It?

The seller usually issues the tax invoice. It’s crucial that it be provided to the buyer at the time of sale so that the transaction can be properly documented.

However, in some cases, if a buyer is required to calculate VAT on their own, such as for imported goods or services, they may need to issue a tax invoice themselves.

What Information is Included?

For a tax invoice to be valid in the Philippines, it must include the following details:

- The seller’s name, address, and Tax Identification Number (TIN)

- The buyer’s name and address

- A description of the goods or services sold

- The quantity of goods or services

- The unit price and total amount due

- The VAT amount and the seller’s VAT registration number

- The date of the invoice

- A unique invoice number

Here is a tax invoice example, if a business sells 50 items at ₱500 each, with a 12% VAT, the tax invoice should show:

- Seller’s name, address, and TIN

- Buyer’s name and address

- Description of goods: 50 items

- Quantity: 50

- Price per item: ₱500

- Total price: ₱25,000

- VAT rate: 12%

- VAT amount: ₱3,000

- Invoice date: August 29, 2024

- Invoice number: 001234

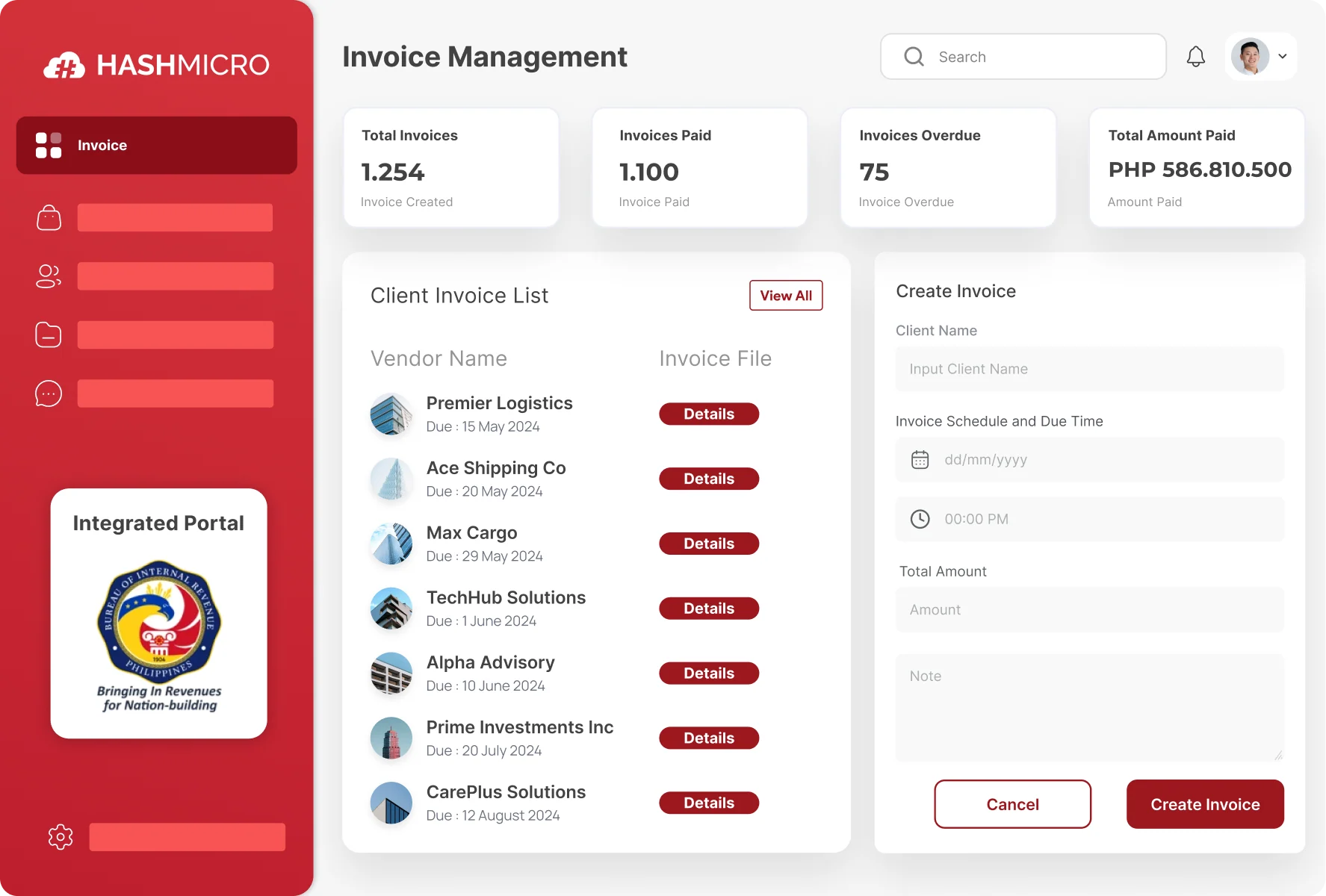

While it may seem like a lot of information to manage, HashMicro Invoicing Software makes it easy.

To emphasize, you can automate tax invoice creation, eliminate repetitive tasks, and use customizable templates to streamline your invoicing process. Thus, this ensures accuracy and saves you valuable time.

Types of Tax Invoices

Businesses use different types of tax invoices depending on the transaction. Here are three common types:

1. Full Tax Invoice

A full tax invoice is very detailed and includes all necessary information, such as the names and addresses of the seller and buyer, a description of goods or services, quantity, price, taxes, date, and invoice number. It’s typically used for large transactions or international trade.

