Xero invoice alternatives have gained attention for offering solutions that cater to businesses with specific needs in terms of functionality, cost, or tool integration.

While Xero is popular for its easy-to-use accounting and invoicing features, it may not suit every business. Thankfully, there are other great tools available. In this article, we’ll explore exciting Xero invoice alternatives that provide simple and efficient solutions.

Ang mga alternatibong ito ay ginawa para gawing mas madali ang pag-i-invoice, tumutulong sa mga negosyo na mabilis makagawa, makapag-send, at ma-track ang kanilang mga invoice.

We’ll highlight each Xero invoice alternative’s unique features and benefits to help you find the best fit for your business.

Key Takeaways

|

Table of Contents

What is Xero?

Xero is a well-known accounting software that small and medium-sized businesses and startups actively use. Since its founding, the company has focused on automating routine tasks and providing comprehensive financial management solutions.

As a result, Xero helps businesses become more competitive while simplifying everyday administration. The software offers features such as cloud-based access, automatic bank feeds, and customizable invoicing.

Furthermore, users can generate essential financial reports and collaborate seamlessly with team members. With over 800 third-party integrations, including Xero Payroll, it enhances its functionality to meet various business needs.

Moreover, Xero allows customization through user-defined fields and branded invoice templates. It also supports payment gateways like Stripe and PayPal, enabling quick payments while sending automated reminders for overdue invoices.

Consequently, its cloud-based nature enables multiple users to access the platform simultaneously, ensuring everyone has up-to-date information.

Need to know!

Using AI in e-invoicing automatically updates vendor payment status and improves budget planning for smooth cash flow. One of the finest options is Hashy AI with innovative features.

Get a Free Demo Now!

What are Xero Features that Would Benefit Your Business?

Xero offers a range of powerful features designed to enhance financial management for businesses of all sizes. By leveraging these features, you can streamline processes, improve efficiency, and gain valuable insights into your financial health. Please take a look at the features below:

-

Cloud-Based Accessibility

Allows you to access your financial data from anywhere, anytime, using any device with internet connectivity. This flexibility supports remote work and enhances collaboration among team members and advisors.

-

Invoicing and Billing

Enables you to create professional invoices easily, customize templates, and automate recurring billing. This feature helps improve cash flow by facilitating faster payments through online payment options.

-

Expense Tracking and Management

Provides mobile app functionality that allows you to capture and manage expenses on the go, ensuring better control over spending through real-time tracking and categorization of transactions.

-

Bank Reconciliation

Automatically syncs bank transactions for error-free reconciliation, saving time and reducing manual errors in financial records. This feature enhances the accuracy of your financial reporting.

-

Integration with Third-Party Apps

Offers compatibility with over 1,000 applications, allowing you to customize your accounting solutions according to your specific needs and streamline workflows.

If you want to know more, please check out Xero invoice alternatives to empower businesses, enhance their financial management processes, save time on manual tasks, and improve collaboration with stakeholders.

By choosing Xero, you gain a valuable partner to help your business achieve financial success.

Why Do You Need Invoicing Software?

How Do Both Advantages and Disadvantages of Xero Affect Your Business?

Xero is a well-known cloud-based accounting software that comes with both advantages and disadvantages, which can significantly affect businesses. Understanding both Xero’s advantages and disadvantages help organizations decide if Xero is suitable for their financial management needs.

While Xero is a popular accounting software, it has some potential drawbacks that have prompted businesses to explore other options. These alternatives offer a variety of unique features and benefits that might better suit your company’s needs. Below are ten noteworthy Xero invoice alternatives to consider:

