Since its launch in 2006, Xero Accounting Software has become one of the most recognized accounting platforms for small to medium-sized businesses. Its clean interface and ease of use have made it a popular choice around the world.

As a cloud-based system, Xero helps businesses manage invoicing, expenses, and bank reconciliation. It also offers real-time financial visibility to support day-to-day decision-making.

But the question remains: is Xero the right fit for every business? Can it scale with your operations or meet more complex accounting needs as you grow?

In this article, we’ll take a closer look at Xero’s strengths and limitations—and more importantly, explore alternative accounting solutions that could be a better match for your business. Including one we know inside out: HashMicro Accounting Software.

Pag-usapan natin ito ng malalim ngayon din.

Table of Contents

Key Takeaways

|

Here’s a shortlist of the best alternatives to Xero accounting software in 2025 for business:

- Best for all-in-one customization: HashMicro Accounting System

- Best for AI-powered automation: Sage Intacct

- Best for freelancers and startups: Wave Accounting Software

- Best for seamless integrations: FreshBooks

- Best for large-scale enterprises: NetSuite Accounting System

- Best for affordability and small businesses: Zoho Books

- Best for simple financial management: KasHoo

- Best for SMEs and tax compliance: MYOB

- Best for integrated ERP solutions: Omegasoft

- Best for user-friendly experience: ZarMoney

- Best for budget-conscious startups: FreeAgent Accounting System

- Best for VAT and tax submissions: KashFlow

Xero Accounting Software Features

Here are some of the key features that make Xero an invaluable tool for managing your business finances efficiently:

- Automatic bank feeds: Say goodbye to manual transaction entry. Xero’s automatic bank feeds pull all your transactions directly from your bank or credit card, seamlessly updating your account and saving you hours on monthly bank reconciliation.

- Invoicing and billing: With Xero, creating and sending invoices and bills is simple, helping you get paid faster. Use customizable templates and online payment options that let customers pay with just a few clicks.

- Reporting and analytics: Xero’s reporting tools provide real-time insights into your business, enabling smart decisions about resource allocation.

- Mobile app: Stay on top of your finances from anywhere with Xero’s mobile app. You can send invoices, reconcile transactions, and approve bills directly from your smartphone or tablet.

Advantages of Using Xero Accounting Software

Xero provides these advantages to its users, including:

- Cloud Accessibility and Security: Xero ensures data is securely stored in the cloud, effectively minimizing the risk of loss while enhancing overall security.

- User-Friendly Interface: An easy-to-navigate interface makes accounting tasks accessible for users from diverse backgrounds, facilitating quicker training and smoother team adoption.

- Automation and Efficiency: the software automates essential accounting tasks such as bank reconciliation, expense tracking, and financial reporting.

- Integration and Scalability: Xero’s ability to integrate with over 700 third-party applications provides the flexibility to customize functionalities to meet specific business needs, ensuring a tailored accounting experience.

Disadvantages of the Xero Accounting System

While Xero offers some benefits, there are several factors that a user must consider before they use Xero, such as:

- Higher Costs for Advanced Features: Xero offers a range of features, it can become costly, particularly for those requiring access to advanced functionalities, which may drive up overall expenses.

- Integration and Configuration Limitations: integration with third-party applications can sometimes pose challenges, including broken connections or the need for re-authentication, which may disrupt workflow.

-

Limited Project and Inventory Management: Xero has limitations in project and inventory management; its features may not be adequate for businesses with complex needs.

Top 12 Alternatives to Xero Accounting Software in 2025

After knowing some of the advantages and disadvantages of the Xero system, it’s important to consider other alternatives that better align with your business needs while also adhering to accounting principles for accurate financial management.

Here are 12 recommended Xero accounting software alternatives that you can consider:

1. HashMicro Accounting System

Reasons for using this system: extensive and diverse customization options.

