A VAT invoice is a key document for businesses registered for value-added tax (VAT) in the Philippines. Specifically, it records the details of a sale, including the VAT charged, thus ensuring tax records are accurate and compliant with Bureau of Internal Revenue (BIR) rules.

According to the SERP-P, the standard VAT rate in the Philippines is 12%, and it is applied to goods, properties, and services. However, some transactions, such as exports, qualify for a 0% VAT rate. Managing rates and creating accurate VAT invoices can be challenging.

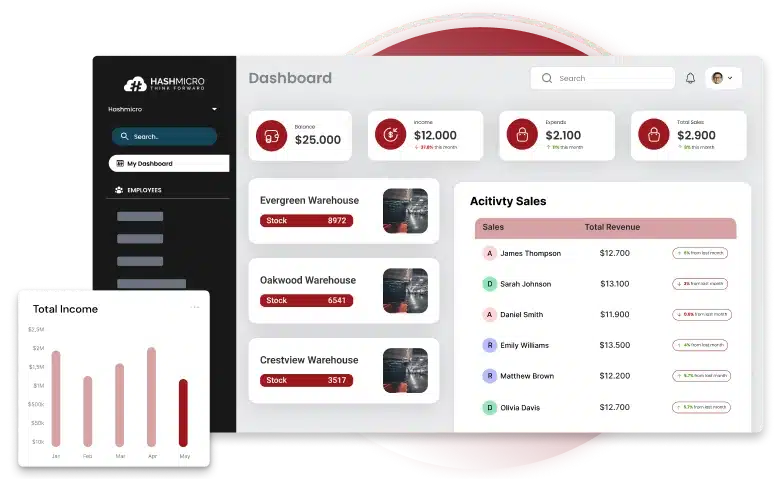

Therefore, invoicing software like HashMicro simplifies this by automating VAT invoice creation. It helps businesses apply the correct VAT rate, reduces errors, and ensures all VAT tasks follow BIR regulations.

In this discussion, the article will cover the key aspects of VAT invoicing in the Philippines, such as who must issue them, the required details, and how invoicing software simplifies the process. Pag-unawa sa mga ito helps businesses stay compliant and enhance financial management.

Key Takeaways

|

Table of Contents

What is a VAT Invoice?

Businesses registered for VAT issue a VAT invoice when a sale includes Value-Added Tax. It records the transaction, including the VAT amount, and acts as a legal record for both the seller and buyer, ensuring accurate tax documentation.

The main role of a VAT invoice is to confirm the seller’s VAT responsibility and allow VAT-registered customers to reclaim the VAT they’ve paid. In the Philippines, these invoices must be issued promptly at the time of the sale or delivery of goods or services, following BIR regulations.

Who Must Issue a VAT Invoice?

In the Philippines, VAT-registered businesses must issue a VAT invoice when selling goods or services that are subject to VAT. This includes transactions with:

- Another VAT-registered business (B2B transactions)

- Government agencies or departments

- Local authorities or government bodies

- Institutions established by law

- Individuals or entities involved in VAT-exempt activities

VAT invoices are also needed for sales to non-registered entities if the goods or services are subject to VAT. This ensures compliance with BIR rules, keeps accurate tax records, and allows VAT-registered buyers to reclaim the VAT they’ve paid.

Other Types of VAT Invoices

In addition to standard VAT invoices, businesses in the Philippines use other invoice types to meet specific needs. These include e-invoicing BIR, batch invoicing, simplified invoicing, and summary invoicing, each designed to streamline the invoicing process and ensure compliance with BIR regulations.

1. Electronic invoicing

Electronic invoicing allows businesses to issue digital invoices, and it is gaining popularity with the BIR’s Electronic Invoicing System. Both parties must agree to this format, ensuring record integrity and availability for BIR review.

2. Batch invoicing

Batch invoicing is ideal when sending multiple invoices to the same customer. The system records common details once per group of invoices, simplifying the process and reducing the administrative workload.

3. Simplified invoicing

Simplified invoicing, in particular, is used for small transactions where full details aren’t necessary, such as in retail. It includes the date, supplier’s info, a brief description, and the tax amount, thereby ensuring compliance without excess detail.

4. Summary invoicing

Summary invoicing consolidates several transactions to the same customer within a month into one invoice. As a result, it reduces paperwork and simplifies tracking, ultimately making monthly billing for repeat clients easier.

Accounting software can greatly assist in managing these various types of VAT invoices. It integrates with your financial management, making tracking, storing, and retrieving invoices easier.

You can also discover the best invoicing software recommendations to help you input VAT invoice details accurately and automate the entire process.

VAT Requirements in the Philippines

The Value-Added Tax (VAT) system is governed by specific regulations that businesses must adhere to. Ito ang mga mahalagang requirements sa VAT:

VAT registration

Businesses with annual gross sales over PHP 3 million must register for VAT. Smaller businesses can choose to register. VAT-registered companies must file and declare VAT returns regularly.