-

HashMicro

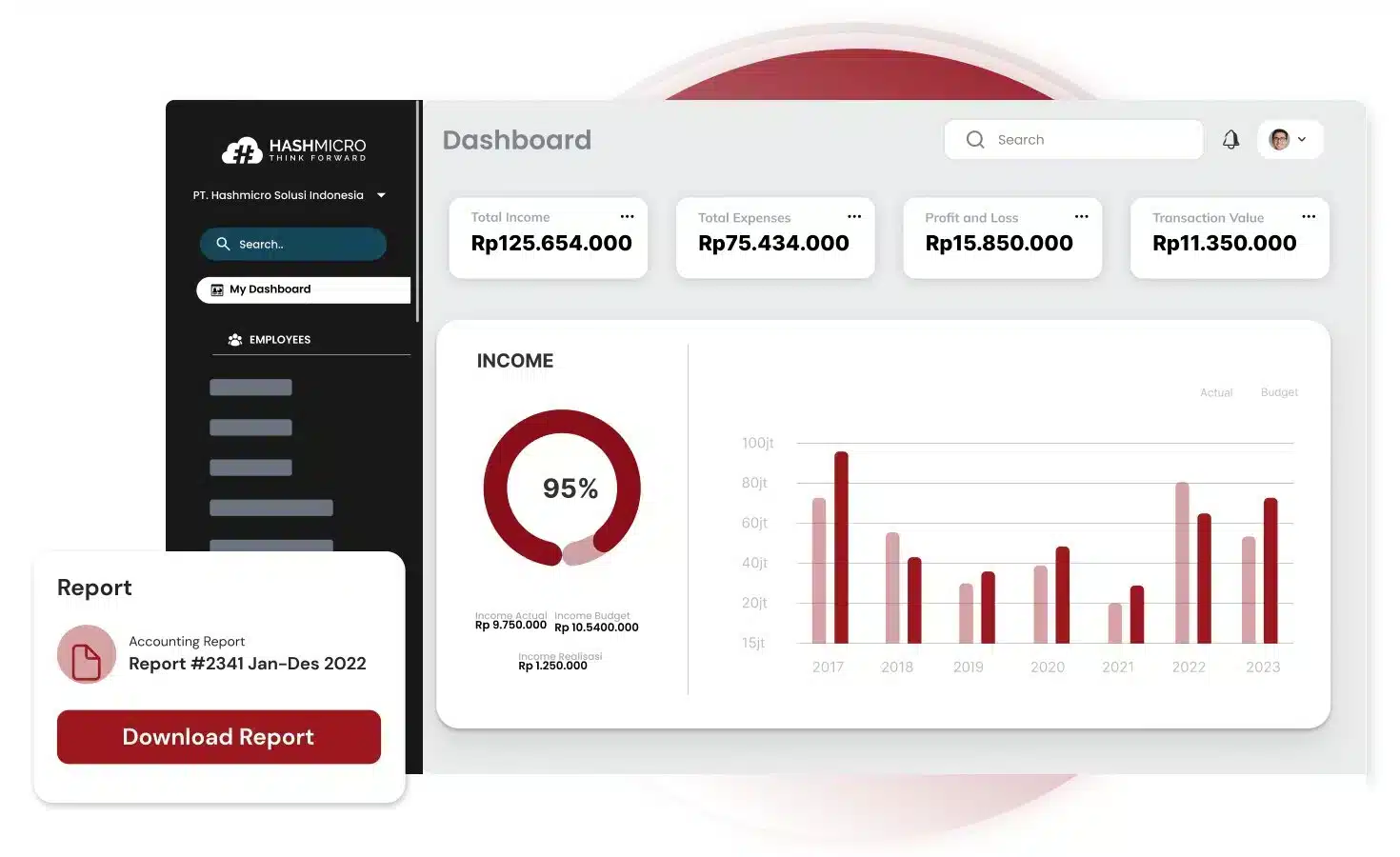

HashMicro inventory is suitable for businesses seeking a customizable inventory system that can be tailored to their specific needs as well as tracking their invoices more efficiently. With the integration of Hashy AI the system becomes smarter, enabling automated processes and predictive analytics to optimize inventory management.

It helps streamline business processes by transitioning from paper invoices to more practical and efficient digital invoices. This not only simplifies operations but also enhances cost efficiency, making it a great option for companies aiming to optimize their workflow.

Want to improve your invoicing process? HashMicro’s invoicing software makes it simple to create and manage invoices automatically. Say goodbye to manual work and mistakes and enjoy quicker payments and better tracking.

If you’re interested in seeing how it works for your business, try the free demo! There’s no commitment, so it’s a great way to discover how HashMicro and Hashy AI can help make your invoicing easier and more efficient!

If you want to know more, below are some of the best features of HashMicro Inventory that worth to be considering:

-

-

Creating invoices

-

The invoice generation feature makes it easy for you to create invoices using specific templates. You can even customize these templates for different clients. This way, you won’t need to remake a template each time, even if you’re sending it to a different recipient.

Once the required data is filled in, you can print or send the invoice directly via email.

-

-

Tax & discount management

-

When creating an invoice, it’s important to include the appropriate tax deductions and discounts according to the transaction value. Electronic invoice software simplifies this process by automatically calculating the taxes and discounts for each client.

