As the growing business hub in the Philippines, with SMEs and large enterprises thriving in industries like tourism and manufacturing, Cebu businesses need to implement accounting software.

With the Bureau of Internal Revenue (BIR) mandating businesses to use BIR-ready accounting software, choosing the right system ensures compliance and efficiency for your businesses, especially those in the Cebu area.

From handling invoices, expenses, and payroll to tracking assets and liabilities, an accounting solution tailored for Cebu-based businesses will streamline financial management.

With that said, let’s explore the top accounting software philippines for your business, shall we?

Key Takeaways

|

Table of Contents

Top Cebu Accounting Software in 2025

Here are the best accounting software options for businesses in Cebu:

- HashMicro Accounting Software – Best all-in-one BIR-accredited solution

- Xero – Best for cloud-based accounting and integration

- FreshBooks – Best for freelancers and service-based businesses

- Sage Intacct – Best for large businesses with advanced financial management needs

- Oracle NetSuite – Best for enterprises requiring an ERP-integrated system

- Authentic System Solutions – Best for local businesses needing customizable features

- Innosoft – Best for innovative financial management solutions

- Accountable – Best for small businesses seeking user-friendly accounting

- Fasttrack – Best for enterprises requiring fast and reliable financial processing

- N-Pax – Best for comprehensive business and accounting solutions

What is an Accounting System?

An accounting system is a tool that automates financial transactions, bookkeeping, and tax reporting. It helps businesses track revenue, expenses, assets, and liabilities while ensuring financial accuracy. With the right software, companies can simplify accounting tasks and reduce human errors.

For businesses in Cebu, using BIR CAS-ready software ensures compliance with local tax laws while making tax filing more efficient. This helps businesses save time and keep organized records for audits. By adopting accounting software, Cebu-based businesses can focus more on growth and less on manually managing financial processes.

Need to know!

AI-driven accounting enhances accuracy and regulatory compliance. Hashy, the AI assistant by HashMicro, supports Cebu businesses in achieving seamless financial management.

Get a Free Demo Now!

Benefits of Using Accounting Software

Accounting software provides numerous advantages that help businesses operate smoothly and comply with tax regulations. Whether you’re a small startup or a growing enterprise, having an efficient accounting system can significantly improve financial management and avoid accounting problems.

Here are some ways an accounting software could help your business:

- Compliance with BIR Regulations – Ensures accurate tax reporting and financial statements.

- Time and Cost Savings – Reduces manual work and prevents costly errors.

- Real-time Financial Insights – Helps business owners make data-driven decisions.

- Scalability – Adapts to business growth with additional features as needed.

- Integration with Other Business Tools – Works seamlessly with payroll, inventory, and CRM systems.

By implementing accounting software, businesses in Cebu can optimize financial processes, reduce human errors, and ensure seamless tax compliance. Investing in the right system also allows companies to focus on growth while keeping financial management efficient and stress-free.

Top 10 Cebu Accounting Software Options

Previously, we’ve only simply covered the basics. Now, let’s dive deeper into why those 10 software are the best options for your business, especially those based in Cebu. Let’s start with the first one:

1. HashMicro Accounting Software

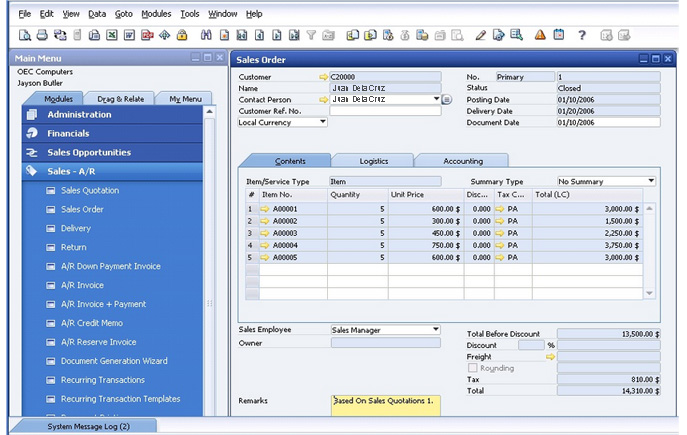

HashMicro is an accredited BIR accounting software designed to simplify financial management for businesses of all sizes. It helps companies track transactions, assets, liabilities, and expenses with precision, ensuring compliance with local regulations.

For businesses in Cebu, HashMicro is a game-changer. Its intuitive interface, combined with its powerful automation features, reduces human errors and speeds up financial processes. Whether you run a small startup or a large enterprise, HashMicro’s BIR-compliant system ensures you stay on top of tax obligations without the hassle.

