Did you know the world of accounting isn’t one-size-fits-all? Which type of accounting suits your needs? With various specialties, each serves unique financial purposes. Whether you run a small business, work in finance, or are exploring an accounting career, this guide will help you understand different accounting types and how they can benefit your business or profession.

We’ll dive into the 11 key types of accounting, breaking down the differences between general and specialized fields like forensic or managerial accounting. Plus, you’ll discover how accounting platforms for Philippine businesses can simplify every type of accounting, making financial management more efficient for businesses of all sizes. Whether you’re just starting out or already a pro, this guide has you covered.

Importance of Understanding Types of Accounting

Knowing the different types of accounting is key for many reasons. It helps you pick the right accounting for your business. It also ensures your team has the right accounting expertise. Plus, it aids in making smart financial choices. By grasping the differences between these accounting disciplines, you can use the best accounting for your goals. This way, you can boost your financial success in the Philippines.

Getting accounting knowledge is good for several reasons:

- It lets you make better, strategic business decisions by knowing the financial effects of your actions.

- It helps you find the accounting skills, types of accounting principles, your business needs and hire the right people.

- It makes talking to your accountants and financial advisors easier. This leads to better teamwork and financial management.

- It deepens your understanding of the importance of accounting. This way, you can use it to grow your business.

By spending time learning about different accounting types, such as retail accounting software, you gain a deeper understanding of the benefits of accounting. This knowledge helps you reach your financial goals in the Philippines.

The 11 Different Types of Accounting

Accounting is not just spreadsheets and calculators—it’s the glue holding businesses together! Whether you’re decoding financial puzzles in forensic accounting or guiding big decisions with management reports, there’s a specialty for every skill set.

As companies expand and regulations get trickier, accounting has evolved to tackle all the challenges. From managing daily finances to solving financial mysteries, here’s a look at the key types of accounting that keep businesses thriving!

1. Financial Accounting

Financial accounting focuses on external reporting and producing financial statements for stakeholders such as investors and regulators by preparing financial statements like balance sheets and income statements. They ensure a company’s financial info is accurate and follows the rules.

- Key Reports: Balance sheet, income statement, cash flow statement.

- Audience: External stakeholders like investors, creditors, and regulators.

- Compliance: Follows strict standards (PFRS or IFRS) for consistency and transparency.

- Purpose: Provides a clear picture of a company’s financial health at a given point in time.

2. Management Accounting

Management accounting is used internally to help company leaders make informed decisions. It provides financial data, often leveraging accounting as an information system to deliver timely and accurate insights. This approach focuses on using accounting information to grow the business and increase profits.

- Focus: Internal decision-making, budgeting, and forecasting.

- Reports: Performance evaluations by department or product line.

- Purpose: Helps managers control operations and plan for the future with detailed data.

- Real-time Data: Provides timely insights for quick decision-making.

3. Cost Accounting

Cost accounting looks at a company’s expenses in detail. It helps understand production and operational costs. This info is key for pricing, budgeting, and finding cost savings.

Cost accounting zeroes in on the costs of production to improve efficiency.

- Focus: Direct and indirect costs (materials, labor, overhead).

- Purpose: Helps businesses control production costs and set product prices.

- Budgeting Tool: Assists in forecasting future production expenses for better planning.

- Specialty: Vital for manufacturing and production-based businesses.

4. Tax Accounting

Tax accounting in the Philippines is governed by the BIR, focusing on compliance with local tax laws. It’s essential for both businesses and individuals to ensure they meet tax obligations while minimizing liabilities.

- Main Task: Preparing and filing tax returns, including VAT, income, and withholding taxes accounting.

- Focus: Minimizing tax liabilities while adhering to the Philippine Tax Code.

- Specialty: Differs from financial accounting by focusing solely on tax-specific regulations.

- Jurisdiction: Adheres to BIR rules and guidelines, including local tax incentives for SMEs.

5. Auditing

Auditors verify the accuracy of a company’s financial records. They ensure that financial statements comply with legal standards and regulations. This role can be found in firms, government agencies, or internal audit departments.

- Main Task: Reviewing and validating financial statements in line with PFRS and BIR regulations.

- Focus: Ensuring transparency and accuracy of financial records, crucial for both internal control and regulatory compliance.

- Specialty: Different from general accounting by focusing on verifying the integrity of records.

- Jurisdiction: Follows PFRS, IFRS, and BIR standards for various industries.

6. Governmental Accounting

Governmental accounting in the Philippines deals with the finances of public entities, ensuring that taxpayer money is properly managed and accounted for. Local governments must follow guidelines from the Commission on Audit (COA).

- Focus: Accountability for public funds.

- Regulations: Follows Government Accounting and Auditing Manual (GAAM) and COA standards.

- Purpose: Ensures transparency and proper use of government resources.

- Usage: Used by national and local government units.

7. Public Accounting

Public accounting provide a range of services like tax prep, auditing, and consulting. They work for big firms or smaller practices.