This automation ensures that every invoice is processed with accurate calculations, reducing the chance of errors and saving you time compared to manual calculations. As a result, the final total on the invoice is more precise and tailored to each transaction.

-

-

Managing credit limits

-

Besides calculating tax deductions and discounts, e-invoice software with credit limit management features also helps you set different credit limits. Each client has their own credit limit, which can be based on the prices of your company’s products or services.

-

-

Real-time invoice reporting

-

The sixth feature is extremely useful for keeping track of how long invoices have been outstanding. It also allows you to identify any invoices that haven’t been paid yet, giving you a clear picture of your overall revenue.

This way, you can easily monitor your income and follow up on any payments that are overdue.

-

-

Online payment management

-

The third feature focuses on managing online payments. With this feature, customers can easily make their payments using an online payment gateway, which simplifies the transaction process.

Additionally, it enables the sending of receipts through the same portal, making it convenient for both the business and the customer. This feature is particularly beneficial for streamlining the purchase order process that companies need to handle, ensuring everything runs smoothly from payment to receipt.

-

-

Invoice verification and approval

-

Some invoices including sales invoice may include special prices or discounts for certain transactions. This system allows you to handle the approval and verification of invoices that feature these special pricing options.

By using this system, you can ensure that the invoices are accurately checked and approved, making it easier to manage transactions with unique pricing arrangements.

Besides the main features, understanding both the advantages and disadvantages that the system has are crucial for your decision in choosing the best Xero invoice alternatives system. You may look at the table below:

Advantage |

Disadvantage |

|

|

If you’re unsure and eager to find the perfect pricing plan for your company’s needs, click the banner below! You’ll uncover all the details about HashMicro as the top-rated e-invoicing software in the Philippines, including pricing options and the amazing features it offers to streamline your invoicing process.

Quickbooks Online

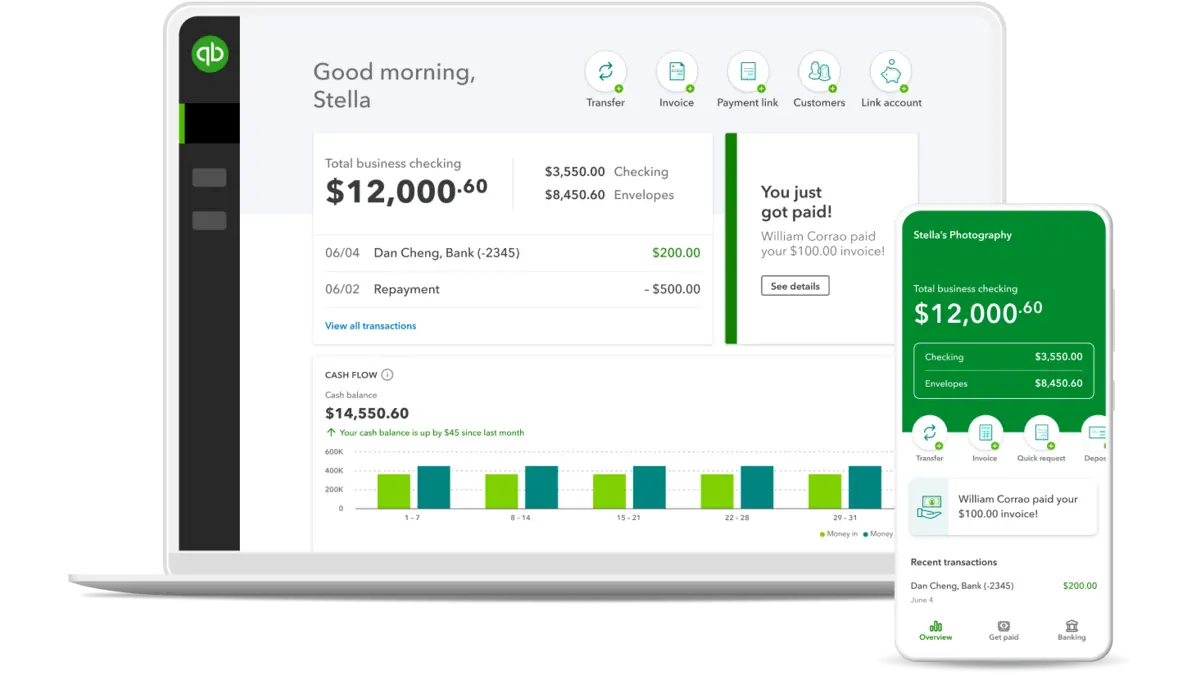

QuickBooks by Intuit is renowned for its simplicity and effective financial management solutions, particularly for small to medium-sized businesses. The QuickBooks accounting software offers essential features that streamline invoicing and accounting tasks, making it a preferred choice for many users.