By choosing HashMicro Accounting Software, Cebu businesses can enhance financial accuracy, streamline accounting operations, and stay BIR-compliant. Don’t miss out – join the free demo today!

Why choose us? This software automates tedious accounting tasks, allowing businesses to focus on strategic growth rather than manual data entry. It integrates seamlessly with other business tools like inventory management, CRM, payroll, and more.

HashMicro Accounting Software Features:

- Asset Database and Depreciation – Manage company assets, track depreciation, and generate accurate reports effortlessly.

- Client Monitoring Dashboard – Get a complete view of client transactions, invoices, and financial records in one place.

- PFRS-Compliant Financial Reporting – Generate detailed financial statements that align with Philippine Financial Reporting Standards.

- Financial Budgeting and Realization – Set financial goals, track expenses, and compare budgets with actual performance.

- Automated Tax Calculation – Ensure accurate tax computations and effortlessly stay compliant with BIR regulations.

- Profit and Loss with Templates and Budget Forecast – Gain insights into your financial health with customizable reports.

| Pros | Cons |

|---|---|

|

|

2. Xero

Xero is a cloud-based accounting software designed to help businesses automate financial processes and stay on top of their finances. It offers an intuitive interface that makes it easy to manage invoices, track expenses, and ensure tax compliance with real-time financial insights.

With its powerful automation features and integration with banking systems, Xero provides a seamless way for Cebu businesses to handle financial transactions. It is ideal for small and medium-sized enterprises looking for a scalable, cloud-based solution.

Why choose Xero? This software simplifies financial management by allowing businesses to access their accounting data anytime, anywhere. It integrates with multiple business tools, enabling efficient bookkeeping and reducing manual errors.

Xero Accounting Software Features:

- Bank Reconciliation – Sync transactions with bank feeds for accurate financial tracking.

- Expense Tracking – Monitor expenses in real-time and categorize spending.

- Multi-Currency Support – Manage transactions in different currencies with automatic conversions.

- Financial Reporting – Generate financial statements and reports with insights into business performance.

- Mobile Access – Access accounting data on the go with the Xero mobile app.

| Pros | Cons |

|---|---|

|

|

3. FreshBooks

FreshBooks is cloud-based accounting software tailored for freelancers and service-based businesses. It simplifies financial management with user-friendly tools and an intuitive interface that streamlines invoicing, expense tracking, and time management, allowing professionals to focus more on their core services.

For businesses in Cebu, FreshBooks provides a seamless solution to handle financial tasks efficiently. Its automation features reduce administrative workload, enabling business owners to manage their finances on the go through mobile accessibility.

Why choose FreshBooks? This software automates routine accounting tasks, saving time and reducing errors. It offers customizable invoicing, expense tracking, and time management features, all accessible through a user-friendly interface.

FreshBooks Accounting Software Features:

- Expense Tracking – Capture receipts using your smartphone, categorize expenses, and monitor spending to maintain financial organization.

- Time Tracking – Record work hours, assign them to specific projects or clients and generate accurate invoices based on tracked time.

- Project Management – Collaborate with team members, set project timelines, and monitor progress within the platform.

- Financial Reporting – Generate detailed reports on profit and loss, sales tax summaries, and expense reports to gain financial insights.

- Scalability – Adaptable to your business growth, FreshBooks offers plans and features that scale with your needs.

| Pros | Cons |

|---|---|

|

|

4. Sage Intacct

Sage Intacct is a cloud-based financial management solution tailored for large enterprises seeking advanced accounting capabilities. It automates core financial processes, offers real-time reporting, and scales to support business growth.

For businesses in Cebu, Sage Intacct provides a robust platform to manage intricate financial structures, ensuring compliance with local and international standards. Its modular design allows customization to fit specific industry needs, making it ideal for enterprises operating in diverse sectors.

Why choose Sage Intacct? This software enhances financial visibility and operational efficiency. The intuitive dashboards and customizable reports empower decision-makers with actionable insights, facilitating strategic planning and resource allocation.

Sage Intacct Accounting Software Features:

- Accounts Receivable Management – Accelerates cash flow by automating invoicing and collections, ensuring timely payments.

- Cash Management – Provides real-time visibility into cash positions, enabling effective liquidity management across accounts.

- Project Accounting – Tracks project costs and revenues, offering insights into profitability and performance.

- Inventory Management – Monitors stock levels and automates reorder processes to maintain optimal inventory.

- Financial Reporting and Dashboards – Generates customizable reports and dashboards, delivering real-time insights into financial metrics.