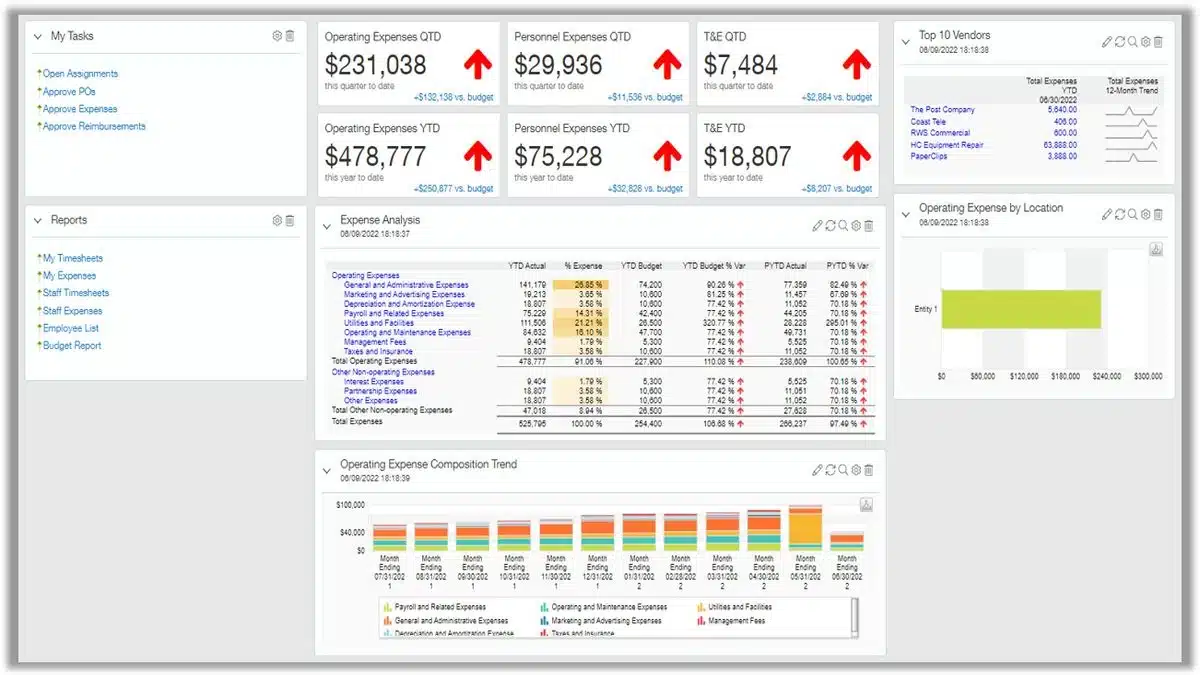

The first alternative to Xero accounting software is HashMicro. As the name implies, HashMicro’s accounting software is specifically designed to facilitate its users’ accounting management. One of the steps to realize this is the availability of flexibility in customization.

Yes, with the customization feature, HashMicro’s system can follow all the user’s specific needs. The system’s extensive scalability also supports this. So, this system can continue to run optimally as developments occur in the company.

HashMicro also understands that transparency is very important in accounting management. So, they do not limit the number of users in this application so that several people can supervise financial management at once.

Dagdag pa, narito ang ilang feature ng HashMicro accounting system na makakatulong sa iyo:

- Bank Integration – Auto Reconciliation

- Multi Level Analytical

- Profit & Loss vs Budget & Forecast

- Cash Flow Reports

- Forecast Budget

- Financial Statement with Budget Comparison

| Pros | Cons |

|---|---|

|

|

2. Sage Intacct

Reason for using this system: Equipped with AI that facilitates the automation process.

Sage Intacct is an advanced accounting system equipped with AI technology support that helps automate various financial processes more intelligently and efficiently. This AI feature helps analyze accounting data in real-time, providing deeper insights for faster and more accurate business decision-making.

In addition, Sage Intacct is known for its high flexibility in terms of customization. The system is designed to be easily adapted to a business’s specific needs, be it creating customized financial reports or setting up relevant modules for specific industries.

Sage Intacct features:

- Advanced financial

- Business intelligence support

| Pros | Cons |

|---|---|

|

|

3. Wave Accounting Software

Reason for using this system: Offers a free plan with comprehensive features.

The next Xero alternative you can consider is Wave accounting system. One of the reasons why Wave is worth considering is the free availability of one of the modules. Yes, Wave provides a free option with a basic system option that is quite helpful for accounting management.

Wave also offers several comprehensive features, one of which is End-of-year tax form generation. This feature makes it easy for users to manage year-end tax reporting by automatically compiling and calculating the data required for tax forms, saving time and reducing the risk of human error.

Wave accounting software features:

- Invoicing and online payment acceptance.

- Optional payroll add-on.