- Focus: Serving individuals, businesses, and government clients.

- Services: Auditing, tax planning, and consulting.

- Specialty: Works across industries, offering expertise in multiple areas.

- Role: Conducts external audits and assists with financial planning in compliance with PFRS and BIR guidelines.

8. Forensic Accounting

Forensic accounting specializes in investigating financial fraud and disputes. They use their skills to gather evidence and testify in court.

- Focus: Financial investigations, fraud detection, and litigation support.

- Purpose: Helps uncover illegal activities like fraud or embezzlement.

- Specialty: Frequently used in court cases as expert testimony.

- Role: Provide clear evidence-based analyses for legal resolutions.

9. Fiduciary Accounting

Fiduciary accounting focuses on managing assets and financial matters for someone else’s benefit. It requires understanding legal duties and having strong record-keeping and communication skills.

- Focus: Trusts, estates, and guardianships.

- Responsibility: Ensures assets are managed responsibly and in the best interest of beneficiaries.

- Transparency: Provides detailed reports to ensure proper management of entrusted funds.

- Specialty: Commonly used in legal and estate planning.

10. Fund Accounting

Fund accounting tracks and reports financial resources in nonprofits and government. It ensures funds are used as intended. Fund accounting is used by non-profits and government entities to track funds restricted for specific purposes.

- Focus: Accountability for resource allocation rather than profit.

- Purpose: Ensures that funds are used according to donor or regulatory requirements.

- Records: Maintains separate financial records for each fund.

- Specialty: Essential for maintaining legal and ethical transparency in non-profits and governments.

11. International Accounting

International accounting is key for global businesses. It deals with accounting standards, currency conversions, and cross-border tax and regulations.

- Focus: Navigating accounting across multiple countries.

- Compliance: Ensures adherence to international standards like IFRS Philippines.

- Purpose: Helps companies manage cross-border financial operations, including taxes and exchange rates.

- Specialty: Key for multinational corporations.

Also read: A Guide to Electronic Invoice System BIR Philippines in 2024

Specialized Accountants vs General Accountants

In the world of accounting, you’ll find many professionals with different skills. Some specialized accountants know a lot about one area, while general accountants understand many areas well.

Specialized accountants are experts in areas like tax accounting, forensic accounting, or international accounting. They focus on one area and offer deep insights. They’re great at solving complex accounting problems with their specialized knowledge.

General accountants know a lot about many areas. They can do many accounting tasks, like financial reports and budgeting. They’re good at understanding different business needs and giving a full picture of a company’s finances.

- Specialized accountants excel in deep, niche-specific expertise.

- General accountants offer a more versatile, all-encompassing accounting skillset.

- Choosing between a specialized accountant or a general accountant depends on the specific requirements of your business or career goals.

Understanding the strengths of both specialized and general accountants is crucial for making a smart choice. Whether you need in-depth expertise or a broad overview, knowing the difference ensures you find the right fit for your business in the Philippines.

But regardless of which type of accounting you choose, leveraging accounting automation such as accounting software and business budgeting software can elevate your business.

It streamlines processes, reduces errors, and provides real-time insights, allowing you to meet your financial needs more efficiently and effectively. Now, let’s take a closer look at one of the leading accounting system solutions growing in popularity in the Philippines.