By adopting Sage Intacct, Cebu-based enterprises can enhance their financial operations, achieve greater transparency, and support strategic growth initiatives.

| Pros | Cons |

|---|---|

|

|

5. Oracle NetSuite

Oracle NetSuite is a powerful ERP-integrated accounting solution designed for enterprises seeking a comprehensive financial management system. It automates core accounting tasks, improves operational efficiency, and offers real-time financial insights to help businesses make data-driven decisions.

For Cebu-based businesses, Oracle NetSuite delivers a scalable, cloud-based solution that supports financial operations across multiple locations. Its automation features reduce manual errors and streamline reporting, making it ideal for large enterprises with complex financial structures.

Why choose Oracle NetSuite? This software simplifies financial management by integrating accounting, inventory, procurement, and compliance within a single platform. With AI-powered analytics, businesses gain valuable insights into their financial health, allowing for better forecasting and strategic planning.

Oracle NetSuite Accounting Software Features:

- Comprehensive ERP Integration – Connects accounting with sales, inventory, and procurement for a unified system.

- Automated Financial Management – Reduces manual processes and enhances accuracy in reporting.

- Customizable Financial Reports – Generates tailored financial statements to meet specific business needs.

- Cloud-Based Accessibility – Enables businesses to access financial data anytime, anywhere.

- Regulatory Compliance Management – Ensures adherence to tax laws and financial regulations.

By adopting Oracle NetSuite, Cebu-based enterprises can improve financial accuracy, enhance operational efficiency, and gain deeper visibility into their business performance.

| Pros | Cons |

|---|---|

|

|

6. Authentic System Solutions

Authentic System Solutions is flexible and customizable accounting software designed to cater to the unique needs of local businesses. It simplifies financial management by enabling businesses to track transactions, monitor expenses, and generate detailed financial reports easily.

For Cebu-based businesses, this software provides a localized approach to accounting, ensuring compliance with regional tax laws while offering scalable solutions that grow alongside a company’s expansion.

Why choose Authentic System Solutions? This software offers a user-friendly interface and advanced financial tracking, making it an excellent choice for small to medium-sized enterprises. It seamlessly integrates with other business tools to provide an all-in-one accounting experience.

Authentic System Solutions Accounting Software Features:

- Customizable Financial Reports – Generate detailed reports tailored to specific business needs.

- Automated Expense Tracking – Simplifies monitoring and categorizing expenses for accurate budgeting.

- Tax Compliance Management – Ensures adherence to BIR regulations and tax filing requirements.

- Invoice and Billing System – Create, send, and manage invoices efficiently.

By adopting Authentic System Solutions, Cebu-based businesses can enjoy greater financial efficiency, improved tax compliance, and enhanced decision-making through powerful automation and reporting tools.

| Pros | Cons |

|---|---|

|

|

7. Innosoft

Innosoft is a cutting-edge financial management software designed to help businesses automate their bookkeeping, tax compliance, and invoicing. It provides an easy-to-use interface and robust automation features that make accounting simpler and more efficient.

For Cebu businesses, Innosoft is an excellent choice for those needing a flexible and scalable accounting system. Its cloud-based capabilities allow business owners to manage finances from anywhere, ensuring real-time updates and seamless data access.

Why choose Innosoft? This software minimizes manual work by automating essential accounting processes, reducing errors, and increasing efficiency. It also integrates well with other business applications, making financial management smoother and more streamlined.

Innosoft Accounting Software Features:

- Automated Bookkeeping – Reduces manual data entry and ensures accurate financial records.

- Tax Compliance Management – Keeps businesses compliant with BIR regulations and simplifies tax reporting.

- Invoice and Billing System – Allows easy creation and tracking of invoices to ensure timely payments.

- Seamless Integration – Connects with other tools such as payroll, inventory, and CRM systems.

By choosing Innosoft, Cebu-based businesses can enhance financial efficiency, stay tax-compliant, and ensure seamless financial management without the hassle of manual accounting tasks.

| Pros | Cons |

|---|---|

|

|

8. Accountable

Accountable is a highly intuitive accounting software tailored for small businesses that need an easy-to-use financial management system. It helps business owners track income and expenses and manage tax compliance effortlessly, allowing them to focus on business growth rather than complex bookkeeping tasks.

For Cebu-based businesses, Accountable provides a simple yet effective way to manage finances without requiring extensive accounting knowledge. Its user-friendly dashboard, automation capabilities, and tax preparation features make it a perfect fit for startups and small enterprises looking for cost-effective solutions.

Why choose Accountable? This software offers a clean, no-fuss interface that reduces the learning curve, making financial management easier for non-accountants. It also automates invoicing and tax calculations, ensuring accuracy and compliance with local regulations.

Accountable Accounting Software Features:

- Expense Management – Track spending with categorized expenses and digital receipt uploads.