With QuickBooks accounting software, users can automate invoicing, customize templates, and set up recurring invoices while also tracking invoice status for timely follow-ups. It integrates directly with bank accounts and credit cards, automating transaction syncing and simplifying expense and income tracking to enhance overall efficiency.

In addition, it provides tools for tracking billable hours, generating immediate financial reports like profit and loss statements, and managing expenses efficiently through mobile receipt uploads. These features make QuickBooks an ideal solution for businesses looking to improve financial organization and decision-making.

Advantage |

Disadvantage |

|

|

QuickBooks Online software: ideal choice for companies seeking reliability and convenience in managing their finances. Its user-friendly interface and dependable customer support ensure smooth financial management, allowing businesses to thrive and succeed.

Initial price:

-

- Simple Start: ₱ 320,33 / $ 5,70 per month

- Essential : ₱ 472,07 / $ 8,40 per month

- Plus : ₱ 674,39 / $ 12 per month

- Advanced : ₱ 1281,34 / $ 22,80 per month

-

FreshBooks

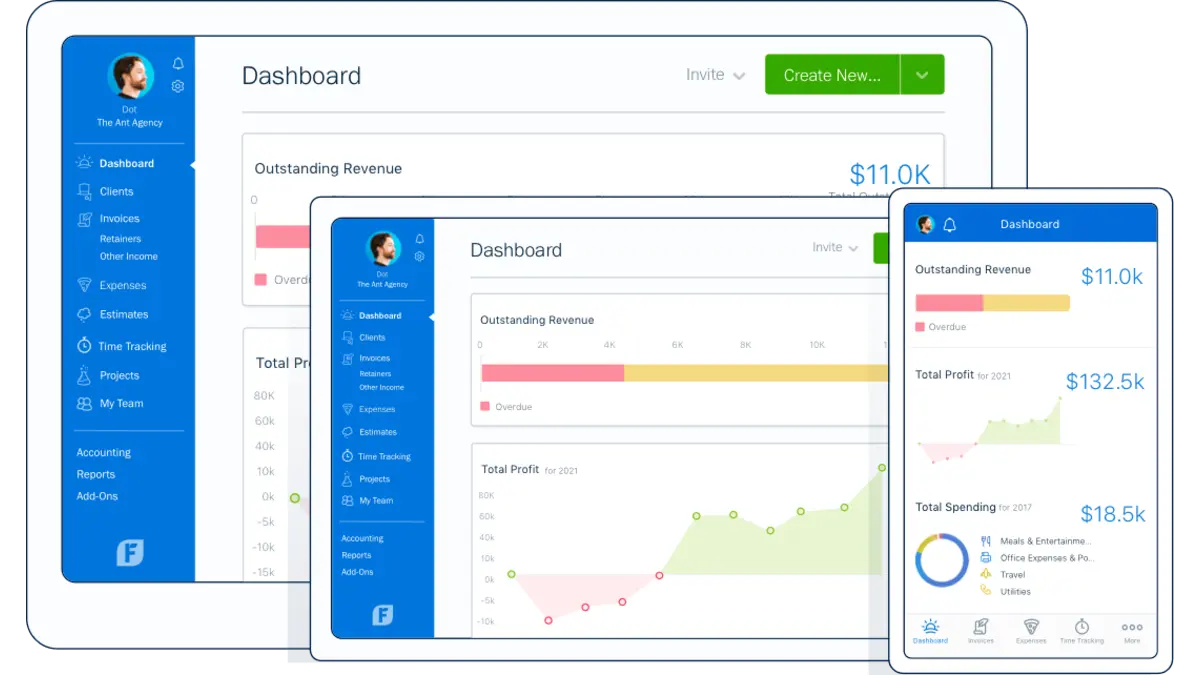

FreshBooks is a user-friendly online accounting and invoicing platform designed for small businesses and freelancers, helping them manage finances effortlessly.

With features like customizable invoices, automatic payment reminders, and expense tracking, it allows users to focus on their business instead of financial details.

