Imagine juggling multiple tasks without knowing what assets you have, where they’re located, or if they’re being used efficiently. Sounds a bit overwhelming, right? Sa mabilis na takbo ng negosyo ngayon, napakahalaga na alam mo ang bawat detalye ng iyong assets.

Guesswork won’t get you far, and this is where an asset audit becomes useful. Think of it as your map to recognizing everything you own, whether it’s equipment, technology, or other valuable resources.

By knowing exactly what’s on hand, you can avoid unnecessary costs and ensure your resources are used wisely. Kapag maayos ang lahat, mas magiging efficient ang mga proseso at posibleng tumaas pa ang kita.

This article will guide you through the steps to set up an effective asset audit and explain why it’s one of the smartest decisions for protecting your business and keeping operations smooth. Because when managing your assets, clarity is key!

Key Takeaways

|

Table of Contents

What is Asset Audit?

An asset audit is like a health check for your business’s physical resources. It reviews everything you own, from equipment and technology to machinery, to make sure it’s accounted for and in good condition.

In short, it gives you a clear view of what you actually have. The audit checks if your assets are listed in your records, are physically there, and are being used. It also looks at their condition to see if they are working well or need repairs.

This process helps you avoid unnecessary spending and keeps your business running smoothly. It also spots potential risks like wear and tear, ensuring you comply with regulations. Sa ganitong paraan, protektado at maayos ang pamamahala ng iyong mga yaman.

Regular asset audits help you stay organized, prevent losses, and make smarter business decisions. Whether done internally or with an auditor, an asset audit keeps your resources working effectively for you.

What are the Examples of Asset Audit?

Asset audits are crucial for businesses of all sizes as they help ensure that everything is in order and operating efficiently. Let’s explore some engaging examples of asset audits that can benefit various types of businesses in the Philippines:

-

Physical Asset

These include equipment, machinery, vehicles, and furniture. For instance, if you run a construction company, auditing your heavy machinery can help you check their condition and ensure they’re well-maintained. Similarly, a retail store can keep track of its furniture and fixtures to ensure everything is in good shape and being used effectively.

-

Technological Assets

This category focuses on hardware and software. Imagine you own an IT company—you would want to audit your computers, servers, and network systems regularly to make sure they’re secure and up to date. For example, reviewing your software licenses can help confirm that all are valid and in use, saving you from potential legal headaches down the line.

This category focuses on hardware and software. Imagine you own an IT company—you would want to audit your computers, servers, and network systems regularly to make sure they’re secure and up to date. For example, reviewing your software licenses can help confirm that all are valid and in use, saving you from potential legal headaches down the line.

-

Intangible Assets

These are valuable but non-physical items like patents, trademarks, and brand reputation. For instance, if you hold patents, it’s wise to assess their value and ensure they’re properly protected. This not only safeguards your intellectual property but can also boost your business growth and competitiveness.

-

Inventory

For retailers and manufacturers, auditing inventory is key to tracking stock levels and minimizing losses. Picture a grocery store regularly checking its inventory to spot discrepancies. This practice ensures they have just the right amount of products to meet customer demand while avoiding overstocking.

-

Real Estate Assets

If your business owns properties, conducting audits can help assess their value and condition. For example, a real estate firm might evaluate its rental properties to check if they’re generating expected income and whether they need repairs or upgrades. This can lead to more profitable investments.

-

Financial Assets

This includes cash, investments, and accounts receivable. Regular financial audits help review cash reserves and outstanding invoices to ensure accurate financial reporting. For a small business, auditing receivables can be an effective way to follow up on overdue payments, improving cash flow and overall financial health.

-

Human Resources Assets

While it’s less common, auditing employee records is essential for complying with labor laws and internal policies. A company can review employee files to ensure all necessary documents are complete and current, which helps maintain legal compliance and boost workforce efficiency.

What are the Benefits Do Companies Get From Asset Audit?

Conducting regular asset audits can unlock numerous benefits for your business, making operations smoother and more efficient. Here’s a friendly and engaging look at what you can gain:

-

Better Organization and Efficiency

Imagine walking into your workspace and knowing exactly where everything is located. A thorough asset audit by using a fixed asset audit checklist helps you track your assets, eliminating the hassle of misplaced equipment. A better organization allows your team to focus on what they do best, leading to smoother daily operations.

-

Cost Savings and Increased Profitability

By understanding your assets, you can avoid unnecessary purchases and make smarter financial decisions. For example, if you discover underutilized equipment, you can reallocate it instead of buying new items. This maximizes resource use and boosts profitability, allowing you to invest back into your business.

-

Accurate Accounting and Financial Reporting

Using asset audit tools, such as IT asset audit checklists, provides vital information about the condition and value of your assets. This accuracy ensures that your financial reports are reliable, making it easier to communicate with stakeholders and make informed decisions.

-

Asset Audit can improve Compliance with Regulations

Regular asset audits simplify compliance with government regulations. Keeping precise records prepares you for inspections and reduces the risk of penalties, allowing you to focus on growing your business.