- Income and expense tracking.

| Pros | Cons |

|---|---|

|

|

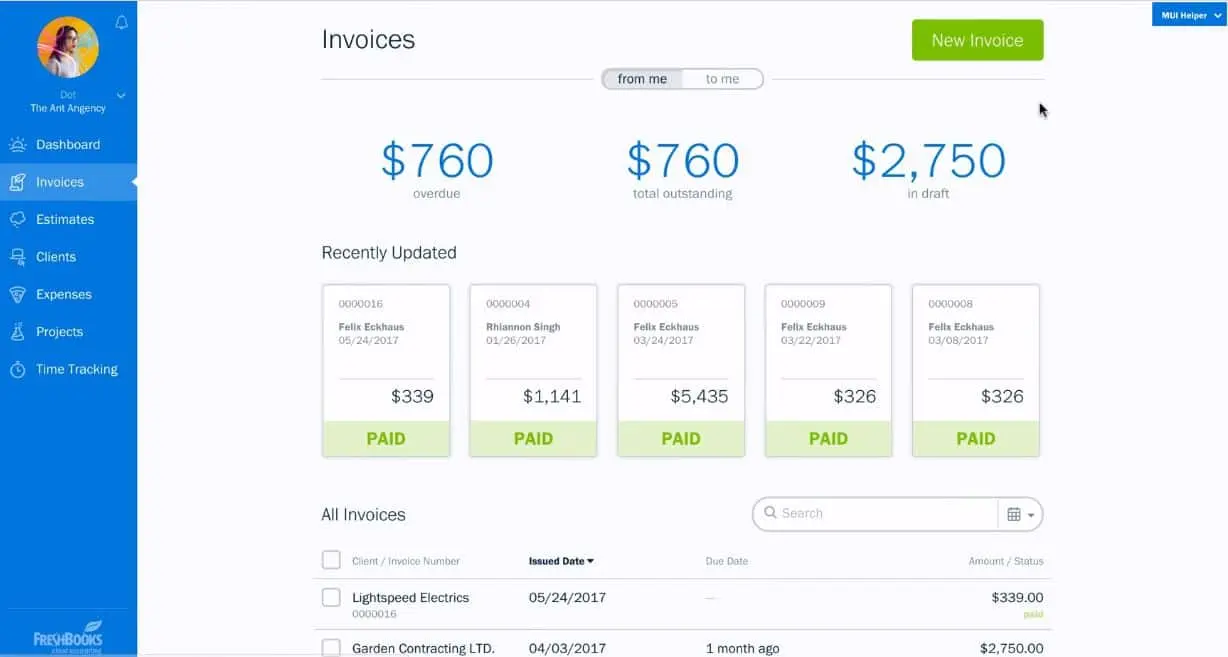

4. FreshBooks

Reason for using this system: Has the best integration features.

QuickBooks Accounting System is a complete accounting solution designed to meet the needs of businesses of any size, especially for those who need to track physical resources such as inventory and fixed assets. W

In addition, QuickBooks also offers integrated asset management tools, allowing businesses to track the usage, depreciation, and maintenance of their physical assets. With this comprehensive solution, businesses can monitor their overall operations more easily and efficiently,

FreshBooks accounting software features:

- Cashflow management

- Extensive tax support

- Widely integrated

| Pros | Cons |

|---|---|

|

|

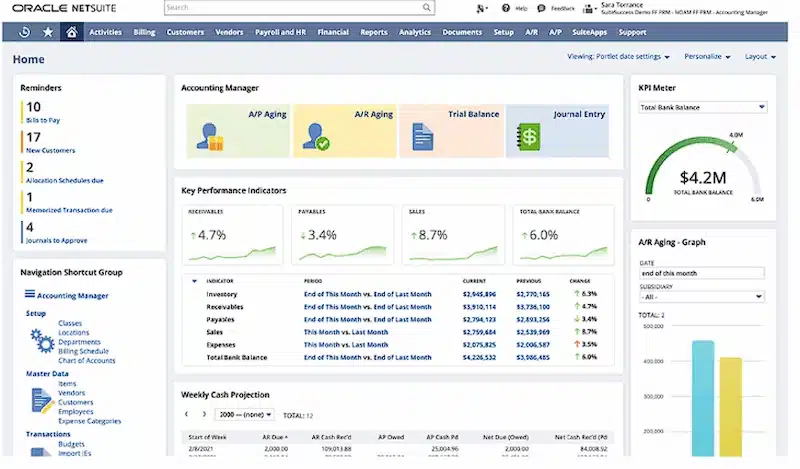

5. NetSuite Accounting System

Reason for using this system: Has complex features and is suitable for large-scale businesses.