The platform also includes tools for time tracking, project management, real-time financial reporting, and mileage tracking.

It integrates smoothly with other software, streamlining workflows and improving overall efficiency, making it a valuable solution for business financial management.

Advantage |

Disadvantage |

|

|

FreshBooks Software: the ideal choice for small businesses, freelancers and service-based professionals who want to simplify their financial management. Its easy-to-use interface allows users to focus on their core business activities while efficiently handling invoicing, expense tracking, and time management.

Initial price:

-

- Lite : ₱ 320,33 / $ 5,70 per month

- Plus : ₱ 556,37 / $ 9,90 per month

- Premium : ₱ 1011,58 / $ 18,00 per month

- Select : discuss with a specialist

-

Wave

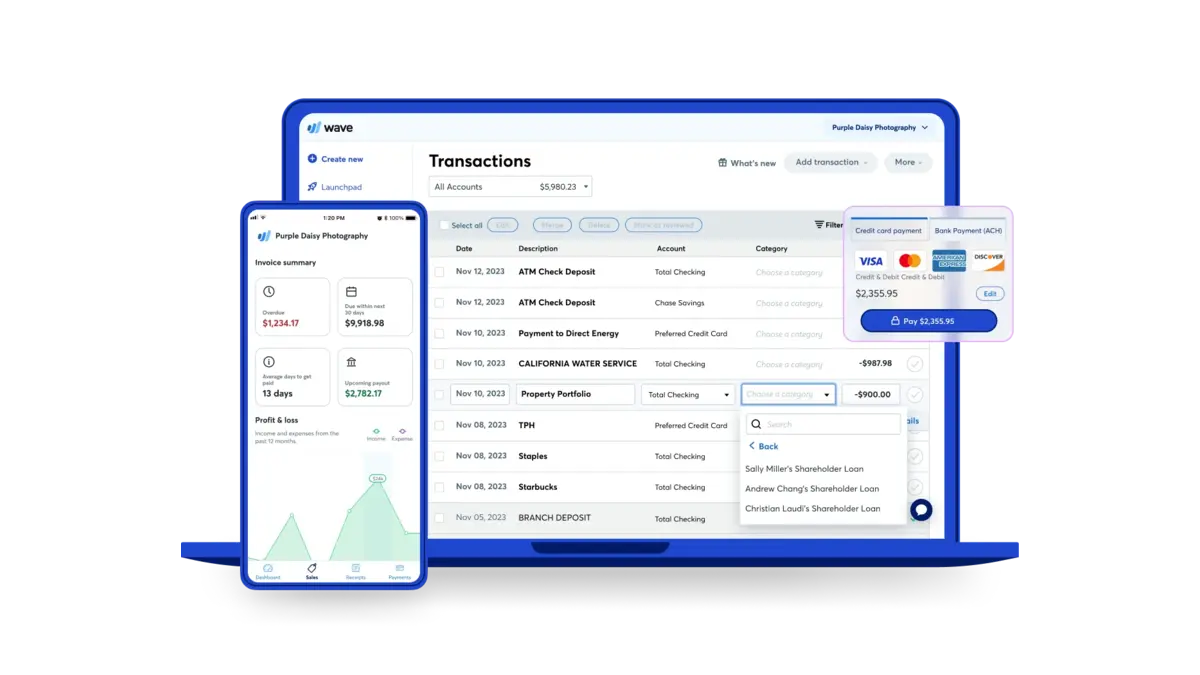

As one of the Xero invoice alternatives software, this platform offers small businesses free, easy-to-use tools that simplify financial management.

Its intuitive design allows users to navigate features like invoicing, expense tracking, and payroll effortlessly. Consequently, they can focus on business growth rather than complex accounting tasks. This user-friendly approach ensures that even those with little accounting experience can manage their finances effectively.

Moreover, users can access all customer information in one centralized location, eliminating the need to search through multiple files or apps. The platform enables tracking of payments and communications, thus providing insights into both paid and unpaid invoices, along with a record of interactions.

Additionally, customers can conveniently pay their bills online through various options, such as credit cards or bank transfers. This facilitates faster payments and significantly reduces the time spent on collections.

Overall, this platform streamlines financial management for small businesses, enhancing efficiency and promoting growth.

Advantage |

Disadvantage |

|

|

Wave Software: Ideal for small business owners and freelancers looking for a cost-effective and simple accounting solution. It is perfect for those who want to manage their finances without complicated features or high costs.

