Have you ever struggled to determine how long your assets will stay useful and profitable? This is a common problem for many business owners in the Philippines. Uncertainty about an asset’s lifespan can mess up your budget and lead to surprise costs.

Planning for repairs, maintenance, or replacement is hard if you’re unsure how long an asset will keep working well. Getting the useful life of your assets right is key to making smart choices about spending, upkeep, and future investments.

By learning how to estimate and adjust the lifespan of your assets, you can keep things running smoothly and avoid financial headaches. In addition, by leveraging asset management software, you can also automate tracking, scheduling, and reporting for better accuracy and control. Read on to discover more!

Key Takeaways

|

Table of Contents

What is Useful Life of Assets?

Asset management is essential for businesses to maximize returns and minimize costs over time. One key aspect of asset management is estimating how long an asset will provide value, often called the “useful life.” This concept is critical because it directly impacts how an asset is depreciated over time, influencing a business’s financial statements.

This concept estimates how long the asset can be used to generate revenue before it becomes outdated, inefficient, or needs replacement. It’s important to note that an asset’s useful life differs from its physical life. While physical life refers to the total time an asset can physically function, useful life focuses on its productive capacity.

For instance, a machine may still operate after its useful life has ended, but its efficiency and profitability may have diminished. An asset management system helps business owners understand this distinction and decide when keeping, replacing, or upgrading assets is financially practical.

Methods to Determine Useful Life

Official guidelines (e.g., PFRS)

The Philippine Financial Reporting Standards (PFRS) provide guidelines for determining asset useful life. These standards align with global practices while considering local business environments, offering a standardized range for asset depreciation.

Adhering to PFRS helps businesses maintain accurate financial records. While these guidelines offer a useful starting point, they might not always match the actual performance of your assets.

Factors like usage, maintenance, and operating conditions should be considered to adjust the useful life accordingly. Following PFRS ensures compliance and provides a consistent baseline for annual depreciation calculations.

Manufacturer’s recommendations

Manufacturers usually provide useful life estimates for their products, indicating how long they can perform optimally. These estimates are based on thorough product testing and real-world data, making them reliable for business owners.

It’s important to check the manufacturer’s specifications when purchasing equipment or machinery. However, an asset’s actual lifespan can vary depending on its usage and maintenance practices.

If an asset faces harsher conditions or excessive use, its useful life might be shorter than the manufacturer’s estimate. Using these recommendations as a guide is wise, but adjusting them to fit your business’s unique needs is equally crucial.

Historical data usage

Historical data usage provides a reliable method for estimating an asset’s useful life based on its performance history across various industries, like schools, construction, healthcare, and more.

By examining maintenance records, downtime incidents, and more, businesses can identify patterns that help predict the longevity of assets. For instance, if a type of machinery typically lasted ten years in a school setting, a similar machine purchased for a construction site might also be expected to have a comparable useful life.

This approach allows for more informed decision-making by avoiding underestimation or overestimation of asset lifespans, tailoring expectations to the specific conditions and demands of each industry.

Depreciation methods overview

Depreciation methods play a crucial role in determining an asset’s useful life. The straight-line method spreads an asset’s cost evenly over its useful life, while accelerated methods allocate more depreciation in the early years.

The choice of method impacts financial reporting and how an asset’s useful life is perceived. For instance, an accelerated depreciation method may shorten an asset’s financially useful life but can provide tax benefits by reducing taxable income in earlier years.

On the other hand, straight-line depreciation offers more stable expense reporting. Understanding these methods helps you choose the right approach for your business’s financial goals.

Calculating Depreciation and Useful Life

Calculating depreciation based on an asset’s useful life is essential for tracking its value and planning future expenses. The most straightforward method is to use straight-line depreciation, which requires three key pieces of information: the asset’s initial cost, its salvage value (the amount you can sell it for at the end of its useful life), and its estimated useful life.

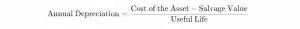

The formula for straight-line depreciation is:

Where:

- Cost of the Asset is the initial purchase price.