NetSuite Accounting System is an accounting solution specifically designed for large companies that require high flexibility. One of its main advantages is its extensive customization and integration capabilities.

NetSuite allows users to customize modules and features according to their specific business needs, from financial reporting to asset management.

In addition, NetSuite is also designed to handle large scale operations, making it an ideal choice for multinational companies or organizations with high business complexity. With advanced features for financial process automation, in-depth analytics, and multi-currency and multi-entity support,

NetSuite accounting features:

- Mobile access

- Powerful and variety tools

| Pros | Cons |

|---|---|

|

|

6. ZohoBooks

Reason for using this system: Suitable for medium to low-scale businesses due to affordable prices.

Zoho Books is a cloud-based accounting system designed for easy access, even through mobile devices. The mobile app allows users to manage their business finances from anywhere at any time.

This allows business owners to keep track of transactions in real-time without having to be in the office all the time

Zoho Books features:

- Receivable

- Payables

- Banking

| Pros | Cons |

|---|---|

|

|

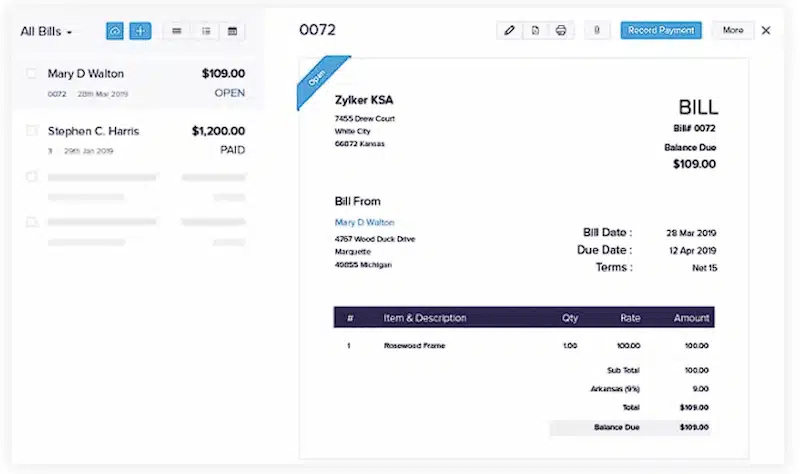

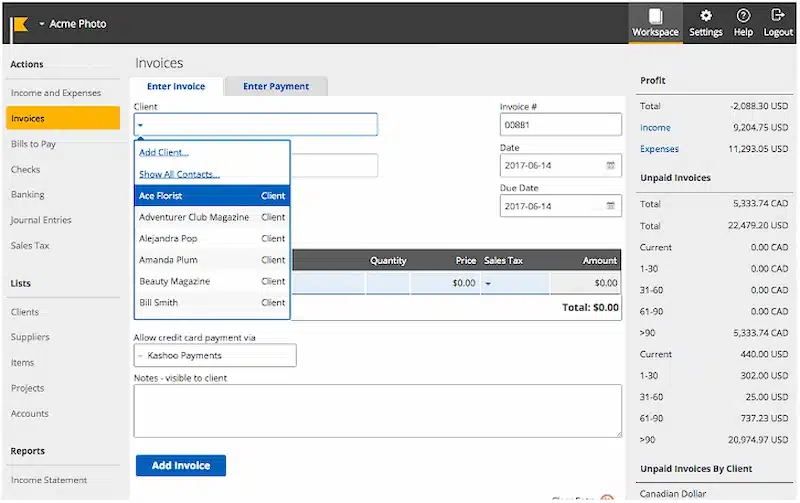

7. KasHoo

Reason for using this system: Suitable for medium to low scale businesses.

Kashoo Accounting System is a cloud-based accounting software designed to help small businesses manage their finances simply and efficiently.

With features like invoicing, expense tracking, and automatic bank reconciliation, Kashoo allows users to easily manage their business finances without requiring in-depth accounting knowledge.