- Tax Preparation Tools – Automate tax calculations and generate reports for easier tax filing.

- Cash Flow Tracking – Monitor incoming and outgoing funds with real-time insights.

- User-Friendly Dashboard – Intuitive interface designed for non-accountants and small business owners.

By using Accountable, Cebu-based small businesses can take control of their finances with a simple, reliable, and efficient accounting solution.

| Pros | Cons |

|---|---|

|

|

9. Fasttrack

Fasttrack is an enterprise-focused accounting solution designed for businesses that require fast, reliable, and automated financial processing. It optimizes core accounting tasks, including auditing, payroll, and tax compliance, reducing manual workload and increasing accuracy.

For Cebu-based enterprises, Fasttrack provides a seamless financial management experience, ensuring compliance with BIR regulations while improving efficiency. With its automation capabilities, businesses can eliminate repetitive processes, gain real-time financial insights, and enhance decision-making.

Why choose Fasttrack? This software is built for businesses that need precision, speed, and reliability in managing their financial data. It integrates with various enterprise systems, streamlining operations and minimizing errors.

Fasttrack Accounting Software Features:

- Automated Auditing Tools – Reduces errors and ensures compliance with accounting standards.

- Payroll Management – Simplifies salary processing, tax deductions, and employee payment tracking.

- Real-Time Financial Monitoring – Provides up-to-date insights into revenue, expenses, and cash flow.

- Integration with ERP Systems – Seamlessly connects with other business management tools for enhanced efficiency.

By choosing Fasttrack, Cebu businesses can streamline financial operations, improve compliance, and maintain accurate, real-time financial records with minimal effort.

| Pros | Cons |

|---|---|

|

|

10. N-Pax

N-Pax is a robust accounting and business management solution designed to help companies efficiently handle their financial data. It streamlines financial operations, inventory tracking, and compliance management, ensuring businesses have accurate records.

For Cebu-based businesses, N-Pax offers a localized approach to financial management, supporting regulatory compliance while improving efficiency. With its automation capabilities, businesses can reduce manual processes, enhance accuracy, and make data-driven financial decisions.

Why choose N-Pax? This software provides a powerful suite of financial tools that integrate seamlessly with other business functions, enabling companies to stay on top of their operations.

N-Pax Accounting Software Features:

- Automated Financial Management – Reduces manual data entry and ensures financial accuracy.

- Regulatory Compliance Tools – Ensures businesses meet BIR and other local tax regulations.

- Secure Cloud-Based Access – Enables users to manage financial data anytime, anywhere.

- User-Friendly Interface – Simplifies accounting for non-accountants while offering powerful features for finance professionals.

By adopting N-Pax, Cebu businesses can take control of their financial management, improve compliance, and optimize efficiency with a reliable, automated accounting solution.

| Pros | Cons |

|---|---|

|

|

How to Choose the Best Cebu Accounting Software

Selecting the right accounting software is essential for Cebu businesses to manage finances efficiently and stay compliant with local regulations. A well-suited accounting system will simplify financial processes, automate tax compliance, and help businesses make informed financial decisions.

Before making a decision, consider the following factors to ensure that the chosen software aligns with your business needs:

- Budget – Find software that fits your financial capacity without sacrificing essential features.

- Features – Ensure it includes invoicing, expense tracking, tax compliance, and financial reporting.

- Scalability – Choose a system that can grow with your business.

- Integration – Look for software that connects with banking, inventory, and HR tools.

- Security – Prioritize data protection and compliance with local laws.

Investing in the right accounting software will help Cebu businesses save time, reduce errors, and maintain compliance with BIR regulations. With automated processes and real-time insights, business owners can focus on strategic growth while keeping financial management simple and stress-free.

Conclusion

Cebu businesses need accounting software to automate financial transactions, track expenses, and simplify tax reporting. Using BIR-compliant software helps businesses manage finances accurately, ensuring compliance and efficiency. The right system allows companies to reduce errors and improve decision-making.

Choosing HashMicro Accounting Software will give Cebu businesses a reliable and fully integrated solution for financial management. With automation, real-time insights, and compliance-ready tools, it simplifies accounting for startups and enterprises alike. Join the free demo today and experience effortless financial management!

Frequently Asked Questions

-

Which software is mostly used for accounting?

HashMicro, Xero, and FreshBooks are popular accounting software. They offer invoicing, expense tracking, and financial reporting features.

-

What software do you need for accounting?

You’ll need software like HashMicro for bookkeeping, payroll, and financial management. Choose one based on your business size and needs.

-

What is the basic accounting system?

A basic accounting system tracks income, expenses, assets, and liabilities. It often uses double-entry bookkeeping for accurate financial records.