-

Identification and Removal of Ghost Assets

A ghost asset is a fixed asset that cannot be found or used by a company because it either doesn’t physically exist anymore or is broken beyond repair. This means the asset is listed on the company’s books, but it’s not available for use in operation.

A ghost asset is a fixed asset that cannot be found or used by a company because it either doesn’t physically exist anymore or is broken beyond repair. This means the asset is listed on the company’s books, but it’s not available for use in operation.

An asset audit helps you identify and remove these ghost assets, leading to more accurate financial statements and preventing unnecessary tax obligations.

-

Increased Credibility with Investors and Stakeholders

Regular asset audits enhance your credibility with investors. When seeking investment or preparing to sell your business, accurate asset records reassure potential investors, making your company more attractive.

To make the most of these benefits, we invite you to explore our asset management software recommendation. It can help streamline the audit process and enhance your organization in a user-friendly way.

How to Perform an Asset Audit?

Ready to take your business operations to the next level? Conducting an asset audit is a smart way to enhance efficiency, improve financial accuracy, and ensure compliance. Don’t worry; it sounds more complicated than it is! Here’s a simple and engaging guide to help you through the process.

-

Gather Your Team and Plan

First things first: gather your team and outline your plan! Decide which locations and types of assets you want to audit. Assign specific roles and responsibilities, and set clear deadlines to keep everyone on track. A well-organized plan can make the process smoother and save you valuable time.

-

Collect Essential Asset Information

Now it’s time to dive into the details! Start by gathering important information about each asset. You’ll want to note:

-

-

Asset location

-

-

-

Asset model

-

-

-

Asset manufacturer

-

-

-

Serial number

-

-

-

Purchase or installation date

-

This information ensures that you have accurate records and helps verify that everything is in the right place.

-

Update Additional Asset Characteristics

An audit is the perfect opportunity to refresh your asset inventory. Record additional details such as:

-

Asset SKU (Stock Keeping Unit)

is a unique identifier like that similar to a code being assigned to each asset in a company’s inventory. It helps businesses track and manage their assets efficiently.

-

-

Asset color

-

-

-

Supplier information

-

-

-

User history

-

If you’re using an inventory app, consider adding high-resolution photos of your assets. Visuals can make tracking assets easier and more engaging!

-

Assess Current Asset Value

Next up, let’s determine the current value of your assets. Collaborate with your accounting team to gather accurate depreciation rates. Here are some methods you might use:

-

- Cost Method: The original purchase price.

- Market Value Method: The current market price.

- Value-Based Method: Original cost minus accumulated depreciation. Knowing the value of your assets helps you with budgeting and financial planning, giving you confidence in your decisions.

-

Check Asset Movement

Keep in mind how often your assets are moved or used. For example, vehicles or heavy machinery that frequently relocate may depreciate faster. Understanding this can help you plan for replacements and ensure you’re prepared for any future needs.

-

Conduct Physical Verification

Time for the fun part—getting hands-on! Verify each asset against your BIR inventory list. Check that each asset is present, confirm its condition, and ensure it meets regulations. This step is crucial for maintaining accurate records and identifying any discrepancies, so take your time!

-

Update Your Asset Register

Once you’ve completed the audit, it’s time to make some updates! Revise your asset register with any necessary changes. Tag any missing assets as ghost assets for future write-off. Updating discrepancies is key to keeping your records accurate and complete.

-

Leverage Technology for Future Asset Audit

Consider using asset tagging systems, inventory apps, or management software to streamline future audits. Technology can simplify tracking and ensure you always have accurate records at your fingertips.

How Does Asset Audit Work?

The asset auditing process is essential for ensuring that a company’s assets are accurately accounted for and properly managed. While the exact steps may vary depending on the organization and its auditors, the fundamental principles remain consistent. Below is an outline of the key steps involved in conducting an asset audit:

-

Define the Starting Point of Asset Audit

Begin by identifying the scope of the audit. This involves deciding whether to focus on specific types of assets, certain departments, or all assets owned by the company. Clearly defining the starting point helps streamline the auditing process.

-

Gather Asset Financial Records When Auditing

Collecting financial records is crucial for reference during the audit. This includes reviewing the company’s balance sheet to understand the listed assets. By having these documents on hand, auditors can cross-reference physical assets with what is reported in the financial statements.

-

Understand Regulations on Asset Audit

Familiarizing oneself with the regulations governing asset audits is an important step. Different companies may have specific rules regarding asset recording, especially for items not yet in physical possession. Knowing these regulations helps ensure compliance and accurate reporting.

-

Set Clear Objectives for Better Asset Audit

Establishing the goals of the audit allows companies to optimize the process. It’s beneficial for executives to discuss priorities with their financial teams before beginning the audit. This ensures that the most important objectives are addressed, leading to more focused and actionable reports.

-

Identify and Address Inconsistencies

After completing the audit, it’s essential to review the findings for any discrepancies. Companies often hold follow-up meetings to discuss any inconsistencies found during the audit process. If discrepancies arise, teams can formulate strategies to prevent similar issues in the future, thereby improving the accuracy of future audits.