KasHoo features:

- VAT Returns

- Quotes & Estimates

- Purchases & Expenses

| Pros | Cons |

|---|---|

|

|

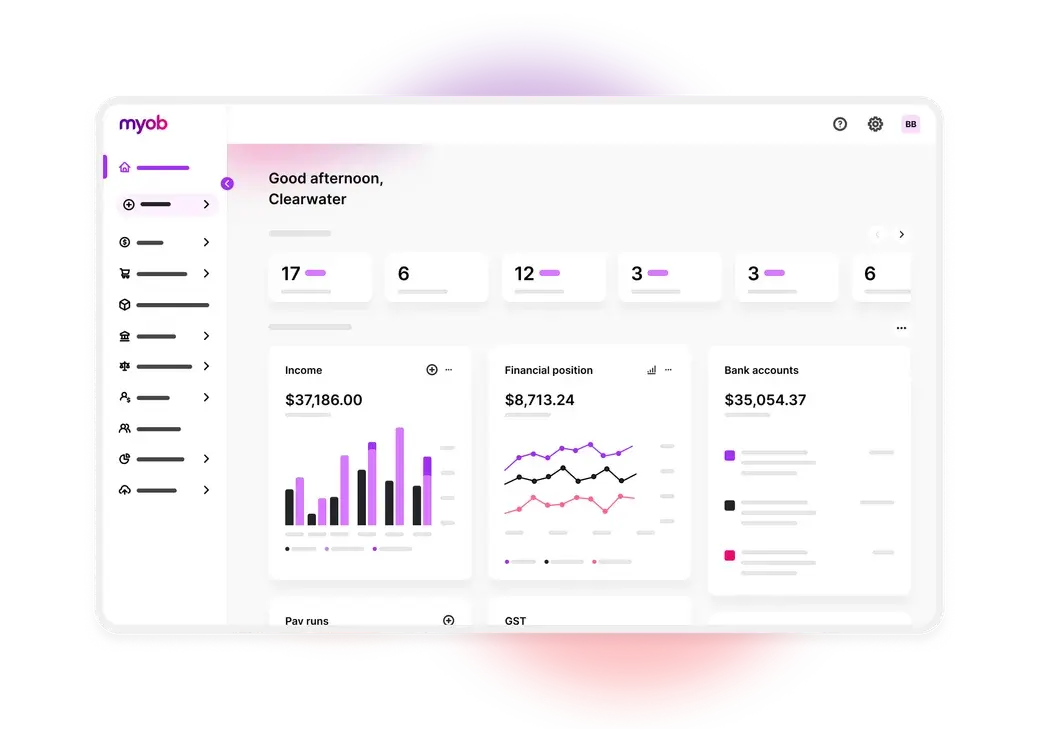

8. Software Accounting MYOB

Reason for using this system: Wide application scalability

MYOB (Mind Your Own Business) is an accounting system designed to help businesses, especially SMEs, easily manage their finances. One of its strengths is its intuitive interface, making it easy for users, even those with no accounting background, to manage their finance

MYOB is also known for its regular updates, ensuring the system is always in line with the latest tax and accounting regulation changes.

In addition, MYOB can be integrated with various other systems, such as inventory management and CRM, allowing for more efficient data synchronization for wider business needs.

MYOB features:

- Tax management

- Payroll

| Pros | Cons |

|---|---|

|

|

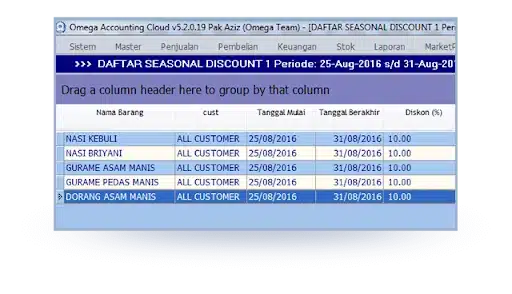

9. Omegasoft

Reason for using this system: Suitable for companies that need an integrated ERP.

Omegasoft is a cloud-based accounting system designed to facilitate business financial management with flexible access from anywhere. Its cloud-based advantage allows users to access and monitor financial data in real time without location restrictions.

In addition, the system offers an integrated workflow, linking various business aspects such as sales, purchasing, and stock management in a single platform.