Initial price:

-

- Starter Plan : ₱ 0 / $ 0

- Pro Plan : ₱ 899,18 / $ 16 per month

-

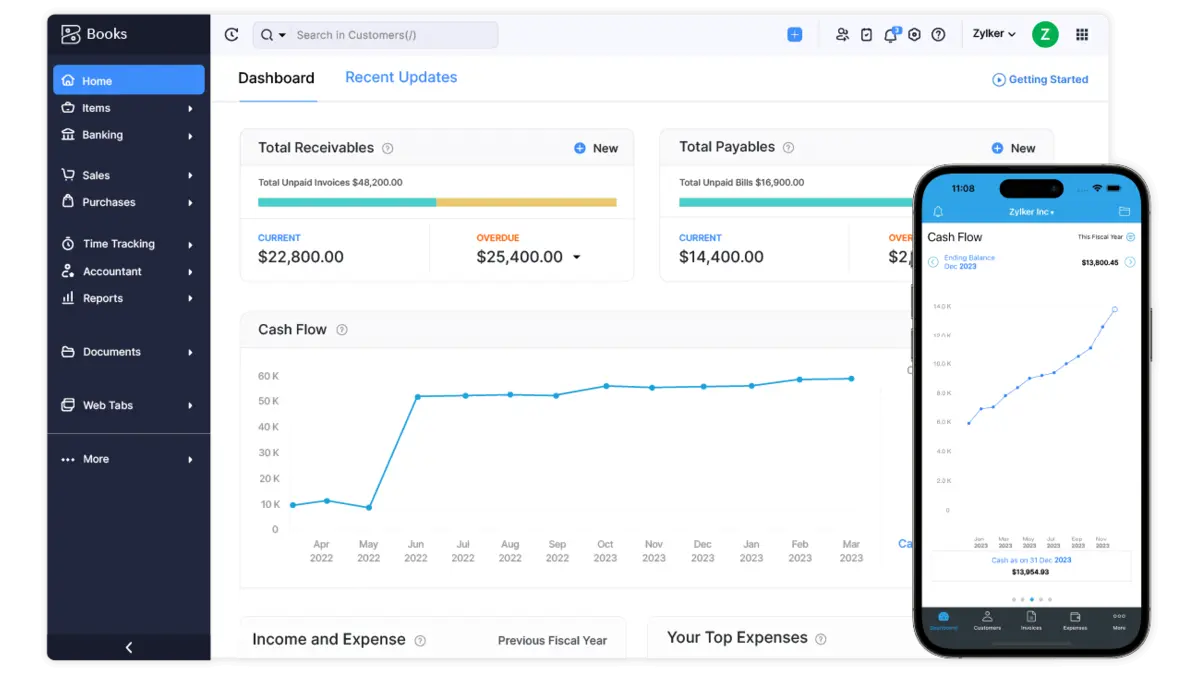

Zoho Books

Zoho Books is a user-friendly accounting solution for small and growing businesses, offering comprehensive financial management without the complexities of traditional software.

Advantage |

Disadvantage |

|

|

Zoho Books: ideal for small and growing businesses seeking a user-friendly accounting solution that simplifies financial management while providing essential tools for transaction organization and expense tracking.

Initial Price:

-

- Free Plan : ₱ 0 / $ 0 per month

- Standard: Plan : ₱ 843,88 / $ 15 per month

- Professional Plan : ₱ 2250,34 / $ 40 per month

- Premium Plan : ₱ 3375,51 / $ 60 per month

- Elite Plan : ₱ 6751,02 / $ 120 per month

- Ultimate Plan : ₱13502,04 / $ 240 per month

-

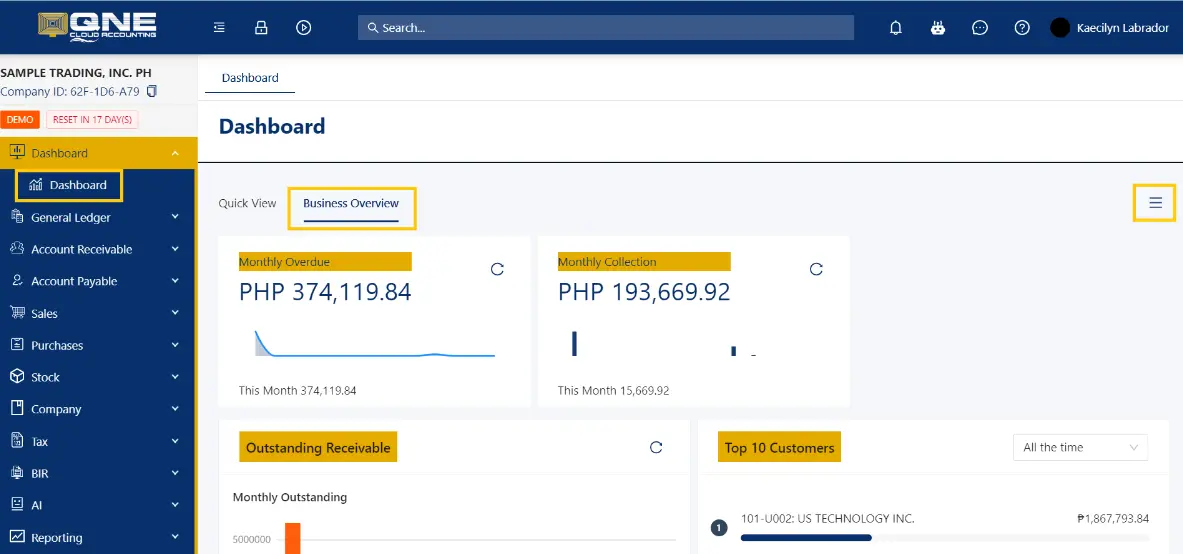

QNE Software

QNE Software is an accounting company from the Philippines that provides solutions for local accounting needs through a user-friendly cloud accounting platform. With over 20 years of experience, the software has improved over time and now includes AI features to make financial management easier and more accurate.

Additionally, QNE Software offers important functions like Financial Accounting, Billing, Sales and Purchase Distribution, Inventory Management, and Point of Sales, all designed to help businesses run smoothly and increase productivity.

Moreover, the platform includes several key features. Instant e-Invoice Generation allows users to quickly create e-invoices by entering transaction details, ensuring compliance with local rules and reducing mistakes. In addition, the e-Invoice Inquiry feature enables users to check invoice statuses easily, while customers can access missing information using a QR code on their receipts.

Furthermore, e-Invoice Validation checks for errors in real-time before submitting invoices, which helps speed up the process. The Consolidated e-Invoice feature combines all cash sales and invoices into one simple submission each month, while still allowing users to review individual transactions.

Finally, the e-Invoice Wizard guides users through setting up e-invoices, making it easy to navigate, and the e-Invoice Advisor helps manage customer information to ensure accuracy and save time.

| Advantage | Disadvantage |

|

|

QNE Software: Ideal for businesses that want a simple accounting solution that combines important financial functions with advanced features, making it easier to manage finances and streamline invoicing.

Initial price:

-

- Free package: ₱ 0 / $ 0 per month

- Personal package: ₱ 336,99 / $ 5,99 per month

- Enterprise: no info

-

System SIA

System SIA is an accounting, and inventory management software tailored for businesses in the Philippines, aiming to simplify operations with a customizable platform that meets local needs.

With features like real-time data tracking, detailed reporting, and user-friendly interfaces, System SIA helps businesses effectively manage their finances and inventory. It also supports various payment methods, enhancing productivity and decision-making.

The platform includes several essential features. Client Management software that organizes client details and tracks communications, fostering better relationships and satisfaction.

Expense Tracking allows users to log and categorize expenses while attaching receipts for efficient financial oversight. Additionally, Customizable Invoices enable the creation of professional invoices that reflect a brand’s identity.

Lastly, Project Management and Time Tracking help users plan tasks, set deadlines, and monitor progress while keeping accurate records of hours worked for billing. Overall, System SIA empowers Philippine businesses to operate more efficiently.

Advantage |

Disadvantage |

|

|

System SIA: ideal for small to medium-sized businesses in the Philippines that require a customizable accounting and inventory solution, offering tools for project management, client tracking, and expense management.

Initial Price:

-

- Lite (best for simple inventory): ₱ 3499 / $ 62,25 per month

- Pro (best for finance team): ₱ 5899 / $ 104,95 per month

- Plus (best for a team of accountant): ₱ 6500 / $ 115,65 per month

How to Choose Good Xero Invoice Alternatives Software for Your Business?