VAT rates

The standard VAT rate in the Philippines is 12%, which is applied to selling goods and services. Some transactions, like exports, may qualify for a 0% VAT rate.

VAT invoices and receipts

VAT-registered businesses must issue VAT invoices for selling, leasing, or exchanging goods and properties and VAT receipts for services. These must include the supplier’s TIN, VAT amount, and buyer’s information.

VAT exemptions

Businesses with sales below PHP 3 million are exempt from VAT. Certain transactions, such as selling agricultural products or tuition fees, are also exempt from VAT.

VAT filing and payment

VAT returns must be filed monthly and quarterly. Monthly returns (BIR Form 2550M) are due by the 20th of the following month, and quarterly returns (BIR Form 2550Q) are due by the 25th after the quarter ends.

Penalties for non-compliance

Missing VAT filing or payment deadlines can lead to fines and interest penalties, ranging from PHP 1,000 to PHP 25,000. Severe cases may result in imprisonment.

VAT recovery

VAT-registered businesses can claim input VAT on purchases related to their business. If the input VAT is higher than the output VAT, the balance can be carried over or refunded.

Following all these VAT requirements and staying compliant can be challenging for businesses, especially with the complexities involved in VAT invoicing and filing. However, using invoicing software like HashMicro can help streamline these processes.

Click the banner below to explore HashMicro’s invoicing software pricing and find the best solution for efficiently managing your VAT invoicing needs.

Differences Between VAT Invoices and Standard Invoices

VAT and standard invoices request payment and confirm sales, but they differ in details. VAT-registered businesses issue VAT invoices, including specific details like the VAT amount and registration number.

Sa kabilang banda, standard invoices don’t require VAT details and can be issued by any business, whether VAT-registered or not. They are more flexible for transactions without VAT. Knowing these differences is essential for proper invoicing and compliance with tax rules.

Handling various VAT invoice types and non VAT invoice can be time-consuming. Find out how HashMicro invoicing software can help you save time by automating invoice processes and staying compliant with regulations.

Automate VAT Invoice Processes with HashMicro Software

HashMicro’s invoicing software is built to simplify the entire invoicing process, helping businesses manage VAT-related tasks effortlessly. Enhanced by Hashy AI, it boosts accuracy and efficiency by automating complex calculations. It also allows for the easy generation of sales invoices, non-VAT invoices, and official receipts, saving time and reducing errors.

The software ensures compliance with tax regulations and enhances overall efficiency. With Hashy AI enabling automatic VAT invoice generation, businesses no longer need to worry about calculating VAT amounts accurately.

HashMicro offers a free demo and consultation to help businesses explore how their invoicing software can be tailored to meet specific needs. This hands-on experience ensures you choose the best solution for improving VAT invoicing and overall financial management.

Benefits and Features

- Customizable templates: Easily create and personalize VAT invoice templates, reducing repetitive work.

- Automated tax calculations: The software automates VAT and tax calculations, ensuring accuracy.

- BIR-CAS compliance: HashMicro’s software is BIR-CAS-compliant, simplifying the preparation and management of VAT invoices in line with Philippine regulations.

- Real-time reporting: Track VAT invoice status with real-time updates, enhancing financial management.

- Online payment management: Simplify payments with integrated gateways, speeding up the process.

Try HashMicro’s software and see how it can streamline your VAT invoicing and improve your business operations.

Conclusion

Managing VAT invoices is crucial for accurate tax records and following BIR rules in the Philippines. Software like HashMicro simplifies this by automating tasks, reducing mistakes, and efficiently managing all VAT invoices.

HashMicro Invoicing Software helps simplify VAT invoicing. It automates tax calculations, integrates with accounting systems, and provides real-time updates, making your business run smoother while staying compliant with tax laws.

Want to make VAT invoicing easier? Try a free demo of HashMicro Invoicing Software today! See how it can improve your business and financial management.

Frequently Asked Questions About VAT Invoice

-

What information is required on a VAT invoice in the Philippines?

A VAT invoice in the Philippines must include the date of issue, a BIR-authorized invoice number, the seller’s and buyer’s full names and addresses, TIN, a description of goods or services, the VAT-exclusive price, total amount due, VAT amount, and the date of supply.

-

Can you amend a VAT invoice?

Yes, you can amend a VAT invoice in the Philippines by following Bureau of Internal Revenue (BIR) guidelines. For price changes, issue a debit note for increases or a credit note for decreases. For incorrect VAT rates, adjust the invoice using a credit note and issue a revised one.

-

How to improve VAT invoicing processes?

Using HashMicro Invoicing Software can improve VAT invoicing processes. It automates key tasks such as invoice creation, tax calculation, and tracking, reducing errors and saving time. The software also ensures compliance with BIR regulations, making VAT management more efficient.