Omegasoft features:

- Bank cash mutations

- Receipt of receivables

- Memorial journal

| Pros | Cons |

|---|---|

|

|

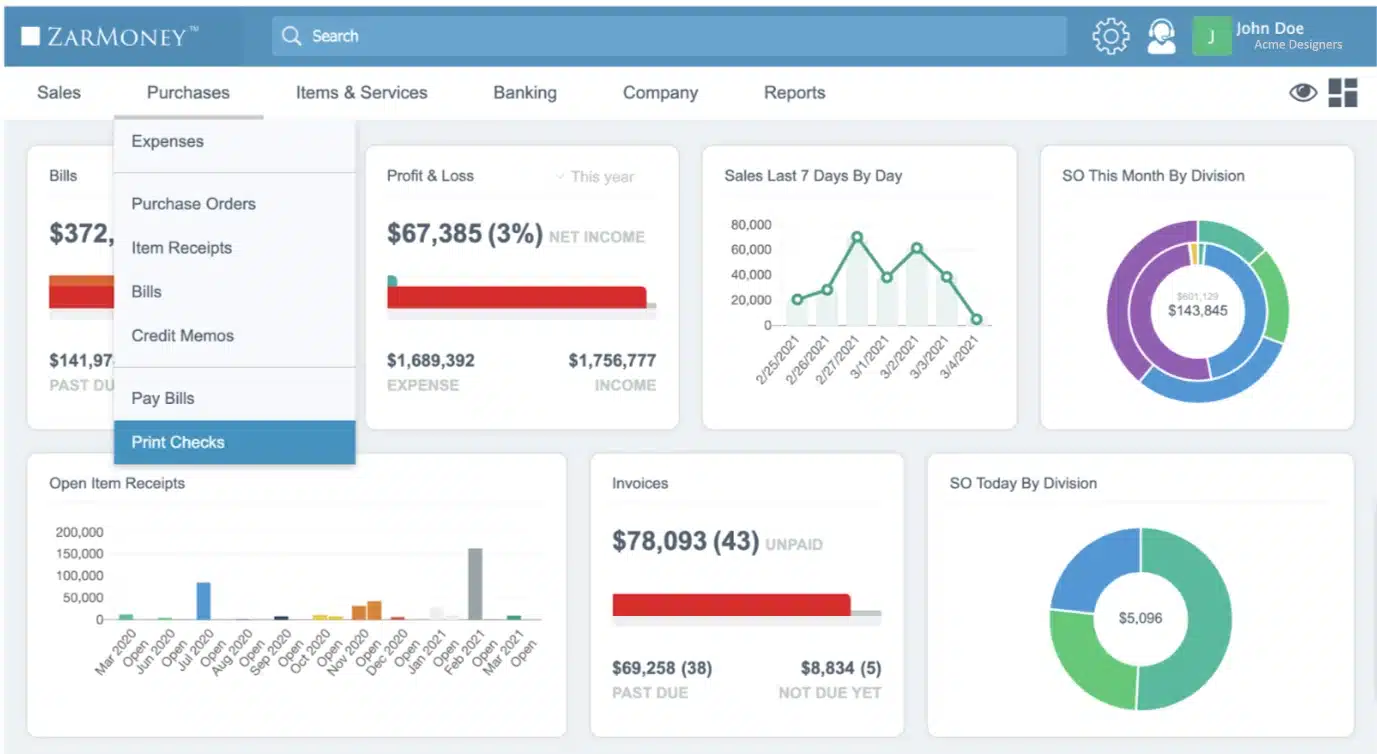

10. ZarMoney

Reason for using this system: User-friendly interface that does not take long to implement.

ZarMoney is a cloud-based accounting system designed for businesses. Its user-friendly interface makes it easy to manage finances without requiring in-depth technical expertise.

In addition, ZarMoney offers comprehensive features, from invoice management to payments to inventory tracking, making it a solid solution for businesses that need a complete accounting tool that is easy to operate.

ZarMoney features:

- Accounting

- Bookkeeping

- Order management

| Pros | Cons |

|---|---|

|

|

11. Freeagent Accounting System

Reason for using this system: Relatively low price making it suitable for start-up businesses.

FreeAgent is an accounting system that offers various features to make business financial management easier. Users can see an overall picture of the company’s financial condition in real-time with a complete overview.

In addition, the invoicing feature makes it easy to create and send invoices automatically, helping to reduce errors and speed up the payment process.