How Can HashMicro Simplify Your Asset Auditing Process?

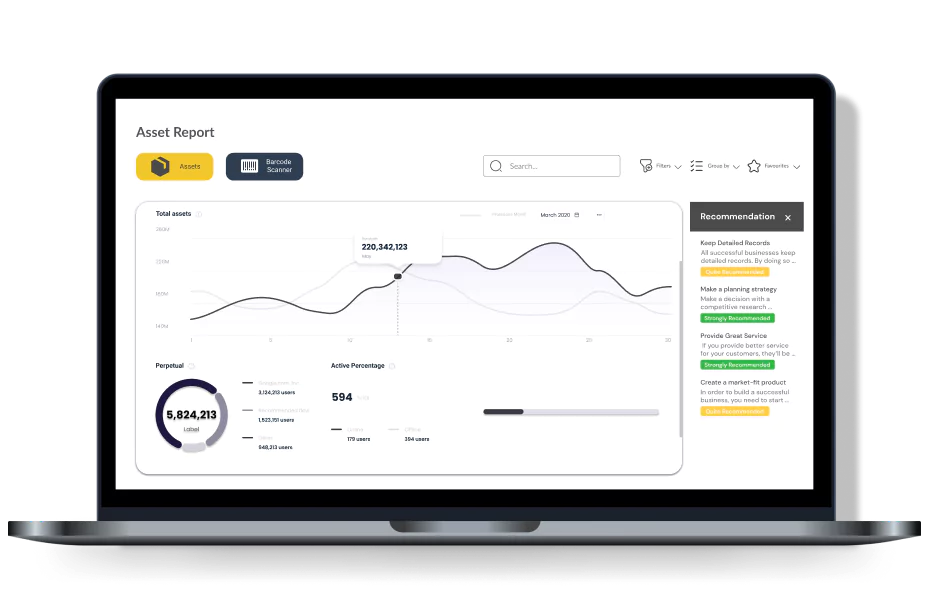

When it comes to managing assets, Filipino businesses deserve tools that make their lives easier. That’s where HashMicro Asset Management System steps in! Here’s how our digital asset audit solution can transform your asset auditing process into a smooth and efficient experience.

-

Seamless Asset Control Software

Our Asset Control module is designed with you in mind. It helps you keep track of all your assets effortlessly, ensuring everything is recorded accurately and easily accessible to the right teams. With this streamlined approach, you can optimize asset usage, minimize downtime, and boost your overall operational efficiency.

-

Boosting Equipment Effectiveness with OEE

One of the standout features we offer is Overall Equipment Effectiveness (OEE). This handy tool helps identify when your equipment isn’t in use, allowing you to take proactive measures to enhance productivity. For industries like manufacturing and construction, where reliable equipment is key, this feature can make all the difference.

-

Smart Maintenance Scheduling

Forget about unexpected breakdowns! With HashMicro, you can set up automatic maintenance schedules for your assets. This means you’ll never miss a maintenance check, keeping your equipment in top shape and your operations running smoothly.

-

Insightful Cost Reporting

Our software provides detailed reports on maintenance costs related to your assets. This valuable insight helps you budget wisely and make informed financial decisions. By keeping an eye on these expenses, you can minimize waste and boost your profitability.

-

Real-time GPS Tracking

Stay connected with your assets, no matter where they are! With our real-time GPS tracking feature, you can know the exact location of your equipment and vehicles. This is particularly beneficial for logistics and construction companies, enhancing efficiency and accountability across your operations.

-

Easy Barcode and QR Code Scanning

Reporting asset status has never been simpler! With HashMicro, your employees can use barcode and QR code scanning right from their mobile devices while on the go. This quick update process keeps everyone informed and helps avoid any miscommunication.

-

Customizable and Flexible Solutions

We understand that every business is unique. That’s why HashMicro is customizable to fit your specific needs. Unlike other ERP systems, our software offers the flexibility you need to ensure you’re getting exactly what works for you and your operations.

By choosing HashMicro’s Asset Control Software, you’re not just simplifying your asset auditing process; you’re setting your business up for success. Let us help you enhance your asset management and pave the way for greater productivity and profitability. Together, we can make asset auditing a breeze!

Conclusion

Conducting an asset audit isn’t just another task on your to-do list; it’s a smart way to boost your business operations. By regularly auditing your assets, you get a clear picture of what you have, how it’s performing, and where you can improve.

This not only helps you make better decisions but also saves costs and ensures everything runs smoothly. For businesses in the Philippines, keeping assets in check through regular audits means smoother operations and higher profits. On top of that, an audit ensures you stay compliant with regulations and avoid any financial slip-ups.

It also boosts your credibility with stakeholders, making your business more attractive to potential investors and partners. An organized asset management system impacts everything from day-to-day processes to your future growth plans.

To make things even easier, HashMicro’s Asset Management System offers an all-in-one solution. You can track, audit, and manage your assets in real time, set maintenance schedules, and generate useful reports, all from a single platform. Try our free demo today and see how HashMicro can simplify asset management and help your business reach new heights!