- Salvage Value is the asset’s estimated value at the end of its useful life.

- Useful Life is the years the asset is expected to be used.

Example calculation

Let’s go through an example to make it clear. Suppose you buy a machine for PHP 100,000. You estimate the machine will have a salvage value of PHP 10,000 at the end of its 10-year useful life. Here’s how you would calculate the annual depreciation:

So, this machine’s annual depreciation is PHP 9,000. This means you would allocate PHP 9,000 each year as an expense, representing the machine’s decrease in value over its useful life.

Why straight-line depreciation is useful

Straight-line depreciation is simple and provides a consistent way to account for an asset’s yearly value. This method is particularly useful for assets that wear out evenly over time, like office furniture or machinery.

Understanding this basic calculation helps business owners keep accurate financial records, plan for future replacements, and avoid sudden financial strain.

While there are other methods, like the double-declining balance, which depreciates assets faster in the early years, mastering the basics of straight-line depreciation is a good starting point for sound financial management.

Adjusting the Useful Life of an Asset

There are situations where an asset’s useful life may need adjustment, such as changes in usage, technology, or operating environment. If an asset is used more intensively than expected, its useful life may shorten.

Conversely, if new technology extends the asset’s efficiency, its useful life might be lengthened. Regular asset condition and performance reviews are essential for making timely adjustments to useful life estimates.

UtilizingCMMS in schools, for instance, helps in scheduling regular maintenance checks and updates, optimizing asset use, and extending their service life in line with educational needs and technological advancements.

By reassessing each year, you can align your asset’s useful life with its actual performance and ensure your financial records remain accurate. This proactive approach prevents surprises and aligns your asset management strategy with your business goals.

Maximize Useful Life of Assets with HashMicro’s Asset Management Software

Managing assets’ useful lives can be challenging without the right tools. HashMicro’s Asset Management Software offers an all-in-one solution that simplifies this process. With its automated features, businesses can efficiently monitor asset lifespans, plan maintenance, and maximize their investments.

Here are five key features of HashMicro’s Asset Management Software:

- Asset Comprehensive Cost Reporting: Provides detailed reports on asset costs, helping businesses make informed decisions on asset management.

- Asset Maintenance Budget: Allows for setting and tracking a maintenance budget to avoid overspending and ensure asset longevity.

- Asset Stock Take with Barcode: Simplifies inventory checks by using barcode scanning, streamlining asset stock-taking processes.

- Parent & Child Asset Management: Manages main assets and their related sub-assets, clearly showing asset hierarchy and usage.

- Fully Integrated with Accounting for Depreciation Tracking: Seamlessly tracks asset depreciation, ensuring financial records are up-to-date and compliant.

By leveraging these features, HashMicro’s Asset Management Software streamlines asset management, allowing businesses to monitor, maintain, and optimize asset performance effortlessly. This software ensures assets are tracked efficiently, contributing to better financial planning and decision-making.

Conclusion

Understanding the useful life of assets is crucial for effective asset management and financial planning. Accurate estimates allow you to budget for replacements, allocate resources, and more. Calculating and adjusting asset lifespan can significantly improve profitability and prevent unexpected costs.

Implementing best practices for managing useful life helps businesses maintain strategic financial management, ensuring they use assets efficiently and replace them at the right time. Simplify this process with HashMicro’s Asset Management Software. Try our free demo today and take the first step toward smarter asset management.

Frequently Asked Questions

-

How do you determine the useful life of an asset?

Estimate an asset’s useful life using guidelines, manufacturer recommendations, and historical data. Regularly review the asset’s condition and usage to adjust its lifespan accurately.

-

What is a useful life and example?

The useful life refers to when an asset is expected to remain productive. For example, businesses use a machine with a 10-year useful life to generate revenue efficiently throughout that time.

-

What is the useful life of assets as per accounting standards?

Accounting standards provide useful life ranges for asset types like machinery or vehicles. These guidelines help standardize depreciation and ensure accurate financial reporting.