Freeagent features:

- Security

- Expenses

- Banking

- Projects

| Pros | Cons |

|---|---|

|

|

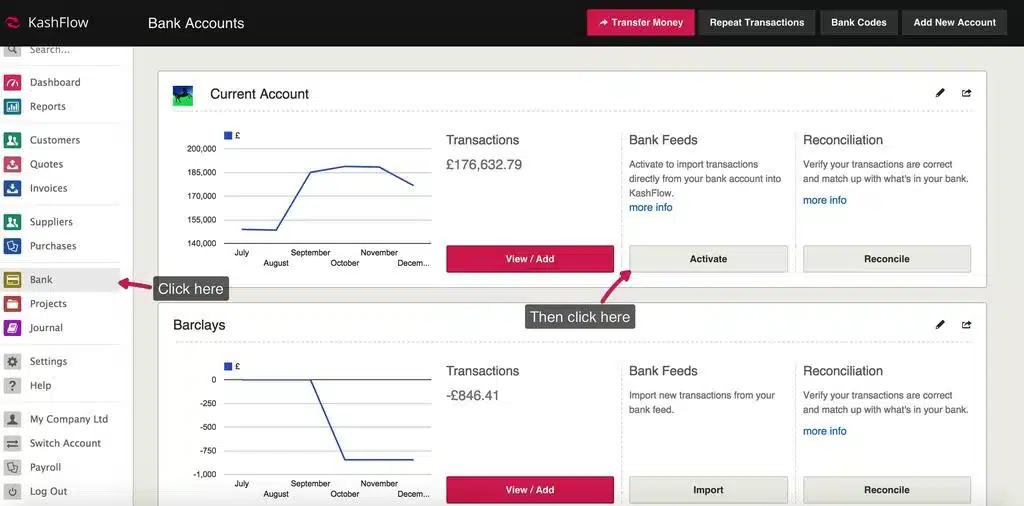

12. KashFlow

Reason for using this system: It has the best VAT submissions feature.

KashFlow is an accounting system designed to help businesses manage finances more efficiently, one of its flagship features is VAT submissions. This feature allows users to automatically calculate, track, and file VAT reports directly to the relevant tax authorities.

In addition, the system has an easy-to-use interface, KashFlow helps businesses save time in the tax administration process and improve the accuracy of financial reports.

KashFlow features:

- VAT Submissions

- Bank integration

- Immediate reporting

- Mobile apps

| Pros | Cons |

|---|---|

|

|

Tips for Choosing the Right Accounting Software for Business

We have previously presented recommendations for systems that can be used as Xero alternatives. But how do you choose the right system for your business?

Here, we present tips that can be the basis for you to determine the system that suits your business needs:

- Identify Business Needs: Understand the business’s specific needs, such as its scale of operations, number of transactions, and required features (for example, tax reporting or bank integration).

- Choose a Scalable System: Choose an accounting automation system that can grow with your business. This way, the software can adjust as the business grows without the need to replace it.

- Evaluate Ease of Use: Make sure the chosen system is easy to use, especially if your team does not have an accounting background. A user-friendly interface will save time and reduce potential errors.

- Check Automation Features: Look for a system with automation features, such as automatic invoicing, tax reporting, and bank reconciliation, that can help reduce manual work and speed up the accounting process.

- Check Support and Data Security: Make sure your accounting system provider offers responsive customer support and has strong data security standards, to protect your business’s financial information from security risks.

HashMicro Accounting as Alternatives to Xero

Xero accounting system has indeed developed into one of the most widely used systems. Even so, it still has some drawbacks you need to consider.

One system you can consider is HashMicro Accounting System, a robust accounting software philippines businesses can rely on. This system comes with comprehensive features and does not limit the number of users. Thus, it can help increase transparency in managing company finances.

If you’re curious about how this system works, schedule a free demo right now by clicking here!

FAQ

-

What is Xero accounting software?

Xero is a cloud-based accounting software designed for small to medium-sized businesses. It offers features like invoicing, expense tracking, bank reconciliation, and financial reporting.

-

Is Xero a good accounting software?

Yes, Xero is considered a good accounting software due to its user-friendly interface, robust features, and strong integration capabilities with other business applications.

-

What are the benefits of Xero Accounting Software?

Benefits of Xero include real-time financial visibility, automatic updates, mobile access, collaborative features for multiple users, and a wide range of third-party app integrations to enhance functionality.