Finding the right invoicing software is essential for running your business smoothly. The right tool can help you generate invoices faster, keep track of payments, and maintain accurate financial records. However, with so many options available, it can be tricky to choose the best one. Here are some tips to help you pick the right invoicing software for your business:

-

Understand Your Business Needs

First and foremost, before selecting invoicing software, think about what your business truly requires. Consider the size of your company, the number of clients you work with, and how often you send invoices. By doing this, you can choose software with features that match your requirements, such as recurring billing or automatic payment reminders.

-

Easy to Use

Next, the invoicing software should be simple to use. Both you and your team should be able to navigate it easily. If the software is overly complicated, it may waste time and lead to errors. Therefore, look for a system that enables you to quickly create, send, and track invoices without too much hassle.

-

Customizable

In addition, your business should be able to customize invoices to align with your brand. Look for software that allows you to add your logo, select your own payment terms, and personalize the invoice design. This customization makes your invoices appear more professional and consistent with your company image.

-

Works with Other Tools

Moreover, it’s beneficial if the invoicing software can connect with other tools you already use, such as your accounting or inventory systems. This capability saves time by keeping all your data updated automatically, thus reducing manual work and mistakes.

-

Strong Security

Furthermore, protecting your financial information is crucial. Make sure the software has robust security features, including encryption and automatic backups. You may also want to choose software that offers two-factor authentication to keep your data extra secure.

-

Affordable and Scalable

In addition, select software that fits your budget but can also grow with your business. As your company expands, the software should accommodate more clients and larger transactions without incurring excessive costs. Flexible pricing plans are a significant advantage, allowing you to upgrade when necessary.

-

Good Customer Support

Finally, if you encounter any problems with the software, quick and helpful customer support is vital. Check whether the provider offers support through chat, email, or phone, ensuring you can resolve any issues without disrupting your business.

Choosing the right invoicing software can simplify your business processes and save you time. Keep these tips in mind to find the best fit for your needs and improve your invoicing efficiency.

Conclusion

While Xero is a popular choice for invoicing and accounting, it might not be the perfect fit for every business due to factors like cost or limited features.

Thankfully, alternatives such as QuickBooks, FreshBooks, Wave, and Zoho Books provide competitive solutions tailored to various business needs, each offering unique benefits. Among these alternatives, HashMicro invoicing software shines as the top invoicing software in the Philippines.

With its fully customizable, cloud-based platform, HashMicro seamlessly integrates with other systems, simplifies invoice generation, and ensures compliance with local regulations.

This powerful combination gives Filipino businesses the flexibility and efficiency they need to stay ahead in financial management.

From managing taxes and processing online payments to tracking invoices in real-time, HashMicro provides cutting-edge solutions that streamline your workflow and supercharge productivity.

Ready to see how it can transform your invoicing process? Test out HashMicro with its free demo and experience its features firsthand—completely risk-free!

FAQ on Xero invoice alternatives

-

Is SAP similar to Xero?

SAP and Xero are both accounting and financial management software, but they differ significantly in scale, target market, and functionality. Xero is designed primarily for small to medium-sized businesses, offering easy-to-use cloud-based accounting solutions with features like invoicing, expense tracking, and payroll management. On the other hand, SAP (particularly SAP ERP and SAP Business One) is designed for larger enterprises and provides more comprehensive enterprise resource planning (ERP) solutions, including supply chain management, manufacturing, human resources, and financial accounting. SAP accounting system is more robust and complex, suitable for businesses with larger, more integrated operational needs, while Xero is simpler and more focused on small business accounting.

-

Which countries use Xero?

Xero is widely used in countries such as New Zealand, Australia, the United Kingdom, the United States, Canada, Singapore, South Africa, Hong Kong, the Philippines, and Malaysia, where cloud-based accounting solutions are essential for small to medium-sized businesses.

-

Are Xero and HashMicro similar?

Xero and HashMicro are both accounting and invoicing software, but they have some differences. Xero primarily targets small to medium-sized businesses around the world, while HashMicro focuses on the Southeast Asian market, especially the Philippines. Xero offers various features like invoicing, expense tracking, and financial reporting. In contrast, HashMicro provides additional tools such as inventory management and sales management, making it a better all-in-one solution for some businesses. Moreover, HashMicro is generally more affordable than Xero, particularly for local businesses, with pricing plans tailored to specific needs. While both platforms are user-friendly, HashMicro is designed with the local market in mind, addressing the specific needs of businesses in the Philippines.