Also read: Restaurant Accounting: A Guide to Master the Basics

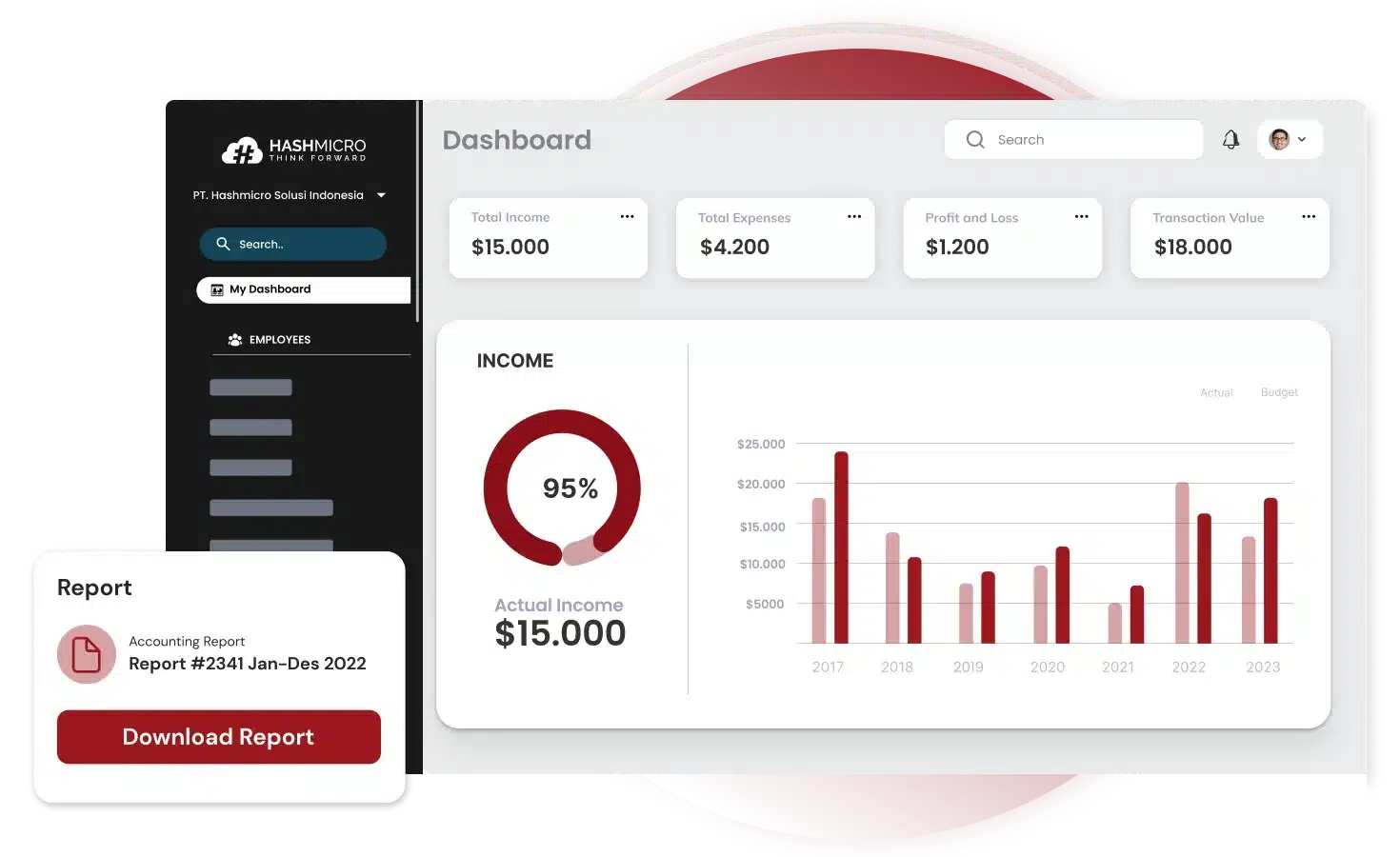

How HashMicro’s Accounting Software Enhances Different Types of Accounting

In the diverse world of accounting, no two specialties are alike. From financial reporting to tax management, each has its own challenges. HashMicro’s Accounting Software meets these needs head-on with automation, real-time data integration, and customized reports. Whether you’re ensuring compliance or analyzing costs, HashMicro helps streamline your process and reduce manual errors.

- Automation: Streamlines financial tracking across all accounting types, minimizing errors.

- Comprehensive Compliance: Ensures transparency with audit trails, useful for governmental or financial accounting.

- Real-Time Data: Supports instant updates, enhancing decision-making for cost and management accounting.

- Custom Reporting: Delivers tailored reports for each specialty, whether for audits, taxes, or budgeting.

Why struggle with manual processes when HashMicro has your back? With advanced reporting features tailored for every accounting need, you can finally focus on making smarter business decisions. Give your accounting process the upgrade it deserves—HashMicro has the tools to make it happen!

Conclusion

The world of accounting is vast and varied, offering different types of expertise to meet the unique needs of businesses. Understanding the different types of accounting gives you the tools to make smarter financial decisions, whether you’re a business owner, a finance professional, or someone pursuing a career in the field. In the Philippines, this knowledge is particularly valuable as the accounting industry continues to evolve.

No matter which type of accounting you focus on, leveraging technology is key to staying efficient and competitive. Accounting software like HashMicro can streamline processes, reduce manual errors, and offer real-time data insights, ensuring your financial management is both effective and compliant with industry standards.

Ready to take your accounting to the next level? HashMicro’s AI Accounting Software offers comprehensive solutions tailored to every accounting need. Try a free demo today and experience how it can transform your financial processes and help your business thrive!

Frequently Asked Questions

-

What are the main types of accouting?

The main types include financial accounting, management accounting, cost accounting, tax accounting, auditing, forensic accounting, governmental accounting, and public accounting.

-

What are the 4 sectors of accounting?

The four sectors are public accounting, corporate (or private) accounting, government accounting, and forensic accounting.

-

What are the 5 major accounts in accounting?

The five major accounts are assets, liabilities, equity, revenues (income), and expenses. These are the key components used to record and report financial transactions.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “What are the main types of accouting?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The main types include financial accounting, management accounting, cost accounting, tax accounting, auditing, forensic accounting, governmental accounting, and public accounting.”

}

},{

“@type”: “Question”,

“name”: “What are the 4 sectors of accounting?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The four sectors are public accounting, corporate (or private) accounting, government accounting, and forensic accounting.”

}

},{

“@type”: “Question”,

“name”: “What are the 5 major accounts in accounting?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The five major accounts are assets, liabilities, equity, revenues (income), and expenses. These are the key components used to record and report financial transactions.”

}

}]

}