For example, a construction company in Manila hires a contractor. The contractor provides a full tax invoice listing all details, such as materials, labour, VAT, and the total payment due

2. Simplified Tax Invoice

A simplified invoice contains less information but still meets BIR requirements. It’s often used for smaller transactions. It includes the seller’s name, the date, a brief description of goods or services, and the total amount payable, including taxes.

For example, a café in Cebu sells coffee and pastries. The café issues a simplified invoice showing its name, the date, a brief description of the items, and the total amount due, including VAT.

3. Electronic Tax Invoice

An electronic tax invoice is sent and received digitally. It includes all the required details like a paper invoice but is more convenient. As a result, this type of invoice is becoming more popular because of the rise of online shopping.

For example, an online retailer in Quezon City sells a product. The retailer sends an electronic tax invoice via email, listing the product, price, VAT, and total amount due.

All in all, understanding the types of tax invoices is key to managing finances effectively.

Using an accounting automation system to handle these invoices boosts accuracy, streamlines tasks, and ensures compliance with tax laws, making your business operations smoother and more efficient.

How to Prepare a Tax Invoice

Creating a tax invoice is essential for businesses as it ensures that you follow tax rules and make transactions run smoothly. Here’s a simple guide on how to prepare a tax invoice format.

Step 1: Gather Necessary Information

Start by collecting all the important details. This includes the seller’s name, address, and Tax Identification Number (TIN), the buyer’s name and address, a description of the goods or services, the quantity, the price, the VAT rate, and the total amount due.

Step 2: Choose or Create a Template

You can either use an online template or create your own using various software. Make sure the template has all the required information, such as seller and buyer details, item descriptions, and the total amount, including VAT.

Step 3: Fill in the Details

Once you have your tax invoice template, enter the transaction details. This includes the invoice number, the date, the names and addresses of the seller and buyer, and a clear description of what was sold.

Step 4: Calculate the Taxes

Use the correct VAT rate, usually 12% in the Philippines, to calculate the tax amount. Make sure the total amount due, including VAT, is clearly shown in Philippine Pesos (₱).

Step 5: Review and Finalize

Check the invoice carefully to ensure all the information is correct and nothing is missing. This step is important to avoid mistakes that could cause problems later.

Step 6: Send the Invoice

Once everything is correct, send the invoice to the buyer. You can do this by email or regular mail, depending on what your business prefers.

Following these steps will not only help you create a tax invoice format that meets legal requirements but also ensure your transactions are clear and well-documented.

In addition, proper invoices play a crucial role in avoiding misunderstandings and keeping your business running smoothly.

On the other hand, as your business expands, managing invoices manually can quickly become time-consuming and error-prone. This is why invoicing software can make a significant difference.

You can explore various invoicing software options to help with your tax invoicing processes.

Moreover, invoicing software automates everything, from generating invoices to calculating taxes and sending payment reminders. Consequently, it ensures accuracy, reduces human error, and saves valuable time by streamlining repetitive tasks.

So, click the banner below to explore HashMicro’s invoicing software pricing and find the perfect solution for your business.

Streamline Tax Invoicing Processes with HashMicro

HashMicro’s invoicing software boosts efficiency by automating tasks like creating, sending, and tracking invoices, reducing errors, and speeding up payment processing. It integrates with systems like accounting and HR, ensuring compliance and improving overall operations.

The software offers customizable templates, real-time reporting, and cloud storage to reduce human error. It also automates tax calculations and supports online payments, enhancing customer satisfaction. HashMicro even offers a free demo to help you get started.

Essential Features of HashMicro Invoicing Software

HashMicro’s invoicing software comes with several essential features that make it a powerful tool for businesses:

- Invoice Generation: Easily create and personalize invoice templates for different clients, reducing repetitive work.

- Tax & Discount Management: Automate tax and discount calculations for accurate invoices.

- Online Payment Management: Simplify payments with integrated online gateways, enhancing customer convenience.

- Credit Limit Management: Set credit limits for different clients to manage finances better.

- Invoice Approval & Validation: Streamline and authorize the approval process for special pricing or discounts.

- Real-Time Invoice Reporting: Track receipt VAT status and unpaid invoices, giving you a clear view of your financial standing.

By implementing this software, businesses can significantly improve their invoicing processes, reduce errors, and ensure compliance with tax regulations.

Conclusion

Tax invoicing is essential for accurate financial records and compliance with regulations. Invoicing software simplifies this process by automating key tasks, reducing errors, and ensuring timely payments, making it easier to manage your business finances.

HashMicro Invoicing Software offers a complete solution to streamline your tax invoicing and financial management. With advanced features, you can automate invoicing, integrate with accounting systems, and enhance overall efficiency, all while staying compliant with tax laws.

Ready to streamline your invoicing process? Try HashMicro Invoicing Software with a free demo today! Discover how it can transform your business operations and help you achieve better financial outcomes.

Frequently Asked Questions About Tax Invoice

-

Is a tax invoice a receipt?

Receipts and tax invoices serve different purposes. A receipt provides proof of purchase, enabling returns of damaged or faulty items to the seller. A tax invoice, on the other hand, displays the purchase price and indicates whether GST was charged.

-

Why do you need a tax invoice?

A tax invoice is essential for complying with Bureau of Internal Revenue (BIR) regulations. It provides a detailed sales record, ensuring accurate tax reporting, and allows VAT-registered buyers to claim input tax credits. It also serves as proof of a transaction for both parties.

-

What is the difference between tax invoice and bill of supply?

GST-registered businesses issue a tax invoice for transactions involving taxable goods or services. On the other hand, a bill of supply is used by businesses under the Composition Scheme or for transactions involving exempt, NIL-rated, or non-GST goods or services.